Wisconsin Small Estate Affidavit Form

The Wisconsin Small Estate Affidavit form can be used for transferring ownership of the decedent’s personal property if the total value of subject assets does not exceed $50,000. The process is also known as a transit by affidavit. Only an heir or a legal representative can use this form to claim the assets.

The small estate affidavit form shall comply with all local laws and regulations concerning the succession process. If a third party possesses any tangible property of the deceased at the time of death, this party has to return the property upon receiving the affidavit.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Wisconsin Laws and Requirements

The small estate succession process is regulated by the Wisconsin Statutes and Annotations (Chapter 867). As we have already established above, the transfer of ownership by affidavit only applies to probate assets with a total value of not more than $50,000.

It is important to mention that the small estate affidavit cannot be used by an heir-at-law or a successor in interest to collect the decedent’s real property. Only a will or testate letters can legally transfer ownership of the real estate after the decedent’s death.

Under local regulations, the decedent’s property shall be distributed between the parties in accordance with the decedent’s payment obligations and duty priorities. The parties claiming the probate assets may include successors in interest, heirs-at-law, legal representatives, guardians, as well as custodians. Any authorized person can request legal administration to resolve ownership matters of the decedent’s estate.

Wisconsin has a special Estate Recovery Program for Medical Aid and other health-related state programs. This practically means that the state authorities can require payment for any medical care services that were provided but not paid for. The state healthcare services can claim the probate assets equivalent to the amount of medical services and procedure costs. For the same reason, the affidavit form requires information on the medical status of the deceased. You can get more details on the Program conditions on the Wisconsin Department of Health Services official website.

Wisconsin Small Estate Affidavit Laws Details

| Max. Estate | $50,000 |

| Min. Time to Wait After Death | Not specified |

| Filing Fee | Not specified |

| State Laws | Wisconsin Statutes and Annotations, Sections 867.01 to 867.03 |

Need other Wisconsin forms? We offer free forms and straightforward personalization experience to everyone who prefers having fewer to none complications when facing forms.

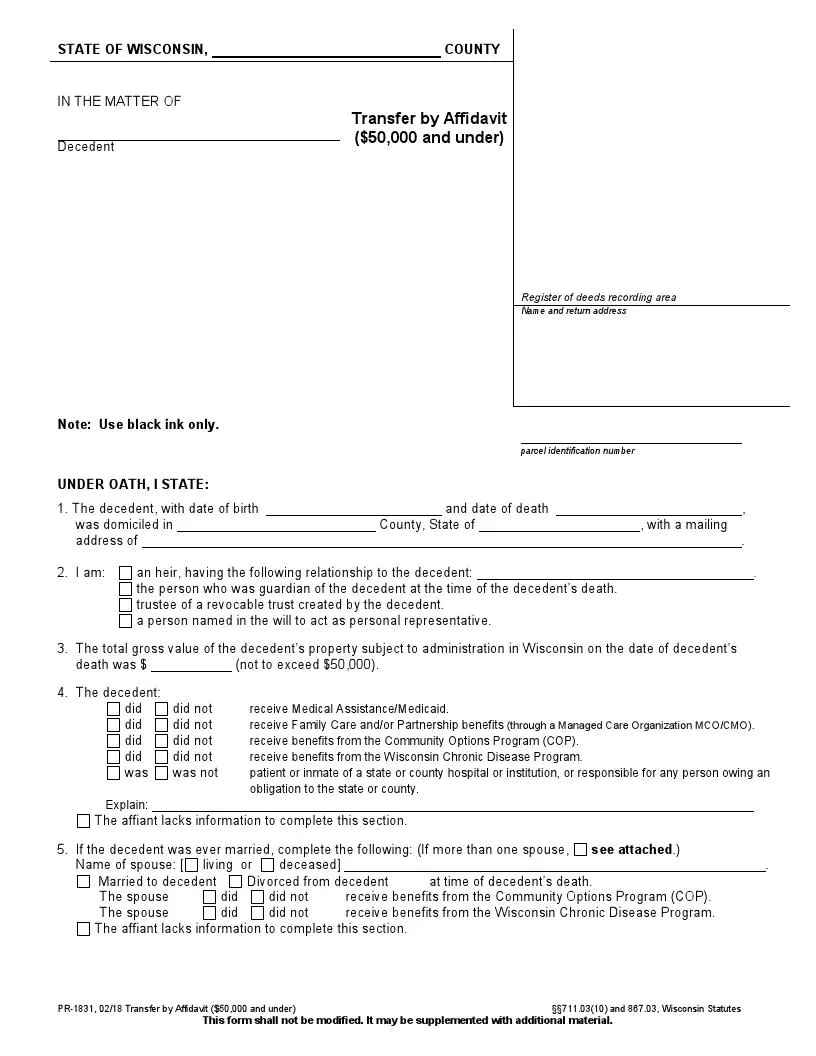

Filling Out the Wisconsin Small Estate Affidavit Form

You need to obtain the proper Wisconsin Small Estate Affidavit form before proceeding to fill it out. We suggest you use our newest software tools to build any legal form you need.

