The concept behind our PDF editor was to make sure it is as user-friendly as it can be. The general procedure of creating wisconsin title transfer form rather simple so long as you keep to all of these actions.

Step 1: Look for the button "Get Form Here" on this website and next, click it.

Step 2: Now, you are on the file editing page. You can add text, edit existing details, highlight certain words or phrases, put crosses or checks, add images, sign the form, erase unwanted fields, etc.

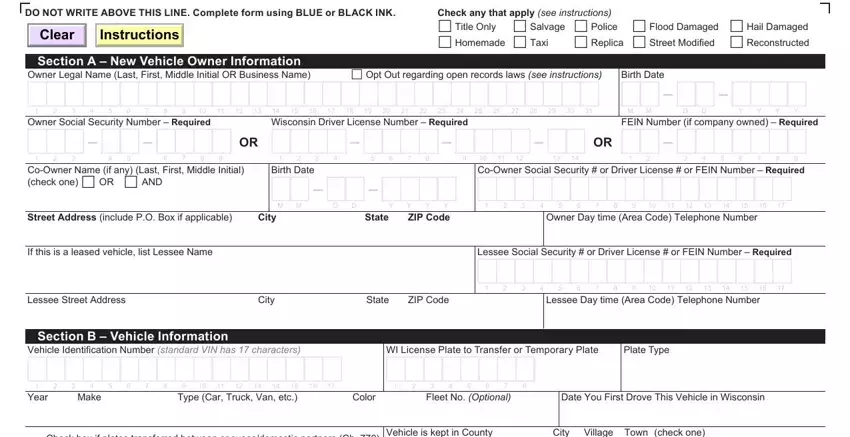

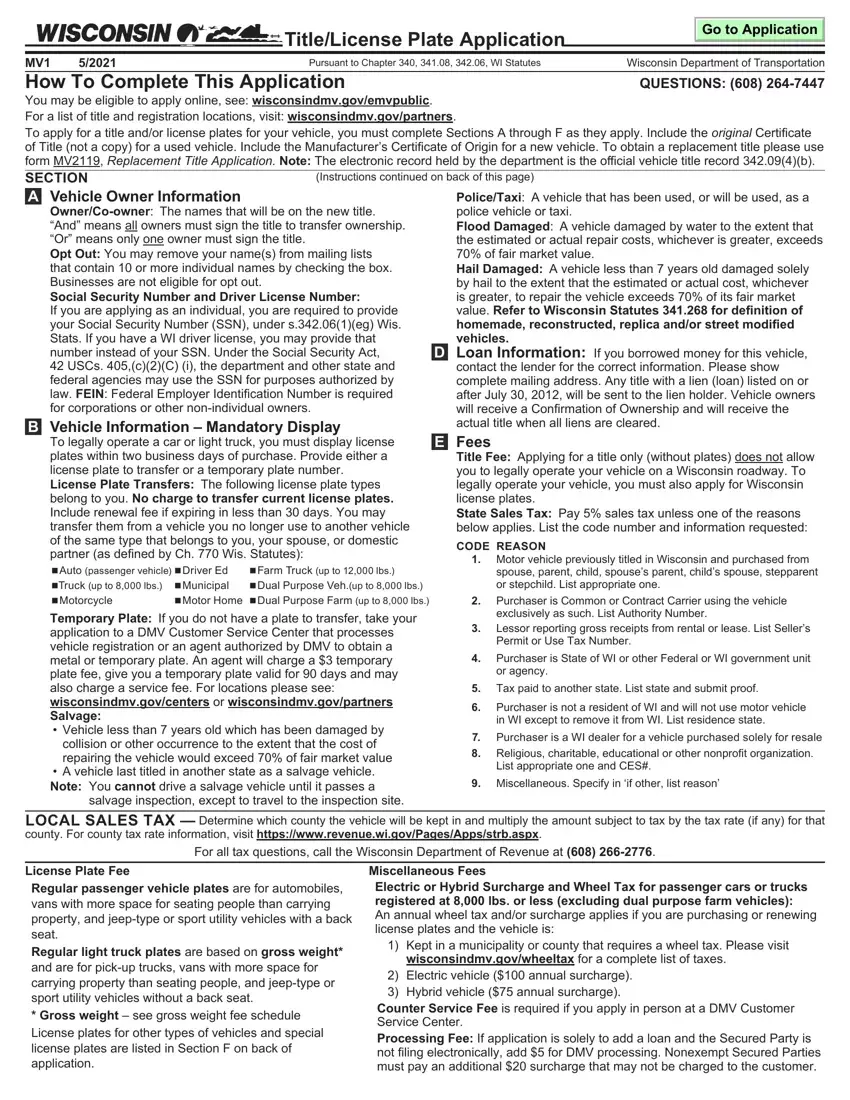

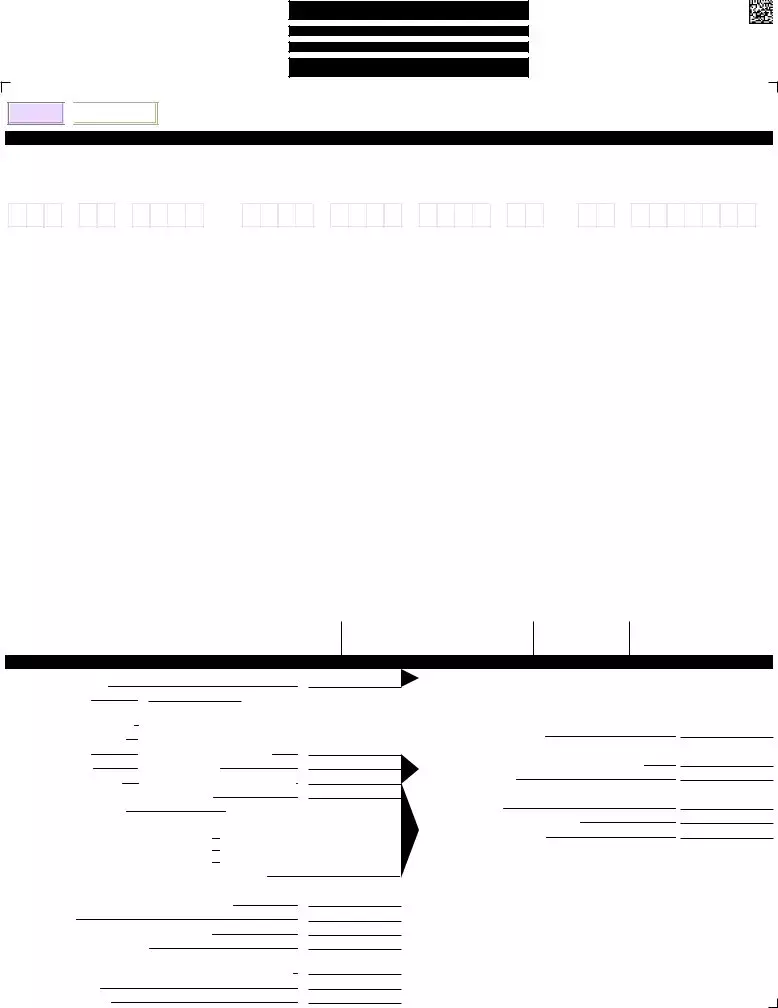

All of these areas are within the PDF form you'll be filling in.

