Minnesota Bill of Sale Form

Minnesota bill of sale is a legal document acting as proof of sale and alleviating possible concerns for both parties during private transactions. Bills of sale protect both the buyer and seller from potential legal disputes over the item sold.

There is no formal requirement to fill out Minnesota bill of sale forms to transfer ownership of personal property. Still, it may be needed in transactions involving a vehicle or boat to title and register it appropriately. You will find free Minnesota bill of sale templates for different situations on this page. We highly recommend using the official Form TR-207 for private transactions with cars and boats.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Minnesota Vehicle Bill of Sale Form |

| Other Names | Minnesota Car Bill of Sale, Minnesota Automobile Bill of Sale |

| DMV | Minnesota Driver and Vehicle Services |

| Vehicle Registration Fee | $6-10 + additional fees |

| Bill of Sale Required? | Yes |

| Avg. Time to Fill Out | 15 minutes |

| # of Fillable Fields | 62 |

Minnesota Bill of Sale Forms by Type

Different types of personal property require specific Minnesota bill of sale forms, and it is crucial to know which type, among other existing forms, has to be chosen in your case.

Minnesota bill of sale for a vehicle shows the change of ownership of a vehicle and contains necessary details that may be requested during the vehicle registration process. New vehicle owners in Minnesota have 60 days to register their vehicles. The same applies to those who bring their vehicles from other states. The registration should be renewed every year.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

