Hawaii Bill of Sale Form

Hawaii bill of sale form serves as a legal contract or agreement between the two parties to purchase any private property. It usually includes information on both the buyer and seller and particular facts about the item sold, such as the registration number, kind, or identification number, and both parties signatures

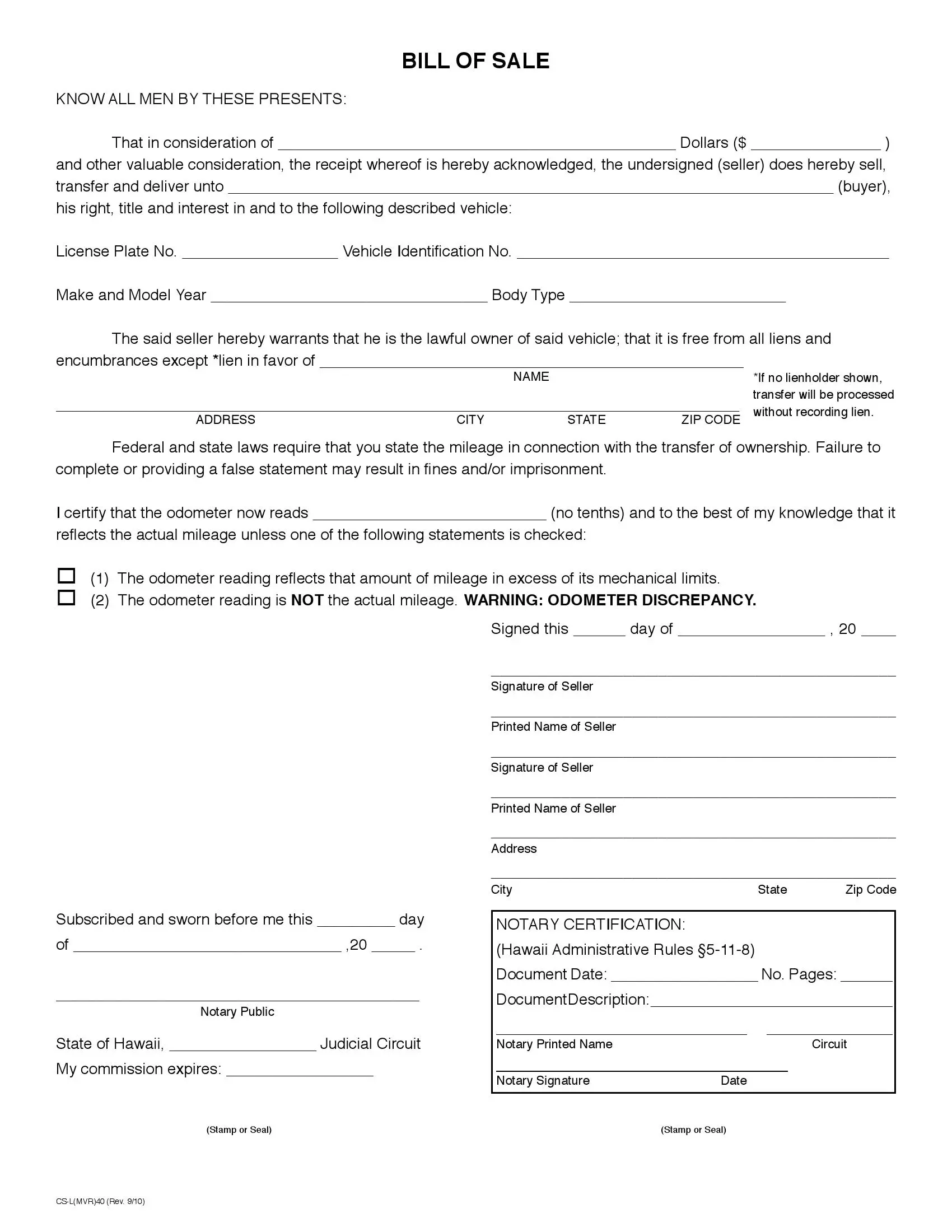

You will find various types of bills of sale for your private transactions that can be filled in and downloaded from our site. There also exists an official Hawaii bill of sale, form CS-L(MVR)40, for vehicle ownership transfer.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Hawaii Vehicle Bill of Sale Form |

| Other Names | Hawaii Car Bill of Sale, Hawaii Automobile Bill of Sale |

| DMV | Hawaii Department of Motor Vehicles |

| Vehicle Registration Fee | $45 |

| Bill of Sale Required? | No |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 39 |

Hawaii Bill of Sale Forms by Type

Each type of private agreement should be accompanied by the signing of a bill of sale. Depending on the item you sell, you can choose from the general and specific templates already predefined for your use.

