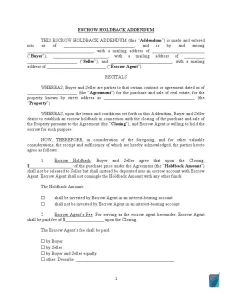

Repair (Holdback) Escrow Agreement Form

The repair escrow agreement is a common part of real estate that you will encounter as a buyer or seller. It essentially works as an insurance policy between the buyers and sellers. You will want to make sure it is included in your printable purchase agreement form whether the property requires many repairs or just a few.

This guide will tell you exactly what should be included in your repair escrow agreement and what you should have listed. There’s also a handy template you can use.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What Is a Repair Escrow Agreement?

You might also hear the repair escrow agreement referred to as the escrow holdback agreement. Oftentimes, a seller will promise to make certain repairs or improvements to the home as part of the purchase price.

The buyer’s money will then be set aside until the seller fulfills his agreement. This money will be held back from the seller until they complete all of the repairs that were listed in the original contract.

The money is usually kept with a company, bank, or moneylender. This way, the buyer knows that the seller has the money and has already given it up in exchange for the repairs. The third party will hold onto the money until the seller is finished with their end of the bargain. These parties such as the bank are referred to as escrow agents.

They are a great addition to any contract because it allows for more transparency and fairness in real estate transactions.

Repairs as part of the escrow agreement can be fixing parts of the property, completing maintenance, or finishing a renovation.

When to Use a Repair Escrow Agreement

You should use this addendum to real estate purchase contract whenever the seller has promised to complete repairs or work done on the home. They should be agreed upon before the sale so that the buyer knows exactly what the home will look like when they move in.

A buyer will give the money for the repairs or the renovations to an escrow agent to assure the buyer that there are enough funds for completing all the agreed-upon work. The agreement should also have an explicit timeframe to ensure that the repair work is done promptly.

The range of situations where you may need a repair escrow agreement is large, but there are some general situations where they will always be needed:

- Certification and verification of equipment or systems such as solar power panels or septic systems.

- Seller’s failure to complete a renovation or addition to the features and improvements that were originally stated.

- Mortgage-related charges that need to be completed on the seller’s end.

- Any agreed-upon obligations that the seller made in contract or to the buyer. This always needs to be fulfilled before the sale is completed.

- Legal or framework related issues that pertain to the title deed of the property will need to be addressed before the sale of the property.

If you are experiencing any issues and aren’t sure if you need a repair escrow agreement, contact your real estate agent. They should be able to advise you on what’s necessary and make the best plan for your situation.

What If the Seller Refuses to Make Repairs?

If the seller refuses to make repairs, you might want to consider contacting the real estate agent. They might advise you to contact a lawyer or take legal action. If you’re able to void the contract and the seller is becoming too complicated to work with, you could also end the agreement and move on.

What Are the Components of the Agreement?

While each agreement may be different, some agreements should be included in every component to make sure both parties have reached the same conclusion. The agreement will typically be attached to the addendum of an existing contract.

It’s also a good idea to work with a lawyer or real estate agent to draft the agreement. This way you can be sure that the agreement has all the necessary factors.

Buyer information

A section will usually be dedicated to the buyer and their personal information. This will include their full name, address, and a few other items.

Seller information

The seller will also need to include their information such as their full name and address. Make sure that the information is listed exactly the same as in the original agreement so that everything matches.

Purpose of addendum

This should be why the repair escrow agreement is being drafted and what the agreement is for repairs and other home fixes. You can refer to the original sale agreement to help you draft the addendum and the purpose for it.

You should also include the original date of the agreement and the escrow agent information. Make sure it has their legal name or company name and their contact information.

Obligations and responsibilities of the seller

This is where all the seller’s responsibilities will be listed and all the repairs and works they are expected to complete. It should also list the monetary amount that is expected to give out for the expected repair work.

Escrow agent responsibilities

This is where you will list the actions and responsibilities expected by the escrow agent. It should also list the commission fee or other form of payment they are receiving for working as the escrow agent.

Signatures

The signatures of the buyer, seller, and escrow agent will all need to be included. They should also print their name and date the day they are signing. Make sure the signatures and the printed names match the original document.

Filling Out the Repair Escrow Agreement Template

The template is easy to fill out and understand. There are a few tips to take into consideration though when it comes to filling out the template.

Indicate the buyer and the seller

The buyer and seller information should be listed under the first section. You should also include the escrow agent information and the mailing addresses for everyone.

Indicate property information

Write down the first purchase agreement date and the address of the property.

Complete all escrow information

Include the name of the escrow agent and their fee. You should also include the holdback amount that is given should also be listed and the way they are receiving their commission.

Signatures

All parties should include their signatures including the buyer, seller, and escrow agent. Make sure that everyone also prints their names.