Below are step-by-step instructions on how to fill out the form. Please make sure that the submitted information is accurate:

1. Indicate the county of death and the name of the deceased.

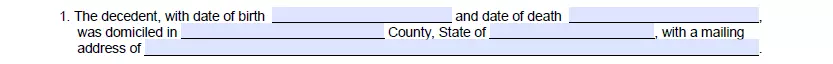

2. The next sections will require you to state the information under oath. Write down the date of birth and the date of death along with the residential address of the deceased.

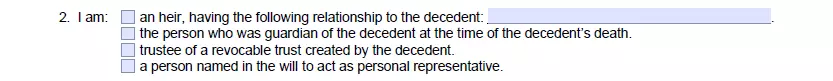

3. Indicate your relationship to the decedent. Check the corresponding box to do so.

4. Enter the total value of the decedent’s estate. Please remember that the total value of the probate assets shall not be over $50,000.

![]()

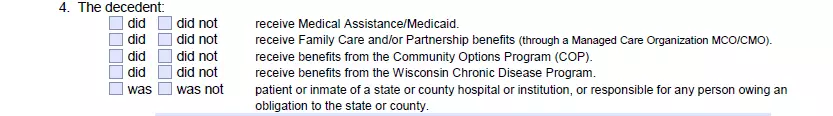

5. Indicate if the deceased was getting any medical care or had a special medical status before death. Check the corresponding box for the relevant state benefits (Family Care, Partnership Benefits, Community Options Program, Wisconsin Chronic Disease Program, or others). If you lack information to fill out this section, just check the corresponding box at the bottom.

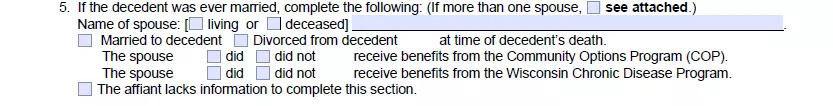

6. Indicate the decedent’s marital status at the moment of death and the special medical status of the spouse (if applicable).

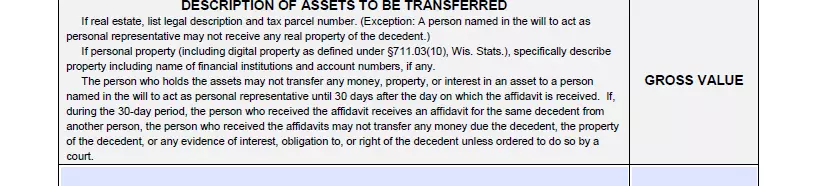

7. Describe the personal property assets subject to the transition of ownership and indicate their gross value.

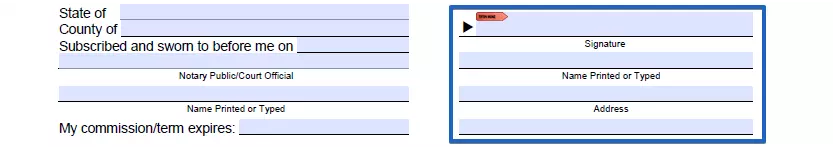

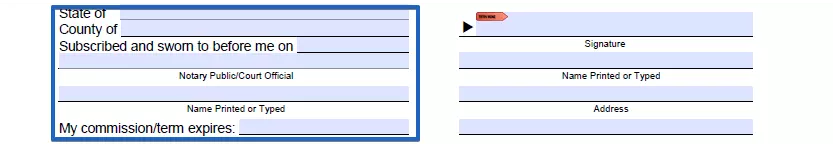

8. Put your signature, printed or typed name, and date of the affidavit subscription as a sign of your consent. Leave the left column for the Notary Public to fill in.

9. The document requires notarization and registration of deeds. Please make sure that the Notary Public signs the affidavit and puts a state seal on it.

Upon completion, send the form to the Department of Health Services (Estate Recovery Program) by mail. Please note that if you are planning to provide a copy of the affidavit to the Estate Recovery Program office or any other financial institution, you will need to submit a separate document containing the Social Security Number of the deceased along with it.