Contact Information

Fax: (866-)897-3415 Telephone: (800) 275-9254

Correspondence: MAC N0005-083 800 Walnut St.

Des Moines, IA 50309

Hours of operation: Mon.–Thur. 7:00 a.m. – 10:00 p.m. Fri. 7:00 a.m. – 8:00 p.m.

Sat. 7:00 a.m. – 6:00 p.m. Sun. 8:00 a.m. – 7:00 p.m. Central Time

Subject: Information required from you supporting your request for mortgage assistance

Dear Borrower,

We‘re responding to your request for mortgage assistance. As the first step in the process, we‘ll need to receive specific documentation from you, which is why we‘re writing you today. Working closely with you, your home

preservation specialist will help you through every step of the process and will explore all the options available, taking your situation and financial circumstances into consideration.

Along the way, your home preservation specialist will keep you informed and do everything possible to move you through the process quickly. We encourage you to respond promptly to any communications and requests for information. And please understand, if you do not provide information in a timely manner, it could impact your eligibility for mortgage assistance.

How to get started

Please call your home preservation specialist right after you receive this package. He/She will walk you through all the enclosed materials and help you start the process. In addition, the instructions included in this package will

also help you understand what‘s enclosed and what you need to complete and return so the process can move

forward.

It‘s important for you to act quickly and return the documents required within 30 days of the date of this letter. That‘s because the sooner you respond, the more options may be available to help you avoid foreclosure.

We’re here to help you

We look forward to working with you and encourage you to contact us with any questions you may have about the materials in this package. You can reach a Wells Fargo Home Mortgage representative is available to help you at 1- 800-275-9254.

Sincerely,

Wells Fargo Home Mortgage

Enclosures

Customer Info Pkt - Web |

Page 1 of 6 |

1/2012 |

Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N.A. ©2012 Wells Fargo Bank, N.A. All rights reserved.

Important points to understand

Helpful information about foreclosure

Helpful information about foreclosure

It‘s important to remember that if you do not make your mortgage payment(s), the foreclosure process could begin or continue during the time you‘re working through the mortgage assistance process with us.

We will continue to do what we can to help you avoid a foreclosure sale. As part of the foreclosure process, you may receive notices from a third-party attorney delivered by mail, or see steps being taken to proceed with a foreclosure sale of your home.

Where to turn if you’re struggling with other expenses

Sometimes customers have trouble keeping up with their monthly expenses, other than their mortgage payments. If this is happening to you, help is available at no cost from a HUD-approved, non-profit credit counseling agency. Simply call a counselor who will work closely with you to lower your other monthly payments, take your financial circumstances into consideration, and create a budget plan to work for you. To find an agency in your neighborhood, call 1-800-569-4287 or call the HOPE Hotline at 1-888-995-HOPE.

Beware of foreclosure rescue scams

Beware of foreclosure rescue scams

Be sure you avoid anyone who asks for a fee for counseling or a loan modification, or asks you to sign over the deed to your home, or to make your mortgage payments to anyone other than Wells Fargo.

This communication is an attempt to collect a debt and any information obtained will be used for that purpose. However, if you have received a discharge of this debt in bankruptcy or are currently in a bankruptcy case, this notice is not intended as an attempt to collect a debt, and we have a security interest in the property and will only exercise our rights as against the property.

We may report information about your account to credit bureaus. Late payments, missed payments, or other defaults on your account may be reflected in your credit report.

With respect to those loans secured by property located in the State of California, the state Rosenthal Fair Debt Collection Practices Act requires that, except under unusual circumstances, collectors may not contact you before 8 a.m. or after 9 p.m. They may not harass you by using threats of violence or arrest or by using obscene language. Collectors may not use false or misleading statements or call you at work if they know or have reason to know that you may not receive personal calls at work. For the most part, collectors may not tell another person, other than your attorney or spouse, about your debt. Collectors may contact another person to confirm your location or enforce a judgment. For more information about debt collection activities, you may contact the Federal Trade Commission at 1-877-FTC-HELP or www.ftc.gov.

Customer Info Pkt - Web |

Page 2 of 6 |

1/2012 |

Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N.A. ©2012 Wells Fargo Bank, N.A. All rights reserved.

