It shouldn’t be a challenge to complete wi z form through our PDF editor. This is the way you can easily quickly design your template.

Step 1: Choose the button "Get form here" to open it.

Step 2: Now you are capable of enhance wi z form. You have a variety of options thanks to our multifunctional toolbar - you can add, eliminate, or alter the content material, highlight its specific parts, as well as conduct various other commands.

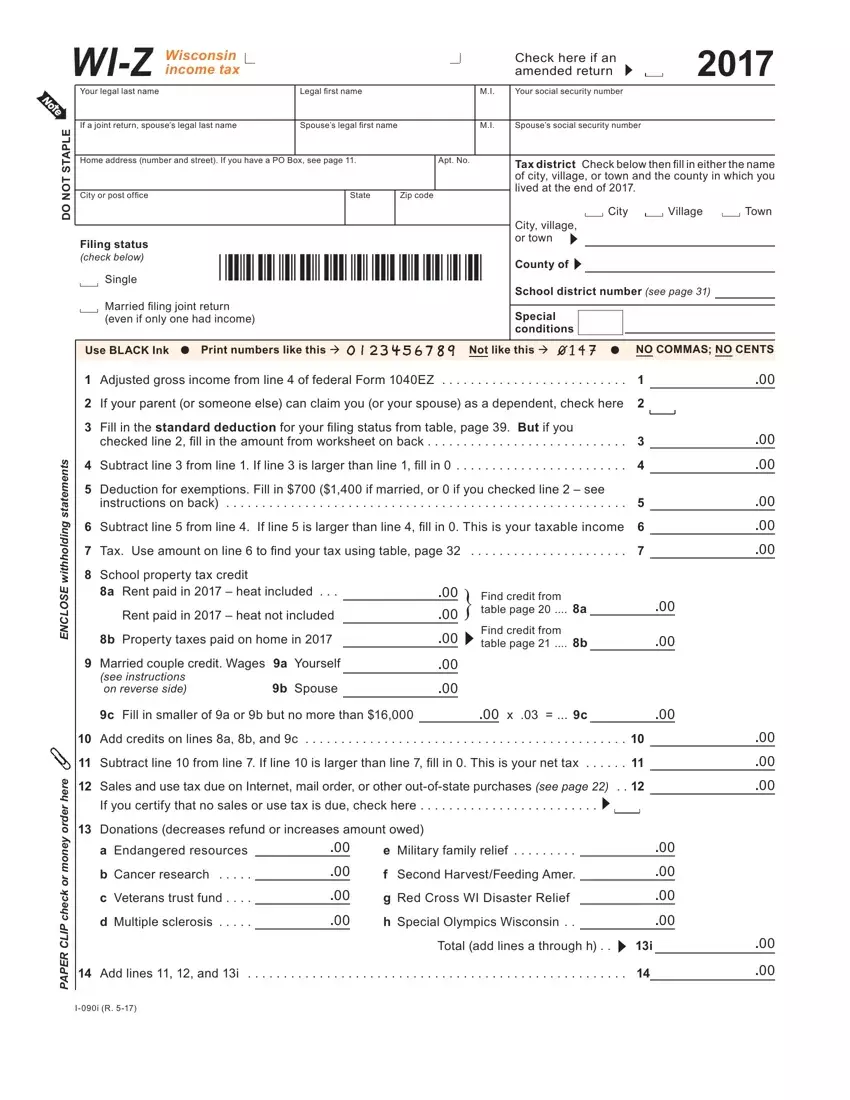

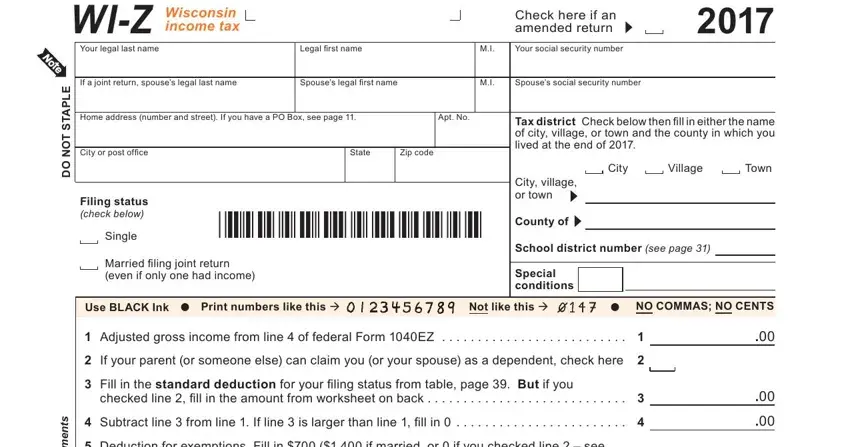

Complete the wi z form PDF and enter the information for each and every area:

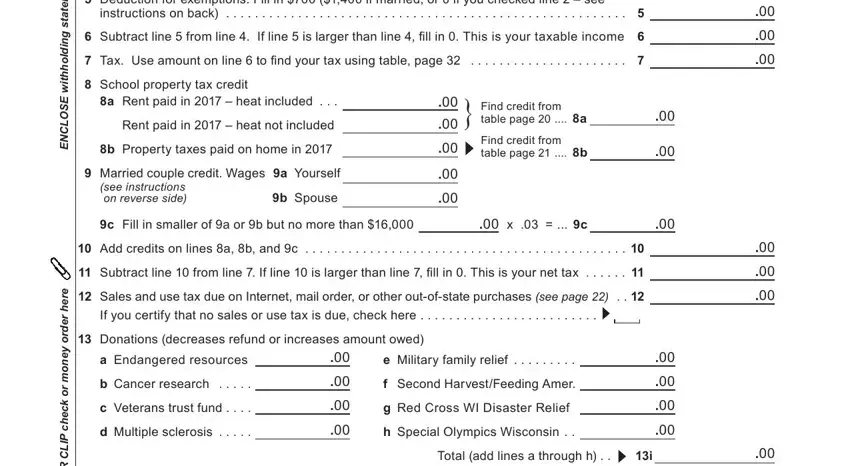

Write down the appropriate details in the space Deduction for exemptions Fill in, instructions on back, Subtract line from line If line, Tax Use amount on line to ind, School property tax credit, a Rent paid in heat included, Rent paid in