Release of Earnest Money Contract Form

A release of earnest money form is a document that contains the permission of both parties to the fillable purchase agreement template to release the money put on an escrow account. It might happen when the inspection of the real estate shows some significant issues, the buyer cannot get the financing for the purchase of a home, or in some other cases. Considering that real estate contracts are typically stacked in the buyer’s favor, they have an escape route, except for some situations. If you want to learn more about these situations and the earnest money release form, read our article.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What Is a Release of Earnest Money?

Earnest money is money put on an escrow account that indicates the buyer’s serious intention regarding the purchase of the seller’s real estate. Essentially, this money is deposited to make the seller feel more secure about the deal and lessen the blow in case the deal falls through. For instance, the seller might rely on earnest money as a source of paying the next month’s mortgage if they expected to sell their home to the buyer who would cover the next month’s payment, but the deal failed.

The buyer might want to have their earnest money released might appear in several cases:

- If a deal falls apart due to the breach of some terms in the real estate sales contract

- If there is a court order which might happen if the deal becomes contentious, or there are unforeseen issues.

When an earnest money deposit is given to an agent or broker, this person becomes an escrow agent, and the deposit is put in an escrow account. An escrow agent is responsible for the earnest money release once the parties provide written permission to do that, or there is a respective court order.

When a Buyer Can Get the Earnest Money Back

Walking away from the deal by the buyer is possible in several cases. The important thing for them is to act within the agreed timeline and purchase agreement.

1. When there is an issue during due diligence

The inspection period might take up to several weeks, which should be specified in the purchase agreement. But there might be plenty of issues that might arise within this period: title or land survey errors, low appraisal, etc. If any of those are found during the inspection, the buyer is entitled to terminate the purchase agreement.

2. When there are financing issues

If the purchase agreement is contingent on the buyer’s ability to obtain financing, they will generally have 2-3 weeks from the effective date of the agreement to get the loan.

The failure to do it will result in the termination of the purchase agreement.

3. Termination of the deal by the seller

In some cases, the seller might want to not proceed with the deal for their personal purposes. In this case, the earnest money will also go back to the buyer.

4. Low appraisal

If the purchase agreement contains the appraisal contingency, the buyer is entitled to get their earnest money back provided the home appraisal shows a lower rate than the price offered by the buyer and the seller doesn’t want to lower the cost.

5. Unsatisfactory home inspection results

It is critical for a seller to list all the faults of the home they sell in disclosures attached to the purchase agreement. But if there is a defect that was not disclosed by the seller. the buyer might get their earnest money deposit back. However, this occasion is quite rare. Typically, the faults found within the home inspection result in the seller presenting a lower price.

6. Change of heart during the final walkthrough

Despite the fact a final walkthrough is not mandatory, it is prudent to conduct one before closing the deal. If the home inspection detected some serious flaws and the seller took an obligation to fix those, the buyer should check whether or not the necessary fixes were made. If not, the buyer is entitled to terminate the contract and get their money back. However, it might be a slippery road. The seller might have done the agreed fixes, but the buyer is not satisfied with what they see. In this situation, if the buyer decides to back out, the seller might take the earnest money.

How to Release the Earnest Money

Three steps separate buyers from having their earnest money released.

Checking the purchase agreement

First, the party wishing to release earnest money should make sure they are eligible for it according to the original purchase agreement. For instance, if the buyer wants to back out due to significant issues found by the inspector, they should do it before the inspection contingency deadline ends.

In case there are any reasons for the buyer to change their decision, it is important to contact the seller in a written form and explain the situation to them.

Preparing and signing an earnest money release form

After negotiating the wish to release the earnest money, both the buyer and seller should sign a release form. This earnest money contract will be the proof of the seller’s consent to return earnest money to the buyer. It is prudent to contact a realtor or lawyer to figure whether there are any other forms that should go with the release form.

Consulting the escrow agent

When the release form has signatures of both parties, it’s time to make it known to the escrow or title company. The escrow agent should be alerted about the buyer backing out of the deal and receive the release forms. Some time should go by to let the escrow agent process the request. If everything is fine, the earnest money will be returned in a short period of time.