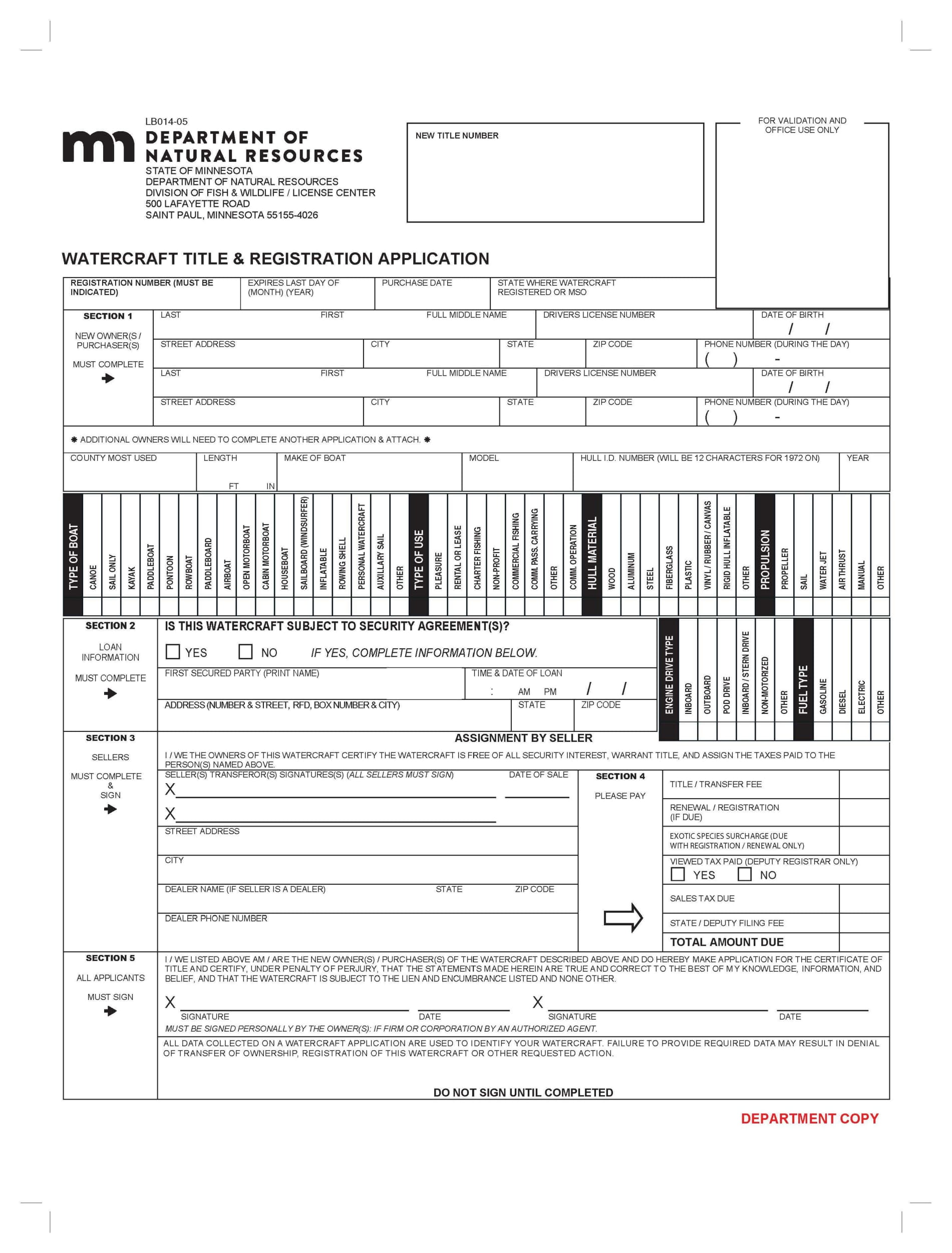

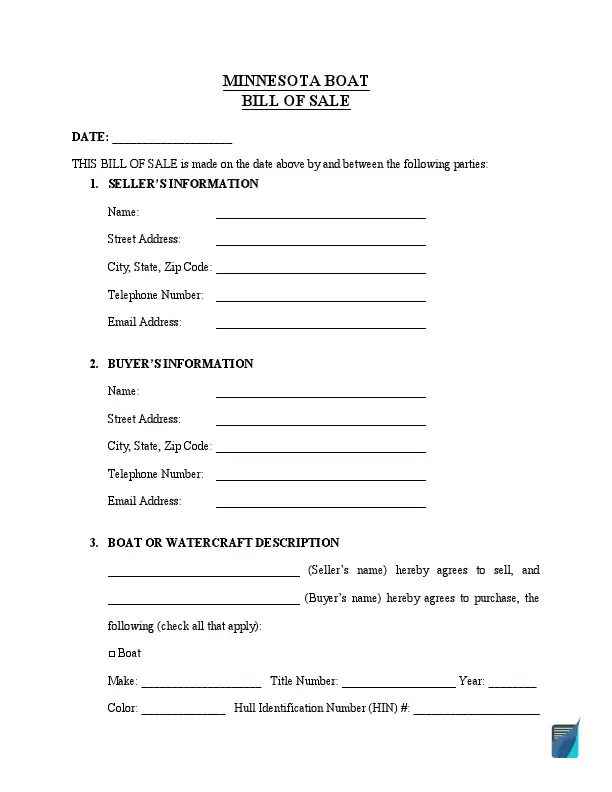

Minnesota bill of sale for a boat has valuable information about a former and a new owner and the boat itself. Boat registration in Minnesota lasts for three years and can be prolonged in-person or online. Among the required documents for your vessel registration are the bill sale form, title and registration application, and certificate of title.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

