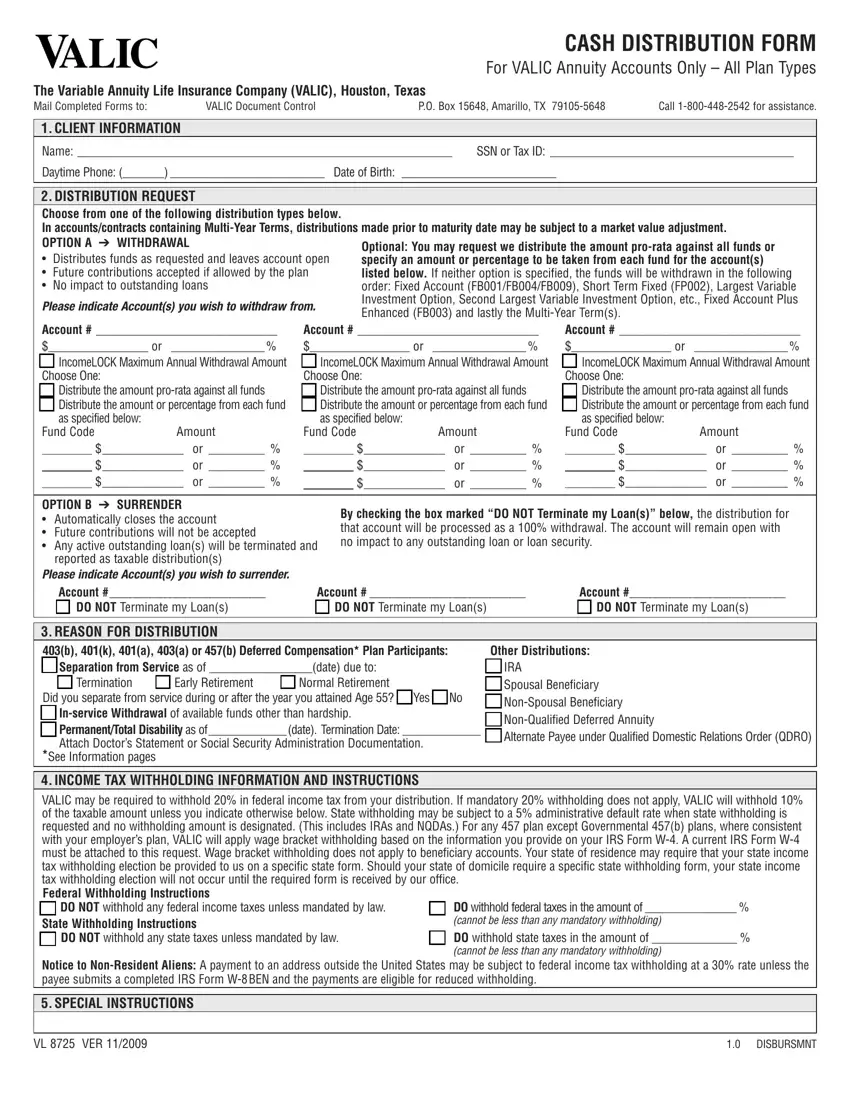

CASH DISTRIBUTION FORM

For VALIC Annuity Accounts Only – All Plan Types

The Variable Annuity Life Insurance Company (VALIC), Houston, Texas

Mail Completed Forms to: |

VALIC Document Control |

P.O. Box 15648, Amarillo, TX 79105-5648 |

Call 1-800-448-2542 for assistance. |

|

|

|

|

|

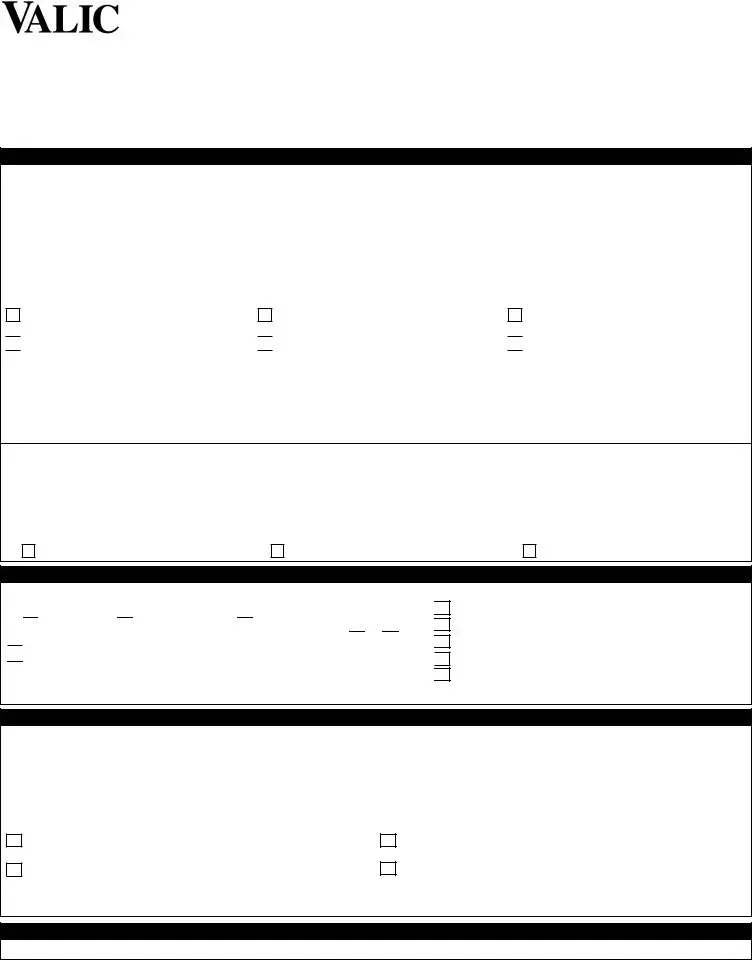

1. CLIENT INFORMATION |

|

|

|

|

Name: ____________________________________________________________ |

SSN or Tax ID: _________________________________________ |

Daytime Phone: (_______) __________________________ |

Date of Birth: __________________________ |

|

|

|

|

|

|

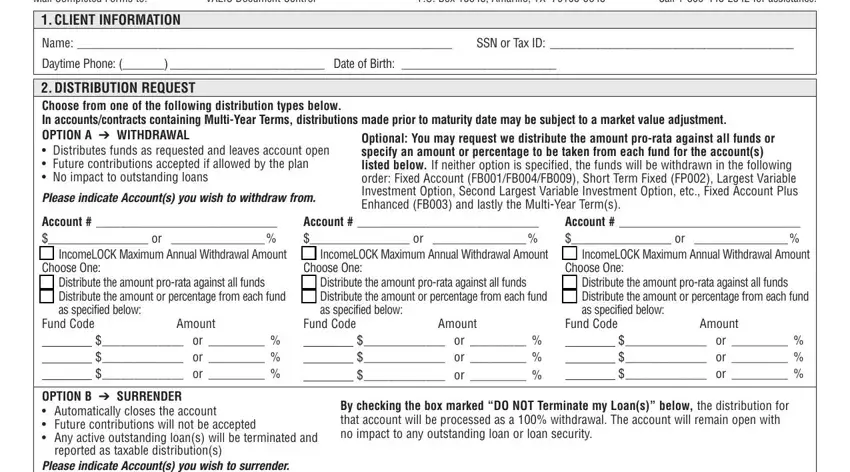

2. DISTRIBUTION REQUEST

|

Choose from one of the following distribution types below. |

|

|

|

|

|

|

|

In accounts/contracts containing Multi-Year Terms, distributions made prior to maturity date may be subject to a market value adjustment. |

|

OPTION A ➔ WITHDRAWAL |

|

|

|

|

|

|

|

|

|

|

|

|

Optional: You may request we distribute the amount pro-rata against all funds or |

|

|

• |

Distributes funds as requested and leaves account open |

|

|

specify an amount or percentage to be taken from each fund for the account(s) |

|

|

• |

Future contributions accepted if allowed by the plan |

listed below. If neither option is specified, the funds will be withdrawn in the following |

|

|

• |

No impact to outstanding loans |

|

|

|

order: Fixed Account (FB001/FB004/FB009), Short Term Fixed (FP002), Largest Variable |

|

|

Please indicate Account(s) you wish to withdraw from. |

