Third (3rd) Party Financing Addendum Form

This addendum to real estate purchase contract is often attached to a purchase agreement so that both the seller and buyer know who is financing the sale. It’s not used if the buyer is receiving financing from the seller. It can also null the printable purchase and sale agreement if the buyer cannot receive the financing that they need to buy the home or property.

Use this guide and template to help you get started with the third-party financing addendum.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

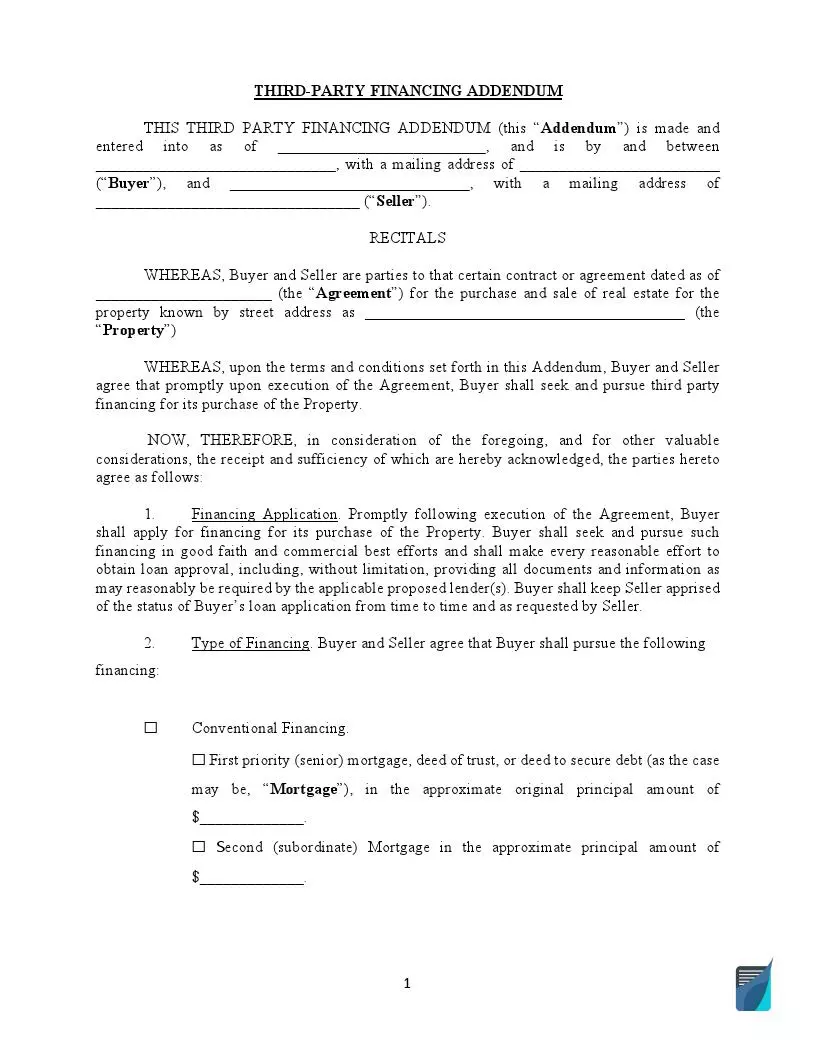

What Is a Third-Party Financing Addendum?

A third-party financing addendum is added to the sales contract to outline the terms of the loan the buyer is using. It can be used for conventional, FHA, or VA loans. The sales contract is contingent on the buyer securing the loan for the mortgage.

If the buyer cannot receive the loan, the contract will be void. The seller will typically need to be pre-approved for the loan or the financing before they can fill out the third-party financing addendum.

What Are the Types of a Third-Party Financing Addendum?

There are several different types of third-party financing that are used and may require this addendum.

A conventional financing addendum is used for a buyer who is using a loan from the Association of Realtors. This is one of the most common loan types and is used by most people who do not qualify for one of the other financing options.

An FHA or VA financing addendum is used when the buyer is receiving financing from the VA or FHA. VA loans are home loans given to veterans or service members. They can also be given to spouses and dependents of veterans in some cases. FHA loans are given by the Federal Housing Administration and are a common financing option.

There’s also a reverse mortgage financing addendum. This is usually used by people who are 62 years or older and allows the seller to get funds for the property in exchange for the homes’ equity.

USDA financing addendum is when there is a property being sold in a suburban or rural area to a buyer who couldn’t qualify for a traditional loan.

Why Use a Third-Party Financing Addendum?

A third-party financing addendum can be used anytime the buyer is receiving financing for a loan. It’s always a good idea to have one because it allows the buyer to terminate the sales contract if they cannot receive the proper funding.

It allows the buyer to have any earnest money they gave refunded back to them. Keep in mind that the buyer still has to give written timely notice if they are canceling the purchase agreement. Otherwise, they may be in breach of the sales contract. Most states require a notice of at least three days before closing.

If you are the buyer, let the seller know as soon as you can that you are not receiving the loan and need to cancel the sale. Keep in mind that the addendum does not require the buyer to obtain the funding in a certain timeframe. This means that the buyer can opt out of the sale as soon as they feel that the approval of the funding will not be given.

The third-party financing addendum can protect the buyer and seller from potential loan issues. Even if someone is pre-approved for a loan, they might not be able to secure the amount they need to purchase the home. Having the addendum in place can give both parties peace of mind when it comes to financing and loan approval.

What Are the Basic Components of the Addendum?

The addendum may look slightly different depending on the financing that is being used and what the loan terms are. The addendum will typically have a few key components that are always included.

Heading

This is the part where the party’s names and addresses are listed. It will also have the date the addendum is being created and the day the parties agreed on the terms.

Financing type

This is the area that will discuss the type of financing that is being used. It will have different details that are listed depending on the loan that has been secured.

- VA financing should list the monthly amortization, loan term, interest rate, and the minimum amount that is guaranteed.

- FHA financing should have the minimum amount guaranteed, the monthly repayments, and the maximum rate of interest.

- USDA financing should include the length of the mortgage term, the maximum rate of interest, the minimum amount that is being guaranteed, and the minimum monthly rate of amortization.

- Reverse mortgage financing should list the interest rate, mortgage term, and the original amount of the mortgage

- Conventional financing will need to show the lifespan of the mortgage, the interest rate, the origination charges, and the principal amount.

Make sure you always indicate the amount of money the buyer is trying to receive from the loan company.

Lender and property approval

The approval of the lender is sometimes needed to gain the financing. You may need to include a section including the date that the approval is needed. You will also need to give the date that the buyer must provide to have the approval of the property. The lender will usually give them a date.

Execution of addendum

This is where the signatures will need to be concluded. The buyer and seller will also need to print their full names and official signatures that match the original purchase agreement.

Filling Out the Third-Party Financing Addendum Template

The template is pretty straightforward and easy to fill out. Make sure to follow these tips to keep the template free of errors and potential issues.

Indicate the parties

The buyer and seller will need to write their names and their mailing addresses. Make sure the names are spelled the same and the addresses are the same as the ones listed on the original purchase agreement.

Indicate property details

Make sure to write the full property address of the real estate property or home that is for sale. You will also include the date of the original purchase agreement.

List the type of financing

Check the box next to the type of financing the buyer is planning on using for the loan for the home. You will also need to list the amount they are planning on receiving from the loan company.

Signatures

In the last part of the template, the buyer and seller should give their official signature that matches the signature on the original purchase agreement. They should also print their name and make sure that it’s legible.