Montana Bill of Sale Form

Montana bill of sale is designed to record the ownership change of an item between a buyer and seller and keep personal records of the transaction.

Although bill of sale forms may be considered unwanted paperwork, buyers and sellers will surely gain from it. It’s not required to have a bill of sale for private sales, but getting one might guarantee the safety of the sale and avert any legal concerns from the transaction.

To avoid queries regarding the legitimacy of a Montana bill of sale, use our free printable template when you plan to sell or buy an item. We’ve also collected all the details to help you become more aware of the bill of sale role and purpose and relieve your worries.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Montana Vehicle Bill of Sale Form |

| Other Names | Montana Car Bill of Sale, Montana Automobile Bill of Sale |

| DMV | Montana Vehicle Division |

| Vehicle Registration Fee | $28-217 |

| Bill of Sale Required? | Yes |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 37 |

Montana Bill of Sale Forms by Type

There are various Montana bill of sale forms designed for specific occasions. Pertaining to the sale type, you must create and sign the suitable Montana bill of sale form and authorize it according to your state requirements. You are free to choose the document among our printable forms. Remember that some of them require notarization.

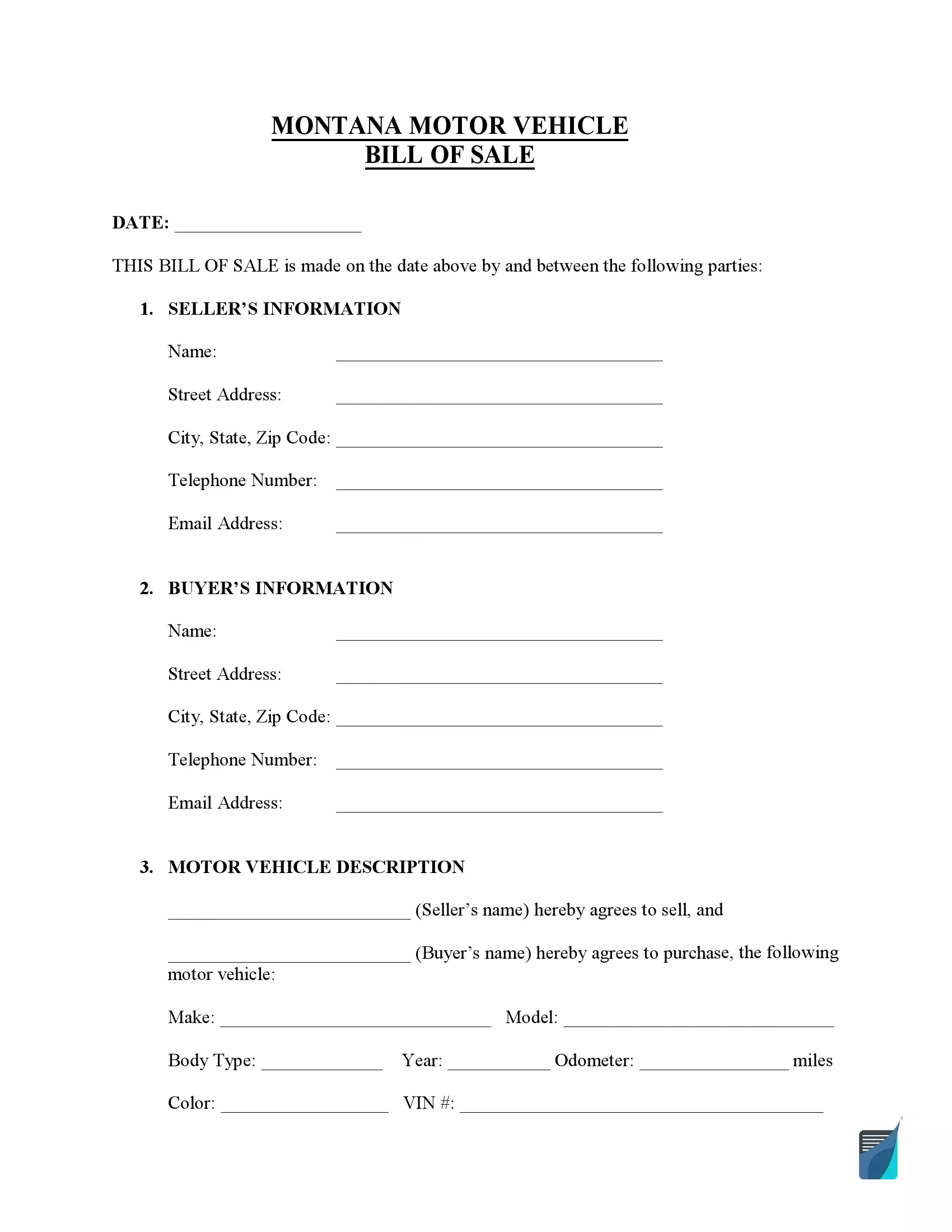

Montana bill of sale for a motor vehicle is a document operating like a receipt of the deal between sellers and buyers. It’s similar to a vehicle bill of sale and includes the boat’s make, model, year, and identification number (HIN). A boat bill of sale is an essential part of the boat registration process and should be provided to the Motor Vehicle Division with the boat’s title.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Required |

| Download | PDF Template |

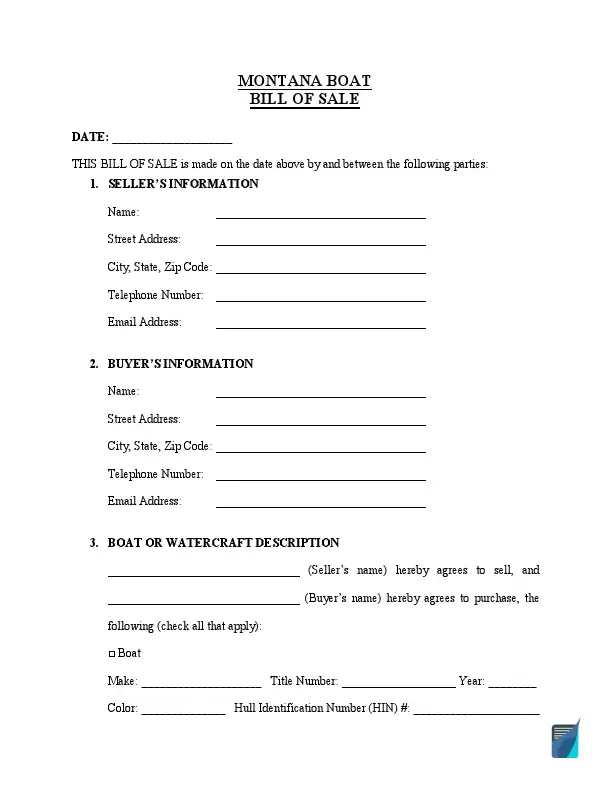

Montana boat bill of sale is a document operating like a receipt of the deal between sellers and buyers. It’s similar to a vehicle bill of sale and includes the boat’s make, model, year, and identification number (HIN). A boat bill of sale is an essential part of the boat registration process and should be provided to the Motor Vehicle Division together with the boat’s title.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

