Our PDF editor was built to be as straightforward as it can be. While you comply with these actions, the process of preparing the va loan comparison disclosure pdf document is going to be straightforward.

Step 1: At first, choose the orange "Get form now" button.

Step 2: When you enter the va loan comparison disclosure pdf editing page, you'll see lots of the options you can take with regards to your file within the top menu.

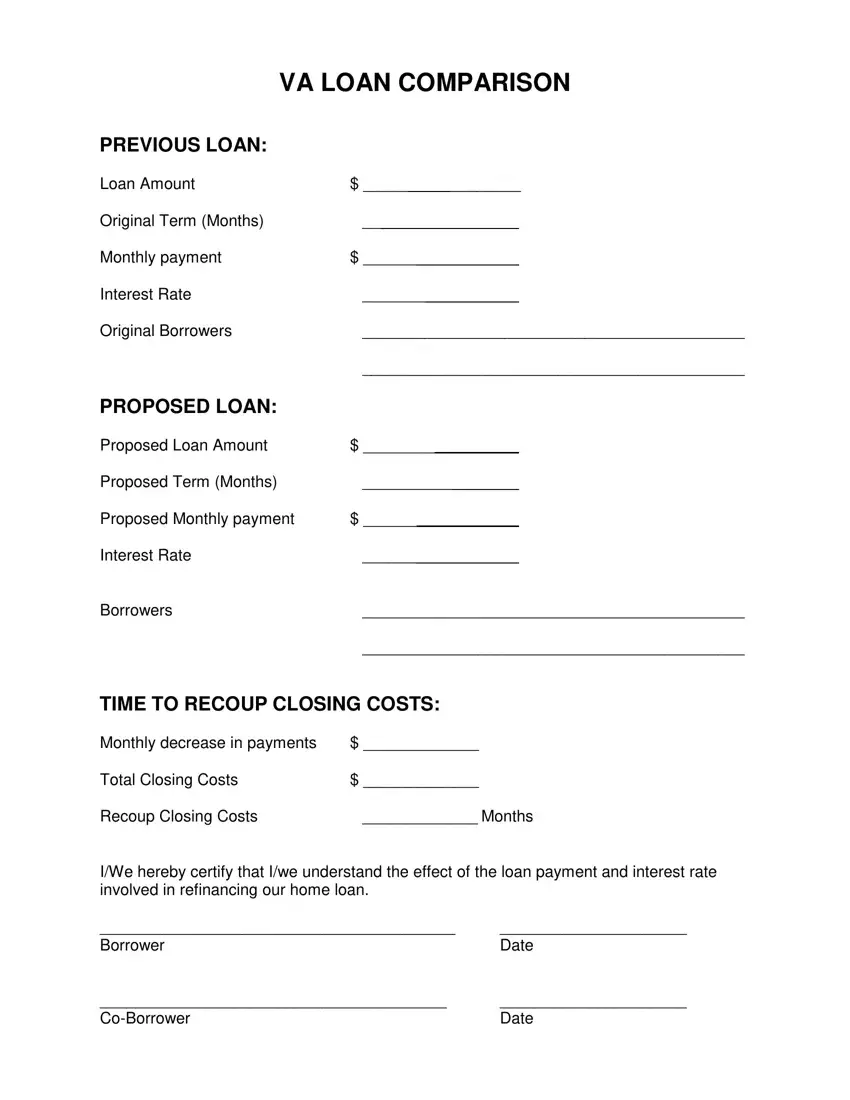

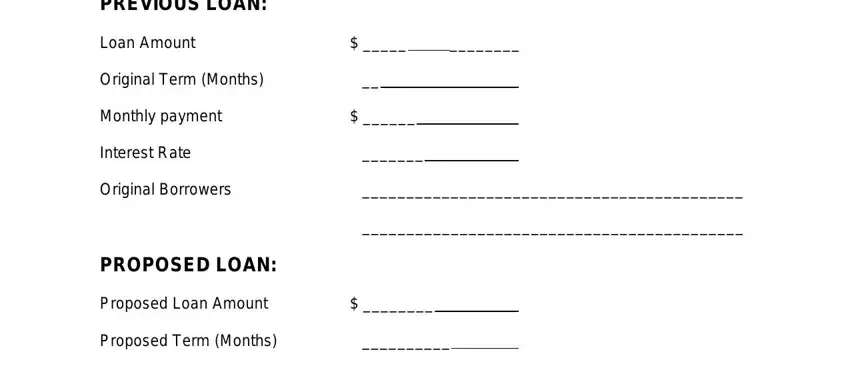

In order to complete the document, provide the data the program will require you to for each of the following segments:

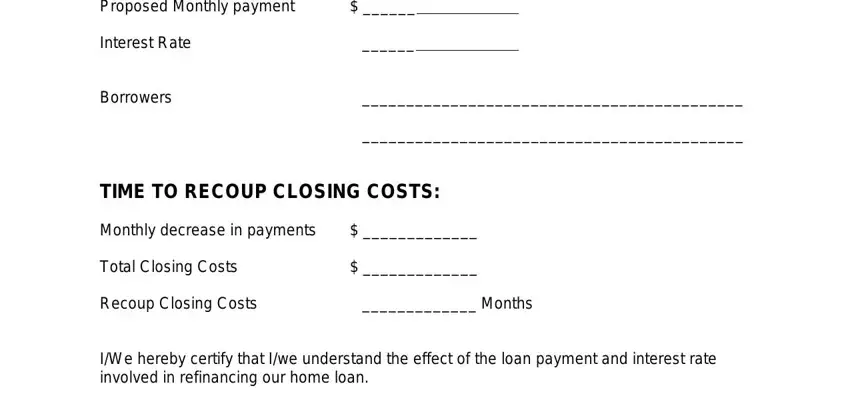

Indicate the information in Proposed Monthly payment, Interest Rate, Borrowers, TIME TO RECOUP CLOSING COSTS, Monthly decrease in payments, Total Closing Costs, Recoup Closing Costs, Months, IWe hereby certify that Iwe, Borrower, and Date.

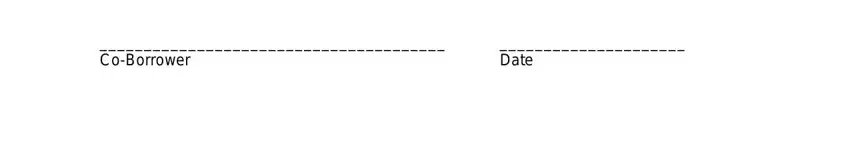

You should be asked for some valuable details so you can complete the CoBorrower, and Date part.

Step 3: As you press the Done button, your ready document can be easily transferred to each of your devices or to email indicated by you.

Step 4: Generate duplicates of the document - it may help you keep clear of possible issues. And don't be concerned - we are not meant to display or watch your data.