heat not included, b Property taxes paid on home in, Married couple credit Wages a, see instructions on reverse side, b Spouse, Find credit from table page a, Find credit from table page b, c Fill in smaller of a or b but no, and x c.

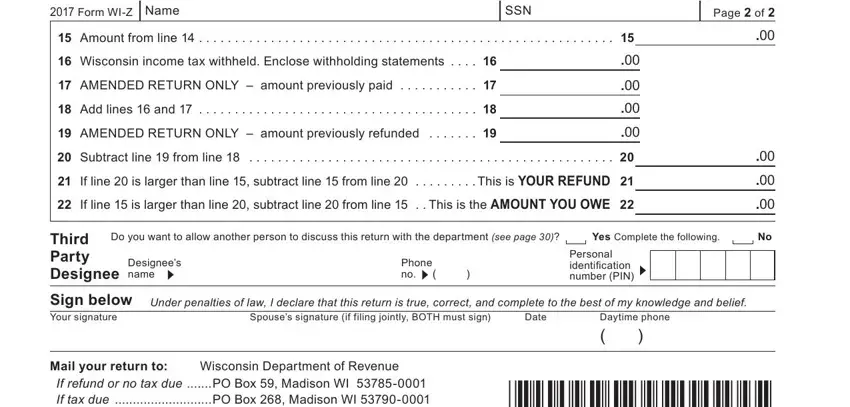

Focus on the crucial details the Form WIZ, Name, SSN, Amount from line, Page of, Wisconsin income tax withheld, AMENDED RETURN ONLY amount, Add lines and, AMENDED RETURN ONLY amount, Subtract line from line, If line is larger than line, If line is larger than line, Third Party Designee, Do you want to allow another, and Yes Complete the following section.

Step 3: Hit the "Done" button. So now, you can transfer your PDF file - save it to your electronic device or send it by means of email.

Step 4: Be sure to make as many duplicates of your form as possible to keep away from possible misunderstandings.