Virginia Small Estate Affidavit Form

The Virginia Small Estate Affidavit Form lets a family member (normally an heir-in-law or a beneficiary indicated in the Living Will) inherit a deceased person’s personal assets. In this state, it is permissible to collect not more than $50.000 owned by the decedent not earlier than 60 days after the time of death.

If the deceased person’s property is evaluated to be not exceeding $25.000, it can be delivered to the successor without generating special documentation. However, 60 days must elapse since the decedent’s death, and there should be no application for assigning a personal agent pending. After 30 days since the decedent’s death, the grantee may request to obtain monetary funds to cover the mortuary handling of the funeral.

You will see some legal language in the small estate affidavit, including the definitions below:

- Designated successor. The person appointed to inherit the proper estate of the decedent on behalf of all successors.

- An individual, corporation, joint venture, fiduciary, partnership, LLC, or any other legal or commercial entity.

- Small asset. A bank account, credit union account, tangible personal property, or specific instruments evincing debt.

- A person, other than a creditor, who has been willfully chosen by the decedent to receive their personal property.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Virginia Laws and Requirements

According to the VA Code § 64.2-601 (2019), the claiming heir must be entitled to collect the personal property.

The individual who has access to the decedent’s small assets is not supposed to check the application of a small asset or question the correctness of any information provided in the affidavit. If this person refuses to transfer payment to the heir, it may be recovered, or its payment or delivery compelled.

If the heir is disabled and incapable of, the designated successor may transmit the payment to the grantee’s conservator or guardian.

If there is no conservator, guardian, or custodian known by the designated successor, they may deliver the payment to any relative of the grantee or anyone providing physical care of this person.

Virginia Small Estate Affidavit Laws Details

| Max. Estate | $50,000 |

| Min. Time to Wait After Death | 60 days |

| Filing Fee | Varies by county |

| State Laws | Virginia Code, Sections 64.2-600 to 64.2-605 |

Need other Virginia forms? We provide free forms and straightforward customization experience to anyone who prefers less hassle when confronted with papers.

Filling Out the Virginia Small Estate Affidavit Form

You are advised to use our form-building software developed to help you create the most recent paper. Follow these simple steps to complete the document successfully:

Enter the Successor(s)’ Personal Data

Those individuals who are about to inherit the decedent’s personal property need to submit their full names, being first duly sworn.

Provide the Information about the Decedent

Write down the deceased person’s full name and indicate the date of his or her death (month, date, year).

![]()

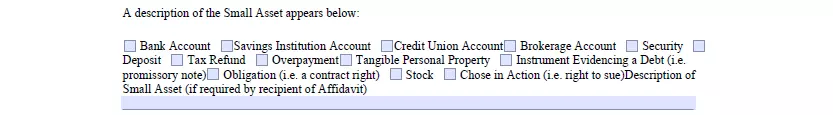

Describe the Assets You Are Supposed to Inherit

A small asset does not only imply monetary funds possessed by the decedent at the time of death. If any indebtedness is owed to the person who passed away, it should also be paid to the grantee, as well as some other specific types of possessions. Check out all the corresponding boxes with the kinds of personal property you believe you are supposed to inherit.

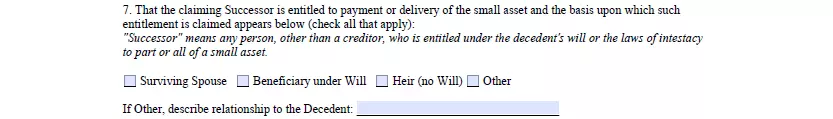

Provide Your Status

It is necessary to indicate your relationship with the deceased person. Choose whether you are a surviving spouse, a beneficiary under the will, the heir (with no will), or another relative of the decedent.

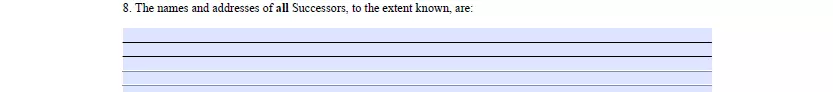

Write Down the Addresses of the Successors

All the grantees should share the personal property left by the decedent. You will need to give information about their current, complete mailing addresses herein. If you need more space than there is in the Affidavit, attach additional pages.

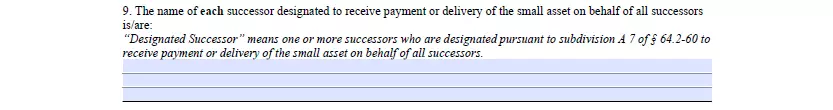

Name the Designated Successors

If there are designated successors, you are required to provide their names in this section. The designated successor should have a fiduciary duty to safeguard and promptly pay or deliver the small asset.

Sign the Paper

All the grantees need to review the information provided and append their signatures, confirming that they have agreed with everything stated above.

Notarize the Form

A licensed notary should witness and authenticate the Affidavit, providing the county where the document is created, the date it becomes effective, and the commission expiration date, notary registration number, and the seal.

Mind that a transfer agent of any security should make written corrections about the ownership of personal property and indicate the successor’s name on the books of a corporation instead of the person who passed away upon the presentation of the Affidavit.