By using the online tool for PDF editing by FormsPal, you'll be able to fill in or alter for w 3 right here. In order to make our tool better and less complicated to utilize, we constantly design new features, with our users' suggestions in mind. If you're looking to get started, this is what you will need to do:

Step 1: Firstly, access the pdf tool by clicking the "Get Form Button" at the top of this page.

Step 2: This editor gives you the capability to customize the majority of PDF documents in a range of ways. Modify it with customized text, adjust existing content, and add a signature - all at your disposal!

As a way to fill out this document, ensure you enter the necessary information in each and every field:

1. To start off, once filling out the for w 3, start in the section that includes the subsequent blanks:

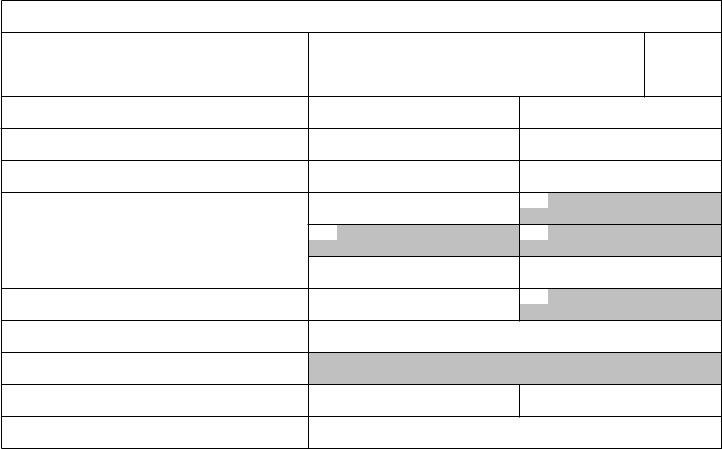

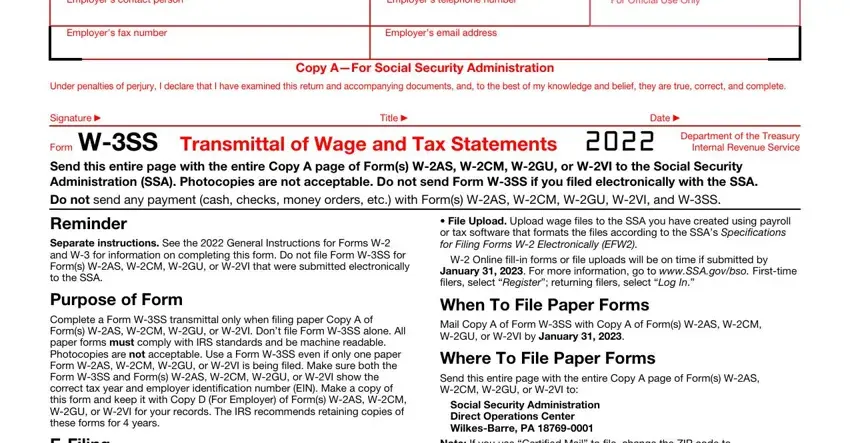

2. The next step would be to submit these blank fields: Employers contact person, Employers telephone number, For Official Use Only, Employers fax number, Employers email address, Under penalties of perjury I, Copy AFor Social Security, Signature, Title, Date, Form WSS Transmittal of Wage and, Internal Revenue Service, Send this entire page with the, Do not send any payment cash, and Reminder Separate instructions See.

Many people often make some errors when completing Employers email address in this area. Make sure you read twice everything you enter here.