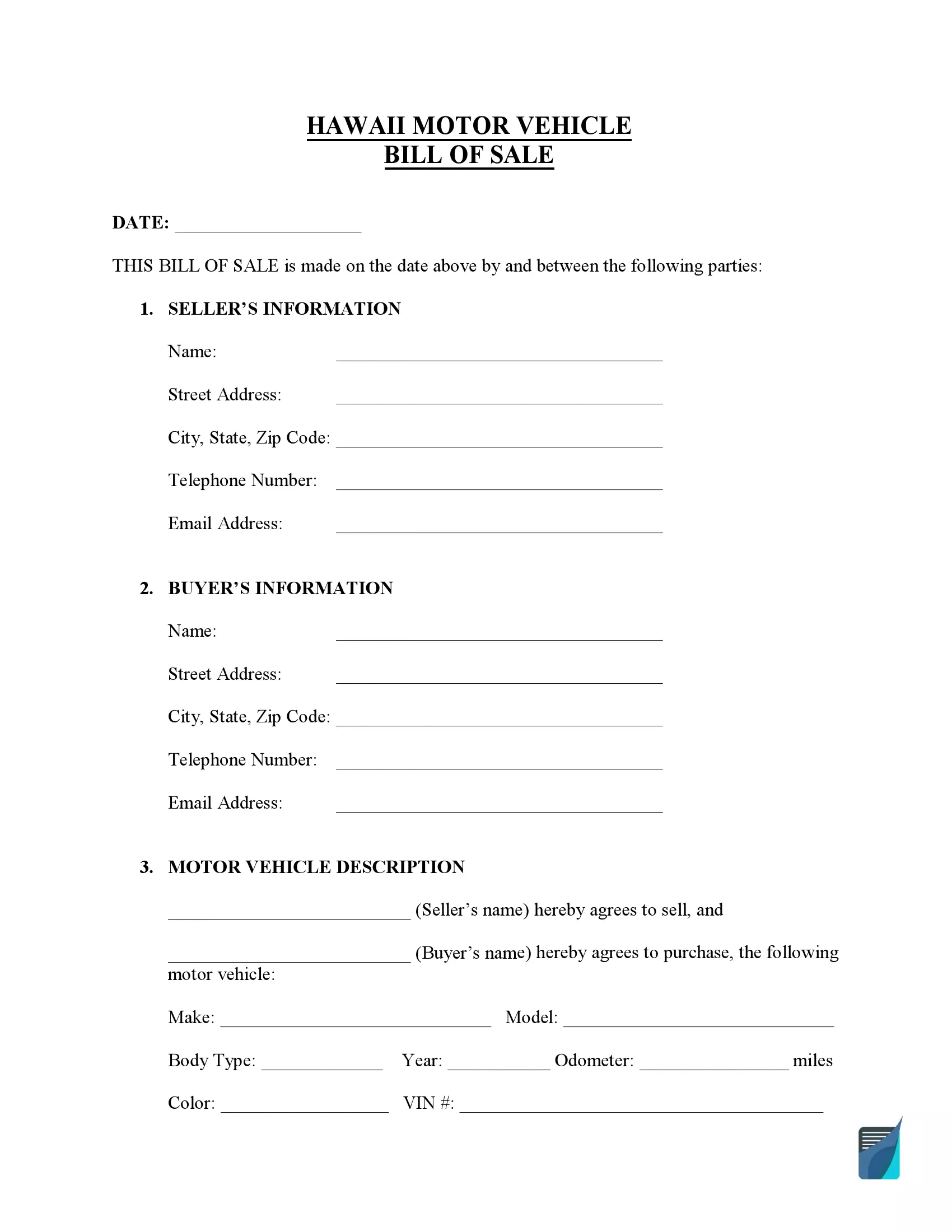

Use a Hawaii bill of sale for motor vehicles to prove the private sale transaction between the two parties. It serves as a legal confirmation of the vehicle transfer to another owner. You’ll have ten days to register your vehicle after moving to Alaska. Non-residents can use the registration of another state for 60 days.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Required |