Instructions —

What you need to do to start the mortgage assistance process

Before we can look into the mortgage assistance options available to you, we need you to gather some important

information about your financial situation. Be sure to call your home preservation specialist right after you receive this package. He/she will explain all of the enclosures and what‘s needed to help you start the process. It‘s also important for you to return the documents requested by the due date by either fax or mail. And don‘t delay,

because by acting soon, more options may be available to you.

Simply follow the instructions below. We‘ve outlined the materials included in this package, details on the documentation that‘s required from you, and some hints to help you along the way.

What’s in this package

Homeowner Assistance Form

IRS Form 4506T-EZ

Cover sheet for mailing or faxing in your completed documents

Prepaid overnight return envelope

What you need to send us

Cover sheet

Cover sheet

Place the enclosed cover sheet on top of all the documentation you return to us, whether you send it in by mail or fax. And if you choose to mail in your documentation, use the enclosed prepaid overnight envelope.

Homeowner Assistance Form

Homeowner Assistance Form

All borrowers must complete, sign and return this document, providing information about your property, income and expenses, and why it‘s difficult for you to make your current mortgage payments.

IRS Form 4506T-EZ Short Form Request for Tax Return Transcript

IRS Form 4506T-EZ Short Form Request for Tax Return Transcript

Each borrower who filed an individual tax return must complete, sign and return a separate 4506T-EZ form. Borrowers who filed a joint tax return may complete and return one 4506T-EZ signed by both borrowers and returned.

Documentation to verify all income of each borrower

Documentation to verify all income of each borrower

Carefully review the ―proof of income‖ section that follows for specific details on the income documentation

you need to gather and send us.

Proof of income information

Below you will find the details on the documentation we‘ll need from you to verify all income of each borrower.

For easy reference, this information is separated into five sections:

1.Gross monthly income

2.Self-employed borrower income/business income

3.Retirement/pension/unemployment and disability income

4.Income from tenants

5.Other income

Please note:

Income must be documented as required.

Include combined income and expenses from the borrower and co-borrower (if any).

If you include income and expenses from a household member who is not a borrower, please specify using the back of this form if necessary.

Additional income documentation may or may not be required.

If you have other types of income, cannot locate required documents, or have questions about the documentation required, please call your home preservation specialist at the phone number in the enclosed letter.

Customer Info Pkt - Web |

Page 3 of 6 |

1/2012 |

Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N.A. ©2012 Wells Fargo Bank, N.A. All rights reserved.

1. Gross monthly income

For wage earners/salary:

If homeowner(s) are wage earners, the following proof of income, including year-to-date information, must be provided, such as most recent paystubs:

30 days of wages

•If paid weekly — send four paystubs

•If paid biweekly — send three paystubs

•If paid semi-monthly — send two paystubs

•If paid monthly — send one paystub

If unable to provide paystubs, salary vouchers with the dates of payment must be dated within the last 30 days, including year-to-date information and the borrower‘s name and/or Social Security number.

If unable to provide paystubs and salary vouchers (e.g., you are paid in cash), please send a letter from the

employer with pay frequency and amount. This letter must be on company letterhead, signed and dated within the last 30 days and include year-to-date information, the borrower‘s name and/or Social Security

number.

The most recent tax returns along with a copy of filed IRS extension must be provided.

‗Other Earned Income‘ such as bonuses, commissions, housing allowance, tips, or overtime:

OReliable third-party documentation describing the amount and nature of the income (e.g. W2, employment contract, or printouts documenting tip income).

2.Self-employed/business income

Borrower‘s complete personal and business tax return for the most recent year with all schedules Most recent quarter, with year-to-date information profit and loss statement that reflects activity for the most recent three months; and

Copies of bank statements for the business account for the last two months evidencing continuation of business activity.

Note: If the federal tax return has not been filed and it is past the filing deadline, please send a copy of the filing extension request along with the profit and loss statement for the year not filed.

3. Retirement, pension, unemployment and disability

IRA/401k/annuity/investment income:

Most recent two months account statement and at least ONE of the following:

OBorrower‘s most recent year of tax returns (1040) including all schedules; or

OMost recent 1099 forms

Retirement or pension:

OAward letter for current year unless it states ―lifetime‖; and

OThree months‘ bank statements.

