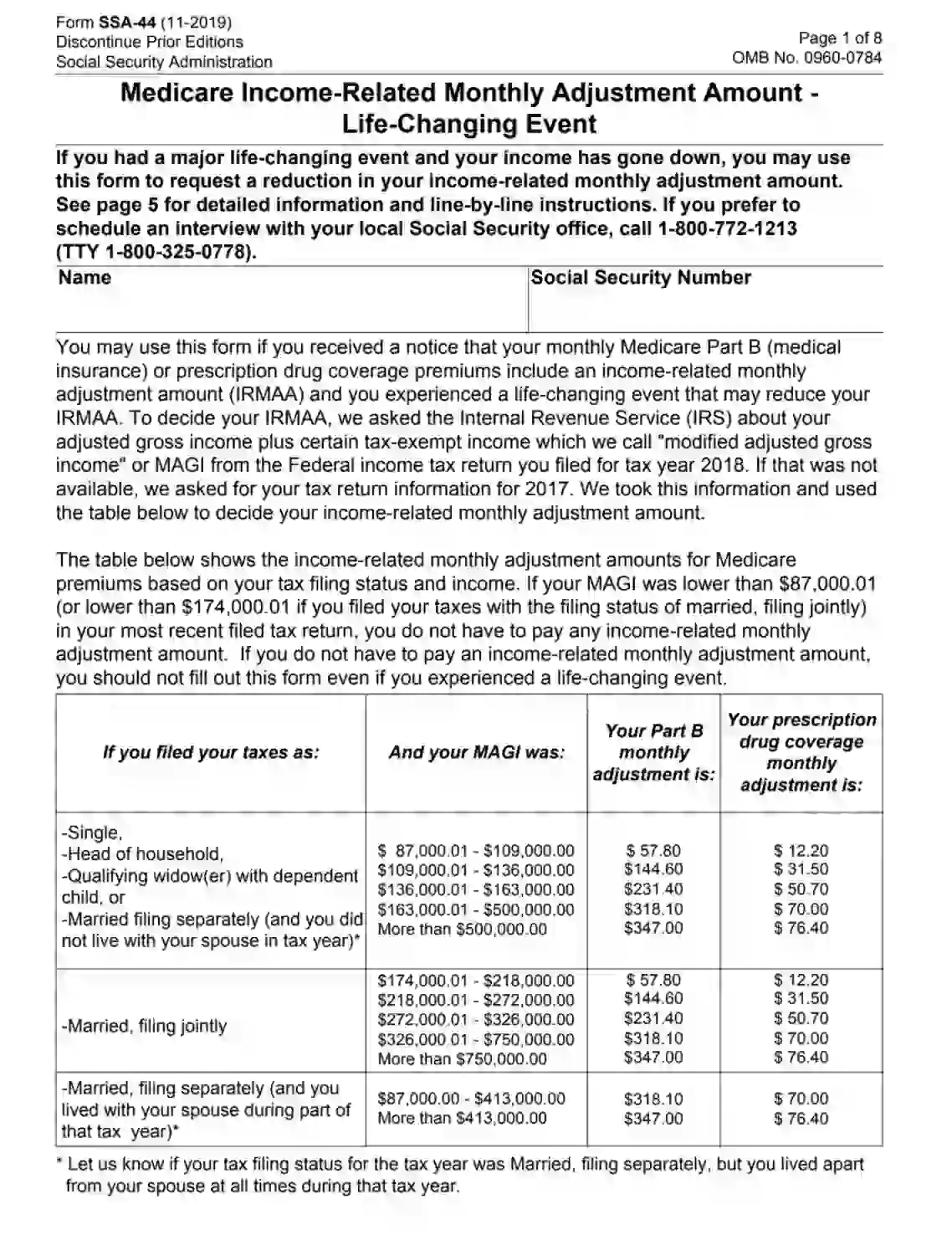

SSA Form SSA-44, known as “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event,” is a form used by Medicare beneficiaries to request a reduction in the Income-Related Monthly Adjustment Amount (IRMAA). IRMAA is an additional charge that higher-income individuals must pay on top of their regular Part B (medical insurance) and Part D (prescription drug coverage) premiums. This form is relevant for beneficiaries who have experienced a life-changing event that significantly reduces their income, such as marriage, divorce, death of a spouse, or cessation of work.