| Download | PDF Template |

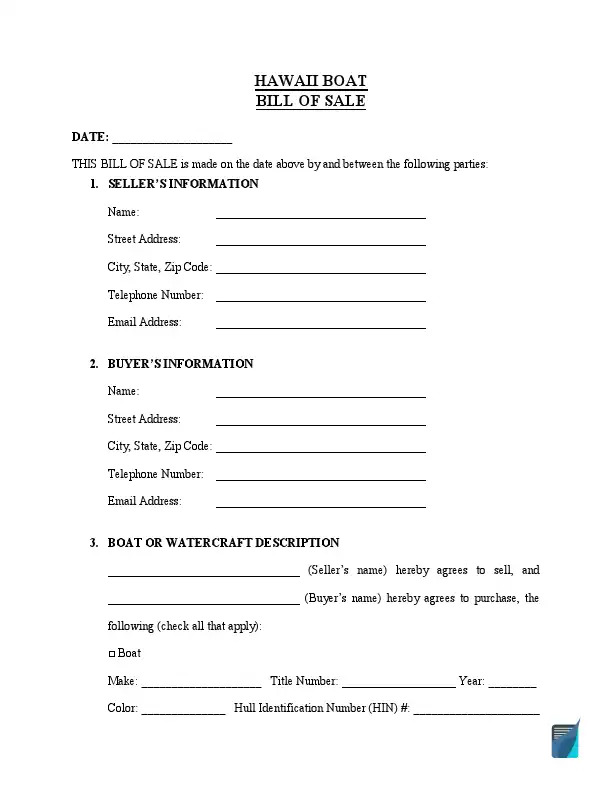

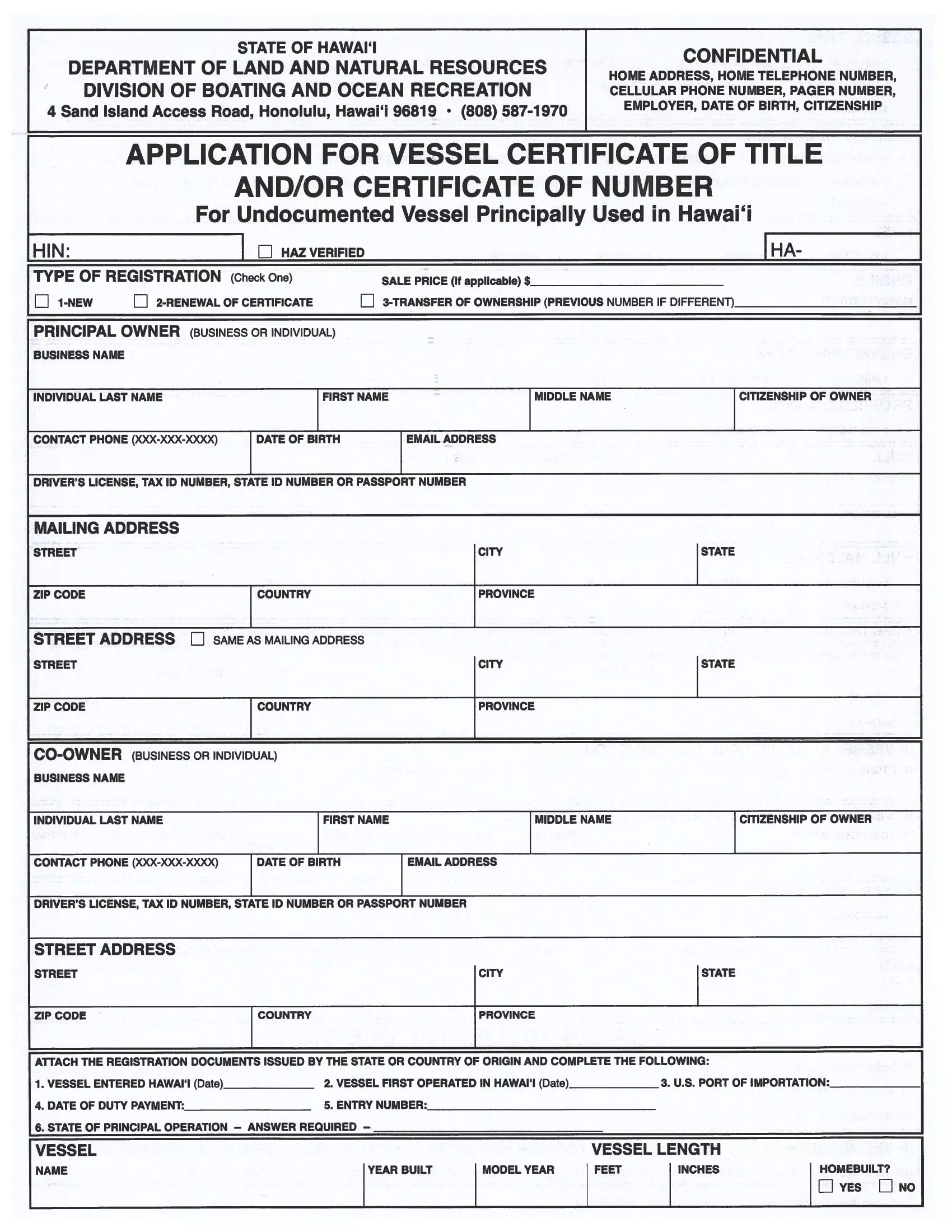

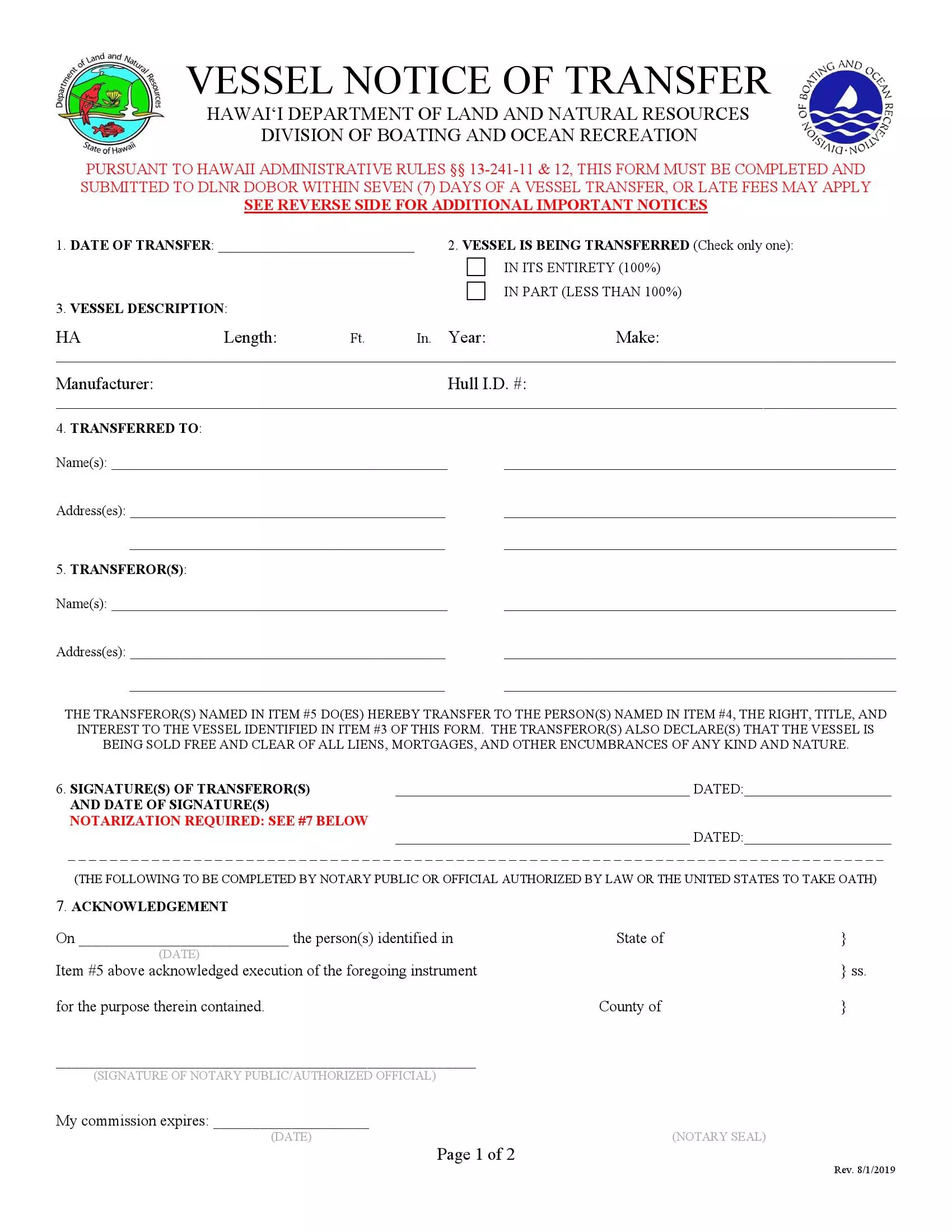

Hawaii boat bill of sale form justifies a private transaction of boat ownership transfer to another party. You will need to present it to apply for a new boat title and registration. The state of Alaska requires that all types of boats be registered. The cost of registering a boat varies based on the type of vessel.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