“

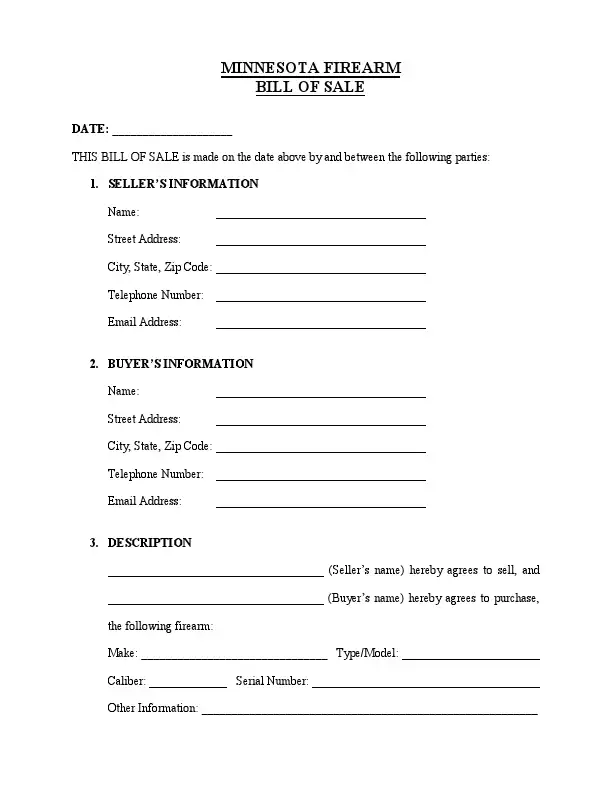

Minnesota bill of sale for a firearm serves as a record of the information about the seller and buyer and legal proof of the ownership change. In Minnesota, purchasing a firearm is possible for those with a permit to purchase or carry a firearm. These documents are issued by local sheriff’s offices. However, some categories of people are prohibited from buying a firearm in the state.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

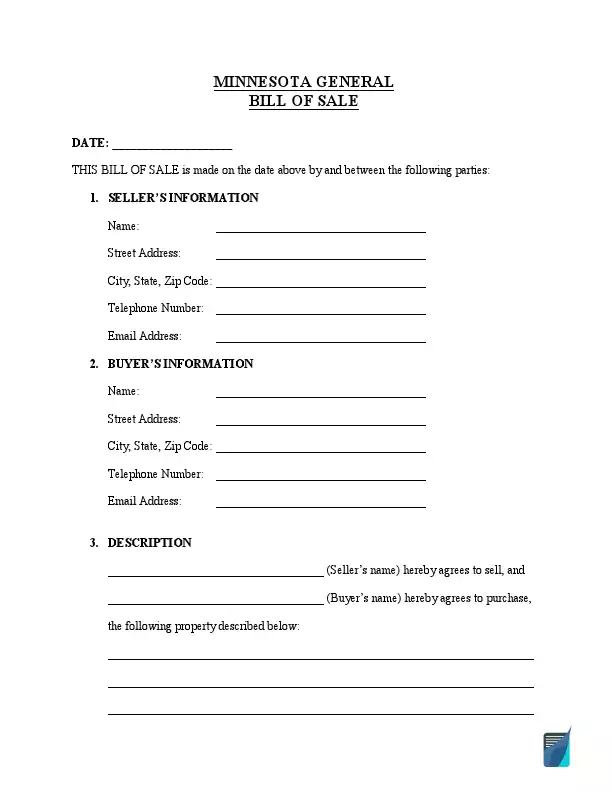

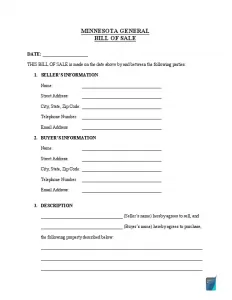

A general bill of sale in Minnesota can be used in various situations, such as purchasing furniture, livestock, machinery, art pieces, motorcycles, bicycles, and trailers. General bill of sale forms are also used to keep personal records of transactions.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