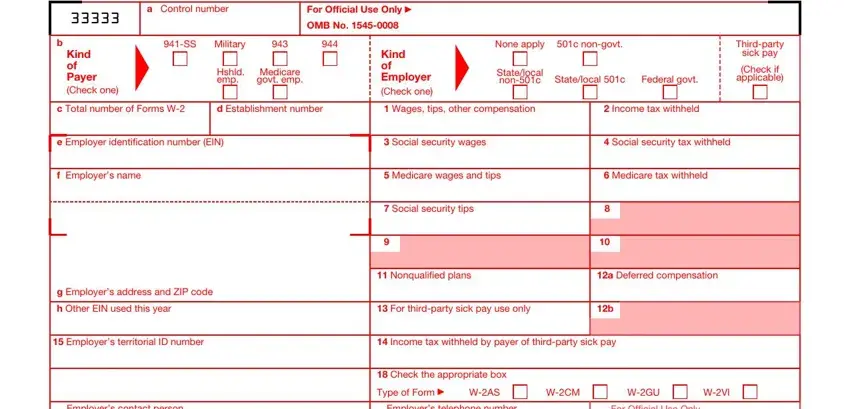

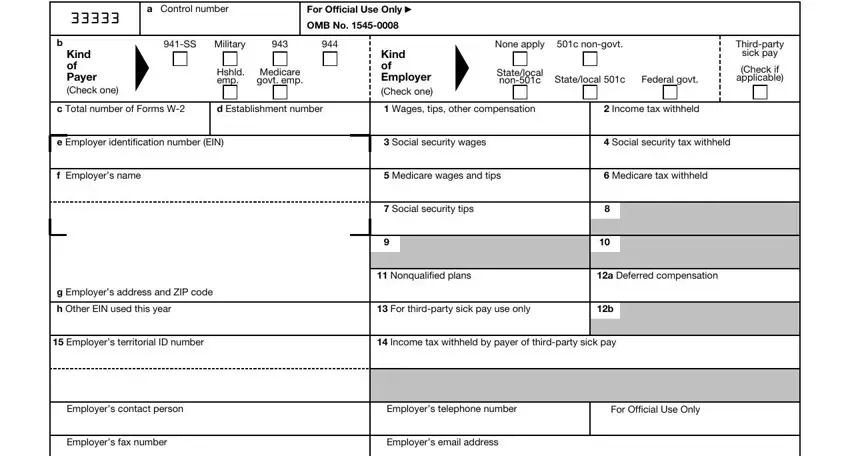

3. In this step, examine DO NOT STAPLE OR FOLD a Control, For Official Use Only, OMB No, Kind of Payer, Check one SS, Military, Hshld emp, Medicare govt emp, Kind of Employer, Check one None apply, Statelocal nonc, c nongovt, Statelocal c, Federal govt, and Thirdparty. Every one of these will have to be filled in with utmost focus on detail.

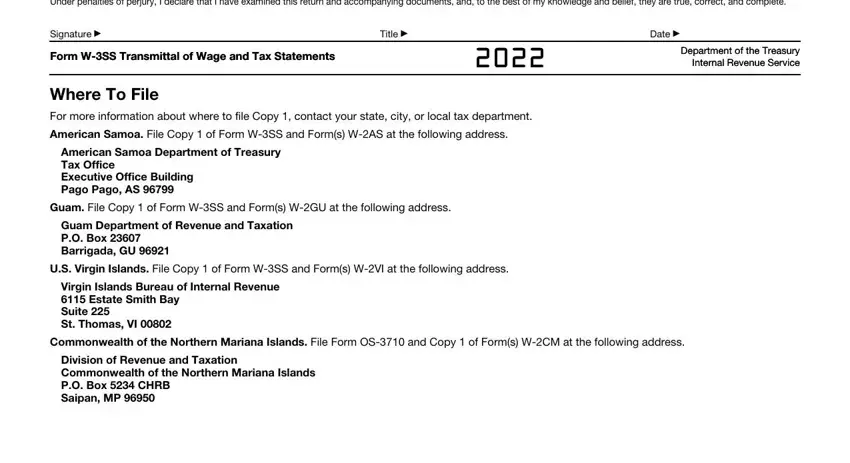

4. Filling in Under penalties of perjury I, Signature, Title, Date, Form WSS Transmittal of Wage and, Department of the Treasury, Where To File, For more information about where, American Samoa File Copy of Form, American Samoa Department of, Guam File Copy of Form WSS and, Guam Department of Revenue and, US Virgin Islands File Copy of, Virgin Islands Bureau of Internal, and Commonwealth of the Northern is vital in this step - don't forget to don't rush and be mindful with every single blank area!

Step 3: Check that your information is accurate and then simply click "Done" to progress further. After registering afree trial account here, it will be possible to download for w 3 or send it via email without delay. The form will also be easily accessible via your personal account page with all of your edits. FormsPal is invested in the confidentiality of our users; we make sure that all information processed by our tool is kept protected.