Investment Option, Second Largest Variable Investment Option, etc., Fixed Account Plus |

|

|

Enhanced (FB003) and lastly the Multi-Year Term(s). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account # _____________________________ |

Account # _____________________________ |

|

Account # _____________________________ |

|

$________________ or _______________ % |

$________________ or _______________ % |

|

$________________ or _______________ % |

|

|

IncomeLOCK Maximum Annual Withdrawal Amount |

|

IncomeLOCK Maximum Annual Withdrawal Amount |

|

|

|

IncomeLOCK Maximum Annual Withdrawal Amount |

|

Choose One: |

Choose One: |

|

Choose One: |

|

|

|

Distribute the amount pro-rata against all funds |

|

|

|

Distribute the amount pro-rata against all funds |

|

|

|

Distribute the amount pro-rata against all funds |

|

|

|

|

|

|

|

|

|

Distribute the amount or percentage from each fund |

|

|

|

Distribute the amount or percentage from each fund |

|

|

|

Distribute the amount or percentage from each fund |

|

|

|

as specified below: |

|

|

as specified below: |

|

|

|

as specified below: |

Fund Code |

Amount |

Fund Code |

Amount |

Fund Code |

Amount |

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

$_____________ |

or _________ % |

|

|

|

|

|

|

|

|

|

|

|

|

|

OPTION B ➔ SURRENDER |

|

By checking the box marked “DO NOT Terminate my Loan(s)” below, the distribution for |

|

• Automatically closes the account |

|

|

|

that account will be processed as a 100% withdrawal. The account will remain open with |