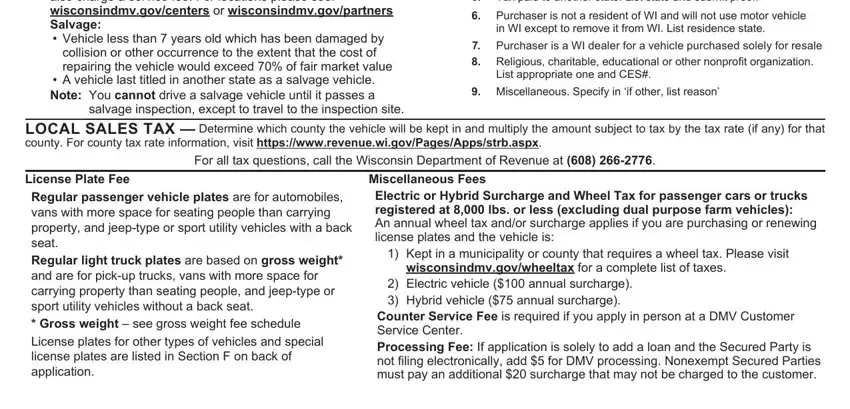

Type in the required data in the space List, appropriate, one, and, CES

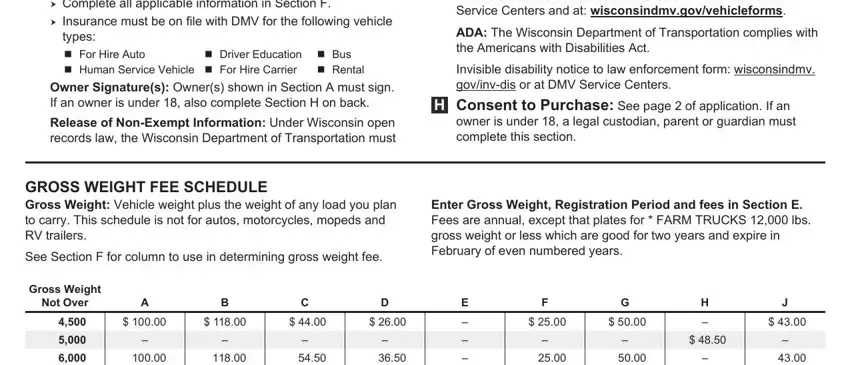

Point out the most important information on the Bus, Rental Gross, Weight and Not, Over field.

In the space Section, A, New, Vehicle, Owner, Information BirthDate, Owner, Social, Security, Number, Required MM, FEIN, Number, if, company, owned, Required BirthDate, City, Y, State YY, ZIP, Code Owner, Daytime, Area, Code, Telephone, Number Lessee, Street, Address City, State, ZIP, Code Section, B, Vehicle, Information and Plate, Type define the rights and responsibilities.

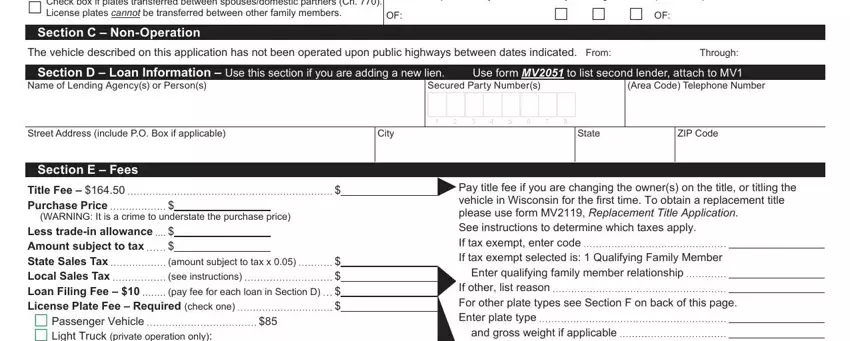

Look at the areas Vehicle, is, kept, in, County City, Village, Town, check, one, OF Name, of, Lending, Agency, s, or, Persons Secured, Party, Numbers Area, Code, Telephone, Number City, State, ZIP, Code and Section, E, Fees, Title, Fee, Purchase, Price and next complete them.

Step 3: Select the "Done" button. Now it's easy to transfer your PDF form to your gadget. In addition, you can forward it via email.

Step 4: You should create as many duplicates of your document as possible to stay away from future worries.

Title/License Plate Application

Title/License Plate Application

Instructions

Instructions