The Voluntary Fiduciary Correction Program (VFCP) Model Application Form, provided by the U.S. Department of Labor's Employee Benefits Security Administration (EBSA), serves as a critical tool for plan officials aiming to rectify certain breaches of fiduciary responsibilities. This comprehensive form not only guides applicants through the process of correcting a wide range of transactions such as delinquent participant contributions, improper loans, and asset mishandlings but also emphasizes the importance of including a detailed checklist and all pertinent supporting documents, like proof of payment. Applicants are urged to submit this form alongside the required checklist and documents to the appropriate EBSA field office, adhering closely to the guidelines available on the EBSA website. The form outlines the need for disclosing corrected transactions, computing the correction amounts including principal and lost earnings, and providing narrative explanations and calculations that elucidate the breach and its remediation. Additional sections request vital plan and applicant information, the potential seeking of relief under PTE 2002-51 to avoid excise taxes, and, crucially, confirmations of compliance and understanding through a penalty of perjury statement signed by plan officials with firsthand knowledge of the transaction. This form is instrumental in ensuring that applicants accurately report their corrections to meet the VFCP requirements, thereby promoting compliance and safeguarding the interests of plan participants and beneficiaries.

| Question | Answer |

|---|---|

| Form Name | Vfcp Application Form |

| Form Length | 5 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 15 sec |

| Other names | vfcp form online, vfcp application form, form vfcp, vfcp program application |

U.S. Department of Labor

Employee Benefits Security Administration

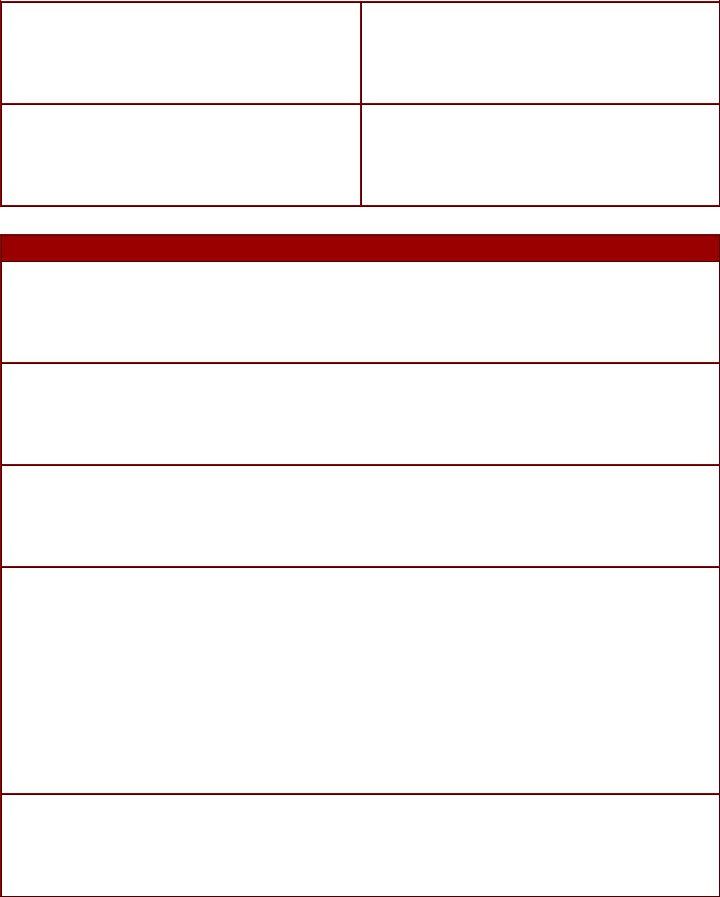

VFCP Model Application Form

This application form provides a recommended format for your Voluntary Fiduciary Correction Program (VFCP) application. Please make sure you include the required VFCP Checklist and all supporting documents identified on the checklist (for example, proof of payment). Submit your application to the appropriate EBSA field office. For full application procedures, consult www.dol.gov/ebsa.

