We've applied the efforts of our best programmers to create the PDF editor you can make use of. The application will permit you to fill in the michigan form vehicle title form without trouble and don’t waste precious time. What you need to do is adhere to these straightforward guidelines.

Step 1: Search for the button "Get Form Here" and hit it.

Step 2: The file editing page is now open. It's possible to add text or change existing data.

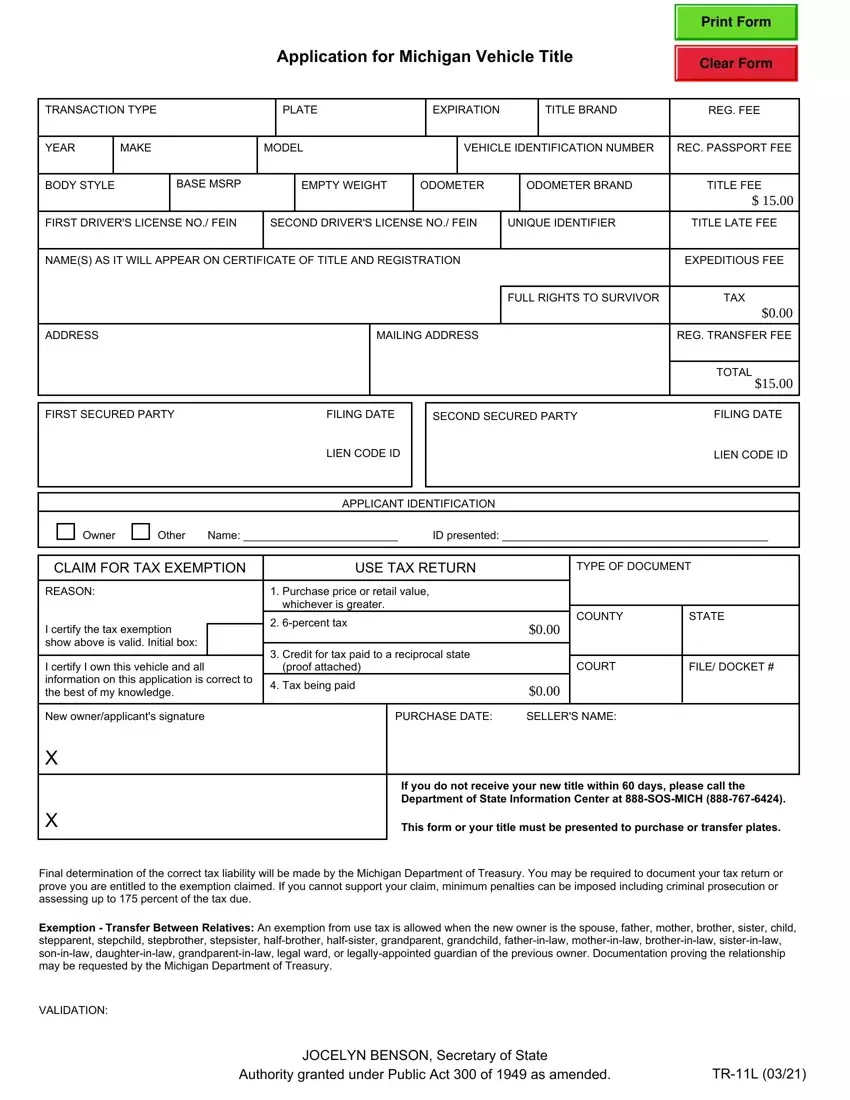

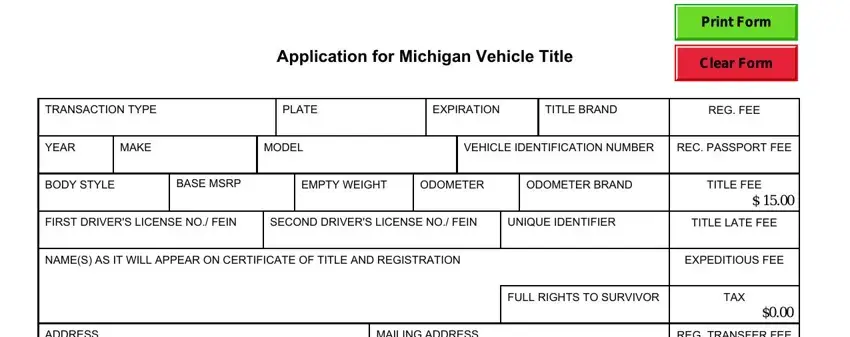

In order to prepare the michigan form vehicle title PDF, provide the content for all of the sections:

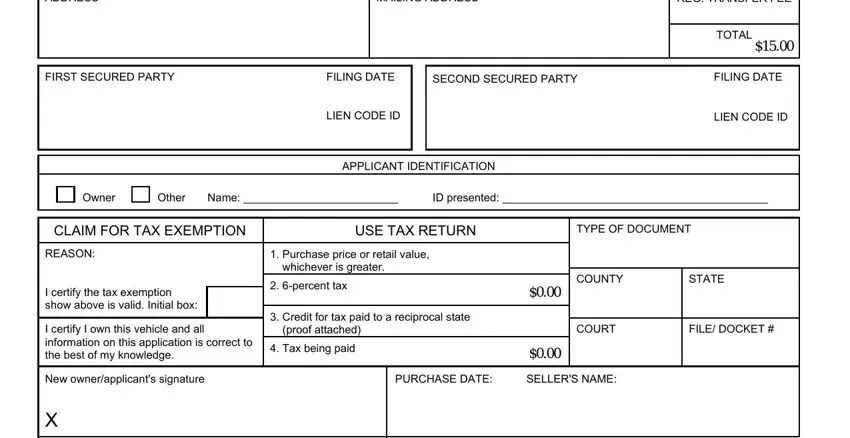

Type in the requested details in the space ADDRESS, MAILING ADDRESS, REG TRANSFER FEE, TOTAL, FIRST SECURED PARTY, FILING DATE, SECOND SECURED PARTY, FILING DATE, LIEN CODE ID, LIEN CODE ID, APPLICANT IDENTIFICATION, Owner, Other, Name, and ID presented.

Step 3: Click "Done". Now you can upload the PDF file.

Step 4: Create duplicates of the document. This should save you from potential issues. We do not see or reveal your data, hence you can relax knowing it is secure.