If you desire to fill out Vermont Form Pt 172 S, there's no need to download and install any kind of programs - just use our online tool. The editor is continually maintained by our team, acquiring awesome functions and becoming better. This is what you would want to do to get started:

Step 1: Open the PDF in our tool by clicking on the "Get Form Button" in the top part of this webpage.

Step 2: As you access the file editor, there'll be the form made ready to be completed. Besides filling out various fields, you may as well perform other sorts of things with the form, that is writing your own text, modifying the initial text, inserting illustrations or photos, putting your signature on the PDF, and more.

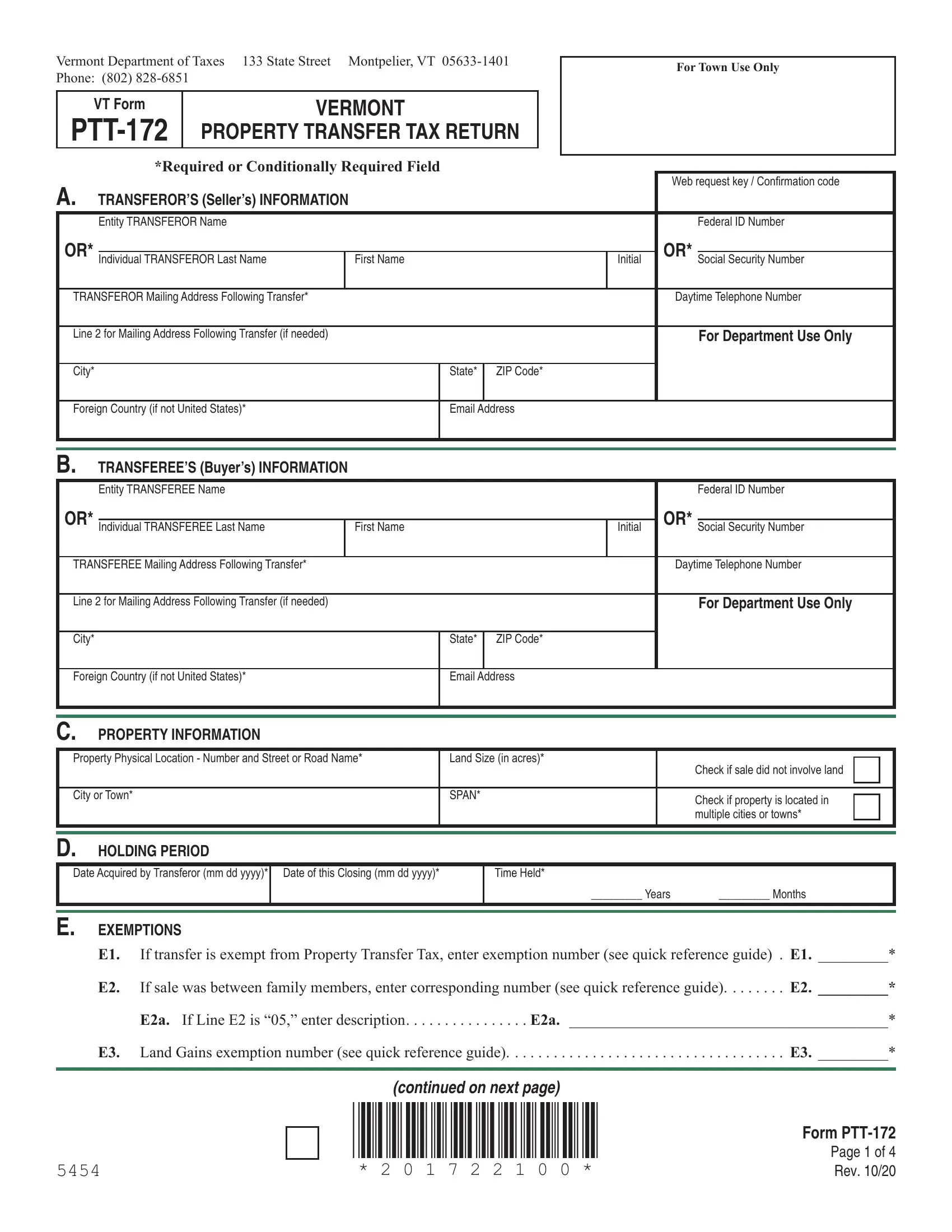

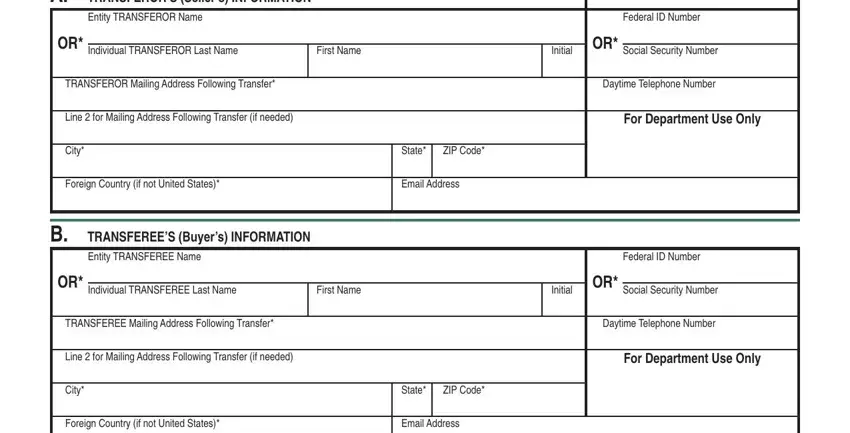

As for the blanks of this particular document, here is what you want to do:

1. Complete the Vermont Form Pt 172 S with a selection of essential blanks. Get all of the necessary information and make certain there's nothing neglected!

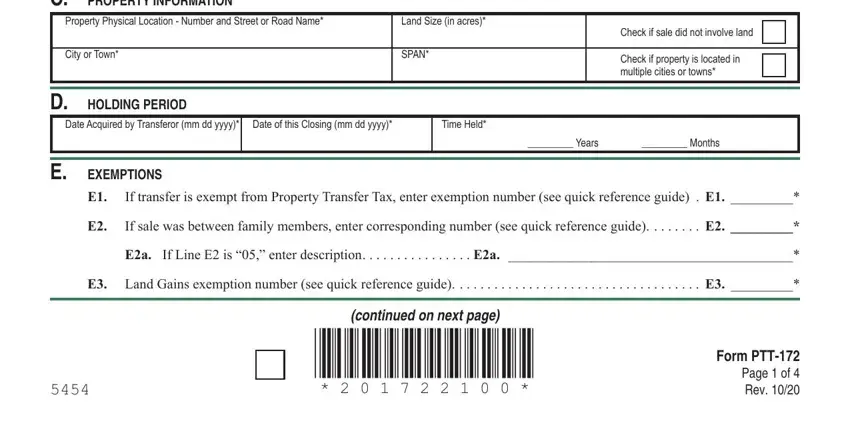