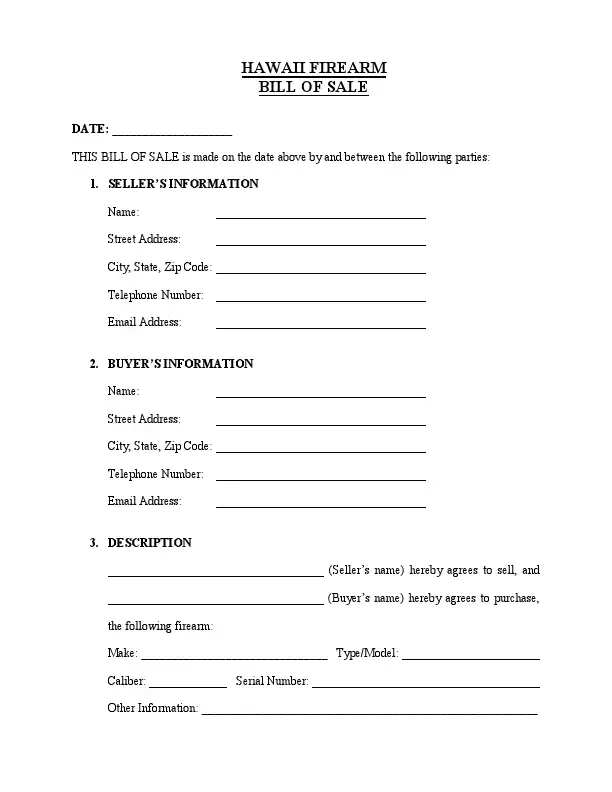

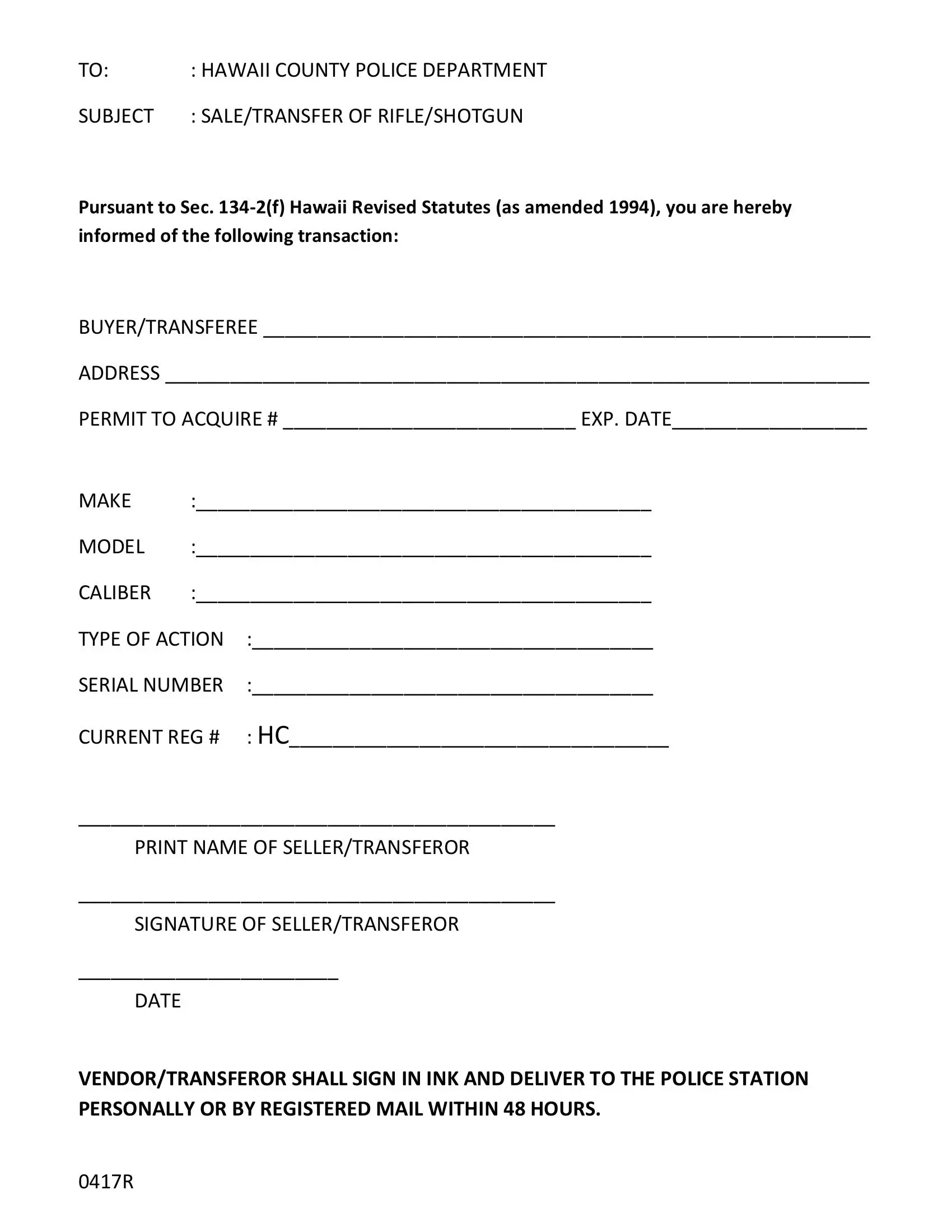

This Hawaii firearm bill of sale contains the information of the owners and both signatures to serve as legal proof of ownership transfer. The state of Hawaii requires the registration of all types of guns. Alaska doesn’t require a permit to open carry or buy a gun if a person is under 21. Also, a permit will not be needed for concealed gun carry.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

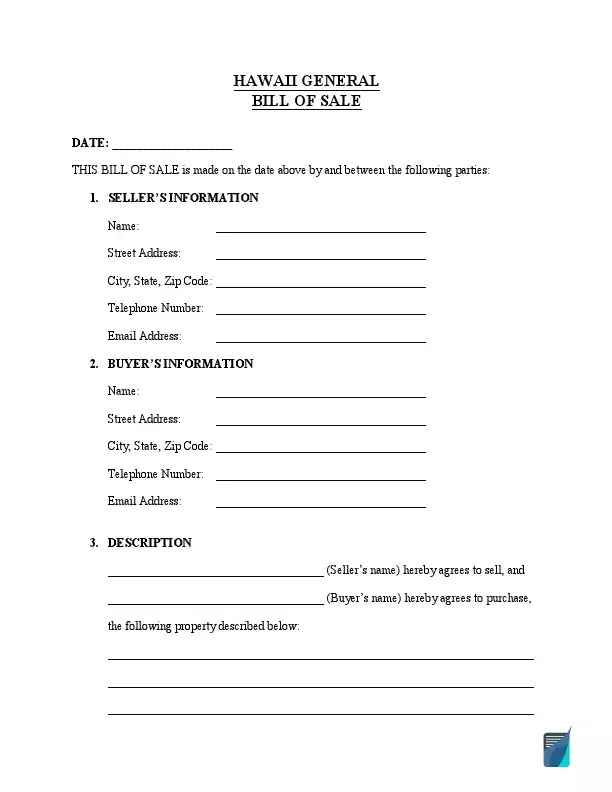

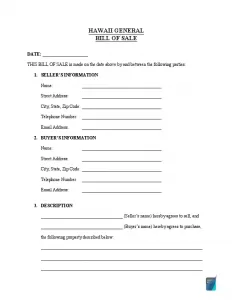

Use a general bill of sale in Hawaii to transfer property ownership to another party. The form only contains the general fields, so you must specify your item of sale details. This document can serve as written proof that the purchase happened on the defined date and provide both the buyer and vendor with an additional layer of legal protection.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

