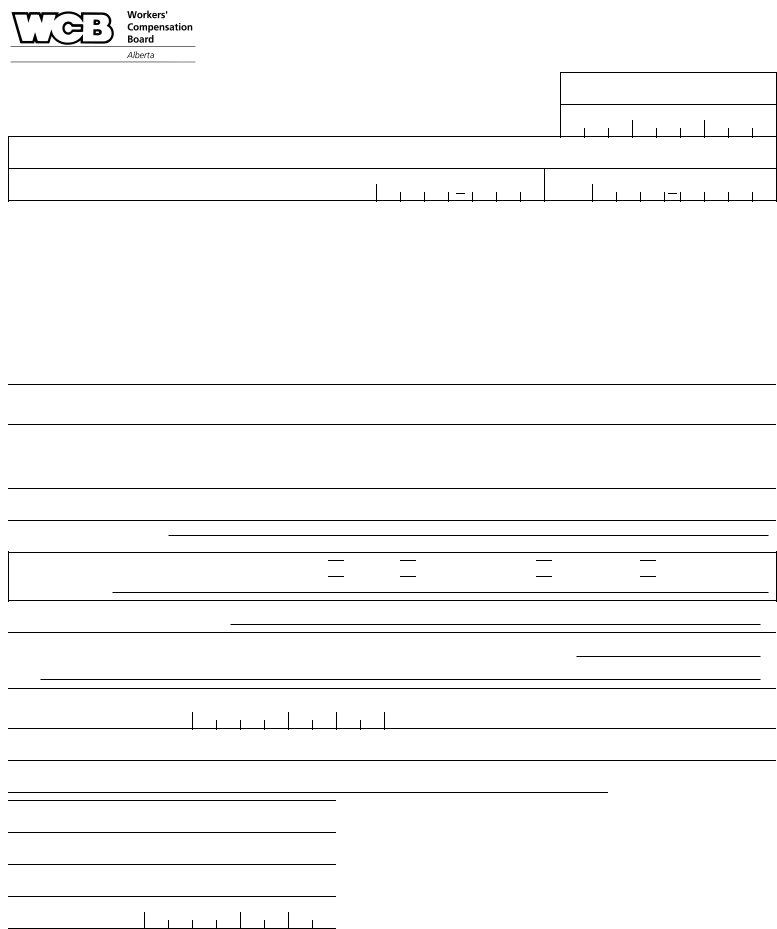

When dealing with the complexities of workers' compensation, specific forms like the WCB C936 form become crucial for both claimants and their support network. This document, integral to the Workers' Compensation Board processes in Edmonton, AB, serves a unique purpose: it enables a personal attendant, who aids a claimant by attending medical examinations, DRDRB review meetings, or appeal hearings, to claim wage loss allowance. The necessity of such a form underscores the intersection of employment, health, and compensation laws, whereby the financial implications of aiding a claimant are formally acknowledged. The form collates essential details about the attendant—from their Social Insurance Number, required for processing T4A slips, to the specifics of their employment and the extent of their wage loss due to their supportive role. This process not only highlights the procedural facets of workers' compensation claims but also the broader implications for those temporarily leaving work to assist. By mandating detailed information, including whether the attendant is directly paid for their time or is self-employed, and the specifics of the time missed from work, the form encapsulates a comprehensive approach to ensuring fair compensation. Furthermore, details such as rate of pay, hours worked, and usual days off, alongside employer information, are gathered meticulously, illustrating the depth of consideration given to each case. This methodical process ensures that the personal attendant's financial loss is addressed, emphasizing the importance of support roles in the continuum of care and compensation for affected workers.

| Question | Answer |

|---|---|

| Form Name | Wcb Form C936 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | T4A, WCB, wcb c936, EDMONTON |

C936

PERSONAL ATTENDANT'S WAGE LOSS

9912 - 107 STREET

PO BOX 2415 EDMONTON AB T5J 2S5 FAX:

Claim Number:

Personal Attendant's Social Insurance #:

Personal Attendant's Name: (Surname) |

(First Name) |

(Initial) |

Address Street |

City/Town |

Province |

(Postal |

Code) |

Telephone Number

( )

Note: WCB requires a personal attendant's Social Insurance Number in order to process T4A slips

The above named personal attendant is required to assist a WCB claimant to attend an appointment (i.e. medical examination, DRDRB review meeting or appeal hearing) in relation to their claim. WCB can pay a wage loss allowance if the personal attendant has a loss of earnings as a result of leaving work to attend the appointment.

TO ALLOW US TO PROPERLY REIMBURSE THE PERSONAL ATTENDANT, PLEASE RETURN THE COMPLETED FORM TO THE ADDRESS OR FAX NUMBER NOTED ABOVE.

1. |

Will you pay the personal attendant directly for the time missed to attend this appointment: |

|

Yes |

|

|

No |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

If other, provide details: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||

2. |

Is the personal attendant self employed? |

If yes, the personal attendant must supply WCB with income and expenses for the period of one month prior |

||||||||||||||||||

|

|

|

Yes |

|

No |

to appointment date. |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

Time missed from work to attend appointment(s): |

Hour or |

|

Day or |

|

|

|

Other (eg., trips) |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

4.Date(s) missed from work:

5. |

Rate of pay: $ |

|

per |

Hour |

Day |

|

Month |

Yearly Gross |

Other |

|

|

|

|

|

|||||

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

Explain other

6.Number of hours worked per week/shift:

7. |

Circle the personal attendant's usual day(s) OFF |

S M T W T F S |

or shift cycle if applicable: |

8.Date shift cycle commenced:

(Year / Month / Day)

9. Employer's Name: |

|

Telephone Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street |

City/Town |

|

Province |

(Postal Code) |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contact Name (Print):

Contact Signature:

Official Title:

Date: |

(Year / Month / Day) |

C - 936 REV APR 2008