Any amount due must be paid on the

WH-1U.

s, s, s.

s, s, s.

s, s, s.

s, s, s.

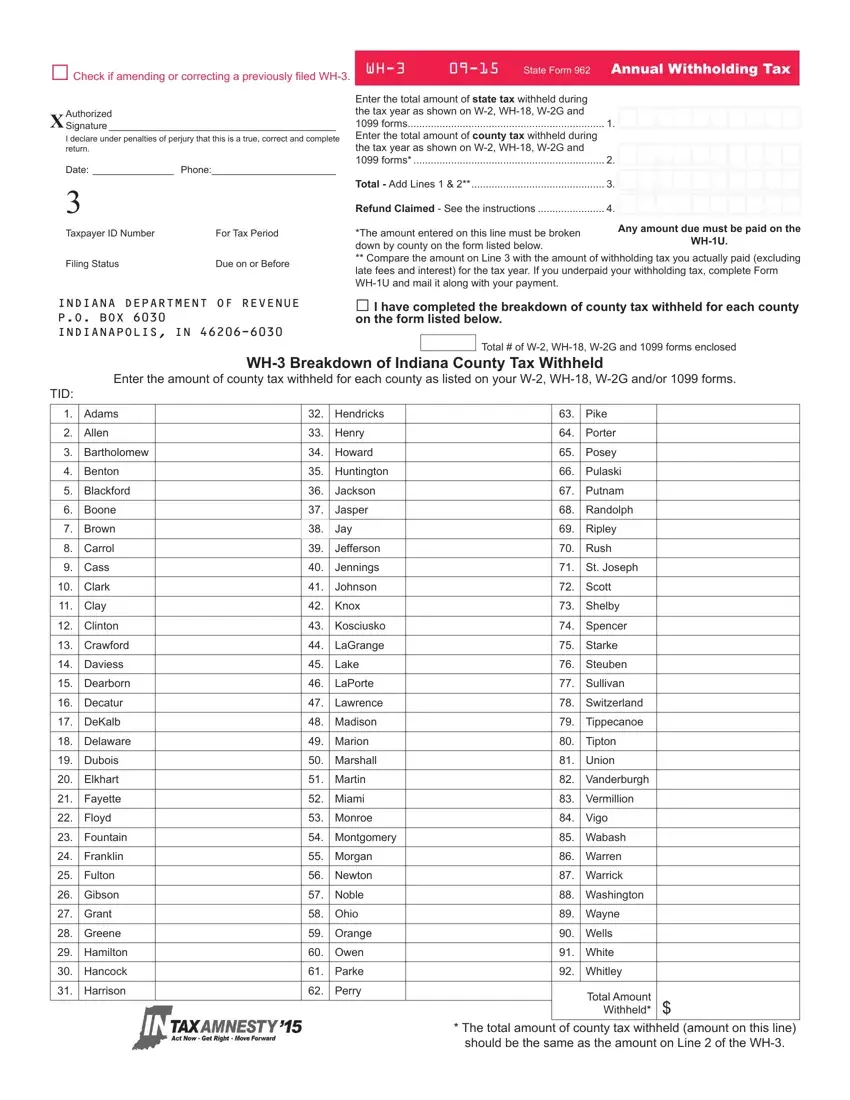

□Check if amending or correcting a previously filed WH-3. WH-3 |

09-15 State Form 962 Annual Withholding Tax |

Authorized

XSignature __________________________________________

I declare under penalties of perjury that this is a true, correct and complete return.

Date: _______________ Phone:_______________________

Enter the total amount of state tax withheld during |

|

the tax year as shown on W-2, WH-18, W-2G and |

|

1099 forms |

1. |

Enter the total amount of county tax withheld during |

|

the tax year as shown on W-2, WH-18, W-2G and |

2. |

1099 forms* |

3

Taxpayer ID Number |

For Tax Period |

Filing Status |

Due on or Before |

INDIANA DEPARTMENT OF REVENUE P.O. BOX 6030 INDIANAPOLIS, IN 46206-6030

Total - Add Lines 1 & 2** |

3. |

Refund Claimed - See the instructions |

4. |

*The amount entered on this line must be broken down by county on the form listed below.