How to Write a Hawaii Vehicle Bill of Sale

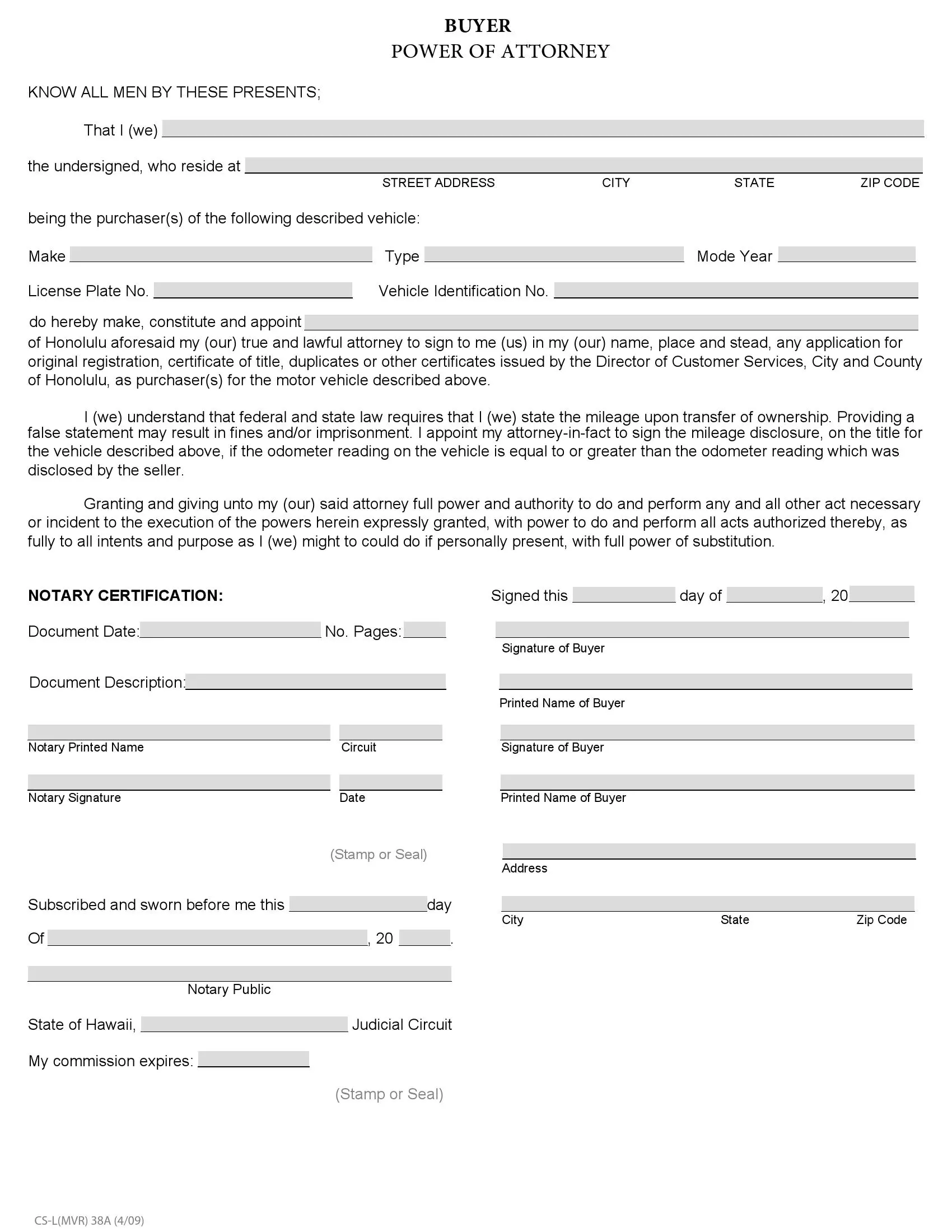

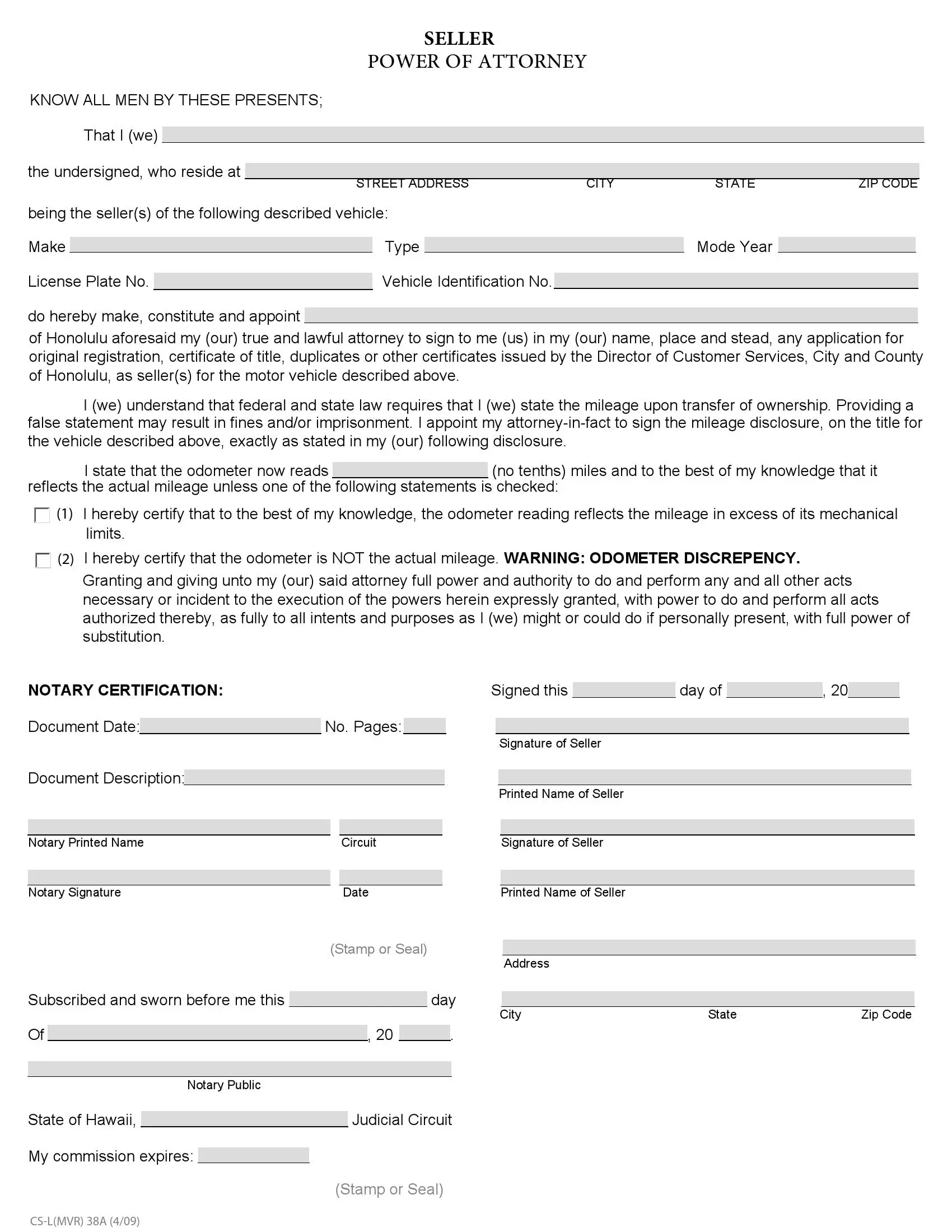

Having a bill of sale will protect both parties and help clarify the purchase details, such as the date of the transaction and vehicle details. Although there is no specific form for most vehicles, Alaska officials offer the state-specific bill of sale Form 808, also known as the in-state Alaska bill of sale for snowmobiles or ATVs.

Filling out a Hawaii vehicle bill of sale form requires providing specific information about the parties, such as buyers and sellers, the vehicle sold, and the odometer disclosure statement. No matter what type of vehicle is being sold, the following steps are required to fill out the document appropriately:

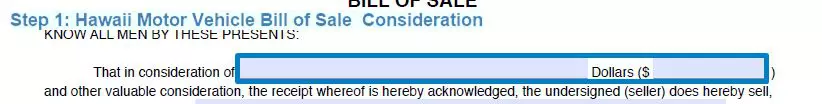

Step 1: Indicate the consideration

First, you need to indicate the consideration for which the vehicle is sold, both numerically and in words.

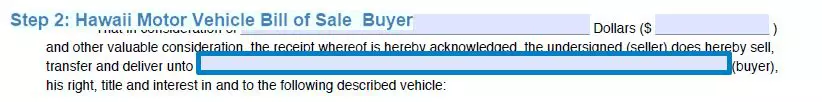

Step 2: Identify the buyer

Secondly, you need to fill out the identification of the party’s section indicating the buyer’s legal name.

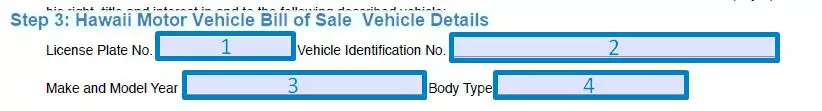

Step 3: Provide the vehicle details

After giving the buyer’s name, you will have to provide the vehicle description, stating its license plate number, vehicle identification number, make, model year, and body type.