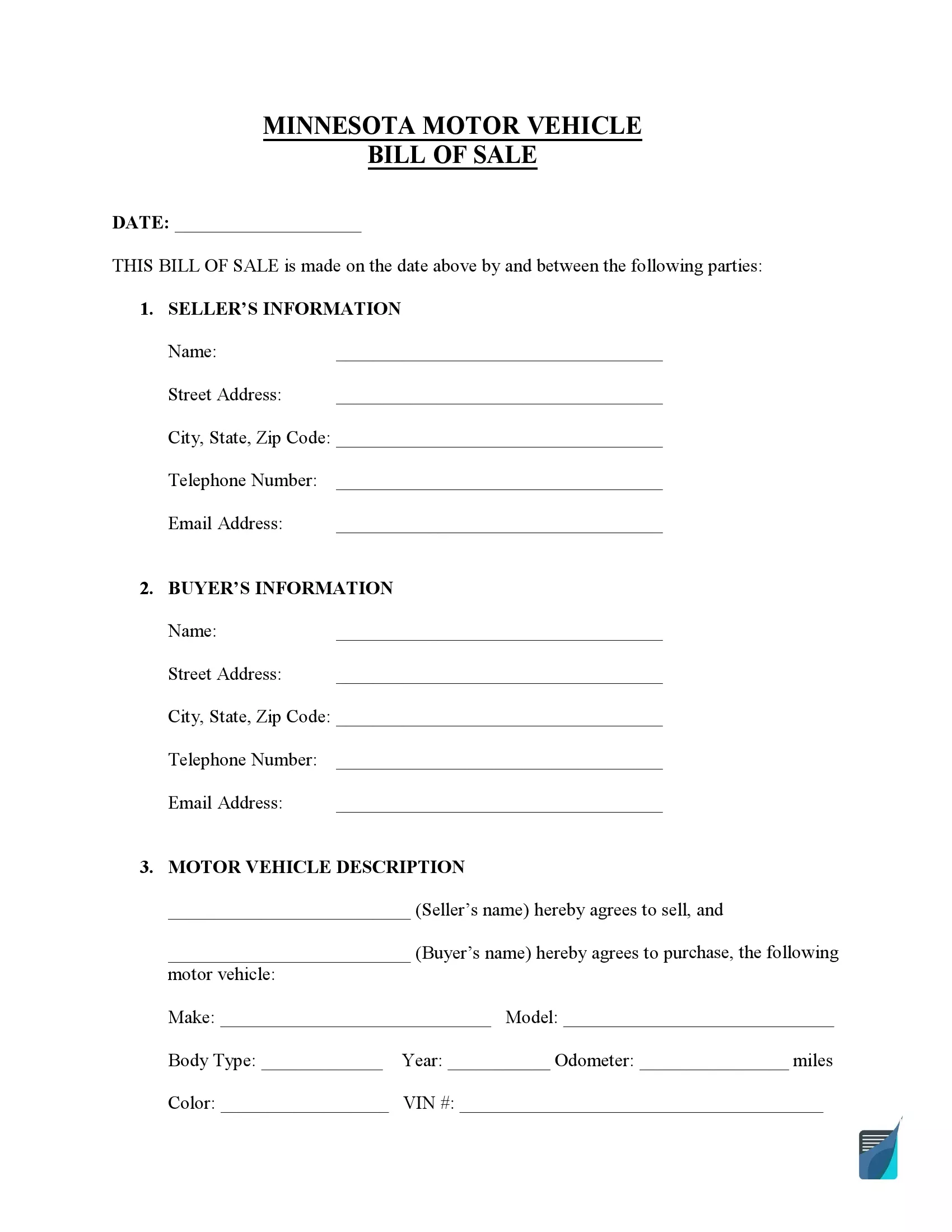

How to Write a Minnesota Vehicle Bill of Sale

There is no state-specific Minnesota bill of sale forms offered by the DMV, so that you can use standardized templates offered online. You’re welcome to use our vehicle bill of sale form for Minnesota, formed and verified by the dedicated lawyer. Remember to write down all the required details about the parties and the vehicle. You will have to provide an odometer disclosure statement as well. To minimize any risks of mistakes or to smoothly finish this process, follow these steps:

Step 1: Date of Document

The Minnesota bill of sale starts with the field indicating the date when this form is completed. From this day, you will have a limited term for applying for registration.

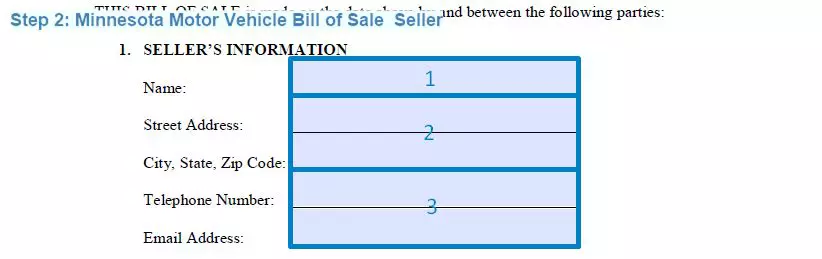

Step 2: Seller’s Information

In the next section, you need to fill out the gaps to identify who the seller is. It is required to include their full legal name, residence address, and contact details such as phone number and email address.