Unemployment income and short-term disability income:

OAward letter within 60 days; and

OThree months‘ recent bank statements or cancelled checks.

Social Security, disability or death benefits, pension, public assistance, or adoption assistance:

ODocumentation showing the amount and frequency of the benefits, such as letters, exhibits, disability policy or benefits statement from the provider; and

ODocumentation showing the receipt of payment, such as copies of the two most recent bank statements showing deposit amounts.

Customer Info Pkt - Web |

Page 4 of 6 |

1/2012 |

Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N.A. ©2012 Wells Fargo Bank, N.A. All rights reserved.

4. Income from tenants

Rental/Boarder income:

OCopy of the most recent filed federal tax return with all schedules, include Schedule E – Supplement Income and Loss. Rental income for qualifying purposes will be 75% of the gross rent reduced by the monthly debt service on the property if applicable; or

OIf rental income is not reported on Schedule E – Supplemental Income and Loss, provide a copy of the current lease agreement with either bank statements or cancelled rent checks demonstrating receipt of rent.

If Boarder income also include:

OProof of occupancy (i.e., cell phone or utility bill, bank statements or other evidence of occupancy from boarder).

5.Other income

Alimony, child support, or separation maintenance payments as qualifying income:*

OCopy of divorce decree, separation agreement, or other written legal agreement filed with a court, or court decree that states the amount of the alimony, child support, or separation maintenance payments and the period of time over which the payments will be received; and

OCopies of your two most recent bank statements or other third-party documents showing receipt of payment.

*Notice: Alimony, child support, or separation maintenance income need not be revealed if you do not choose to have it considered for repaying this loan.

Welfare:

If welfare is listed as income, need a letter from County.

Non-borrower household income

Must be non-obligated fiancé/fiancée, spouse or domestic partner, parent or child (additional relatives may be considered in certain circumstances):

OThe income of a non-borrower who contributes to the mortgage loan payment and is included in the

monthly gross income must be documented and verified using the same standards used for verifying a borrower‘s income, including a completed and signed 4506T-EZ. Proof of occupancy (i.e., cell phone or utility bill, bank statements or other evidence of occupancy from contributor); and

OContribution letter stating contributor‘s name, relationship, frequency, and amount of contribution, signed and dated by contributor.

Customer Info Pkt - Web |

Page 5 of 6 |

1/2012 |

Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N.A. ©2012 Wells Fargo Bank, N.A. All rights reserved.

Helpful hints

OIn order to help you, we need to hear from you — so be sure to call your home preservation specialist right after you receive this package. He/she will explain what‘s needed and help you start the process. It‘s also important that you send us all the required/completed forms and documents requested by the due date. Keep in mind:

•All borrowers need to sign and date all documents where required, and include your loan number on all correspondence.

•Your financial documentation should be current, within the last 30 days.

•It‘s best to submit all documents together in one package. Sending documents separately may increase the processing time. Use the cover sheet enclosed. Submit everything either by fax or by mail using the enclosed prepaid overnight envelope.

OStay in touch with us:

•After you send in your documents, call your home preservation specialist so he or she can ensure everything was received to get the review process started as soon as possible.

•Be sure to provide your home preservation specialist with your best contact number. This will help him/her get in touch with you quickly if there are additional requirements.

•During the process, additional information or documentation may be requested. Timing is important, so be sure you promptly respond to any phone calls or communications.

•If you have a change in circumstances during the process, please advise your home preservation specialist so we can review your situation appropriately.

•At any point, if you have any questions, contact your home preservation specialist.

We’re here for you

You can count on your home preservation specialist to work with you through every step of the mortgage assistance process. Along the way, if you have any questions, be sure to reach out to your home preservation specialist.

Customer Info Pkt - Web |

Page 6 of 6 |

1/2012 |

Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N.A. ©2012 Wells Fargo Bank, N.A. All rights reserved.

Homeowner Assistance Form

Before you complete this form, contact us for assistance.