** Compare the amount on Line 3 with the amount of withholding tax you actually paid (excluding late fees and interest) for the tax year. If you underpaid your withholding tax, complete Form WH-1U and mail it along with your payment.

□ I have completed the breakdown of county tax withheld for each county on the form listed below.

Total # of W-2, WH-18, W-2G and 1099 forms enclosed

Total # of W-2, WH-18, W-2G and 1099 forms enclosed

WH-3 Breakdown of Indiana County Tax Withheld

Enter the amount of county tax withheld for each county as listed on your W-2, WH-18, W-2G and/or 1099 forms.

TID:

1. |

Adams |

32. |

Hendricks |

63. |

Pike |

2. |

Allen |

33. |

Henry |

64. |

Porter |

3. |

Bartholomew |

34. |

Howard |

65. |

Posey |

4. |

Benton |

35. |

Huntington |

66. |

Pulaski |

5. |

Blackford |

36. |

Jackson |

67. |

Putnam |

6. |

Boone |

37. |

Jasper |

68. |

Randolph |

7. |

Brown |

38. |

Jay |

69. |

Ripley |

8. |

Carrol |

39. |

Jefferson |

70. |

Rush |

9. |

Cass |

40. |

Jennings |

71. |

St. Joseph |

10. |

Clark |

41. |

Johnson |

72. |

Scott |

11. |

Clay |

42. |

Knox |

73. |

Shelby |

12. |

Clinton |

43. |

Kosciusko |

74. |

Spencer |

13. |

Crawford |

44. |

LaGrange |

75. |

Starke |

14. |

Daviess |

45. |

Lake |

76. |

Steuben |

15. |

Dearborn |

46. |

LaPorte |

77. |

Sullivan |

16. |

Decatur |

47. |

Lawrence |

78. |

Switzerland |

17. |

DeKalb |

48. |

Madison |

79. |

Tippecanoe |

18. |

Delaware |

49. |

Marion |

80. |

Tipton |

19. |

Dubois |

50. |

Marshall |

81. |

Union |

20. |

Elkhart |

51. |

Martin |

82. |

Vanderburgh |

21. |

Fayette |

52. |

Miami |

83. |

Vermillion |

22. |

Floyd |

53. |

Monroe |

84. |

Vigo |

23. |

Fountain |

54. |

Montgomery |

85. |

Wabash |

24. |

Franklin |

55. |

Morgan |

86. |

Warren |

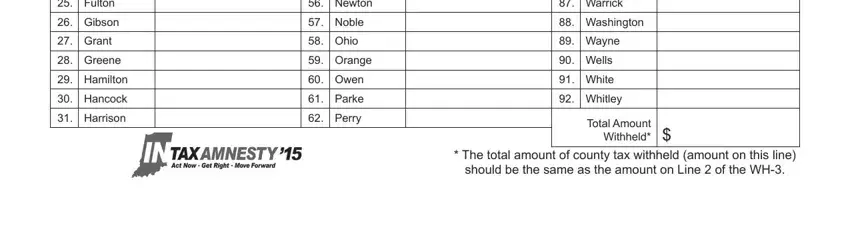

25. |

Fulton |

56. |

Newton |

87. |

Warrick |

26. |

Gibson |

57. |

Noble |

88. |

Washington |

27. |

Grant |

58. |

Ohio |

89. |

Wayne |

28. |

Greene |

59. |

Orange |

90. |

Wells |

29. |

Hamilton |

60. |

Owen |

91. |

White |

30. |

Hancock |

61. |

Parke |

92. |

Whitley |

31. |

Harrison |

62. |

Perry |

|

Total Amount |

|

|

|

|

|

|

|

|

|

|

Withheld* $ |

|

|

|

|

* The total amount of county tax withheld (amount on this line) |

|

|

|

|

should be the same as the amount on Line 2 of the WH-3. |

For Amnesty Filing Only

Instructions for Completing Annual Reconciliation Form WH-3

Line 1 − Enter the total Indiana state income tax withheld as shown on Forms W-2, WH-18, W-2G and 1099.

