Working with PDF forms online is actually simple with our PDF tool. Anyone can fill in wyoming form spending here with no trouble. The editor is consistently improved by our team, acquiring cool functions and becoming better. Getting underway is simple! All you should do is follow the next simple steps down below:

Step 1: Click on the "Get Form" button above. It will open up our pdf editor so that you can start completing your form.

Step 2: The editor helps you work with PDF forms in various ways. Change it by writing your own text, adjust what's already in the PDF, and place in a signature - all manageable within minutes!

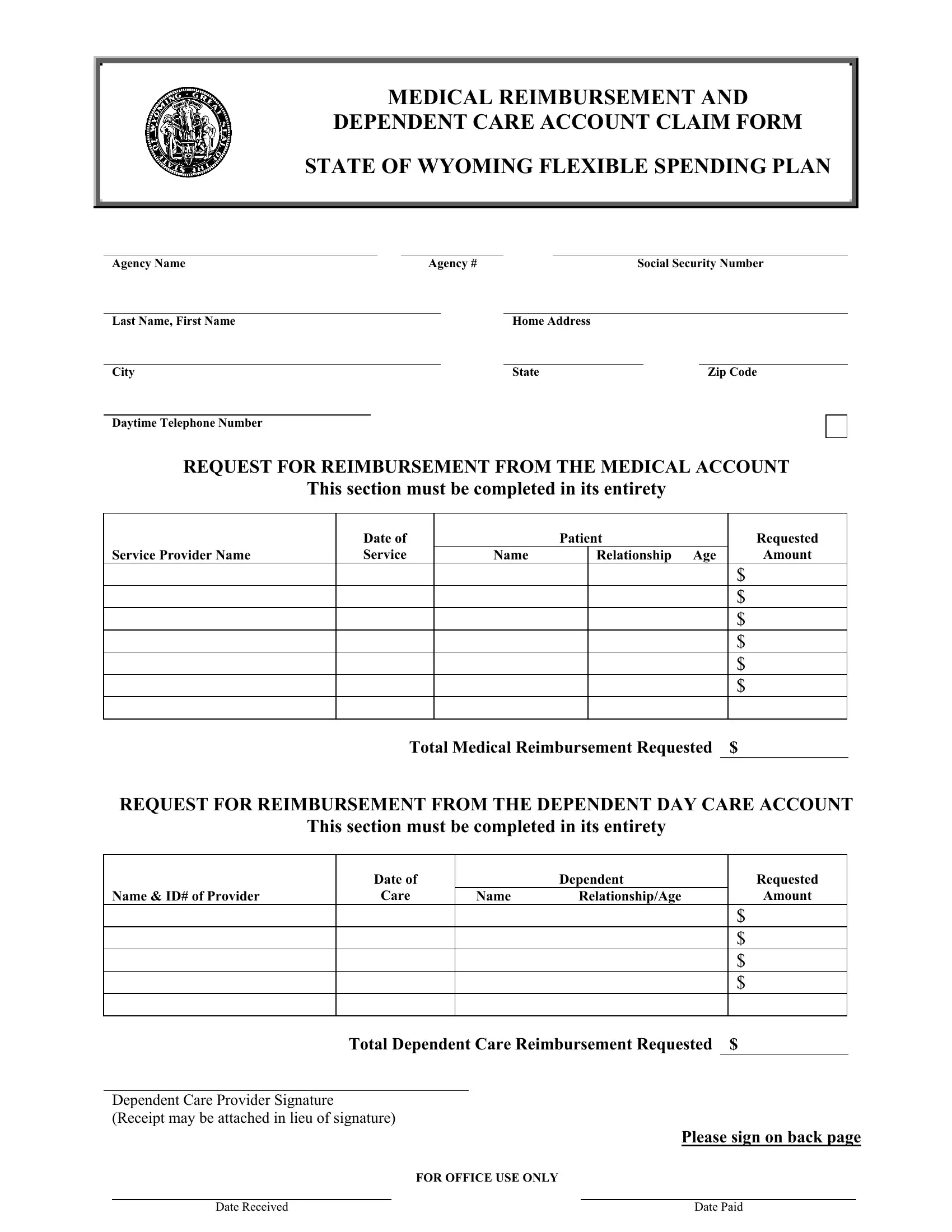

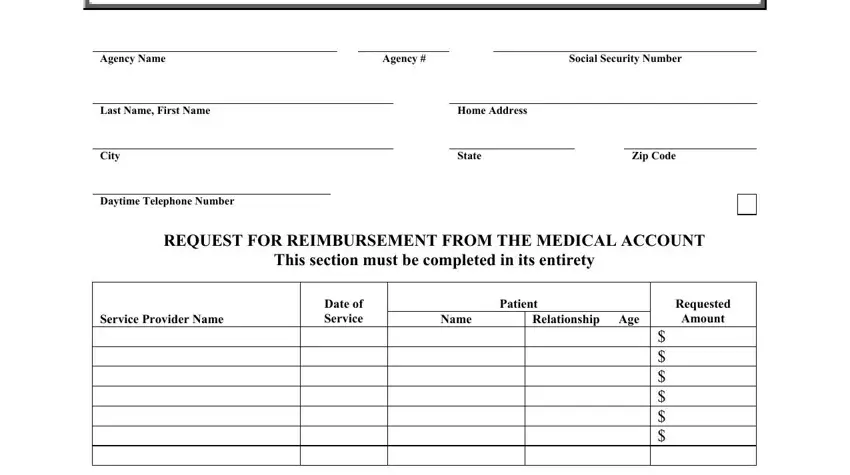

This PDF requires specific information to be typed in, therefore you should definitely take some time to provide precisely what is required:

1. The wyoming form spending needs particular details to be inserted. Ensure that the following blanks are filled out:

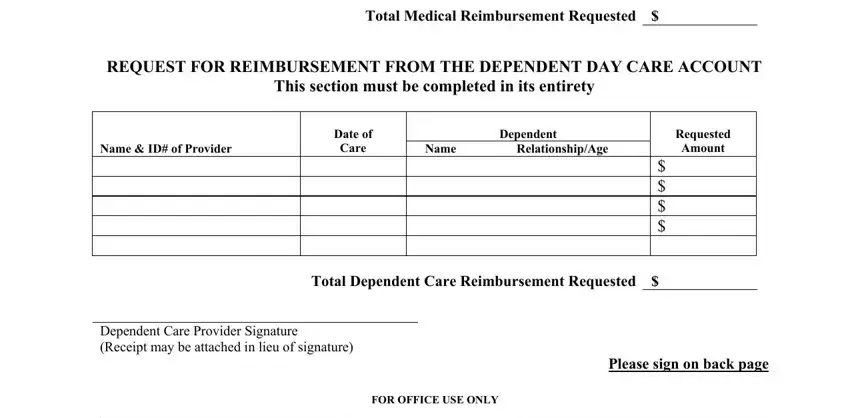

2. Just after this selection of blanks is done, go to type in the applicable details in all these: Service Provider Name, Total Medical Reimbursement, REQUEST FOR REIMBURSEMENT FROM THE, This section must be completed in, Name ID of Provider, Date of, Care, Dependent, Name, RelationshipAge, Requested, Amount, Total Dependent Care Reimbursement, Dependent Care Provider Signature, and FOR OFFICE USE ONLY.

3. This third segment should also be rather easy, cid You must attach an explanation, following reasons, ITEMIZED INVOICES AND AN, DEPENDENT DAY CARE REIMBURSEMENT, Disabled and unable to provide, Expenses eligible for, and Licensed nursery schools and day - all these empty fields will need to be filled in here.

As for Expenses eligible for and ITEMIZED INVOICES AND AN, be certain you double-check them in this current part. These two are certainly the most important ones in the page.

4. Filling in Employees original Signature, Date, This form requires an original, Submit Claims to, Department of Administration, Human Resources Employee Benefits, Attn Cafeteria Plan Section, Capitol Avenue, Emerson Building Room, Cheyenne WY, and Revised EGI is key in this next section - make sure to spend some time and take a close look at each and every empty field!

Step 3: Before moving on, it's a good idea to ensure that all blank fields have been filled in the proper way. When you confirm that it's fine, click on “Done." Go for a 7-day free trial option at FormsPal and get instant access to wyoming form spending - with all changes saved and accessible from your personal account page. FormsPal ensures your data privacy via a protected system that in no way records or distributes any sort of personal information typed in. Rest assured knowing your docs are kept safe any time you use our service!