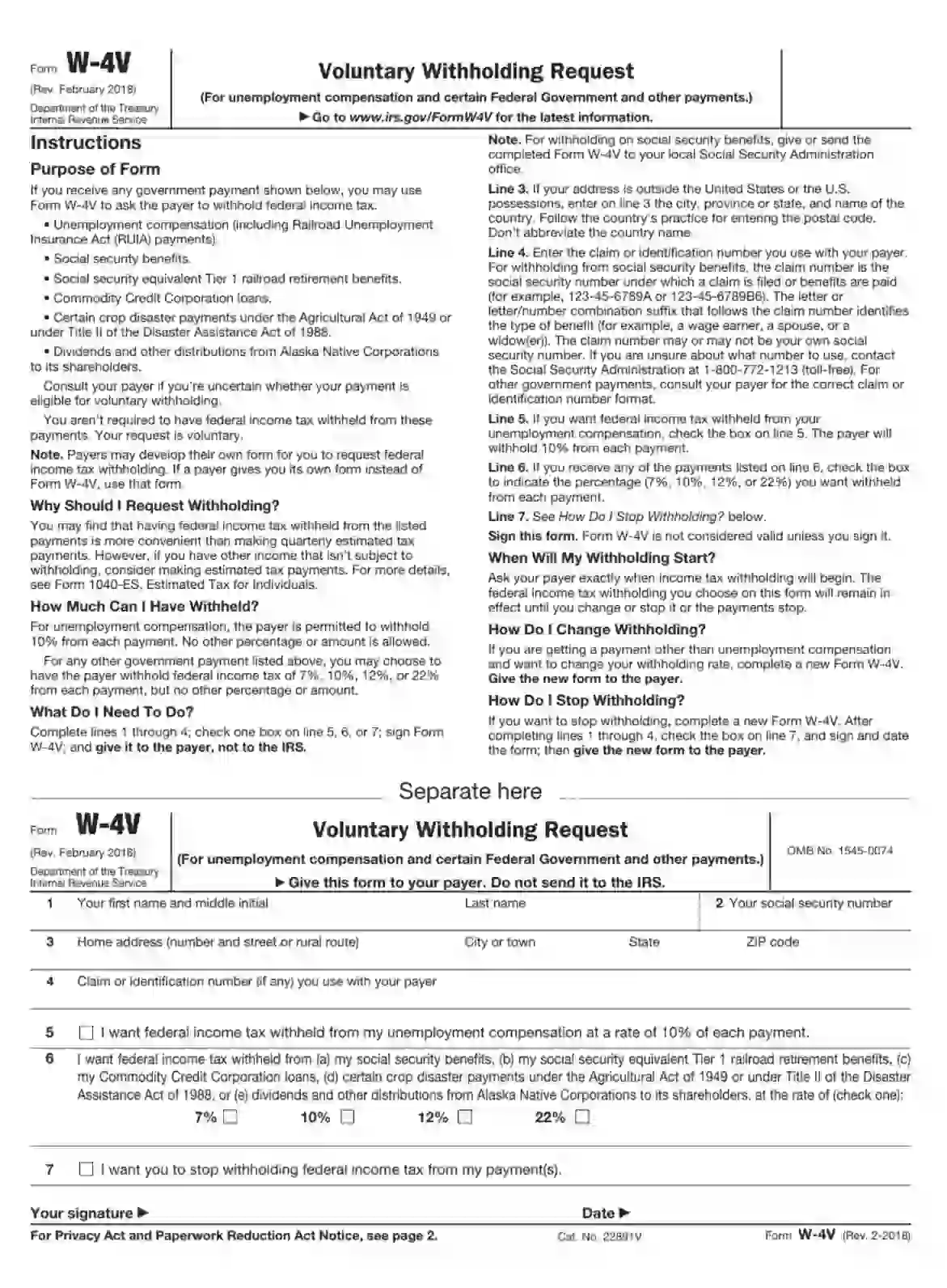

Form W-4V is a tax document used by individuals who receive certain government payments and want to withhold federal income tax from those payments voluntarily. It is typically completed by recipients of unemployment compensation, Social Security benefits, certain Railroad Retirement benefits, or payments from the Department of Agriculture’s Commodity Credit Corporation (CCC).

Form W-4V allows recipients to specify the amount they want withheld from each payment to cover their federal income tax obligations. By completing Form W-4V, recipients of government payments can ensure that enough taxes are withheld to cover their tax liabilities and avoid owing taxes at the end of the year.

How to Complete the W-4V Form

The process of filling out the form is simple and does not take a lot of time. It is a half of page paper, so all you need is to understand how to complete the W-4V Form correctly. I will need to write data in 1-4 fields and mark an appropriate box in the last three lines. Then, all you need to do is to put your signature at the end of the document and send it to the payer.

Please follow our step-by-step filling out instructions below to avoid mistakes and minor or major misunderstandings.

Provide Your Personal Information

For lines one and two, you need to enter your full name, including the first name, middle initials, and surname. Next, you are required to write your SSN (Social Security Number).

Indicate Your Current Address

There is nothing complicated in this third line. Fill out your home address, including the name of the street, its number, city, state, and postal code. If you live outside the US, do not abbreviate the name of your country and fill out this field according to the country’s practice for writing the ZIP code.

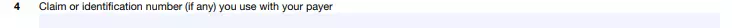

Enter Identification Number (IN) or Claim

The claim number you may use for this purpose is the social security number under which the benefits are paid, or the claim is completed. If you are not sure that you know what claim number you should use, you can call the designated hotline. Check the telephone number either in the form itself or the official website of the Social Security Administration. By calling them, you can address any troubles you meet with identifying your claim number for withholding. If you are interested in other government forms, then you should contact the payer to find out which number to use when filling out the form.

Check the Remaining Suitable Boxes

Mark the box in the fifth line if you want federal income tax withheld from your unemployment compensation. The rate of such withholding is constantly one-tenth of each payment.

The sixth line includes the percentage identification numbers. You should choose how many withholdings you want and mark an appropriate number from the listed ones.

In the seventh line, you can choose an option for stopping federal income tax withholdings. All you need to do if you want to do it is to mark the box on line 7. Also, for this purpose, you will be required to complete a new W-4V Form and repeat all the previous steps.

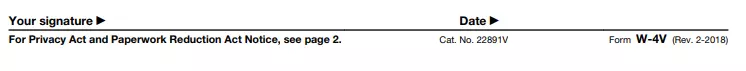

Sign the document and fill out the current date

This is a standard procedure for any official paper. Enter your signature and the filing date at the end.

Finally, you are ready to give or send the complete W-4V Form to the payer and wait for their reaction.