The purpose of SSA Form SSA-44 is to allow Medicare beneficiaries to inform the Social Security Administration (SSA) of changes in their financial status due to these major life events, potentially leading to a lowered IRMAA.

Other SSA Forms

You can find more editable SSA forms accessible with our editor. Following next, we listed a number of the more popular forms found this category. Moreover, remember that it is easy to upload, fill out, and edit any PDF at FormsPal.

How to Fill Out SSA-44 Form

You can find all the instructions regarding the filling out process at the end of the form itself. However, we prepared our own step-by-step guide for you, which is briefer and easier to follow. You can base on it when facing the need to get the SSA-44 form ready and use our smart form-building software that will construct the document quickly and effortlessly. All that you will need is just to enter the required information and put your signature on it.

Introduce yourself

At the beginning of the form, you should write your full name in the left box and your Social Security Number (SSN) in the right one. Remember that your SSN should be the same as in your Social Security card, not in the Medicare one.

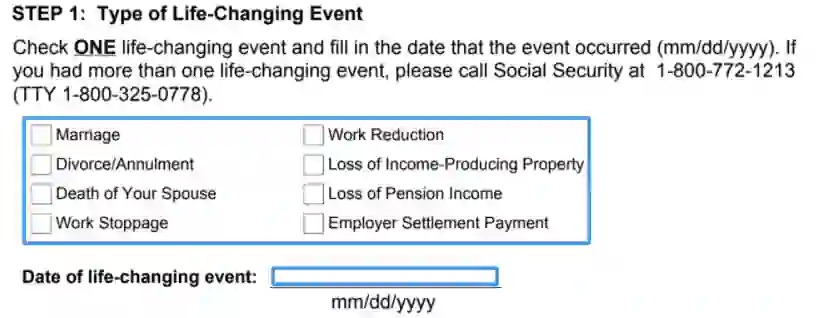

Indicate the life-changing event

Then, as a first step to complete, you need to specify what was your life-changing event and enter the date when it happened.

As we have already mentioned, a life-changing event is an event that SSA takes into account as a legal reason for reconsideration of your IRMAA. It must have happened the same year you ask them to determine your IRMAA or the year earlier. So, for example, if SSA uses your data for the 2018 tax year to determine your 2020’s payment amount, but you got married in 2019, you should ask them to use the 2019 tax year instead of 2018 and indicate it in this section.

To complete this section correctly, pick your case, one out of eight, and mark it. If you experienced more than one life-changing event, you should contact your local office first. Afterward, put the date in the MM/DD/YYYY format below.

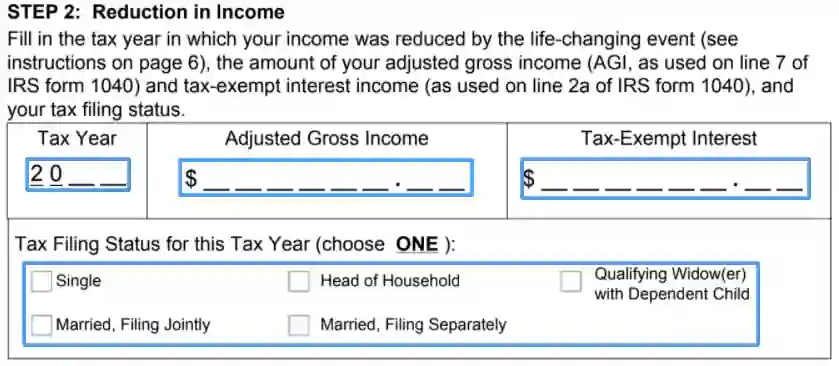

Report your reduction in income

At the second step, you should inform about your recent changes in Modified Adjusted Gross Income due to the life-changing event. Your MAGI is simply your AGI plus Tax-exempt Interest Income as they appear in the IRS form 1040.

There are four parts that you need to fill out — tax year, adjusted gross income, tax-exempt interest income, and tax filing status.

