The notion powering our PDF editor was to allow it to be as simple to use as it can be. The complete process of completing wt 6 quick as soon as you stick to these particular actions.

Step 1: The very first step would be to click the orange "Get Form Now" button.

Step 2: You can find all the actions you can use on your template after you've entered the wt 6 editing page.

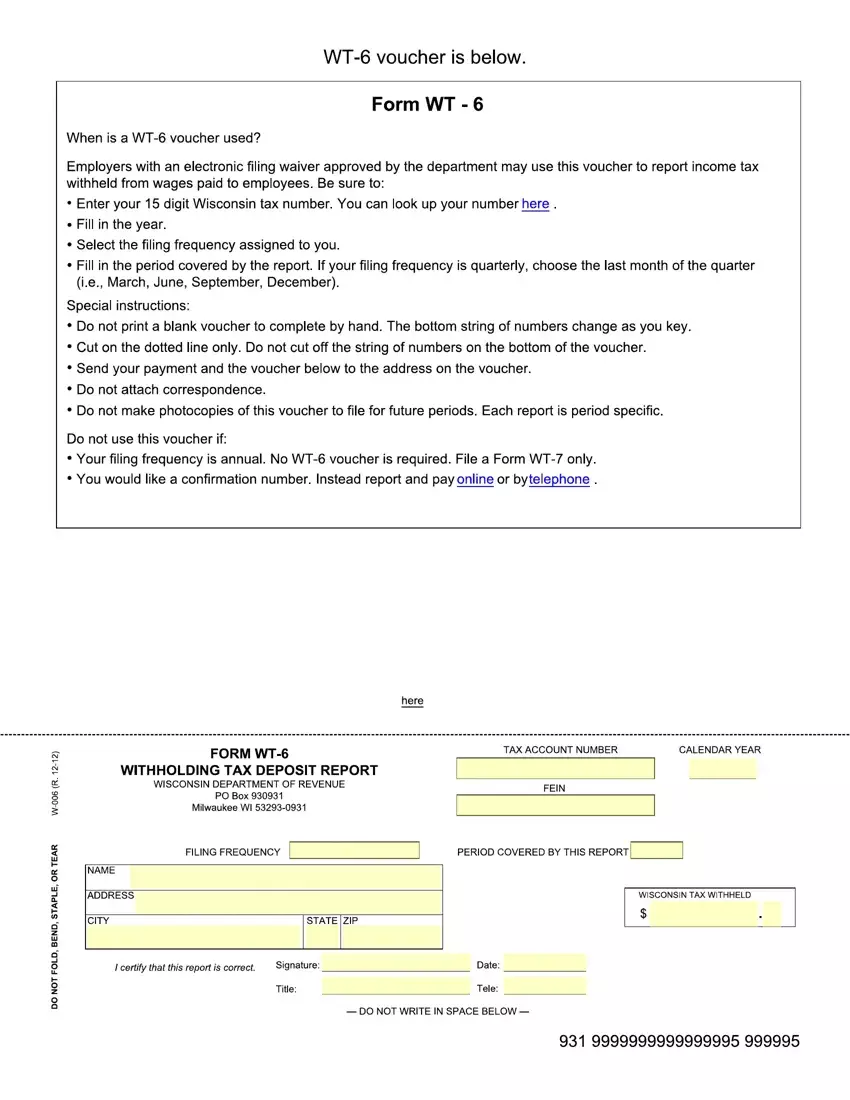

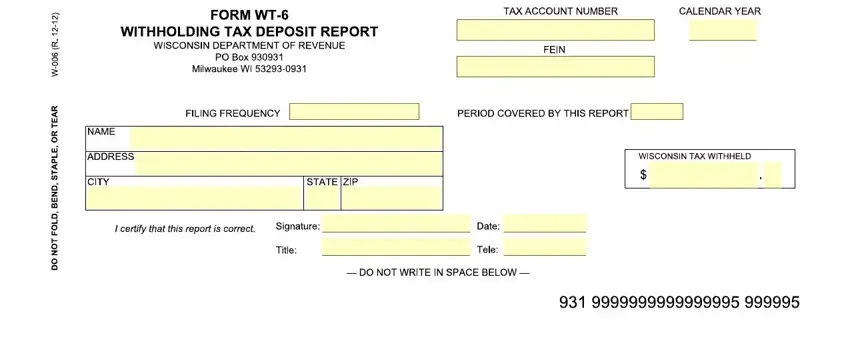

The next sections are what you are going to fill out to have the finished PDF form.

Step 3: Select the "Done" button. Finally, you may transfer your PDF file - save it to your electronic device or forward it through email.

Step 4: In order to avoid any sort of problems as time goes on, you should have at least a couple of duplicates of your document.