|

• Future contributions will not be accepted |

|

|

|

no impact to any outstanding loan or loan security. |

|

• Any active outstanding loan(s) will be terminated and |

|

|

|

|

|

reported as taxable distribution(s) |

|

|

|

|

|

Please indicate Account(s) you wish to surrender. |

|

|

|

|

|

|

Account # _______________________________ |

Account # _______________________________ |

Account #_______________________________ |

|

|

DO NOT Terminate my Loan(s) |

|

DO NOT Terminate my Loan(s) |

|

DO NOT Terminate my Loan(s) |

|

|

|

|

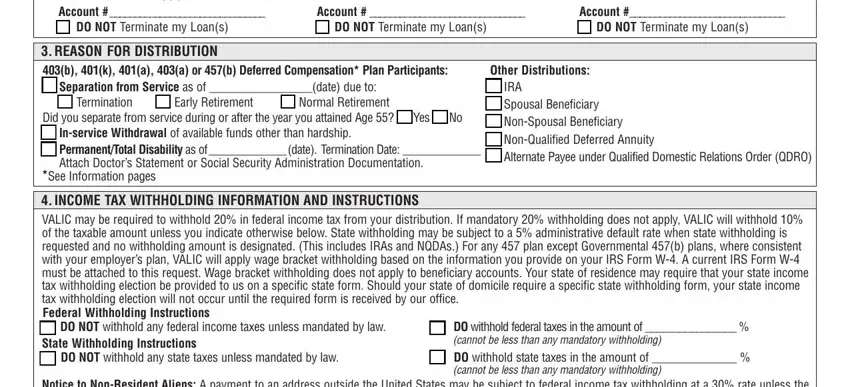

3. REASON FOR DISTRIBUTION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

403(b), 401(k), 401(a), 403(a) or 457(b) Deferred Compensation* Plan Participants: |

|

|

|

|

Separation from Service as of _________________(date) due to: |

|

|

|

|

|

|

Termination |

|

Early Retirement |

|

Normal Retirement |

|

|

|

|

|

|

|

|

|

|

|

|

|

Did |

you separate from service during or after the year you attained Age 55? |

|

Yes |

|

No |

|

|

|

In-service Withdrawal of available funds other than hardship. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Permanent/Total Disability as of_____________ (date). Termination Date: _____________ |

|

|

|

|

|

|

|

|

Attach Doctor’s Statement or Social Security Administration Documentation. |

|

|

|

|

|

|

|

|

*See Information pages

Other Distributions:

IRA

Spousal Beneficiary

Non-Spousal Beneficiary

Non-Qualified Deferred Annuity

Alternate Payee under Qualified Domestic Relations Order (QDRO)

4. INCOME TAX WITHHOLDING INFORMATION AND INSTRUCTIONS

VALIC may be required to withhold 20% in federal income tax from your distribution. If mandatory 20% withholding does not apply, VALIC will withhold 10% of the taxable amount unless you indicate otherwise below. State withholding may be subject to a 5% administrative default rate when state withholding is requested and no withholding amount is designated. (This includes IRAs and NQDAs.) For any 457 plan except Governmental 457(b) plans, where consistent with your employer’s plan, VALIC will apply wage bracket withholding based on the information you provide on your IRS Form W-4. A current IRS Form W-4 must be attached to this request. Wage bracket withholding does not apply to beneficiary accounts. Your state of residence may require that your state income tax withholding election be provided to us on a specific state form. Should your state of domicile require a specific state withholding form, your state income tax withholding election will not occur until the required form is received by our office.

Federal Withholding Instructions |

DO withhold federal taxes in the amount of ________________ % |

DO NOT withhold any federal income taxes unless mandated by law. |

State Withholding Instructions

DO NOT withhold any state taxes unless mandated by law.

(cannot be less than any mandatory withholding)

DO withhold state taxes in the amount of ______________ %

(cannot be less than any mandatory withholding)

Notice to Non-Resident Aliens: A payment to an address outside the United States may be subject to federal income tax withholding at a 30% rate unless the payee submits a completed IRS Form W-8 BEN and the payments are eligible for reduced withholding.