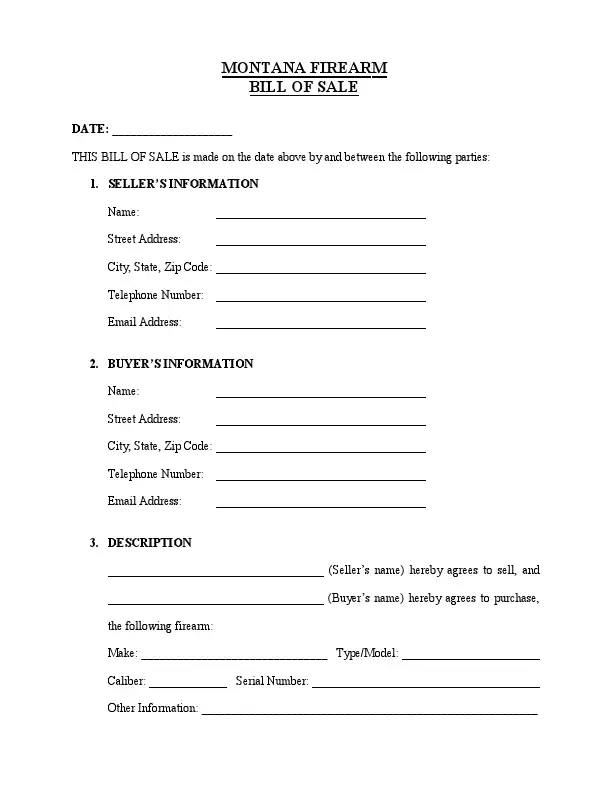

Montana bill of sale for a firearm makes it possible to keep records whenever a weapon changes ownership in Montana. A criminal history check is usually not required before selling a gun in Montana, but it depends on specific circumstances. The details you must indicate on the Montana bill of sale include your gun’s model, caliber, and make. The price and identification number of the gun with the parties’ contact information (DLNs included) are also required.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

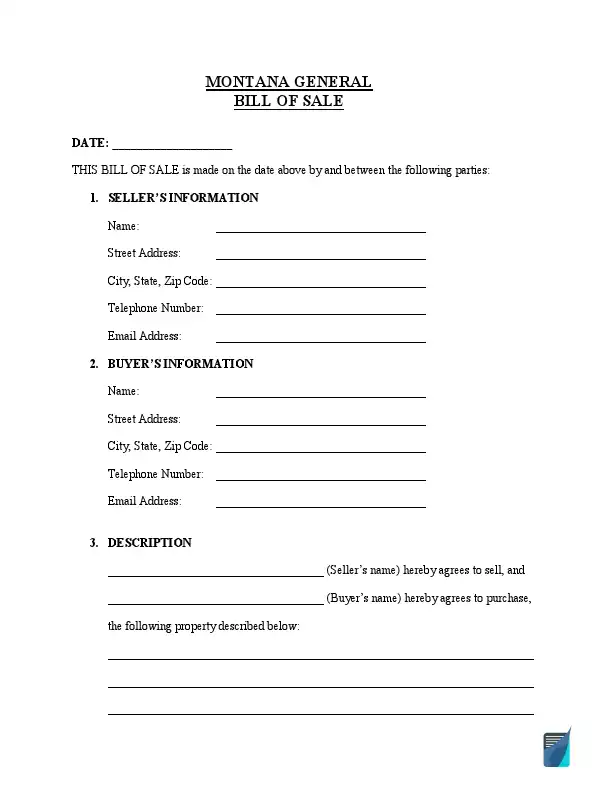

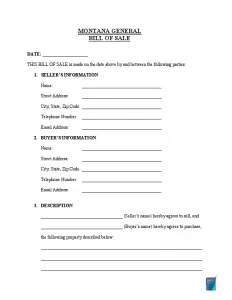

Montana general bill of sale is helpful when no particular bill of sale form is applicable. This form contains basic terms related to different transactions, including the contacts of both the buyer and seller, item description, purchase amount, signatures, and date of signing. Consider choosing general bills of sale for supplies and tack for livestock, machinery, and vehicle accessories.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

