|

West Virginia State Tax Department |

|

|

Offer In Compromise |

|

|

|

|

Form CD-3 (Revised 4/05) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

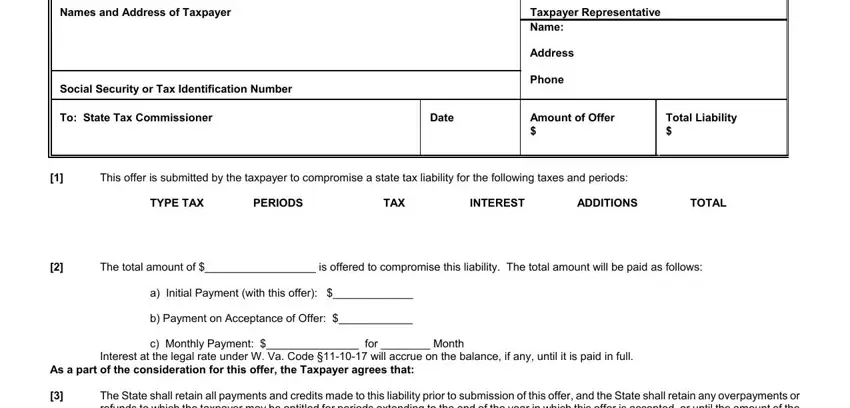

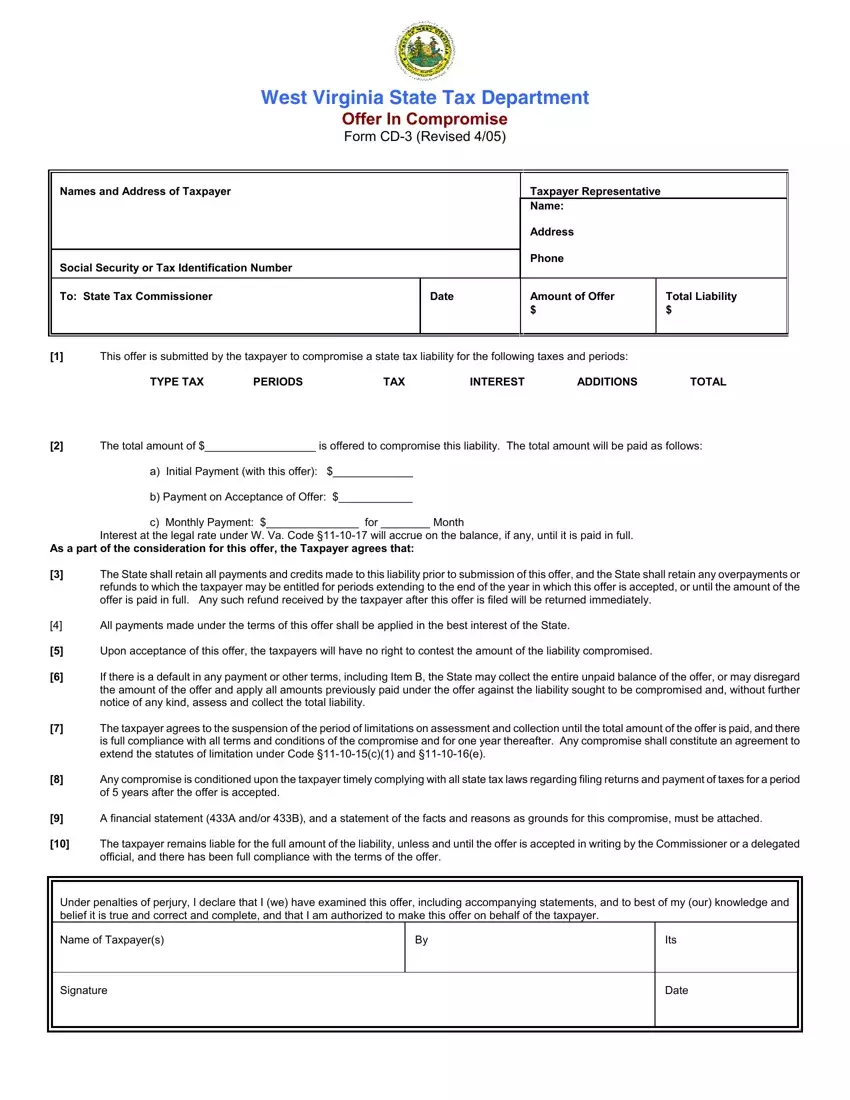

Names and Address of Taxpayer |

|

|

Taxpayer Representative |

|

|

|

|

Name: |

|

|

|

|

Address |

|

|

|

|

Phone |

|

Social Security or Tax Identification Number |

|

|

|

|

|

|

|

|

|

|

To: State Tax Commissioner |

|

Date |

Amount of Offer |

|

Total Liability |

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

[1]This offer is submitted by the taxpayer to compromise a state tax liability for the following taxes and periods:

TYPE TAX |

PERIODS |

TAX |

INTEREST |

ADDITIONS |

TOTAL |

[2]The total amount of $__________________ is offered to compromise this liability. The total amount will be paid as follows:

a)Initial Payment (with this offer): $_____________

b)Payment on Acceptance of Offer: $____________

c)Monthly Payment: $_______________ for ________ Month

Interest at the legal rate under W. Va. Code §11-10-17 will accrue on the balance, if any, until it is paid in full.

As a part of the consideration for this offer, the Taxpayer agrees that:

[3]The State shall retain all payments and credits made to this liability prior to submission of this offer, and the State shall retain any overpayments or refunds to which the taxpayer may be entitled for periods extending to the end of the year in which this offer is accepted, or until the amount of the offer is paid in full. Any such refund received by the taxpayer after this offer is filed will be returned immediately.

[4]All payments made under the terms of this offer shall be applied in the best interest of the State.

[5]Upon acceptance of this offer, the taxpayers will have no right to contest the amount of the liability compromised.

[6]If there is a default in any payment or other terms, including Item B, the State may collect the entire unpaid balance of the offer, or may disregard the amount of the offer and apply all amounts previously paid under the offer against the liability sought to be compromised and, without further notice of any kind, assess and collect the total liability.

[7]The taxpayer agrees to the suspension of the period of limitations on assessment and collection until the total amount of the offer is paid, and there is full compliance with all terms and conditions of the compromise and for one year thereafter. Any compromise shall constitute an agreement to extend the statutes of limitation under Code §11-10-15(c)(1) and §11-10-16(e).

[8]Any compromise is conditioned upon the taxpayer timely complying with all state tax laws regarding filing returns and payment of taxes for a period of 5 years after the offer is accepted.

[9]A financial statement (433A and/or 433B), and a statement of the facts and reasons as grounds for this compromise, must be attached.

[10]The taxpayer remains liable for the full amount of the liability, unless and until the offer is accepted in writing by the Commissioner or a delegated official, and there has been full compliance with the terms of the offer.

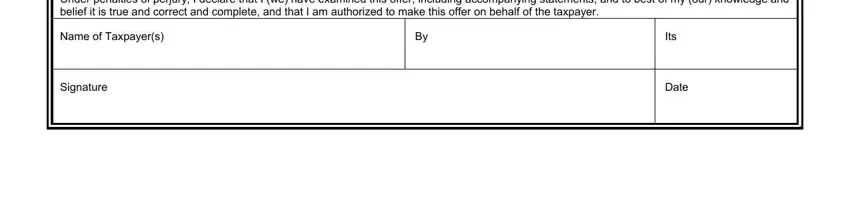

Under penalties of perjury, I declare that I (we) have examined this offer, including accompanying statements, and to best of my (our) knowledge and belief it is true and correct and complete, and that I am authorized to make this offer on behalf of the taxpayer.

OFFERS IN COMPROMISE - INSTRUCTIONS

Authority

W. Va. Code §11-10-5q(c) allows the State Tax Commissioner to compromise a tax liability, which includes all tax, penalty, interest, or additions to tax.

Reason for Compromise

We are allowed to compromise a liability for one or both of the following two (2) reasons: (1) doubt as to whether the taxpayer owes the liability; (2) doubt that we can collect the full amount of the liability. This form and instructions is only used in cases of doubt as to collectibility.

Policy

We will accept an offer in compromise when it is unlikely that we can collect the tax liability in full, and the amount offered reasonably reflects the amount we can collect. An offer in compromise is a legitimate alternative to declaring a case as currently not collectible or to a long-term installment agreement. Our goal is to collect what is potentially collectible at the earliest possible time and at the least cost to the State.