2. Once the prior selection of blank fields is completed, proceed to enter the applicable information in these: C PROPERTY INFORMATION, Property Physical Location Number, Land Size in acres, City or Town, D HOLDING PERIOD, SPAN, Check if sale did not involve land, Check if property is located in, Date Acquired by Transferor mm dd, Time Held, Years Months, EXEMPTIONS, If transfer is exempt from, If sale was between family members, and Ea If Line E is enter description.

Be extremely attentive while completing Ea If Line E is enter description and EXEMPTIONS, as this is the section where a lot of people make mistakes.

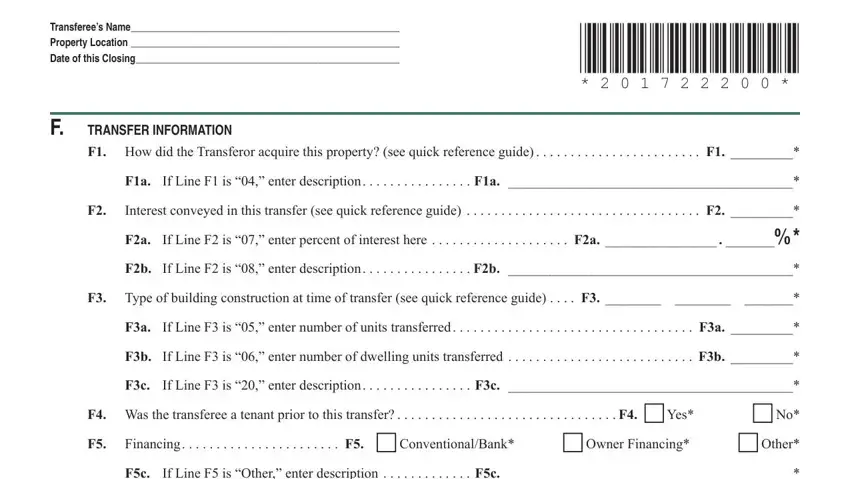

3. Through this part, look at Transferees Name Property, TRANSFER INFORMATION, F How did the Transferor acquire, Fa If Line F is enter description, Interest conveyed in this transfer, Fb If Line F is enter description, F Type of building construction at, Fa If Line F is enter number of, Fb If Line F is enter number of, Fc If Line F is enter description, F Was the transferee a tenant, F Financing, and Fc If Line F is Other enter. All of these are required to be filled out with utmost accuracy.