Mortgage Loan Number: |

|

|

|

|

I/we want to: |

Keep the Property |

|

Sell the Property |

|

The property is my/our: |

Primary Residence |

|

Second Home |

Investment Property |

The property is: |

Owner Occupied |

|

Renter Occupied |

Vacant |

Borrower |

|

Co-borrower |

|

Borrower’s name |

|

Co-borrower’s name |

|

|

|

|

|

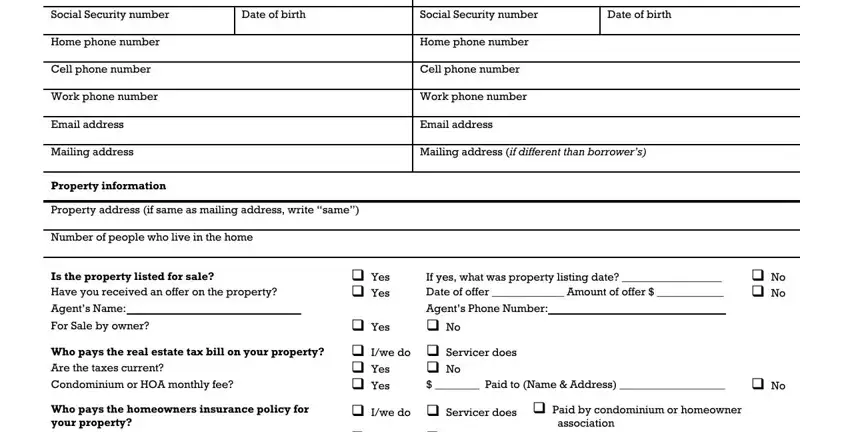

Social Security number |

Date of birth |

Social Security number |

Date of birth |

|

|

|

|

Home phone number |

|

Home phone number |

|

|

|

|

|

Cell phone number |

|

Cell phone number |

|

|

|

|

|

Work phone number |

|

Work phone number |

|

|

|

|

|

Email address |

|

Email address |

|

|

|

|

Mailing address |

|

Mailing address (if different than borrower’s) |

|

|

|

|

|

Property information

Property address (if same as mailing address, write “same”)

Number of people who live in the home

Is the property listed for sale?

Have you received an offer on the property? Agent’s Name:

For Sale by owner?

Who pays the real estate tax bill on your property?

Are the taxes current?

Condominium or HOA monthly fee?

Who pays the homeowners insurance policy for your property?

Is the policy current?

Name of insurance company________________________

Yes

Yes

Yes

I/we do

Yes

Yes

I/we do

Yes

If yes, what was property listing date? __________________

Date of offer _____________ Amount of offer $ ____________

Agent’s Phone Number:

No

Servicer does

No

$ ________ Paid to (Name & Address) ___________________

Servicer does Paid by condominium or homeowner

association

No

Insurance company phone number _____________________

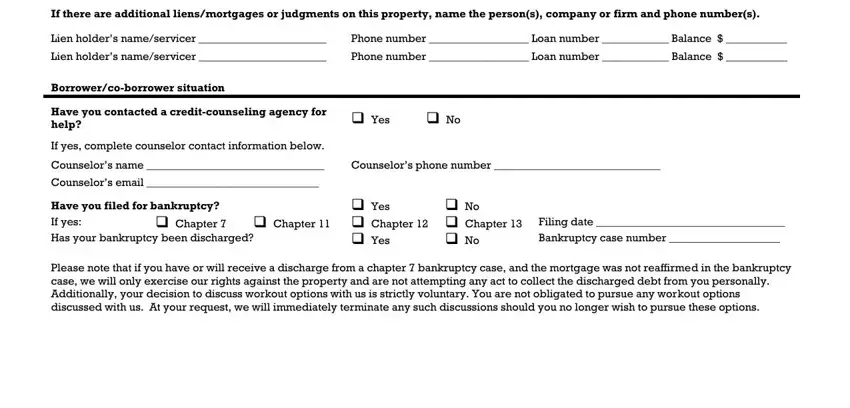

If there are additional liens/mortgages or judgments on this property, name the person(s), company or firm and phone number(s).