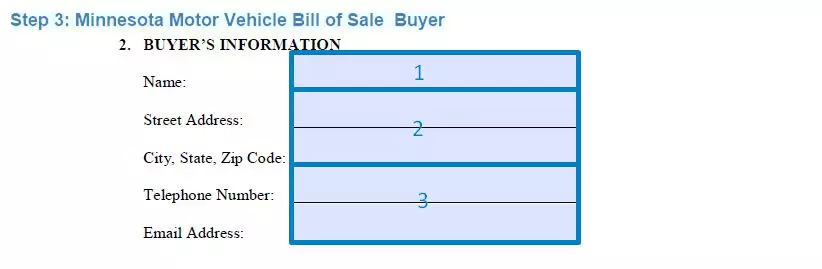

Step 3: Buyer’s Information

Similar to the previous section, you need to verify the information regarding the buyer. Type in the buyer’s full name, physical address, and phone number with an email address in the corresponding fields.

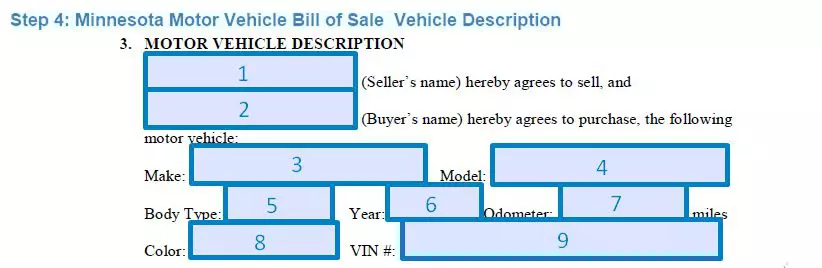

Step 4: Vehicle Description

Next, you need to fully describe the vehicle to which ownership will be transferred after this transaction. It’s vital to provide the most precise and accurate information regarding it to help verify which vehicle is sold. The required description of the vehicle is as follows:

- Make

- Model

- Body type

- Year

- Odometer reading

- Color

- VIN

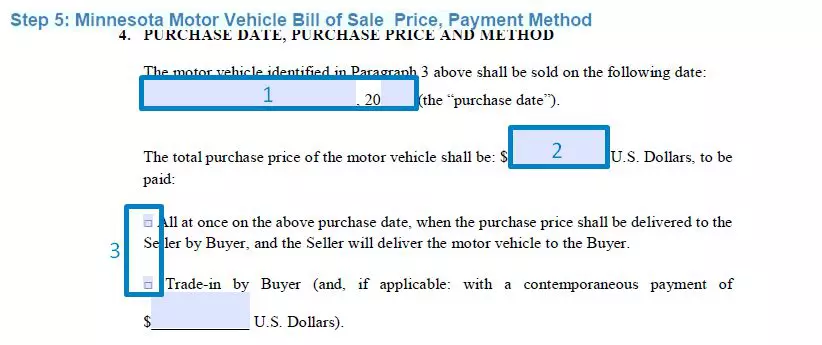

Step 5: Purchase Price, Date, and Method

In the next section, you need to indicate the date of the purchase when the vehicle is sold. This date can differ from when the Minnesota bill of sale is conducted, and in this case, the deadlines for vehicle registration will be counted from the date indicated here.

Then, you must provide the whole sum paid for the vehicle. You must also describe the transaction’s agreed-upon payment method between the parties. There are several options for transferring vehicle ownership, so you need to select the one that corresponds to your case.

- All at once. If you select this option, the buyer must pay the total price on the day of the purchase mentioned above.

- Trade-in. If the vehicle is sold through the trade-in, the buyer exchanges the old vehicle to purchase the new one. In this case, it’s mandatory to put in the buyer’s vehicle information, including its make, model, year, color, VIN, and odometer disclosure.

If the buyer needs to deliver contemporaneous payment, its amount must also be provided in the corresponding field.