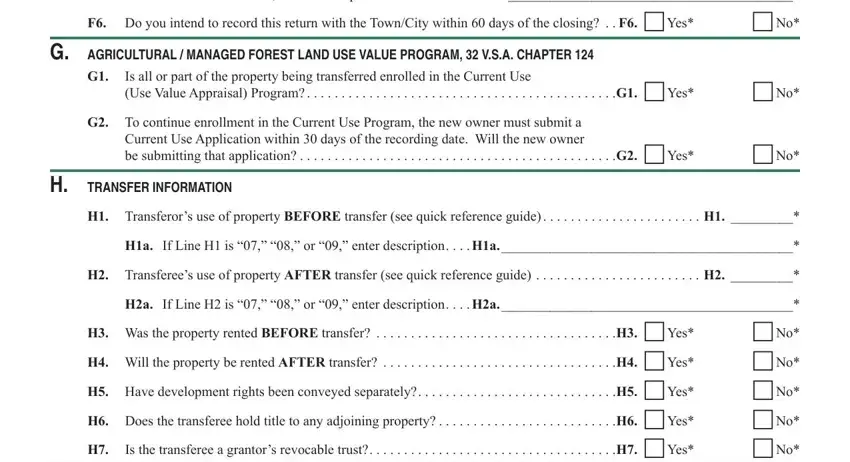

4. The subsequent paragraph needs your information in the following parts: Fc If Line F is Other enter, F Do you intend to record this, G AGRICULTURAL MANAGED FOREST, Is all or part of the property, G To continue enrollment in the, TRANSFER INFORMATION, H Transferors use of property, Ha If Line H is or enter, H Transferees use of property, Ha If Line H is or enter, H Was the property rented BEFORE, H Will the property be rented, H Have development rights been, H Does the transferee hold title, and Is the transferee a grantors. It is important to provide all requested info to go forward.

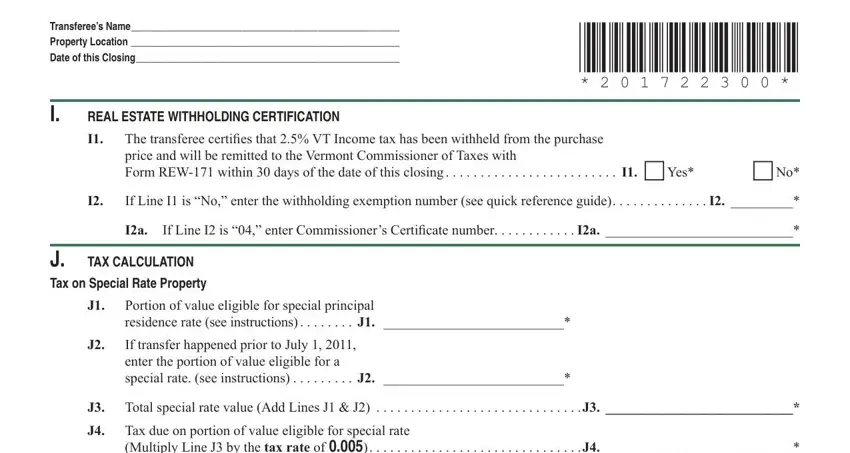

5. This very last section to submit this document is crucial. You must fill out the necessary fields, such as Transferees Name Property, REAL ESTATE WITHHOLDING, The transferee certifies that VT, If Line I is No enter the, If Line I is enter Commissioners, TAX CALCULATION, J Tax on Special Rate Property, Portion of value eligible for, If transfer happened prior to July, J Total special rate value Add, J Tax due on portion of value, and Multiply Line J by the tax rate of, prior to finalizing. If you don't, it could end up in a flawed and probably incorrect paper!

Step 3: Revise the information you have typed into the form fields and then hit the "Done" button. Make a 7-day free trial plan with us and gain instant access to Vermont Form Pt 172 S - available from your personal account. Here at FormsPal, we do everything we can to make certain that all of your information is maintained secure.