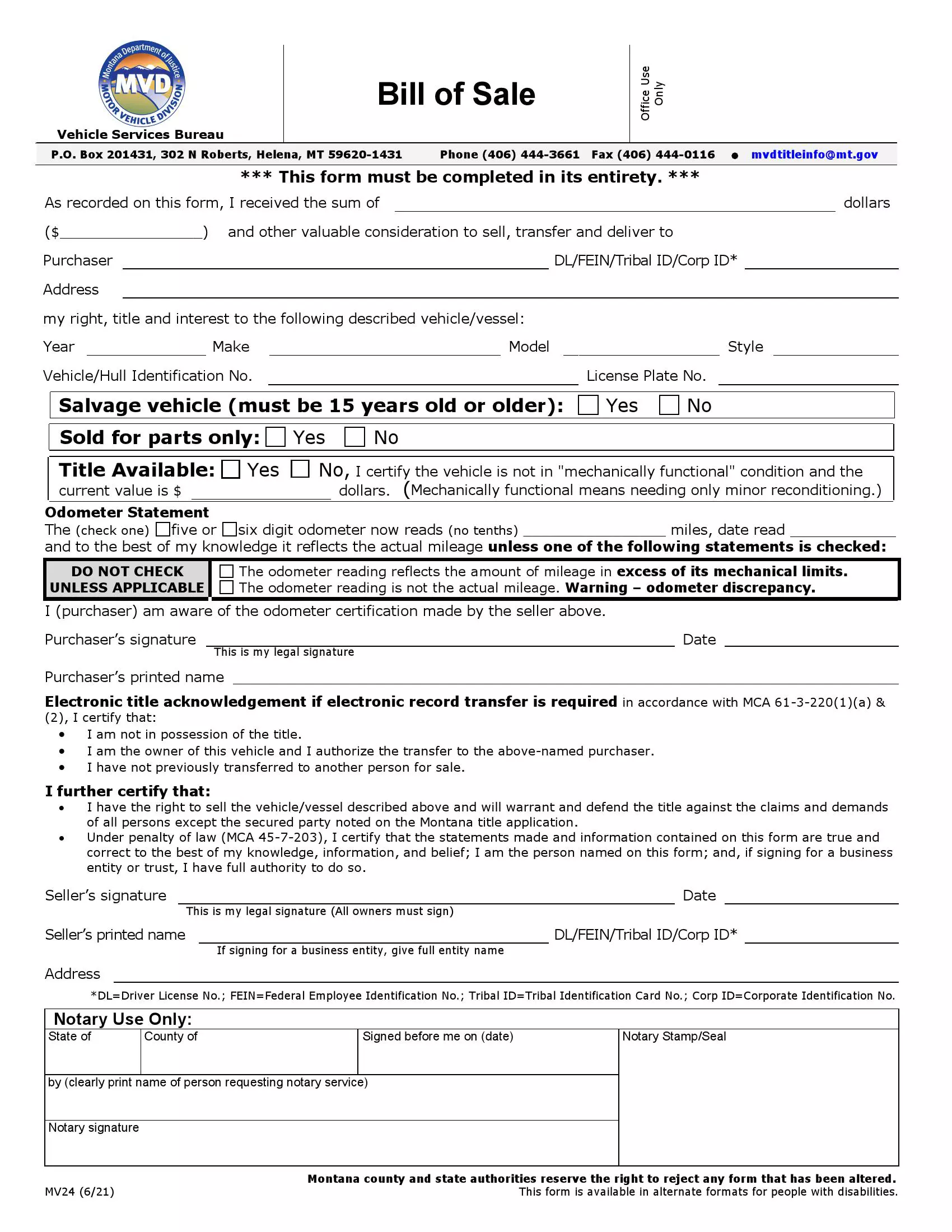

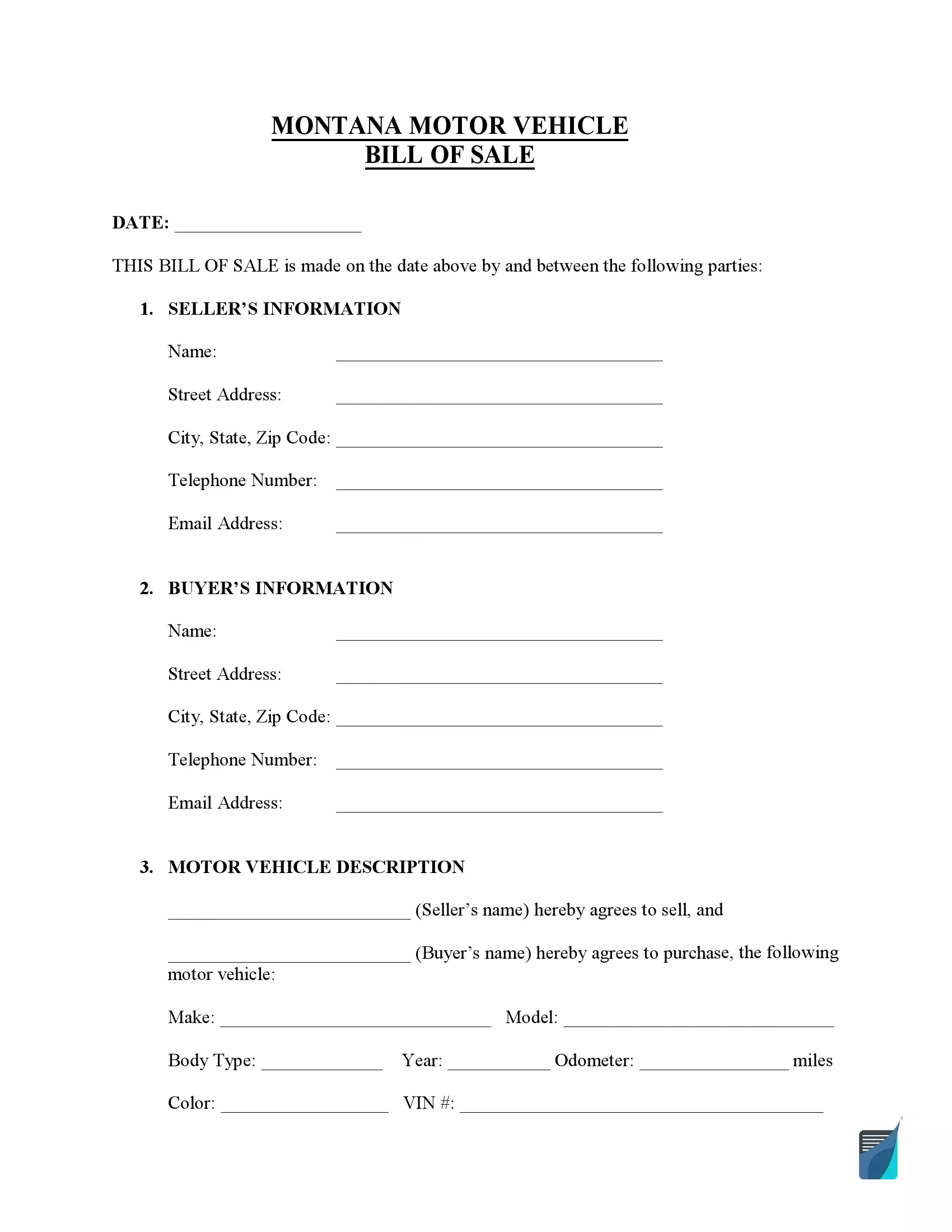

How to Write a MT Vehicle Bill of Sale

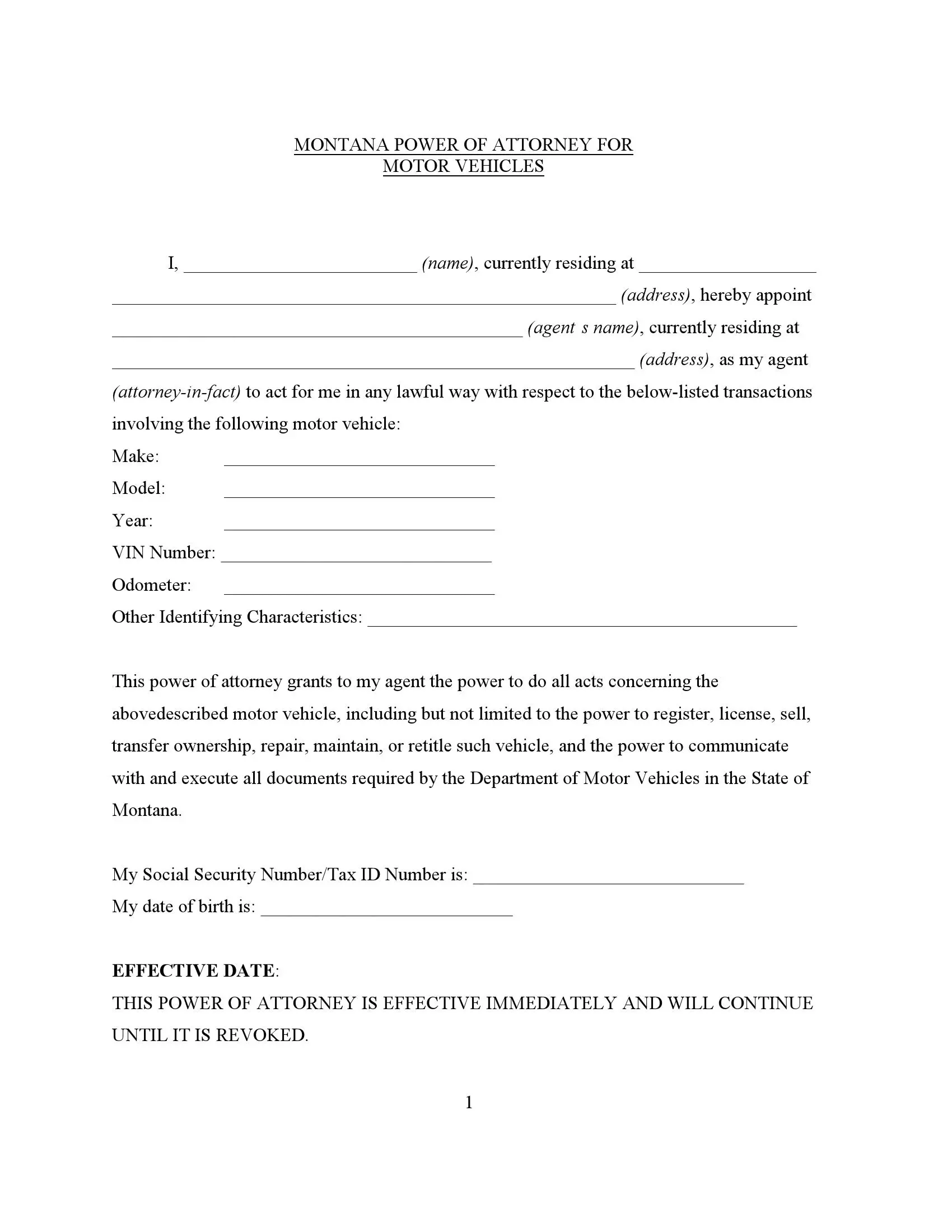

Form MV-24 is the official bill of sale form the Motor Vehicle Division provides to sell and purchase a motor vehicle in Montana. It should be notarized and submitted along with other documentation to register the newly purchased vehicle. Apart from the bill of sale template, buyers will need to collect the title, which includes the vehicle registration number (VIN) and signatures of both parties on the back.

For secure purchases and title transfers, the state provides the official Montana bill of sale template private individuals may use during title ownership changes. Make the following steps to fill out the form with no errors.

