Hawaii Last Will and Testament Form

A Hawaii last will is a vital legal document representing the last wishes of a testator regarding their assets and ways in which they’d wish them to be distributed to their chosen beneficiaries. As a rule, most people will only benefit from creating will forms.

Even when you do not have a lot of assets, a will may help your family situation and end up being essential to your close relatives after your death. Here, you can easily get a free last will form valid in Hawaii that you can fill in online and print out.

Additionally, down the page, there’s a lot of information in relation to the last will preparation process and common issues.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Hawaii Last Will Laws and Requirements

| Requirements | State laws | |

| Definitions | §560:1-201 – General Definitions | |

| Statutes | Chapter 560 – Uniform Probate Code; Article II – Intestate Succession and Wills | |

| Signing requirement | Two witnesses | §560:2-502 Execution; witnessed wills; holographic wills |

| Age of testator | 18 and older | §560:2-501 Who may make will |

| Age of witnesses | 18 and older | §560:2-505 Who may witness |

| Self-proving wills | Allowed | §560:2-504 Self-proved will |

| Handwritten wills | Recognized under certain circumstances | §560:2-502 Execution; witnessed wills; holographic wills |

| Oral wills | Not recognized | |

| Holographic wills | Recognized under certain circumstances | |

How to Prepare a Hawaii Last Will

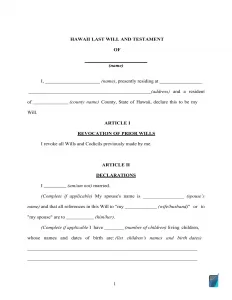

1. Consider your options. Before getting started, you need to decide if you want to use the help of a legal professional or write the entire document on your own. If you would like to make the last will on your own, pick the type you’ll use: a solely handwritten, holographic will, or a free Hawaii will form.

2. Specify your information. Establish the testator and their particulars: full name and residence (city, county, and state). Check the details you entered along with the remainder of the passage, which includes “Expenses and Taxes.”

3. Establish the executor (or executrix). Select the executor of your estate and enter their particulars: full legal name and place of residence, which should usually be in the same state the testator lives since almost all states enforce special rules on out-of-state executors. As a precaution, it’s possible to choose an alternative executor of your last will and testament. That way, you’ll be able to be certain that even if the originally appointed executor can’t perform their obligations, there is another dependable person you can rely on.

4. Appoint the guardian (optional). You are able to specify a trusted person as a guardian if you’ve got minor or dependent children that need to be looked after. If there are no instructions concerning who exactly should look after your children, the guardian will be selected by the court.

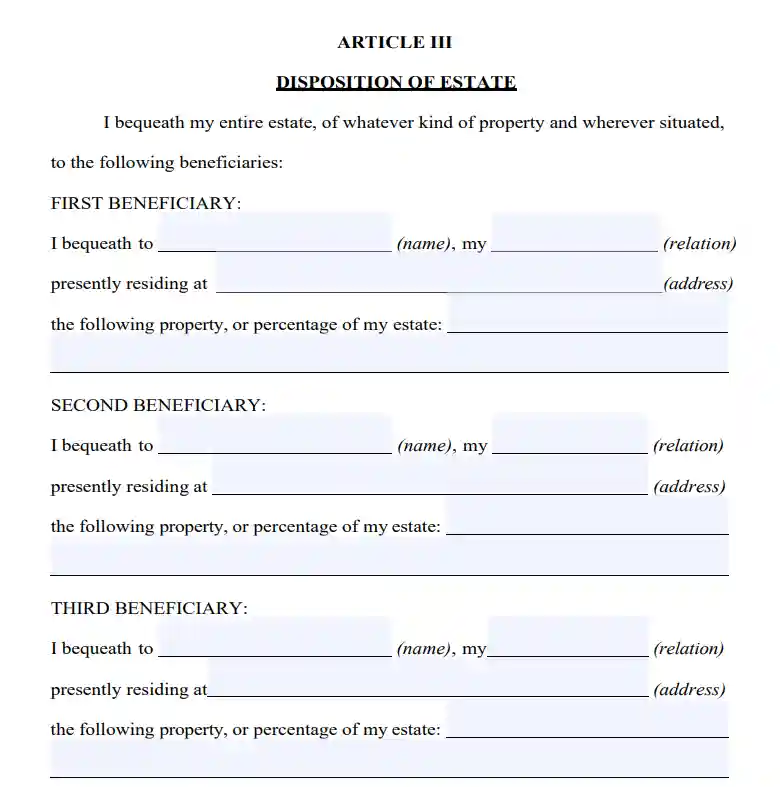

5. Indicate your beneficiaries. At this point, specify those people to whom you wish to leave your property and assets, that is, your beneficiaries. Fill out their full names, addresses, and your relationship to them (spouse, child, friend).

6. Designate assets. If you have a property distribution planned that’s not equal, it’s possible to explain it in this part. Money for unpaid debts, realty, shares, company ownership, cash, and any material items of financial value you possess can be in the will. Please notice that there are things that cannot be distributed in the will, for example, life insurance and joint and living will property.