5. SPECIAL INSTRUCTIONS

VL 8725 VER 11/2009 |

1.0 DISBURSMNT |

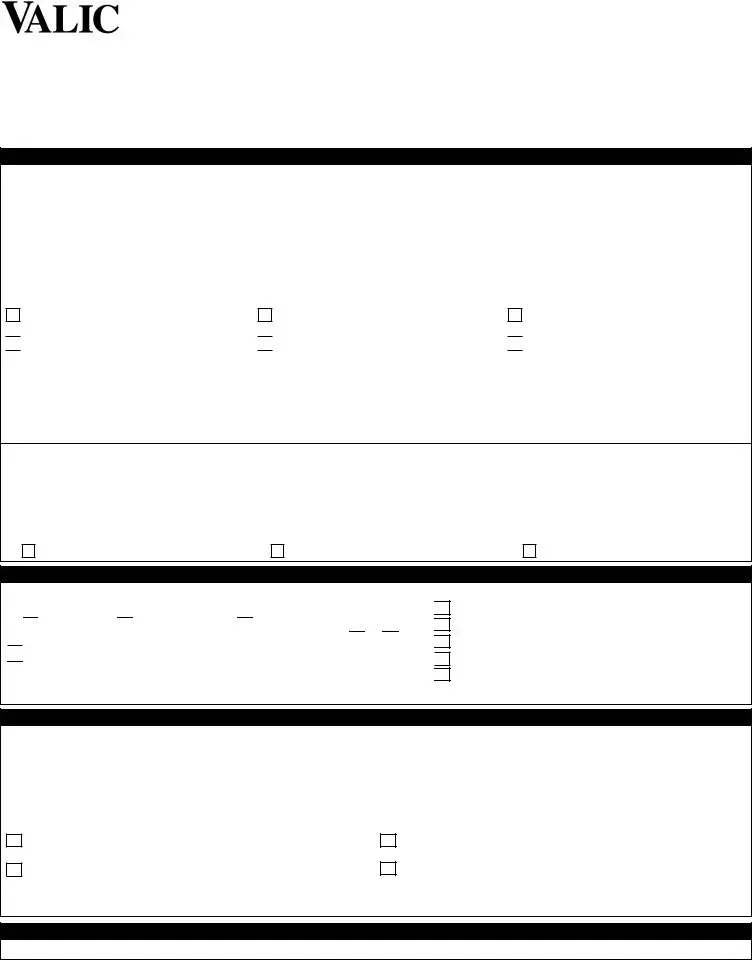

CASH DISTRIBUTION FORM

For VALIC Annuity Accounts Only – All Plan Types

The Variable Annuity Life Insurance Company (VALIC), Houston, Texas

Mail Completed Forms to: |

VALIC Document Control |

P.O. Box 15648, Amarillo, TX 79105-5648 |

Call 1-800-448-2542 for assistance. |

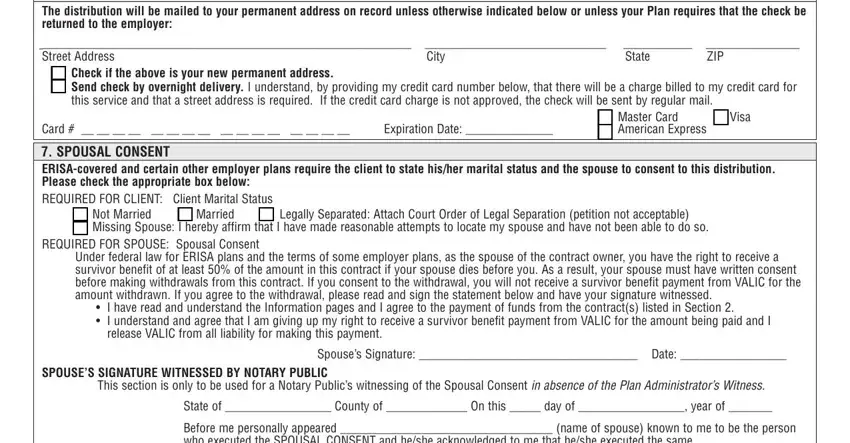

6. MAILING INSTRUCTIONS

The distribution will be mailed to your permanent address on record unless otherwise indicated below or unless your Plan requires that the check be returned to the employer:

___________________________________________________________ _____________________________ ___________ |

_______________ |

Street Address |

City |

|

|

State |

ZIP |

|

|

|

Check if the above is your new permanent address. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Send check by overnight delivery. I understand, by providing my credit card number below, that there will be a charge billed to my credit card for |

|

|

|

this service and that a street address is required. If the credit card charge is not approved, the check will be sent by regular mail. |

|

|

|

|

|

|

|

|

|

Master Card |

|

|

Visa |

|

|

|

|

|

|

|

|

|

Card # __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ |

Expiration Date: ______________ |

|

|

American Express |

|

|

|

|

|

7. SPOUSAL CONSENT

ERISA-covered and certain other employer plans require the client to state his/her marital status and the spouse to consent to this distribution. Please check the appropriate box below:

REQUIRED FOR CLIENT: Client Marital Status |

|

|

|

|

Not Married |

|

Married |

Legally Separated: Attach Court Order of Legal Separation (petition not acceptable) |

|

|

|

|

|

|

Missing Spouse: |

I |

hereby affirm |

that I have made reasonable attempts to locate my spouse and have not been able to do so. |

REQUIRED FOR SPOUSE: Spousal Consent

Under federal law for ERISA plans and the terms of some employer plans, as the spouse of the contract owner, you have the right to receive a survivor benefit of at least 50% of the amount in this contract if your spouse dies before you. As a result, your spouse must have written consent before making withdrawals from this contract. If you consent to the withdrawal, you will not receive a survivor benefit payment from VALIC for the amount withdrawn. If you agree to the withdrawal, please read and sign the statement below and have your signature witnessed.