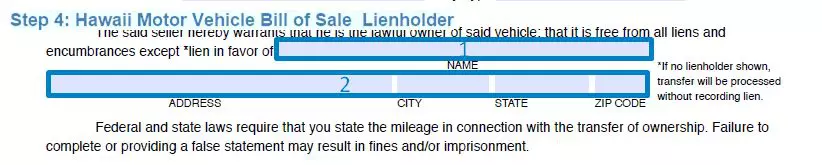

Step 4: Specify the lienholder (optional)

The next step is optional, as if no lienholder is present, the transfer will be processed without recording the lien. Otherwise, you need to provide the details of the lienholder, like name and address.

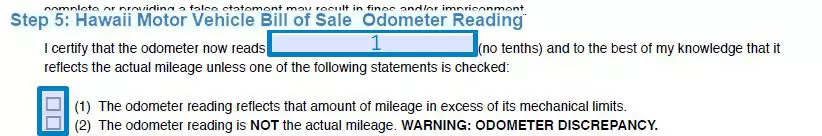

Step 5: Indicate the odometer reading

Federal and state laws require the seller to disclose the vehicle’s actual mileage to the buyer. You will need to state the odometer reading in the relevant section. If the amount of mileage is more than the mechanical limits, or there is an odometer discrepancy, you will have to indicate it by checking the appropriate box.

Step 6: Date and sign the document

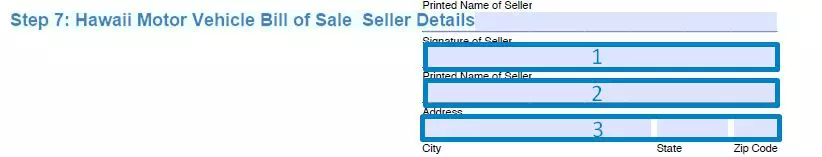

Only the seller must sign the bill of sale. If there is more than one seller, the other will also need to sign the document. The date on which the bill of sale is made must also be included.

Step 7: Provide the seller’s details

After the signature, the seller(s) must specify their details, including the printed name(s), street address, city, state, and zip code.

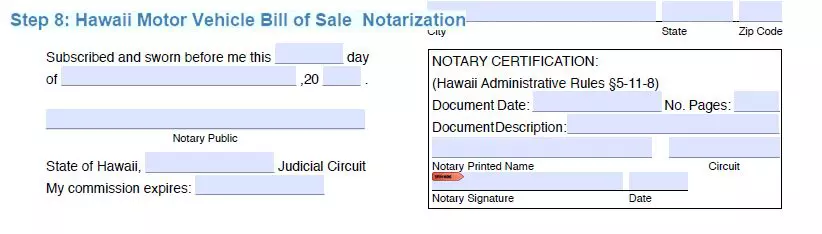

Step 8: Get a notary acknowledgment

As the seller, you will have to notarize your vehicle bill of sale in Hawaii. The notarization date and all the relevant notary certification details must be described at the end of the document.