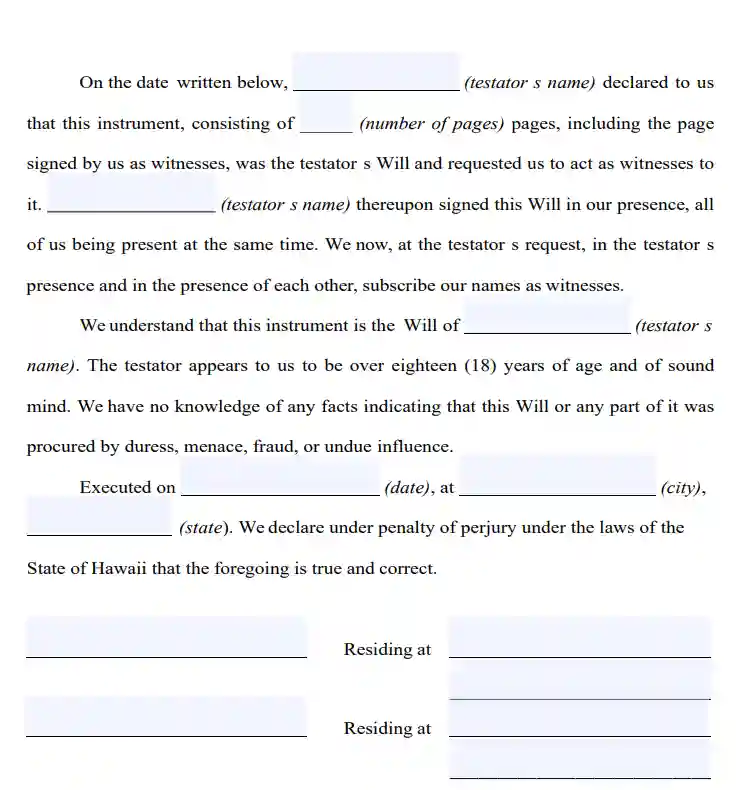

7. Ask witnesses to finalize the document. Hawaii law specifies that a minimum of two witnesses have to sign a last will for it to be deemed valid. You may name a person as a witness only if they’re older than 18 years and are disinterested in your bequest. Think about picking witnesses who are younger than you to ensure that they will likely be present in case the will is contested in court or if some other problem takes place. At this point, you (as well as your two witnesses) must sign the paper after filling in your full legal addresses and names. Don’t forget to look over every section thoroughly prior to concluding the matter.

Create a Free Hawaii Last Will Template

Frequently Asked Questions

Do I have to notarize my last will in Hawaii for it to be valid?

Hawaii law affirms that a last will can be valid without getting a notary public to authorize it. But if you would like to attach a self-proving affidavit to your last will and testament, you’ll have to notarize it. A self-proving last will makes probate simpler since the court can acknowledge it without getting in contact with the witnesses who are involved.

Is it mandatory (in Hawaii ) to add a self-proving affidavit to my last will?

According to Hawaii law, there’s no need to attach a self-proving affidavit to your last will. However, it may not be a bad decision to add this document. During probate, it’ll serve as an alternative for the witness testimony in court and facilitate the process.

Can you leave out your children or spouse from a last will?

In Hawaii, there isn’t such a thing as community or marital property. The term suggests that any possessions gained or improved during the marriage must be equally shared between both marriage partners. In Hawaii, it is possible to disinherit your spouse, but the latter will be able to receive a particular minimum amount of your estate. However, it doesn’t make couples in Hawaii divorce more often than in common-law marriage states.

For the others, it’s legal in Hawaii to disinherit members of your family in your will. With the addition of certain disinheritance sections to your last will, you’ll be able to leave your children (of 18 years and above) or any other members of the family out from getting any of the belongings.

Is it possible to revise a typewritten last will after signing it? (in Hawaii)

Yes, you can adjust it.

A person who wrote the will is permitted to alter or revoke his or her will at any time. The only situation that may not let you do it is if such action is forbidden under the contract you signed.

Additionally, it can be a wise decision to revise your last will whenever you go through an important life event such as:

- Child birth or adoption

- Marriage or divorce

- You purchased or sold real estate or a considerable piece of property.

- Your financial position has changed noticeably

What should I do in case my will has been lost?

In Hawaii, the law says that the court will recognize a last will if it has been damaged or lost. But, the probate court cannot be likely to accept anything other than the initial version of the will to probate.

As per Hawaii law, the absence of the will can be regarded as its repeal. This suggests that the executor should provide proof of the last will and testament’s credibility, which in turn may be rather troublesome.

For holographic wills, things can be far more problematic because sworn witnesses and testimony will be required. Furthermore, you are also to provide evidence of the reason why the will and its elements can’t be provided in a way that will also ensure it wasn’t canceled.

What should one do if he or she is physically unable to sign their last will?

Only per your directive and in your presence is someone allowed to sign your last will (See Hawaii Estate Code §560:2-502). Voice communication, a positive answer to a question, or a gesture are the means that can be used to convey that you prefer a certain person to sign your will.

You can have a notary public sign the name of a testator that is physically unable to do it in case the latter instructs the notary in the presence of a witness. Such a witness is chosen much the same way one could select an executor – they cannot have any legal or equitable interest in any assets that are the concern of or impacted by the will.

Other Documents Related to Wills in Hawaii

| Related documents | Instances when you might want to create one |

| Codicil | You would like to make one or a few minor adjustments to your will. |

| Self-proving affidavit | You would like to keep from possible risks in the probate court. |

| Living will | You would like to state your wishes concerning the end-of-life treatment and life-prolonging procedures. |

| Living trust | You want to think about an alternative to a last will. |