- Separate deposit and balance dates. In this way, the buyer pays the deposit amount on one date and the last amount on the other day that the parties agreed on.

- Gift. If the vehicle is transferred as a gift, there is no obligation to pay on the buyer’s side.

It is also essential to indicate the method the transaction is performed. Clarify if the buyer will pay in cash, by check, cashier’s check, or by money order by selecting the corresponding field. Next, check the box below to see if the taxes are included in the total price or paid separately.

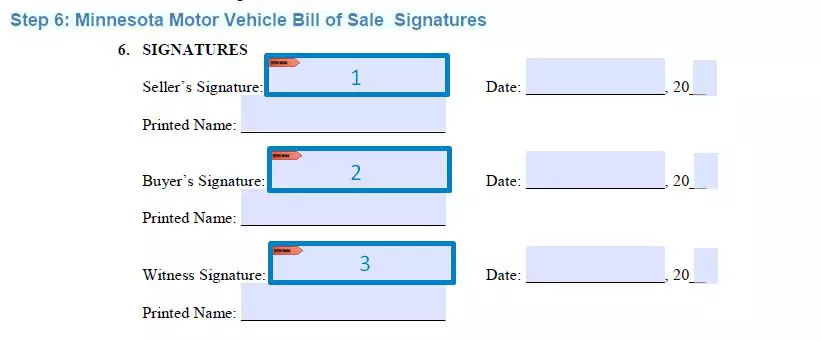

Step 6: Signatures

To verify this Minnesota bill of sale, both parties must sign this document in the presence of one witness. Write down the full name and the date when the document is signed after the signature.

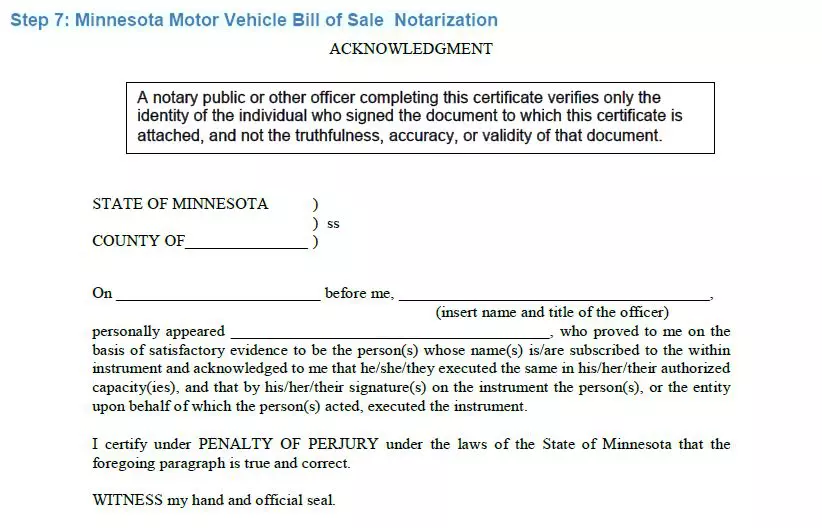

Step 7: Notarization

Lastly, the Minnesota bill of sale must be notarized. The last section is filled and signed by the notary public. Note that the notary public only verifies the identity of the parties but not the actuality of the information indicated in the form.

Registering a Motor Vehicle in Minnesota

To get a title in Minnesota, you must undergo the vehicle registration process at DVS Deputy Registrar’s office office in person or through the mail. For a renewal, you can submit your application to Minnesota DMV online.

After you have purchased the vehicle, you usually have up to 60 days to apply for registration within the state. The registration that has been active for a year needs to be renewed.