Lien holder’s name/servicer _______________________ Phone number __________________ Loan number ____________ Balance $ ___________

Lien holder’s name/servicer _______________________ Phone number __________________ Loan number ____________ Balance $ ___________

Borrower/co-borrower situation

Have you contacted a credit-counseling agency for help?

If yes, complete counselor contact information below.

Counselor’s name ________________________________

Counselor’s email _______________________________

Have you filed for bankruptcy? |

|

If yes: |

Chapter 7 |

Chapter 11 |

Has your bankruptcy been discharged?

Yes |

No |

|

Counselor’s phone number ______________________________ |

Yes |

No |

|

Chapter 12 Chapter 13 |

Filing date __________________________________ |

Yes |

No |

Bankruptcy case number ____________________ |

Please note that if you have or will receive a discharge from a chapter 7 bankruptcy case, and the mortgage was not reaffirmed in the bankruptcy case, we will only exercise our rights against the property and are not attempting any act to collect the discharged debt from you personally. Additionally, your decision to discuss workout options with us is strictly voluntary. You are not obligated to pursue any workout options discussed with us. At your request, we will immediately terminate any such discussions should you no longer wish to pursue these options.

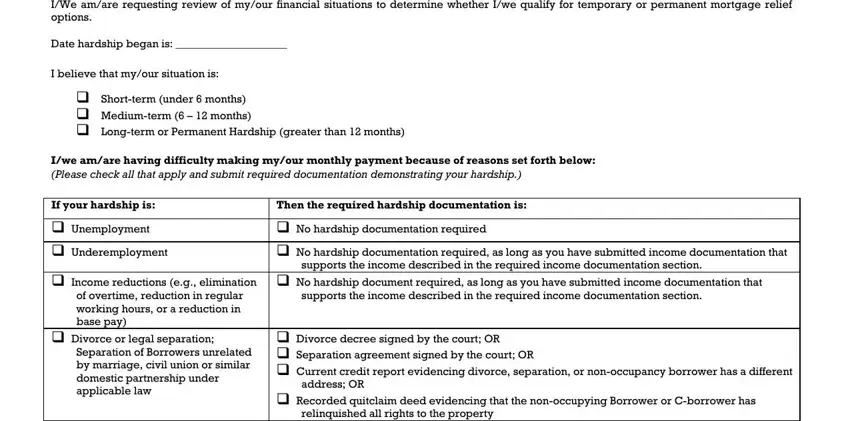

Hardship Affidavit (Provide a written explanation with this request describing the specific nature of your hardship.)

I/We am/are requesting review of my/our financial situations to determine whether I/we qualify for temporary or permanent mortgage relief options.

Date hardship began is: ____________________

I believe that my/our situation is:

Short-term (under 6 months)

Medium-term (6 – 12 months)

Long-term or Permanent Hardship (greater than 12 months)

I/we am/are having difficulty making my/our monthly payment because of reasons set forth below:

(Please check all that apply and submit required documentation demonstrating your hardship.)

|

If your hardship is: |

Then the required hardship documentation is: |

|

|

|

|

Unemployment |

No hardship documentation required |

|

|

|

|

Underemployment |

No hardship documentation required, as long as you have submitted income documentation that |

|

|

supports the income described in the required income documentation section. |

|

Income reductions (e.g., elimination |

No hardship document required, as long as you have submitted income documentation that |

|

of overtime, reduction in regular |

supports the income described in the required income documentation section. |

|

working hours, or a reduction in |

|

|

|

base pay) |

|

|

|

Divorce or legal separation; |

Divorce decree signed by the court; OR |

|

Separation of Borrowers unrelated |

Separation agreement signed by the court; OR |

|

by marriage, civil union or similar |

Current credit report evidencing divorce, separation, or non-occupancy borrower has a different |

|

domestic partnership under |

address; OR |

|

applicable law |

|

Recorded quitclaim deed evidencing that the non-occupying Borrower or C-borrower has |