•I have read and understand the Information pages and I agree to the payment of funds from the contract(s) listed in Section 2.

•I understand and agree that I am giving up my right to receive a survivor benefit payment from VALIC for the amount being paid and I release VALIC from all liability for making this payment.

Spouse’s Signature: ___________________________________ Date: _________________

SPOUSE’S SIGNATURE WITNESSED BY NOTARY PUBLIC

This section is only to be used for a Notary Public’s witnessing of the Spousal Consent in absence of the Plan Administrator’s Witness.

State of _________________ County of _____________ On this _____ day of _________________, year of _______

Before me personally appeared __________________________________ (name of spouse) known to me to be the person

who executed the SPOUSAL CONSENT and he/she acknowledged to me that he/she executed the same.

Notary Public __________________________________________________________

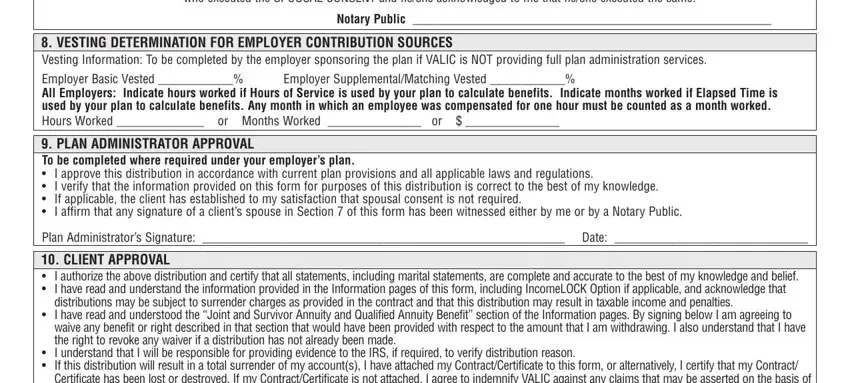

8. VESTING DETERMINATION FOR EMPLOYER CONTRIBUTION SOURCES

Vesting Information: To be completed by the employer sponsoring the plan if VALIC is NOT providing full plan administration services.

Employer Basic Vested ____________% Employer Supplemental/Matching Vested ____________%

All Employers: Indicate hours worked if Hours of Service is used by your plan to calculate benefits. Indicate months worked if Elapsed Time is used by your plan to calculate benefits. Any month in which an employee was compensated for one hour must be counted as a month worked.

Hours Worked ______________ or Months Worked _______________ or $ _______________

9. PLAN ADMINISTRATOR APPROVAL

To be completed where required under your employer’s plan.

•I approve this distribution in accordance with current plan provisions and all applicable laws and regulations.

•I verify that the information provided on this form for purposes of this distribution is correct to the best of my knowledge.

•If applicable, the client has established to my satisfaction that spousal consent is not required.

•I affirm that any signature of a client’s spouse in Section 7 of this form has been witnessed either by me or by a Notary Public.

Plan Administrator’s Signature: __________________________________________________________ Date: _______________________________

10. CLIENT APPROVAL

•I authorize the above distribution and certify that all statements, including marital statements, are complete and accurate to the best of my knowledge and belief.

•I have read and understand the information provided in the Information pages of this form, including IncomeLOCK Option if applicable, and acknowledge that distributions may be subject to surrender charges as provided in the contract and that this distribution may result in taxable income and penalties.

•I have read and understood the “Joint and Survivor Annuity and Qualified Annuity Benefit” section of the Information pages. By signing below I am agreeing to waive any benefit or right described in that section that would have been provided with respect to the amount that I am withdrawing. I also understand that I have the right to revoke any waiver if a distribution has not already been made.

•I understand that I will be responsible for providing evidence to the IRS, if required, to verify distribution reason.

•If this distribution will result in a total surrender of my account(s), I have attached my Contract/Certificate to this form, or alternatively, I certify that my Contract/ Certificate has been lost or destroyed. If my Contract/Certificate is not attached, I agree to indemnify VALIC against any claims that may be asserted on the basis of the Contract/Certificate being found and presented for payment.

Note: If you borrow, surrender, or withdraw any funds from your contract, the guaranteed elements, non-guaranteed elements, face amount, or surrender value of your existing contract may be affected.

Client’s Signature: ____________________________________________________________________ |

Date: _________________________________ |

|

|

VL 8725 VER 11/2009 |

1.0 DISBURSMNT |

CASH DISTRIBUTION FORM

For VALIC Annuity Accounts Only – All Plan Types

The Variable Annuity Life Insurance Company (VALIC), Houston, Texas

Mail Completed Forms to: |

VALIC Document Control |

P.O. Box 15648, Amarillo, TX 79105-5648 |

Call 1-800-448-2542 for assistance. |

|

|

|

|

INFORMATION

SPECIAL TAX NOTICE

You have the right to at least 30 days to consider your alternatives after receiving this notice. You may waive this review period. Your signature on this form will indicate that either you have had this 30-day review or that you have chosen to waive it, and you are requesting an immediate distribution.