The success of the compromise will be assured only if taxpayers make adequate compromise proposals consistent with their ability to pay the State. Taxpayers are expected to provide reasonable documentation to verify their ability to pay. The goal is a compromise which is in the best interest of both the taxpayer and the State. Where an offer in compromise appears to be a workable solution, the employee assigned the case will discuss the compromise with the taxpayer and, when necessary, assist in preparing the required forms. The taxpayer will be responsible for making the first offer for compromise.

Practical Consideration

It is the taxpayer's responsibility to show us why it would be in our best interest to accept your proposal. When we consider your offer we ask the following questions: (1) Could we collect the amount owed through liquidation of your assets or through an installment agreement? (2) Could we collect more from your assets and future income than is offered? (3) Would collection in the future result in more payment than is offered? (4) Would the public believe that the acceptance of your offer was a reasonable action?

The fact that you have no assets or income at this time from which the State could collect the liability does not mean that the State should simply accept any offer because it is all we can collect now. It would generally be better for us to reject a nominal amount and wait to see what collection potential would arise during the remainder of our ten-year collection period.

Additional Consideration

We believe that you benefit if we accept your offer because you can manage your finances without the burden of a tax liability. Therefore, we may require either: (1) A written agreement that will require you to pay a percentage of future earnings; and/or (2) A written agreement to give up present or future tax refunds.

Tax Compliance

(1)We will not accept your offer if you have not filed all tax returns. (2) We will also require that the taxpayer comply with all future filing and payment requirements. The terms of the offer require future compliance for a period of five (5) years.

Collection and Payments

The submission of an offer does not automatically suspend collection. If it appears the offer was filed to delay collection of the tax or that delay would hinder our ability to collect the tax, we will continue collection efforts. If you have agreed to make installment payments before you made the offer, those payments should continue.

Special Instructions for Offer in Compromise Form

(1)The Offer in Compromise form must be used to submit an offer. The form must be filed with the Compliance Division. If you have been working with a specific employee on your case, file the offer with that employee.

(2)Your full name, address and taxpayer identification number(s) must be entered at the top of the Offer form. If this is a joint liability (husband and wife) and both wish to make an offer, both names must be shown. If you are individually liable for a liability and are also jointly liable for another liability, and only one person is submitting an offer, only one offer must be submitted. If you are individually liable for one liability and jointly liable for another and both joint parties are submitting an offer, two (2) Offers must be submitted, one (1) for separate liability and one (1) for the joint liability.

(3)You must list all liabilities to be compromised in item (1). The types of tax, the periods, and the amounts must be specifically identified.

(4)The total amount you offer must be entered in item (2). The amount must not include any amount which has already been paid or collected on the liability. The amount submitted with the offer is entered in 2(a); the amount is to be paid on acceptance of the offer is entered in (2) (b) and any amount to be paid in installments, is entered in 2(c) in item 2. You should pay the amount of the offer in the shortest time possible, or we will reject your offer. Under no circumstances should the payment extend beyond two (2) years. Interest is due at the legal rate from the date of acceptance to the date of full payment.

(5)You must state in detail in item (9) why the State should accept your offer. Attach additional pages as necessary. Describes in detail why you believe the State cannot collect more than offered from your assets and your present and future income.

(6)The taxpayer(s) must sign and date the offer. If a person other than the taxpayer signs the offer, a power of attorney must be submitted with the offer.

(7)Form 433-A, Collection Information Statement for Individuals and/or Form 433-B Collection Information Statement for Business must accompany the Offer. A sole proprietorship liability requires 433-A for the individual and 433-B for the business. A business tax liability requires a 433-B for the business, and 433-A for the sole proprietor, partner(s) or responsible officer(s) seeking a compromise of personal liability. All blocks on forms 433-A and 433-B must be completed. When you submit Form 433-A and/or 433-B, documentation should be submitted to verify values of assets, encumbrances and income and expense information listed on the collection information statement.

What You Are Agreeing To

Please read the Offer in Compromise Form carefully so that you understand that you are agreeing to:

(1)The period for collection is suspended while the offer is pending, while any amount offered remains unpaid, and for one (1) year after all terms and conditions of the offer are fulfilled.

(2)You won't contest or appeal the amount of the liability if your offer is accepted.

(3)You give up of overpayments (refunds) for all tax periods through the year the offer is accepted, and until the amount of the offer is paid in full.

(4)The collection of the entire tax liability, if you do not comply with all the terms of the offer, i.e. payment, future compliance.