Line 2 − Enter the total Indiana county income tax withheld as shown on Forms W-2, WH-18, W-2G and 1099.

All entries on this line must be broken down on Form WH-3 by counties for which the amounts were withheld. The sum of the county break down must equal the amount on Line 2.

Line 3 − Add Lines 1 and 2; and enter the total here. If your account has been overpaid, continue to Line 4. If you have underpaid the withholding tax, see instructions for underpayment of Indiana withholding.

Line 4 − Complete this line only if your account has been overpaid and you are claiming a refund. Enter the amount of your overpayment on Line 4. No refund will be issued unless all areas of the Form WH-3 are complete and all W-2, WH-18, W-2G and 1099 forms are enclosed.

Note: Remittance must be made with the WH-1U or by EFT, but not with the WH-3. Do not staple documents

together.

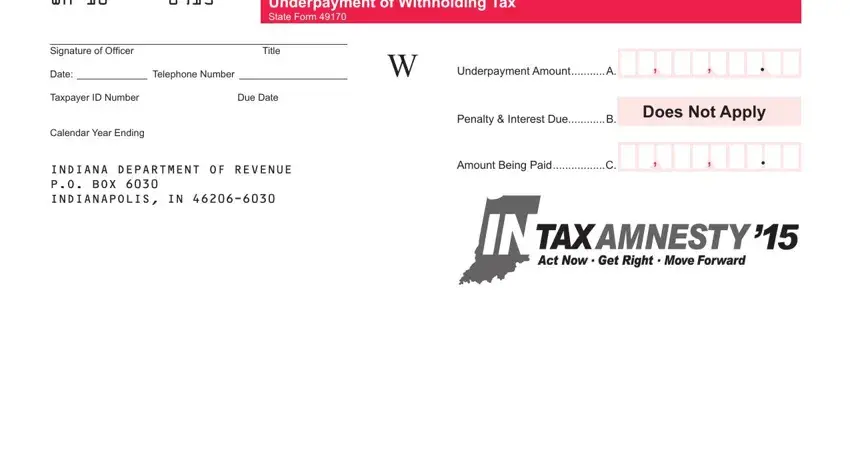

Underpayment of Indiana Withholding Filing Instructions

If you have underpaid the withholding tax, you must remit the amount due. If you normally remit by check, you must use

Form WH-1U. Enter the amount due on Line A.

If you are making the underpayment remittance late, penalty and interest are due. If you are paying the underpayment by check, include the penalty and interest on Line B. *Penalty is 10 percent of Line A or $5, whichever is greater. The total Does Not Apply

amount due should be entered on Line C. Call (317) 233-4016 for further information and for the current interest rate.

If you normally remit by EFT, make a supplemental payment for the final period of the year. Your supplemental payment together with all your other credits should equal the amount on Line 3 of the WH-3. Do not send a WH-1U.

State of Indiana Electronic Filing Instructions |

Filing Status ALL |

Any employer that files more than 25 W-2, WH-18, W-2G and 1099 forms in a calendar year is required to file those forms and the WH-3 electronically. For more information about filing electronically, please visit www.in.gov/dor/4455.htm.

For more than 3,500 W-2, WH-18, W-2G and 1099 forms in a calendar year, visit www.in.gov/dor/4458.htm.

Note: If you are under the mandated threshold of 25 W-2, WH-18, W-2G and 1099 forms for a calendar year, the department will accept these documents on CD or DVD. A completed WH-3 must accompany all CDs or DVDs in the same package. Filings received without acompleted WH-3 will be returned to the taxpayer as “cannot be processed”. If you have technical questions about electronic filing please call (317) 233-5656 or email at IDORB2BSupport@dor.in.gov.

An external label must be affixed to each CD or DVD containing the following information:

External Label for CDs or DVDs −File Name: W2REPORT

−State Taxpayer Identification Number (TID) −Submitter or Company Name −Complete Mailing Address

−Contact Name and Phone Number

Total # of

Total # of

s

s

s

s

s

s