- As for the tax year, remember that it must be more recent than the year SSA uses for their estimation and reflect your income reduction. You can learn what SSA uses from the letter they send you in advance.

To choose whether to indicate this or last year, compare your income levels in these periods of time. In particular, if you have less income in the current year than a year ago, write down this year in the box. If you had less income last year than now, write the last one. Also, if you noticed that SSA uses tax information from three years ago, you can ask them to update it to one from two years ago.

- Use your current adjusted gross income for the tax year you have indicated. If you provide an estimated number, write the one you expect to claim in your tax return.

- The same rule works for the tax-exempt interest income.

- Select your tax-filing status out of the options provided.

Estimate your MAGI

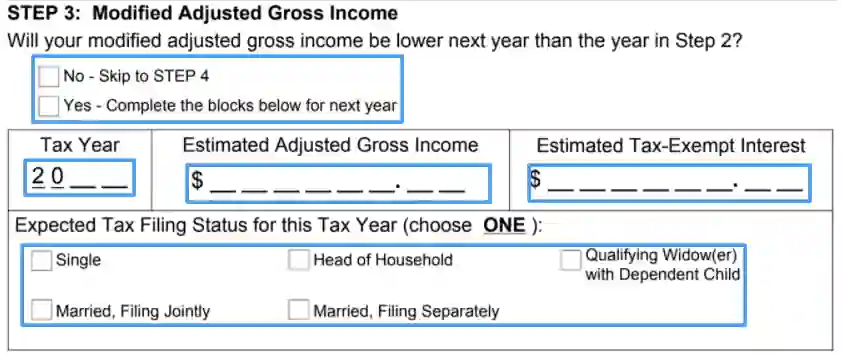

This step is for those who expect even more reduction in their income next year. SSA will use this tax information instead of the one you have reported in the previous step for the determination of your next year’s IRMAA.

The same four parts hold in this section.

- Enter the tax year next after the one from the previous step.

- Write your AGI for this year.

- Write your tax-exempt interest income for this year.

- Mark your tax-filing status.

Attach the documents

Here you should provide evidence that you are eligible to make a request in order to have your form accepted for a review.

Firstly, you are supposed to attach a copy of your Federal income tax return you filed for the year indicated in the second step. This is necessary to prove that your income level has reduced. Note that the copy must include your signature. If you can’t supply it, you can attach an IRS transcript instead.

To prove the occurrence of the life-changing event, you are better to be more accurate. Not all the documents are to be accepted. What you should attach depends on your particular situation. Below you can see the list of legal documents appropriate for each case.

- Marriage — original certificate or certified copy of the public record

- Divorce/Annulment — certified copy of the decree

- Spouse’s Death — certified copy of the certificate, public record, or coroner’s certificate

- Cessation of Work/Reduction — original signed employer’s statement, copies of pay stubs, original/certified documents proving a transfer of your business

If you don’t have these documents, provide just your signed statement but note that in this case, you will need to pay the penalty.

- Loss of Income-Producing Property — original/certified statement from an insurance company or governmental letter, court document (if the property has been stolen)

- Employer Settlement Payment — employer’s statement

- Loss of Pension Income — pension fund administrator’s statement

Sign the form

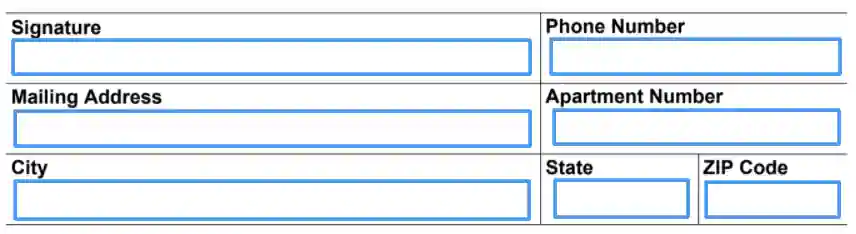

After you completed all the steps and read all the information written in the form, put your signature on the special line. Apart from this, do not forget to provide your contact details, i.e., the phone number and address, so that the authorities could call or send a mail to you in case they wanted to clarify something regarding your form.