|

|

|

|

relinquished all rights to the property |

|

Death of borrower or death of either |

Death Certificate; OR |

|

the primary or secondary wage |

Obituary or newspaper article reporting the death |

|

earner in the household |

|

|

|

Long-term or permanent disability; |

Doctor’s certificate of illness or disability; OR |

|

Serious illness of a borrower/co- |

Medical bills; OR |

|

borrower or depend family |

Proof of monthly insurance benefits or government assistance (if applicable) |

|

member |

|

|

|

|

Disaster (natural or man-made) |

Insurance Claim; OR |

|

adversely impacting the property |

Federal Emergency management Agency grant or Small Business Administration loan; OR |

|

or Borrower’s place of employment |

Borrower or Employer property located in a federally declared disaster area |

|

Distant employment transfer |

No hardship documentation required |

|

|

|

|

Business failure |

Tax return from the previous year (including all schedules AND |

|

|

Proof of business failure supported by one of the following: |

|

|

O |

Bankruptcy filing for the business; or |

|

|

O |

Two months recent bank statements for the business account evidencing cessation of |

|

|

|

business activity; or |

|

|

O |

Most recent signed and dated quarterly or year-to-date profit and loss statement |

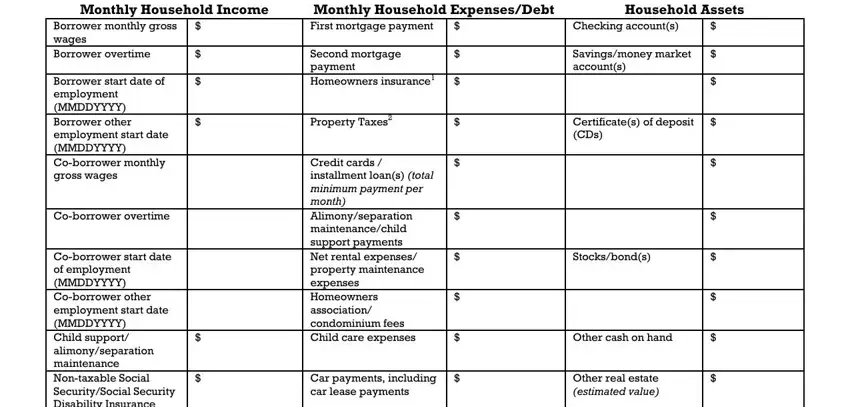

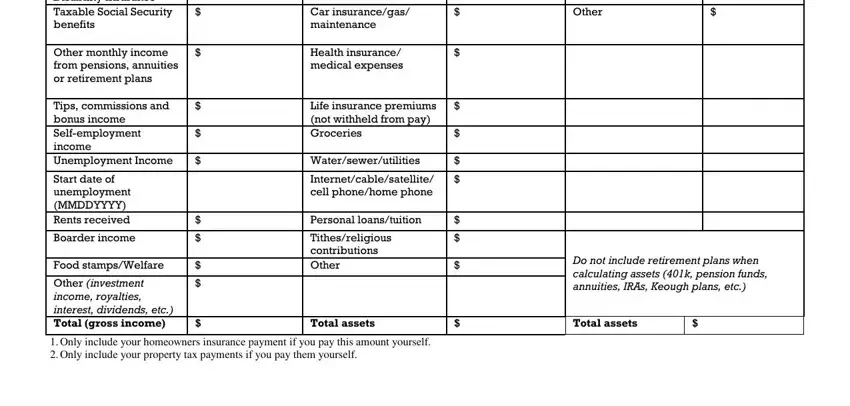

Income/expense for household

Important note: All income must be documented.

Include combined income and expenses from the borrower and co-borrower (if any). If you will be including income and expenses from a household member who is not a borrower, please specify this information on the back of this form. Also, include the non-borrower(s) start date(s) for employment information. You are not required to disclosure child support, alimony or separation maintenance income unless you choose to have it considered by your servicer.