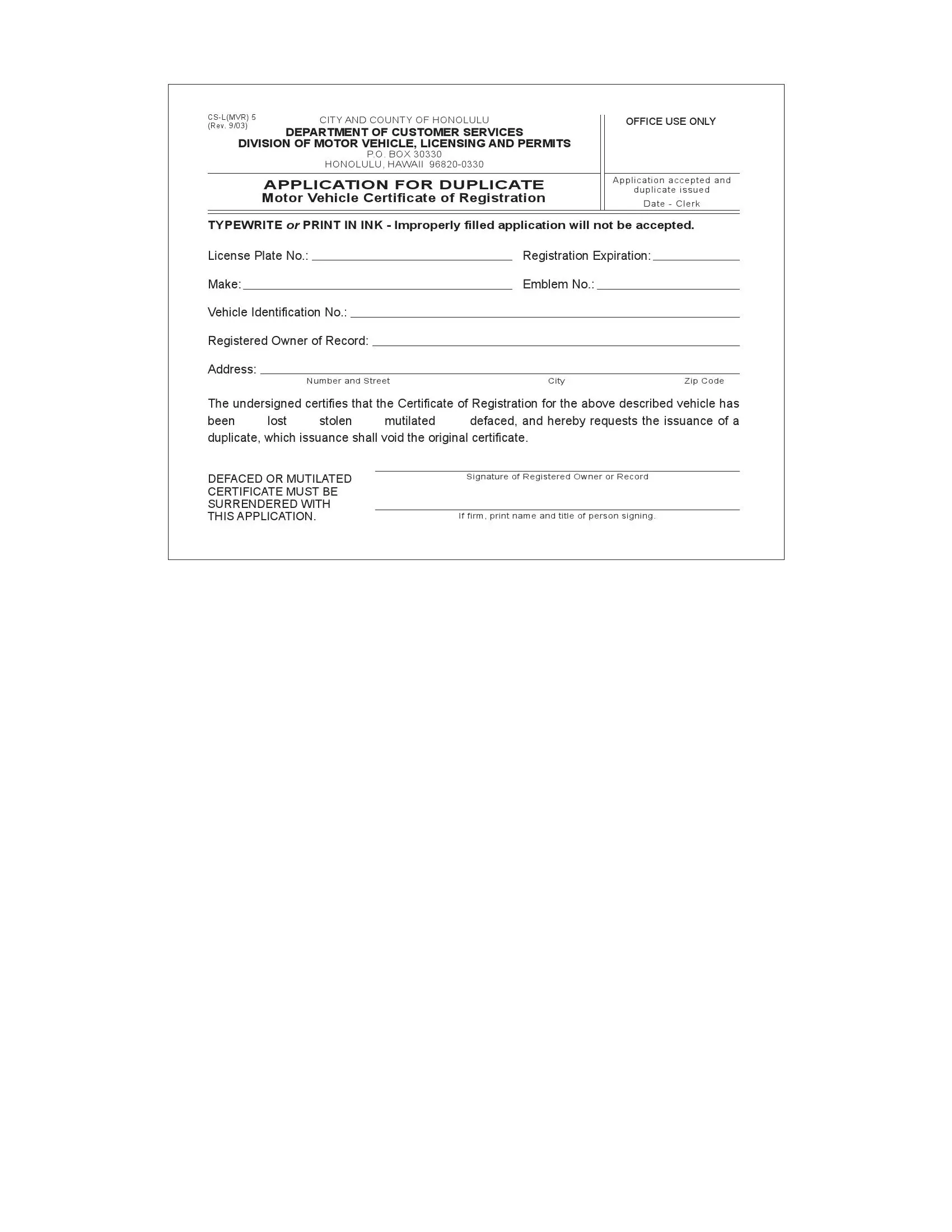

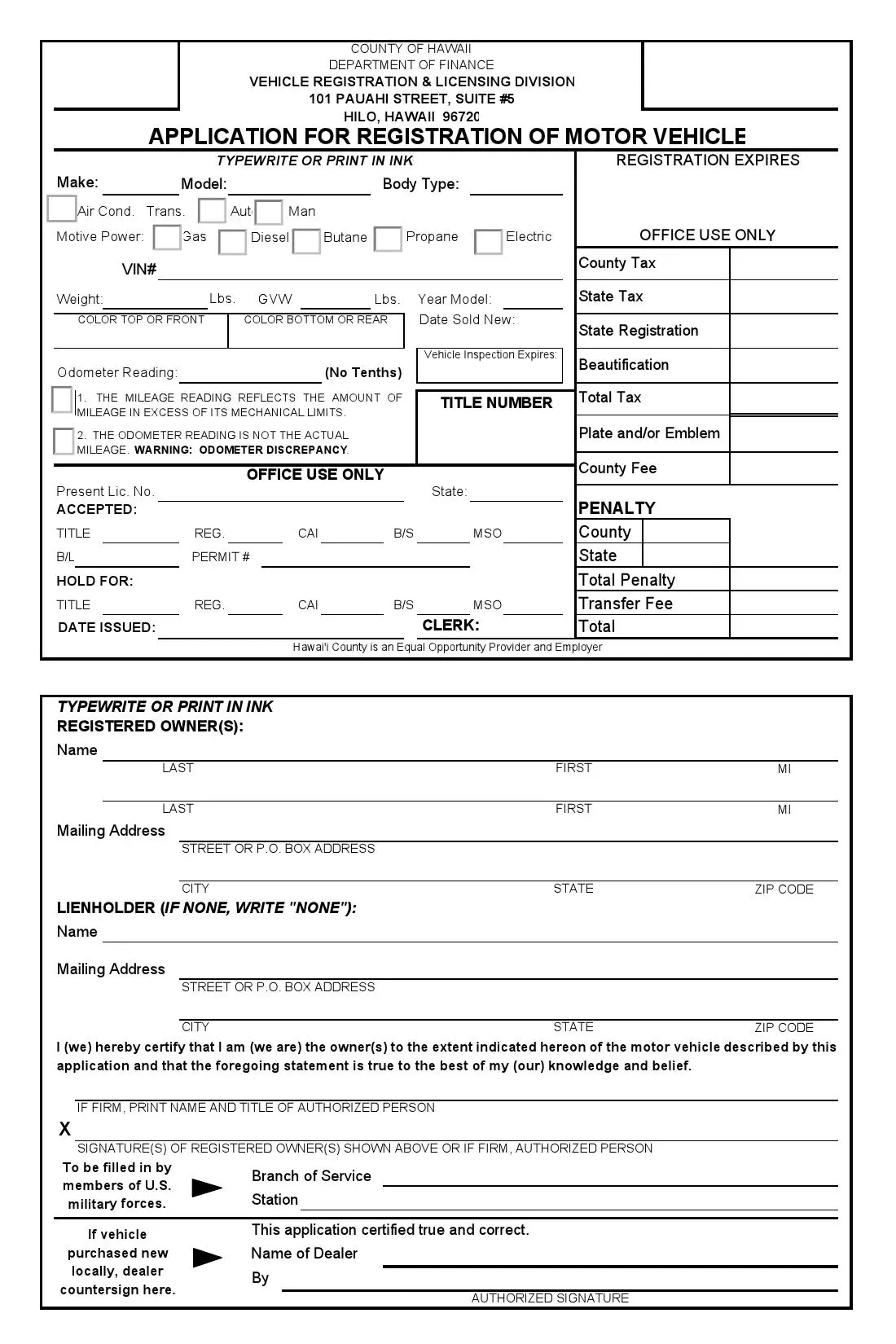

Registering a Motor Vehicle in Hawaii

Once you settle on acquiring a car in Alaska, ensure the seller provides you with a Notice of Vehicle Sale of Transfer. A purchaser must conduct and deliver this form with the original title to the local DMV office.