ELIGIBLE ROLLOVER DISTRIBUTIONS

The information in this notice applies to qualified plans, tax-deferred annuity arrangements, IRAs, and governmental 457(b) deferred compensation plans. Generally, the rules below that apply to payments to employees also apply to surviving spouses and alternate payees.

Most withdrawals from tax-favored retirement plans are eligible for rollover either to an IRA or to another plan if the receiving plan accepts such rollovers. Some plans do not accept rollovers of certain types of distributions. Check with the administrator of that plan about whether the plan accepts rollovers and, if so, the types of rollover distributions it accepts.

Roth 403(b) or 401(k) accounts may be rolled over only to another Roth account or to a Roth IRA. However, Roth IRAs may not be rolled over to a Roth 403(b) or Roth 401(k) account.

ROLLOVERS OF BENEFICIARY ACCOUNTS

Only (1) the participant, or (2) in the case of the participant’s death, the participant’s surviving spouse, or (3) in the case of a domestic relations order, the participant’s spouse or ex-spouse may roll over a distribution into a plan of the participant’s own. An exception to this rule is that a non-spousal beneficiary may, subject to plan provisions, roll inherited funds from an eligible retirement plan into a Beneficiary IRA. A Beneficiary IRA is an IRA created for the sole purpose of receiving funds inherited by non-spousal beneficiaries

of eligible retirement plans. The distribution must be transferred to the Beneficiary IRA in a direct “trustee-to-trustee ” transfer. Beneficiary IRAs must meet the distribution requirements relating to IRAs inherited by non-spousal beneficiaries under Code sections 408(a)(6) and (b)(3) and 401(a)(9).

DISTRIBUTABLE EVENT

Generally a distributable event includes attainment of age 59½ (age 70½ for governmental 457(b) plans), separation from service, disability or death. However, the employer’s plan may place additional restrictions that must also be met prior to a distribution. If you have met a distributable event, you may request a rollover of funds to any eligible plan type or a transfer to a like plan type. If you wish to move funds from your VALIC 403(b) account to another 403(b) account via a rollover distribution, and have made contributions prior to 01-01-87, those amounts may lose a grandfathered status that can impact future required distributions. However, movement of funds from your VALIC 403(b) account to another 403(b) account via a transfer distribution may retain the status. For more information, please call 1-800-448-2542.

ROLLOVER/TRANSFER

Rollover Distributions: If you have met a distribute event on your eligible account(s) or plan you may roll directly to an eligible retirement plan with another carrier. The distribution will not be taxed but will be reported to the IRS. Rollover amounts due to a distributable event generally can remain free of withdrawal restrictions after moving to the receiving plan, unless the receiving plan applies restrictions to rollover amounts.

Transfers: Transfers to a like plan will not be taxed or reported to the IRS. Generally, transfers are allowed regardless of employment status. However, your employer’s plan may restrict you to authorized carriers. Transferred amounts generally become subject to the requirements of the plan receiving the transfer as though originally contributed to that plan. Exchanges of Non-Qualified Deferred Annuities are not taxed but will be reported to the IRS.

EXAMPLES OF SOME POSSIBLE DIFFERENCES IN PLAN RESTRICTIONS

•The new plan may require spousal consent or plan administrator approval for distributions.

•The new plan may restrict distributions.

•Distributions from a governmental 457(b) deferred compensation plan are generally not subject to the 10% premature withdrawal penalty regardless of your age at the time of the distribution. If you roll your governmental 457(b) deferred compensation plan to another plan that is not a governmental 457(b) deferred compensation plan, or into an IRA, any subsequent distributions may be subject to a 10% premature withdrawal penalty.

•Eligible rollovers into a governmental 457(b) deferred compensation plan that were previously subject to a 10% premature withdrawal penalty will continue to be subject to that penalty at the time of withdrawal unless you are over age 59½ or some other exception applies.

•Amounts rolled over to a governmental 457(b) plan generally cannot be withdrawn prior to separation from service or attainment of age 70½ unless the plan allows.

ELIGIBLE ROLLOVER DISTRIBUTIONS PAID DIRECTLY TO YOU

You can request that we pay you directly. Except for IRA distributions, when we pay you directly, federal law requires us to withhold 20% for federal income taxes.

If a distribution is paid directly to you, you may subsequently roll over any pre-tax contributions to another employer-sponsored plan or to an IRA within 60 days. Any distributions of after-tax contributions paid directly to you may not be rolled over to another employer-sponsored plan. However, they may subsequently be rolled over to an IRA within 60 days.

If your eligible rollover distribution is paid directly to you and not rolled over (including any amount withheld), the distribution will be taxable to you in the year you receive it. The distribution will not be taxable to the extent you roll other funds to replace the amount distributed and the amount withheld.

AMOUNTS NOT ELIGIBLE FOR ROLLOVER

Some amounts not eligible for rollover include these: amounts paid from a non-qualified (after-tax) annuity that is not part of your employer’s plan, financial hardship withdrawals, required minimum distributions, deemed distributions due to loan default, and amounts paid from certain deferred compensation plans.