List separately

Applicant Name

Address

Applicant Name

Address

Applicant Name

Address

Transactions Corrected

Check which transactions listed in the VFCP you have corrected:

Delinquent Participant Contributions and Participant Loan Repayments to Pension Plans Delinquent Participant Contributions to Insured Welfare Plans

Delinquent Participant Contributions to Welfare Plan Trusts Loan at Fair Market Interest Rate to a Party in Interest Loan at

Loan at

Loans Failing to Comply with Plan Provisions for Amount, Duration or Level Amortization Default Loans

Purchase of an Asset by a Plan from a Party in Interest Sale of an Asset by a Plan to a Party in Interest Sale and Leaseback of Real Property to Employer

Purchase of Asset by a Plan from a

Payment of Benefits Without Properly Valuing Plan Assets on Which Payment is Based Duplicative, Excessive, or Unnecessary Compensation Paid by a Plan

Expenses Improperly Paid by a Plan

Payment of Dual Compensation to a Plan Fiduciary

Correction Amount

1

Principal Amount: $

Date Paid

Lost Earnings/Restoration of Profit: $

Date Paid

Narrative And Calculations

1. List all persons materially involved in the Breach and its correction (e.g., fiduciaries, service providers):

2. Explain the Breach, including the date(s) it occurred (attach separate sheets if necessary):

3. Explain how the Breach was corrected, by whom, and when (attach separate sheets if necessary):

4.For correction of Delinquent Remittance of Participant Funds, provide a statement from a Plan Official identifying the earliest date on which participant contributions/loan repayments reasonably could have been segregated from the employer’s general assets (attach supporting documentation on which Plan Official relied):

a.Number of days used to determine the date on which participant contributions/loan repayments withheld from employees’ pay could reasonably have been segregated from the employer’s general assets:

b.Description of how this was determined:

5.For correction of Delinquent Remittance of Participant Funds, provide a narrative describing the applicant's contribution and/or repayment remittance practices before and after the period of unpaid or late contributions and/or repayments: (attach separate sheets if necessary)

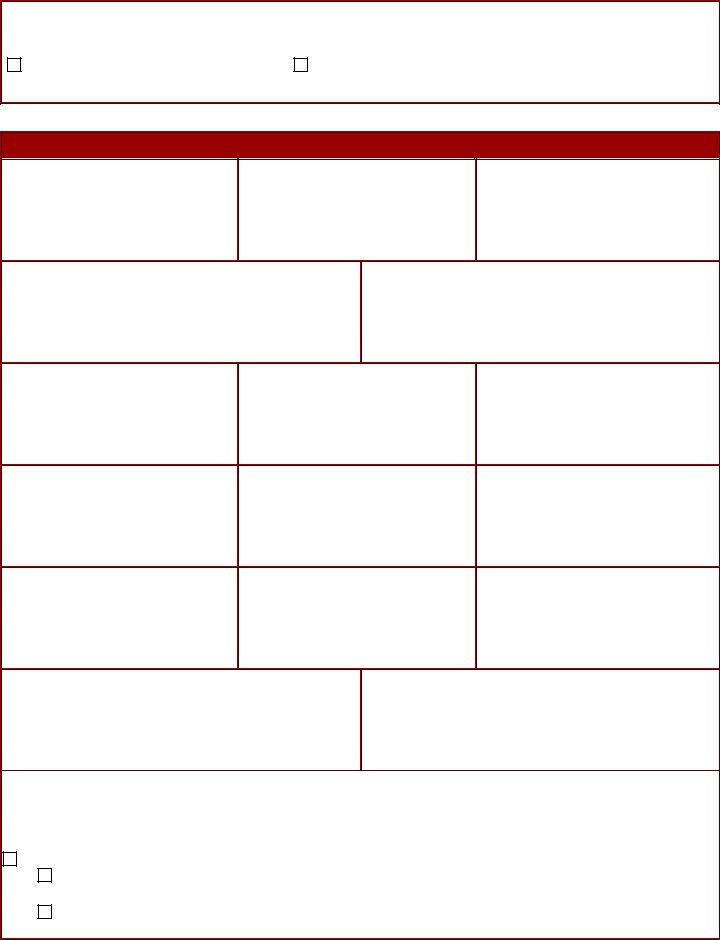

2

6. Specific calculations demonstrating how Principal Amount and Lost Earnings or Restoration of Profits was calculated: (if the Online

Calculator was used, you only need to indicate this and attach a copy of the “Printable Results” page, attach separate sheets if necessary)

Online Calculator (“Printable Results” page attached)

Manual calculation (see attached calculations)

Supplemental Information

Plan Sponsor Name:

EIN:

Address:

Plan Name:

Plan Number:

Plan Administrator Name:

EIN:

Address:

Name of Authorized Representative: (submit written authorization signed by the Plan Official)

Address:

Telephone:

Name of Contact Person:

Address:

Telephone:

Date of Most Recent Annual Report Form 5500 Filing:

For Plan Year Ending:

Is Applicant Seeking Relief Under PTE

Yes - Either:

Submit a copy of the notice to interested parties within 60 calendar days of this application and indicate date of the notice if not on the notice itself;

or

If you are relying on the exception to the notice to interested parties requirement contained in section IV.C. of PTE

3

is less than or equal to $100 and is paid to the Plan, you do not need to provide a notice to interested parties. However, you must provide a copy of a completed IRS Form 5330 or other written documentation showing the calculation of the excise tax amount and proof of payment of this amount to the Plan with your VFCP submission if you elect to pay the excise tax amount (again only an option if less than or equal to $100) to the Plan.