|

1 |

|

2 |

|

3 |

|

|

|

Monthly Household Income |

Monthly Household Expenses/Debt |

Household Assets |

|

Borrower monthly gross |

$ |

First mortgage payment |

$ |

Checking account(s) |

|

$ |

|

wages |

|

|

|

|

|

|

|

|

Borrower overtime |

$ |

Second mortgage |

$ |

Savings/money market |

|

$ |

|

|

|

payment |

|

account(s) |

|

|

|

Borrower start date of |

$ |

Homeowners insurance1 |

$ |

|

|

|

$ |

|

employment |

|

|

|

|

|

|

|

|

(MMDDYYYY) |

|

|

|

|

|

|

|

|

Borrower other |

$ |

Property Taxes2 |

$ |

Certificate(s) of deposit |

$ |

|

employment start date |

|

|

|

(CDs) |

|

|

|

(MMDDYYYY) |

|

|

|

|

|

|

|

|

Co-borrower monthly |

|

Credit cards / |

$ |

|

|

|

$ |

|

gross wages |

|

installment loan(s) (total |

|

|

|

|

|

|

|

|

minimum payment per |

|

|

|

|

|

|

|

|

month) |

|

|

|

|

|

|

Co-borrower overtime |

|

Alimony/separation |

$ |

|

|

|

$ |

|

|

|

maintenance/child |

|

|

|

|

|

|

|

|

support payments |

|

|

|

|

|

|

Co-borrower start date |

|

Net rental expenses/ |

$ |

Stocks/bond(s) |

|

$ |

|

of employment |

|

property maintenance |

|

|

|

|

|

|

(MMDDYYYY) |

|

expenses |

|

|

|

|

|

|

Co-borrower other |

|

Homeowners |

$ |

|

|

|

$ |

|

employment start date |

|

association/ |

|

|

|

|

|

|

(MMDDYYYY) |

|

condominium fees |

|

|

|

|

|

|

Child support/ |

$ |

Child care expenses |

$ |

Other cash on hand |

|

$ |

|

alimony/separation |

|

|

|

|

|

|

|

|

maintenance |

|

|

|

|

|

|

|

|

Non-taxable Social |

$ |

Car payments, including |

$ |

Other real estate |

|

$ |

|

Security/Social Security |

|

car lease payments |

|

(estimated value) |

|

|

|

Disability Insurance |

|

|

|

|

|

|

|

|

Taxable Social Security |

$ |

Car insurance/gas/ |

$ |

Other |

|

$ |

|

benefits |

|

maintenance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other monthly income |

$ |

Health insurance/ |

$ |

|

|

|

|

|

from pensions, annuities |

|

medical expenses |

|

|

|

|

|

|

or retirement plans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tips, commissions and |

$ |

Life insurance premiums |

$ |

|

|

|

|

|

bonus income |

|

(not withheld from pay) |

|

|

|

|

|

|

Self-employment |

$ |

Groceries |

$ |

|

|

|

|

|

income |

|

|

|

|

|

|

|

|

Unemployment Income |

$ |

Water/sewer/utilities |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Start date of |

|

Internet/cable/satellite/ |

$ |

|

|

|

|

|

unemployment |

|

cell phone/home phone |

|

|

|

|

|

|

(MMDDYYYY) |

|

|

|

|

|

|

|

|

Rents received |

$ |

Personal loans/tuition |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Boarder income |

$ |

Tithes/religious |

$ |

|

|

|

|

|

|

|

contributions |

|

Do not include retirement plans when |

|

Food stamps/Welfare |

$ |

Other |

$ |

|

calculating assets (401k, pension funds, |

|

|

|

|

|

|

Other (investment |

$ |

|

|

|

|

|

annuities, IRAs, Keough plans, etc.) |

|

income, royalties, |

|

|

|

|

|

|

|

|

|

|

|

|

interest, dividends, etc.) |

|

|

|

|

|

|

|

|

Total (gross income) |

$ |

Total assets |

$ |

Total assets |

|

$ |

|

|

|

|

|

|

|

|

|

|

1.Only include your homeowners insurance payment if you pay this amount yourself.

2.Only include your property tax payments if you pay them yourself.

Acknowledgment and Agreement

I/We understand that I/we will be considered for all mortgage assistance options available to us, including federal government programs as appropriate. I/We certify as follows:

1.That all of the information in this affidavit is true and accurate and the event(s) identified on page two is/are the reason that I/we need to request a modification of the terms of my/our mortgage, short sale or deed in lieu of foreclosure.