If you direct us to pay the distribution to you, and it is not an eligible rollover distribution, we will apply 10% federal income tax withholding unless you indicate differently.

LOANS

If you request a total surrender of your tax-favored retirement plan account and you have an outstanding loan, the account balance will be reduced by the outstanding loan balance and outstanding loan security will be returned to the account. The offset loan amount will be reported as a taxable distribution and will be taxable to you unless you roll over an equal amount to an employer-sponsored plan or IRA. You may also choose to pay off the outstanding loan balance prior to the surrender by submitting payment in full to the Loan Department.

INCOMELOCK OPTION

If you have chosen the IncomeLOCK living benefit option, withdrawals from the contract will reduce the account value and all benefits of the IncomeLOCK living-benefit option. Withdrawals exceeding the Maximum Annual Withdrawal Amount may reduce future Maximum Annual Withdrawal Amounts. Minimum distribution amounts calculated for each year will include the value of the IncomeLOCK benefit. One year’s required minimum distribution based solely on the value of each individual account will not be treated as an excess withdrawal, but may reduce the Maximum Withdrawal Period. See your contract endorsement.

10% PENALTY

Unless an exception applies, the IRS may also assess a 10% federal tax penalty for early distributions if you are younger than age 59½.

CASH DISTRIBUTION FORM

For VALIC Annuity Accounts Only – All Plan Types

The Variable Annuity Life Insurance Company (VALIC), Houston, Texas

Mail Completed Forms to: |

VALIC Document Control |

P.O. Box 15648, Amarillo, TX 79105-5648 |

Call 1-800-448-2542 for assistance. |

|

|

|

|

SPECIAL TAX TREATMENT FOR CERTAIN LUMP-SUM DISTRIBUTIONS

If you were born before January 1, 1936, and if your qualified plan distribution qualified as a “lump-sum distribution,” you may be entitled to special tax treatment regarding your payment.

TAXATION OF ROTH IRAS AND ROTH ACCOUNTS

Contributions to Roth IRAs and Roth accounts are not deductible and therefore are distributed tax-free at any time. Rollovers or conversions from a traditional IRA or pre-tax eligible retirement plan to a Roth IRA are taxable in the year of the distribution. Earnings which accumulate in a Roth IRA or Roth Account are not taxed currently and are not taxed upon a “qualified” distribution (1) made after the end of the five year period beginning with the tax year in which the first contribution or conversion to a Roth IRA was made, and (2) made after the date you attain age 59½, upon your death or disability, or as a qualified first time home buyer distribution (not applicable to Roth accounts). Distributions of earnings that do not meet the requirements above are taxable, and are generally subject to the 10% penalty tax.

*PRIVATE TAX-EXEMPT EMPLOYER DEFERRED COMPENSATION PLANS

Section 457(b) deferred compensation plans sponsored by private tax-exempt employers require participants to make an irrevocable election regarding the distribution of benefits. Commencement of payments cannot be later than April 1st of the year following the year you attain age 70½ unless you are still working for the plan’s sponsor. Please contact your plan administrator for more information.

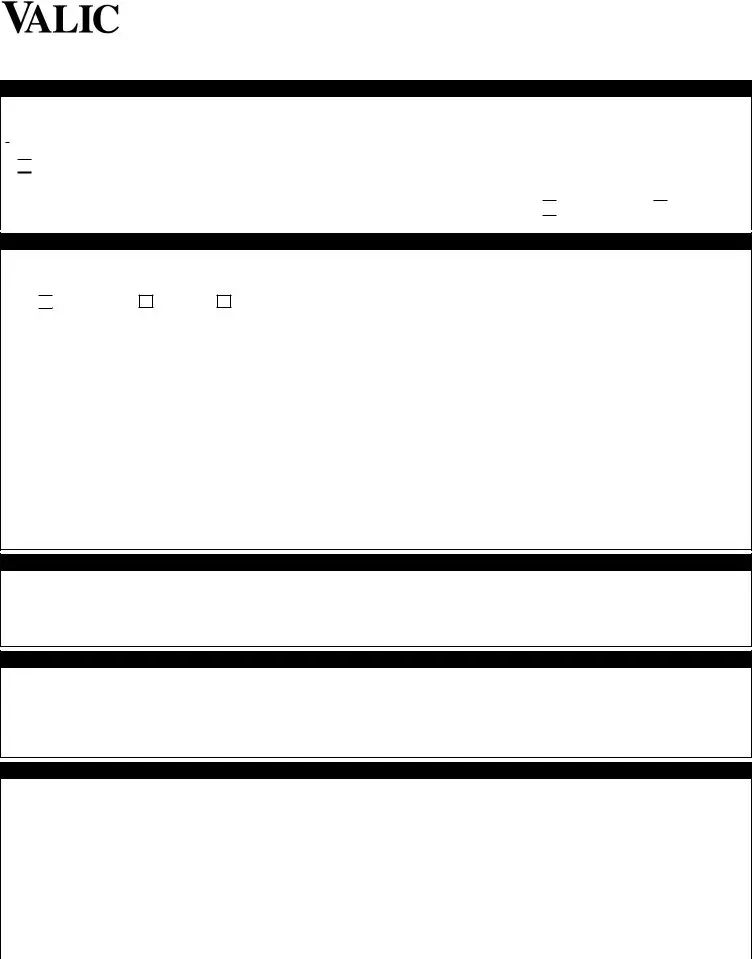

QUALIFIED JOINT AND SURVIVOR ANNUITY AND QUALIFIED ANNUITY BENEFIT: FOR ERISA PLANS ONLY

This notice should be provided to you at least 30 days, but no more than 180 days, before your proposed distribution date.