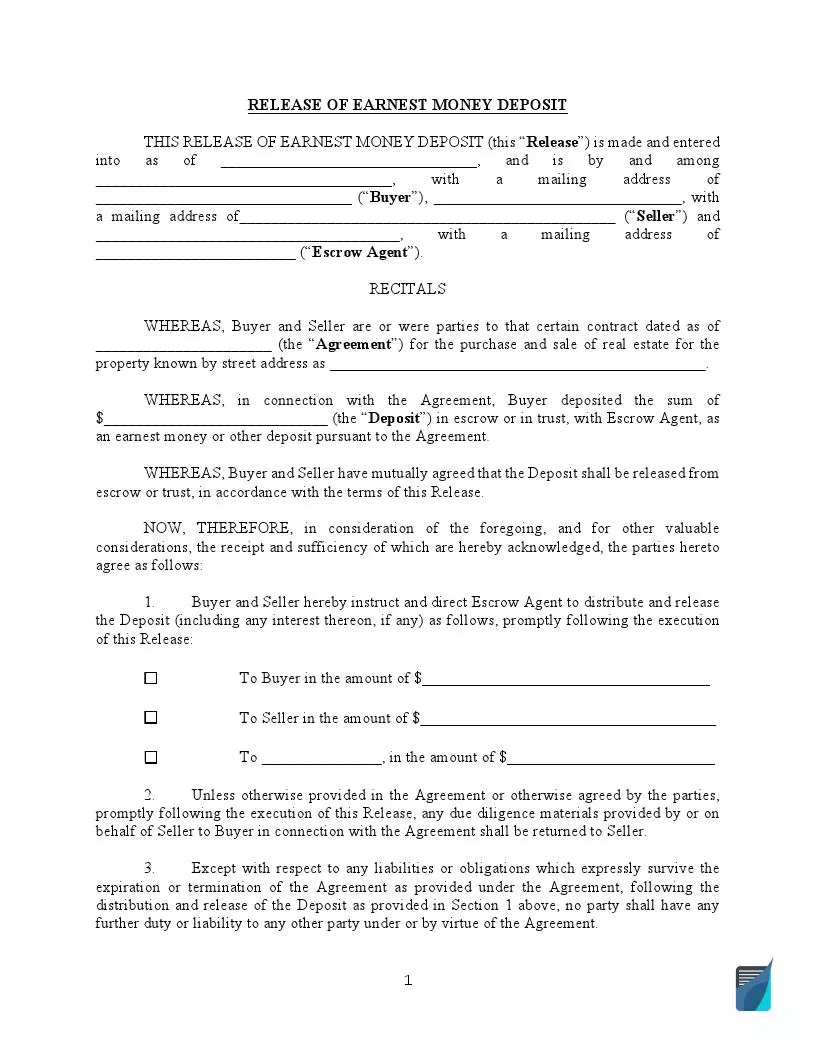

Filling Out the Release of Earnest Money Template

Step 1 – Effective date and parties

First, include the effective date of the addendum to real estate purchase contract, that is, when it is going to be signed by the buyer and seller. Then, indicate the names of the parties.

Step 2 – Details about the original agreement

Further, the earnest money release form has to refer to the original purchase agreement. Include the date of the purchase contract and mention the address of the real estate that is to be sold.

Step 3 – Indemnification

This section of the document should state that the parties are held harmless by the release from liability under the original purchase agreement.

Step 4 – Earnest money

In this paragraph, there should be explicitly said to whom the disbursed money will go. There should be the mention of the escrow agent who is responsible for disbursing money from an escrow account.

According to the document, earnest money might go to one party – either buyer or seller, or to both parties. In both cases, there should be an amount of earnest money specified.

Step 5 – Notice

The document should include an important notice that should warn the parties that they should understand the essence of the release form. If one of the parties has questions regarding the form, they should consult their attorney.

Step 6 – Signatures

If the document is understood by both parties, they should put their signatures beneath the main body. They should also include their print name and date of the signature.