2.I/We understand that the servicer, the U.S. Department of the Treasury, or its agents may investigate the accuracy of my/our statements, may require me/us to provide supporting documentation, and that knowingly submitting false information may violate federal law and may result in foreclosure.

3.I/We understand the servicer may pull a current credit report on all borrowers obligated on the Note.

4.I/We understand that if I/we have intentionally defaulted on my/our existing mortgage, engaged in fraud or misrepresented any fact(s) in connection with this document, the servicer may cancel any Agreement and may pursue foreclosure on my/our home and/or pursue any available legal remedies.

5.I/We understand, to be considered for certain federal government programs my/our property must be owner-occupied. If I/we have not indicated otherwise on this form, I/we certify that: my/our property is owner-occupied and I/we intend to reside in this property for the next twelve months and I/we have not received a condemnation notice and there has been no change in the ownership of the property since I/we signed the documents for the mortgage that I/we want to modify.

6.I/We am/are willing to provide all requested documents and to respond to all servicer questions in a timely manner.

7.I/We understand that the servicer will use the information in this document to evaluate my/our eligibility for a loan modification or short sale or deed in lieu of foreclosure, but the servicer is not obligated to offer me/us assistance based solely on the statements in this document.

8.I/We am/are willing to commit to credit counseling if it is determined that my/our financial hardship is related to excessive debt.

9.If I/we am/are eligible for a trial period plan, repayment plan, or forbearance plan, and I/we accept and agree to all terms of such plan, I/we

also agree that the terms of this Acknowledgment and Agreement are incorporated into such plan by reference as if set forth in such plan in full. My/Our first timely payment following my/our Servicer’s determination and notification of my/our eligibility or prequalification for a trial period plan, repayment plan, or forbearance plan (when applicable) will serve as acceptance of the terms set forth in the notice sent to me that sets forth the terms and conditions of the trial period plan, repayment plan, or forbearance plan.

10.I/We agree that when the Servicer accepts and posts a payment during the term of any repayment plan, trial period plan, or forbearance plan it will be without prejudice to, and will not be deemed a waiver of, the acceleration of my/our loan or foreclosure action and related activities and shall not constitute a cure of my/our default under my/our loan unless such payments are sufficient to completely cure my/our entire default under my/our loan.

11.I/We agree that any prior waiver as to my/our payment of escrow items to the Servicer in connection with my/our loan has been revoked.

12.If I/we qualify for and enter into a repayment plan, forbearance plan, and trial period plan, I/we agree to the establishment of an escrow account if an escrow account never existed on my/our loan as required.

13.I/We understand that the servicer will collect and record personal information, including, but not limited to, my/our name(s), address, telephone number, Social Security number(s), credit score, income, payment history, government monitoring information, and information about account balances and activity. I/We understand and consent to the disclosure of my/our personal information to (a) the U.S. Department of the Treasury or its agents; (b) any investor, insurer, guarantor or servicer that owns, insures, guarantees or services my/our first lien or subordinate lien (if applicable) mortgage loan(s); (c) companies and/or individuals that perform support services in conjunction with home preservation mortgage assistance efforts; (d) auditors, including but not limited to independent auditors, regulators and agencies; and (e) any HUD-certified housing counselor.

14.I/We consent to being contacted concerning this request for mortgage assistance at any cellular or mobile telephone number I/we have provided to the Servicer. This includes text messages and telephone calls to my/our cellular or mobile telephone.

______________________________ |

_____________ |

______________________________ |

_____________ |

Borrower Signature |

Date |

Co-borrower Signature |

Date |

Contacts – if you have questions

If you have questions about this document or your available options, please contact your home preservation specialist.

If you have questions about your options that your servicer cannot answer or if you need further counseling, call the Homeowner’s HOPE™ Hotline at 1-888-995-HOPE (4673). A Hotline counselor will help you by answering questions about your available options and providing you with free HUD-certified counseling services in English and Spanish.

Helpful information about foreclosure

Helpful information about foreclosure Beware of foreclosure rescue scams

Beware of foreclosure rescue scams

Cover sheet

Cover sheet Homeowner Assistance Form

Homeowner Assistance Form IRS Form

IRS Form  Documentation to verify all income of each borrower

Documentation to verify all income of each borrower