To register a vehicle, you need to submit the following registration forms:

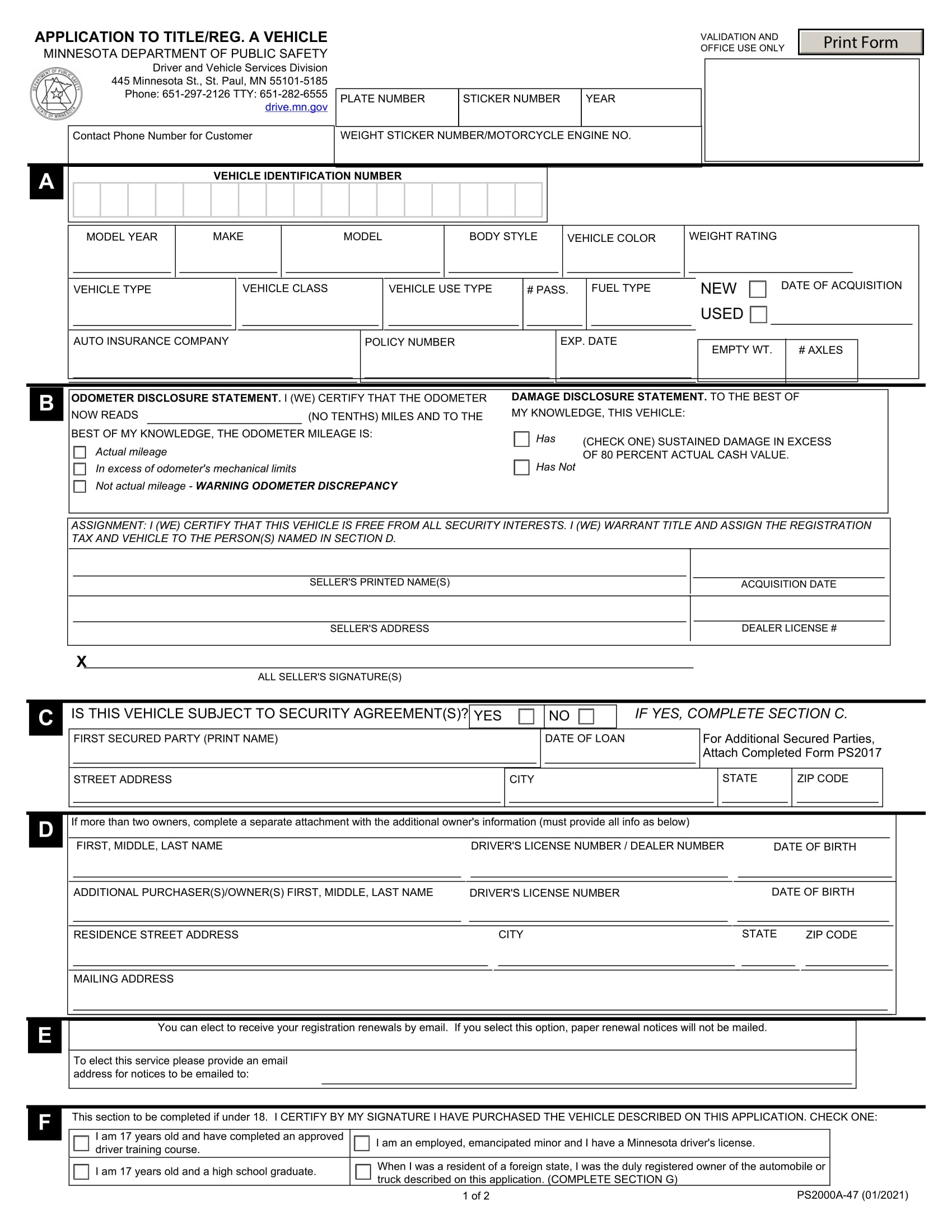

- Application to Title and Register a Motor Vehicle (PS2000A-47)

- Odometer Disclosure Statement (federal form)

- Bill of sale form

- A check to prove that registration fees are paid

- Insurance document with a minimum of $30,000 for the person’s bodily injury and $10,000 for possible property damage