No

I will pay any applicable excise tax to the IRS

I have filed a Form 5330 and paid excise tax

This transaction is not covered by Section 4975 of the Internal Revenue Code

Proof of Payment

Signed, dated receipt from the recipient of funds transferred to the plan (such as a financial institution)

Canceled check

Bank statements for the plan's account

Executed wire transfer

Other:

Disclosure of a current investigation or examination of the plan by an agency, to comply with Section 3(b)(3)(v):

PBGC |

|

Any state attorney general |

State: |

Any state insurance commissioner |

State: |

Contact person for the agency identified: |

|

In order to help us improve our service, please indicate how you learned about the VFCP:

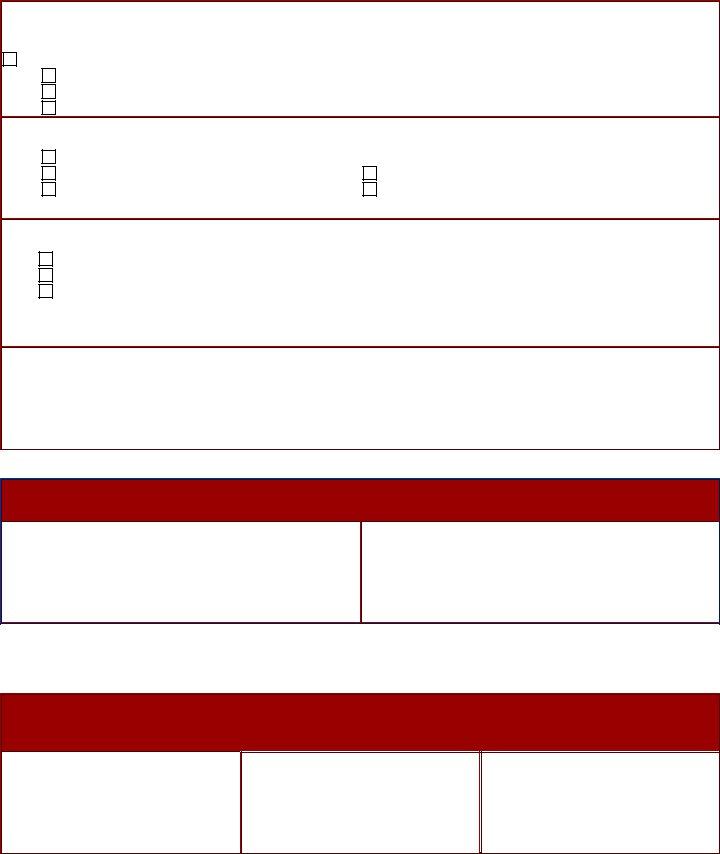

Authorization Of Preparer

I have authorized (name of authorized representative) to represent me concerning this VFCP application.

Name of Plan Official

Signature of Plan Official

Penalty of Perjury Statement - The following statement must be signed and dated by a plan fiduciary with knowledge of the transaction that is the subject of the application and by the authorized representative, if any. Each plan official applying under the VFCP must also sign and date the statement, which must accompany any subsequent additions to the application.

Under penalties of perjury I certify that I am not under investigation (as defined in VFCP Section 3(b)(3)) and that I have reviewed this application, including all supporting documentation, and to the best of my knowledge and belief the contents are true, correct, and complete.

Name and Title

Signature

Date

4

Name and Title

Signature

Date

This application form provides a recommended format for your Voluntary Fiduciary Correction Program (VFCP) application. Please make sure you include the required VFCP Checklist and all supporting documents identified on the checklist (for example, proof of payment). Submit your application to the appropriate EBSA field office. For full application procedures, consult www.dol.gov/ebsa.

Paperwork Reduction Act Notice

The information identified on this form is required for a valid application for the Voluntary Fiduciary Correction Program of the U.S. Department of Labor’s Employee Benefits Security Administration (EBSA). You are not

required to use this form; however, you must supply the information identified in order to receive the relief offered under the Program with respect to a breach of fiduciary responsibility under Part 4 of Title I of ERISA. EBSA will use this information to determine whether you have satisfied the requirements of the Program. EBSA estimates that assembling and submitting this information will require an average of 6 to 8 hours. This collection of information is currently approved under OMB Control Number

5