Vehicle registration is required under any state law, including the state of Hawaii. The vehicle’s title and ownership rights should be transferred appropriately between the buyer and the seller once the change of ownership has been done. Following this, the new owner must register their vehicle according to the respective country’s procedure. They may also be required to renew their vehicle registration annually.

The five countries of Hawaii have different requirements for vehicle registration. Therefore, contacting the motor vehicle registration licensing office is highly recommended to verify all the information before indulging in any of these activities.

Although the documents required may vary depending on the country, some of the standard documents required for the process are:

- Bill of sale

- Certificate of title

- Odometer disclosure statement

- Driver’s license

- Completed application for registration form

- Safety inspection certificate

- Proof of insurance, including liability coverage and personal injury protection coverage

- Motor vehicle power of attorney (in case the agent will be representing the seller in the transfer of the vehicle)

The type of motor vehicle decides the motor vehicle registration fees. For example, a passenger car weighing up to 3700 pounds comes with a fee of $ 135, and above 3700 pounds is $187. The fee of $38.40 is the minimum tax required to be paid as provided by the state of Hawaii on motor vehicles. There are some exemptions to tax disabled or military veterans.

You should contact the motor vehicle registration office to determine how much registration fees you owe. However, a few examples of these fees are:

- State fee: $45

- Country fee: $12

- Transfer fee: $5

Relevant Official Forms

Fillable form to apply for registration of the vehicle in a state.

The Vessel Registration Form is used to register or apply for a new title of a vessel in Hawaii.

The Vessel Notice of Transfer documents sale of a vessel between two parties, for transfer of vessel registration.

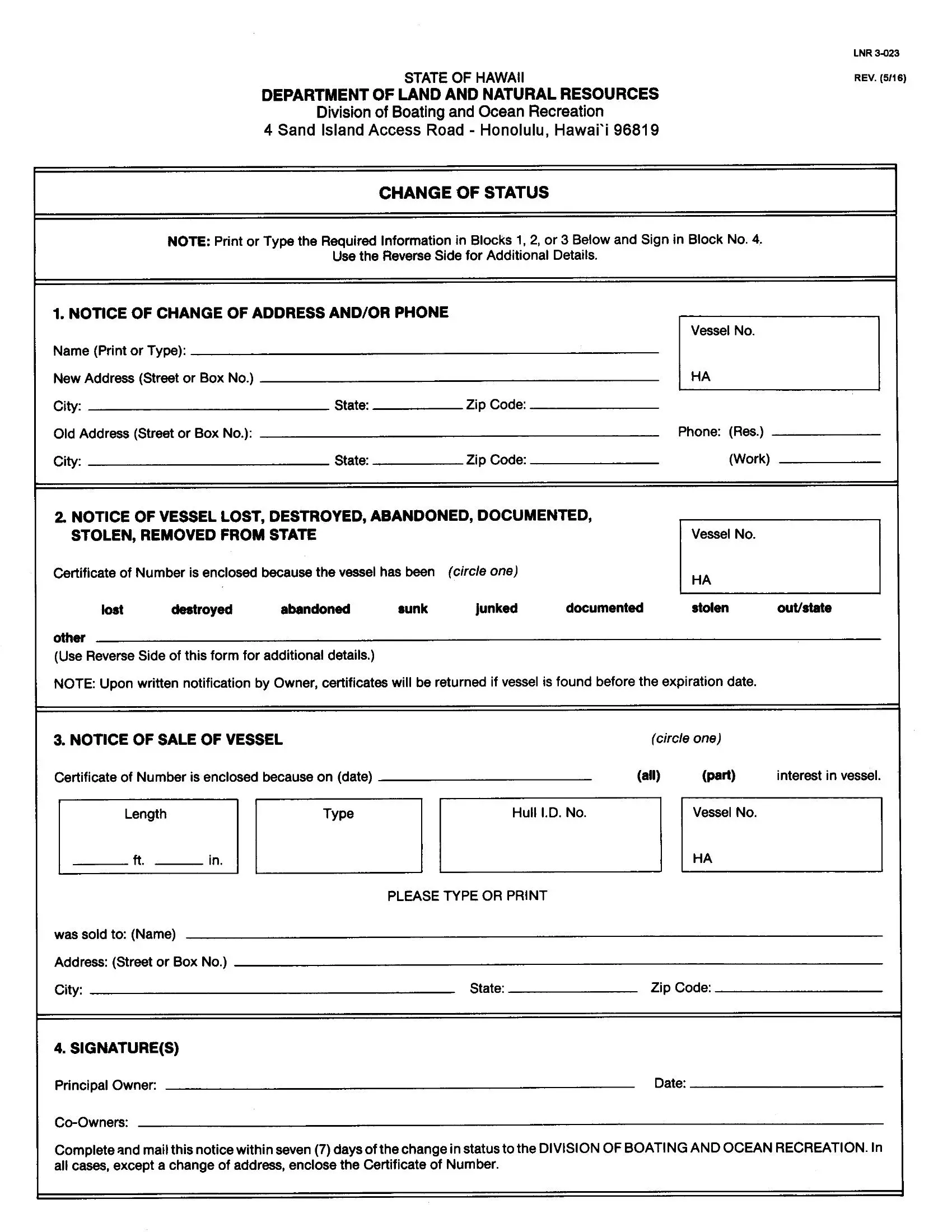

Notify the local DMV about the change in status of the vessel or owner’s contact information by submitting this form.

The vendor must submit a form for rifle or shotgun transfer after the gun sale.

Short Hawaii Bill of Sale Video Guide