If you are married, your retirement plan distributions will be paid to you in the form of a Qualified Joint and Survivor Annuity (“QJSA”) unless you elect a different form of distribution. Under your QJSA, if your spouse survives you, the plan will pay him or her at least 50% of the amount the plan had been paying to you, on the same frequency as the payments to you. If you are not married, your benefit will be paid monthly over your life and will end upon your death unless you elect a different form of distribution. This benefit is referred to as a Qualified Annuity Benefit (“QAB”).

The plan may satisfy the QJSA or QAB by using your vested account balance to purchase an annuity contract from an insurance company. The actual monthly payments made under the annuity contract will depend on the value of your account balance, annuity purchase rates used by the insurance company, your age, and if you are married, your spouse’s age at the time the distribution begins.

The following table reflects the relative values of monthly payments from a Joint and Survivor Annuity and a Life Annuity, assuming a vested account balance of $5,000 and an interest rate of 6%. This table is based on the Annuity 2000 Mortality tables. The table is hypothetical and does not reflect the value of your individual benefit or the actual payments you or your beneficiaries would receive. Please note that as the ages change, the payment amount will change. If none of the examples closely approximates your situation, you may obtain a more accurate value specific to your situation from your plan administrator or from your financial advisor.

Age at Benefit Starting Date

Annuitant |

70 |

65 |

60 |

55 |

50 |

45 |

40 |

35 |

Spouse |

65 |

70 |

55 |

60 |

45 |

50 |

35 |

40 |

Monthly Payment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annuitant Life |

|

|

|

|

|

|

|

|

Only |

39.62 |

35.35 32.38 |

30.27 |

28.75 |

27.61 |

26.76 |

26.13 |

Joint and |

|

|

|

|

|

|

|

|

50% Survivor |

35.47 |

33.65 30.21 |

29.26 |

27.53 |

26.99 |

26.07 |

25.76 |

|

|

|

|

|

|

|

|

|

Joint and |

|

|

|

|

|

|

|

|

75% Survivor |

33.71 |

32.86 |

29.23 |

28.78 |

26.95 |

26.70 |

25.73 |

25.58 |

This QJSA or QAB requirement may not apply to smaller account balances (generally below $5,000) and will not apply if you have elected another form of benefit. A partial withdrawal would be considered another form of benefit for this purpose. Other alternate forms of benefits that may be available under your employer’s plan and under your plan investments may include:

Annuity

An annuity can provide you with payments for your life or for your life and that of your beneficiary; payments for a specified period; payments for your lifetime with a minimum guaranteed period; or a continuation of payments to your surviving spouse that is different from the plan’s percentage of

the payments made to you. Generally, the more that the form of payment guarantees, such as a minimum period of payments, or payments to your surviving spouse or to another beneficiary, the more that specified benefit amount will cost. There are IRS rules that may limit the period during which payments may be made.

Lump Sum Distribution

If you elect a lump sum distribution, your benefit will be paid to you in one payment. The amount of your benefit is the vested portion of your account balance as of the valuation date used to calculate your distribution.

Installments

If you elect to receive your benefits in installments, you may specify the dollar amount and frequency of your payments. The period of time over which you receive these installments cannot be greater than your life expectancy or the joint life and last survivor expectancy of you and your designated beneficiary. There are other IRS rules that may further limit the period over which you receive payments.

In order to elect one of these alternative forms of benefits you must waive your right to the QJSA or QAB, and if you are married, your spouse must also consent in writing. In addition, this written consent must be witnessed by a Notary Public or by your Plan Administrator. You are entitled to 30 days (but no more than 180 days) within which to make this decision. Although you have at least 30 days to make this decision, under some circumstances, you may waive this minimum 30-day period, and if you submit a waiver of the QJSA or QAB less than 30 days after it is signed we will assume that you are waiving this notice period. Unless a waiver of the QJSA or QAB is made irrevocably, you have the right to revoke the waiver and execute another waiver at a later time, up to the time when the benefit payments have started. You also have the right to defer receiving a distribution, subject to the terms of your employer’s plan as well as legal requirements that generally require distributions to commence upon the later of attainment of age 70½ or retirement.

The investment options available to you, the right to change investment options, and the fees imposed under the investment options will not be affected by your decision to defer distributions.