- Driver’s license

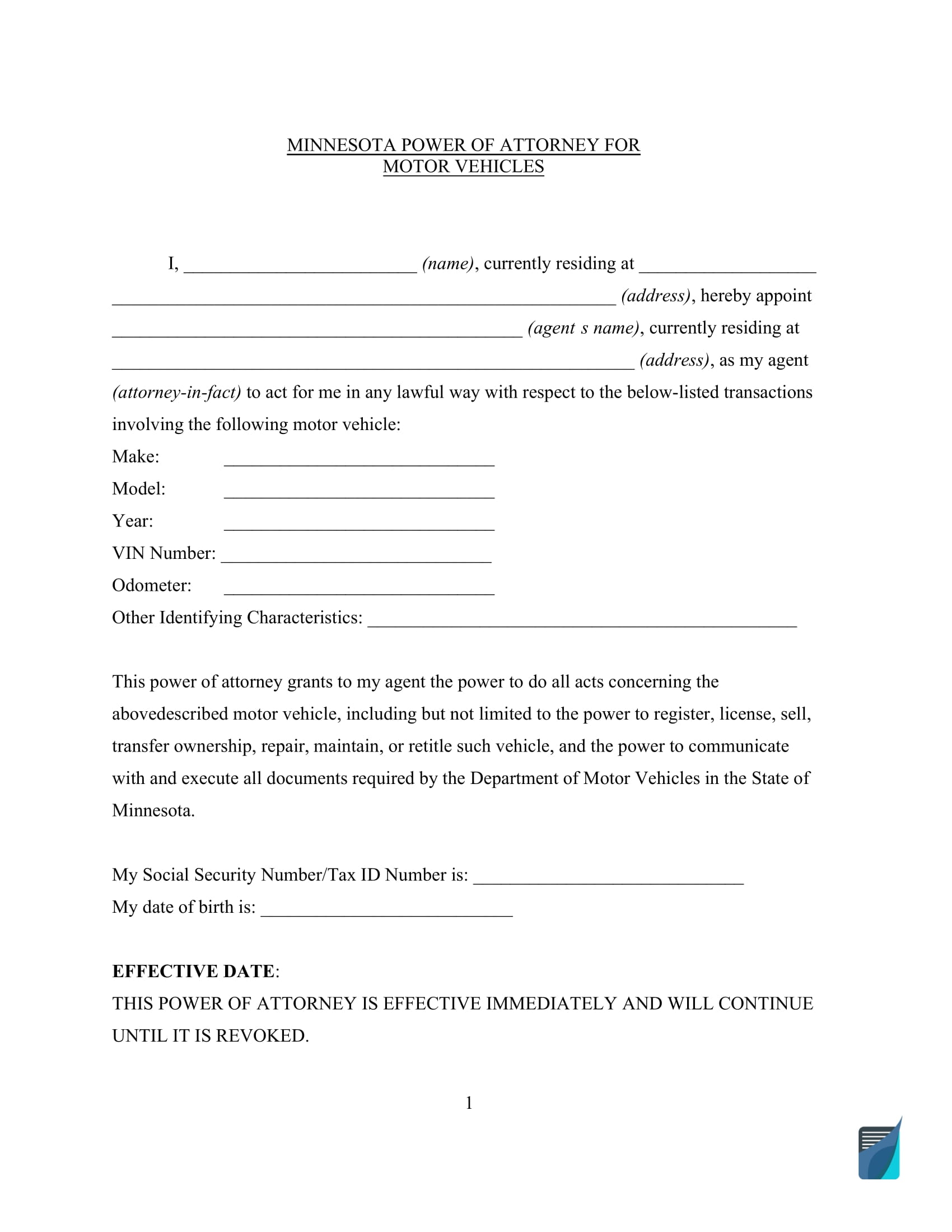

- Additional documents may be required for specific cases, such as an Affidavit to Correct the Ownership Record of a Motor Vehicle (PS2025) or Power of Attorney if a third party submits the documents on your behalf

You will be required to pay the fees for registration or renewal and the registration tax. The fees may include the filing fee ($7), wheeling tax ($10-20) in certain counties, and surcharges.

Relevant Official Forms

Use a motor vehicle power of attorney if you plan to authorize someone else to address the DMV on your behalf.

Use a Minnesota Uniform Firearm Application Permit to Carry a Pistol to get a permit to carry a weapon in Minnesota. This application must be submitted in person.

Short Minnesota Bill of Sale Video Guide

Other Minnesota Forms