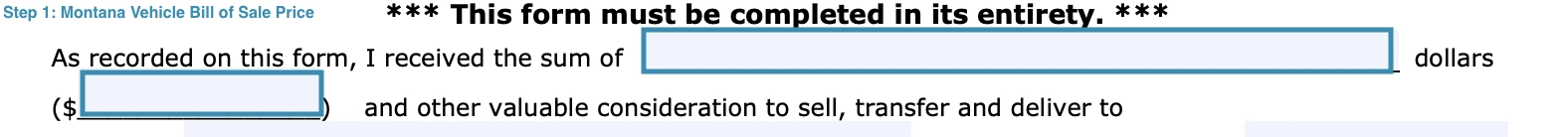

Step 1.

Clarify the sum paid for the vehicle’s transfer.

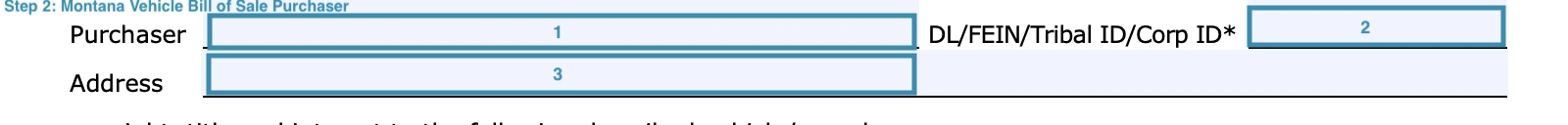

Step 2.

Indicate who the purchaser is. The required information to be listed is:

- Purchaser’s Name

- DL, FEIN, Tribal ID, or Corp ID

- Address: Street, City, State, and Zip Code

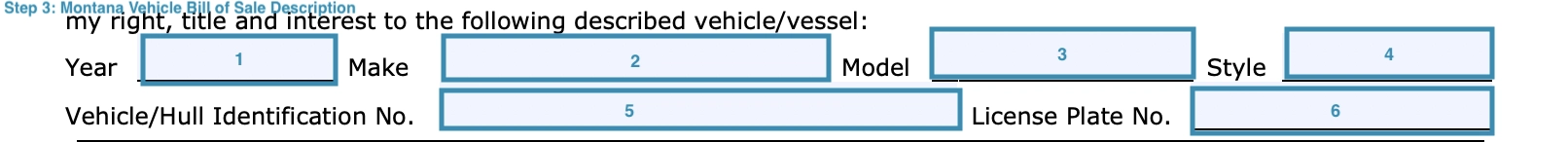

Step 3.

Describe the vehicle or vessel. The seller needs to provide complete information about the vehicle:

- Year of Production

- Make of Vehicle

- Model

- Style

- Vehicle Identification Number (VIN)

- License Plate Number

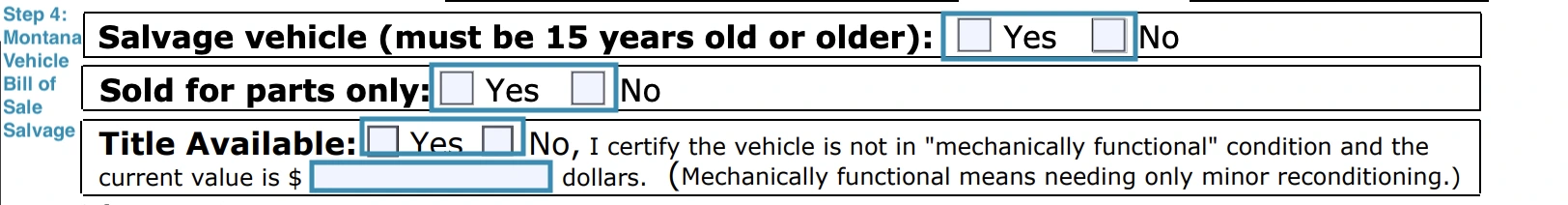

Step 4.

If the vehicle is 15 years old or older and is a salvage vehicle, you need to indicate it. If it is no longer possible to operate the vehicle and it’s sold for the parts only, specify if it still has a title and includes the current value in dollars.

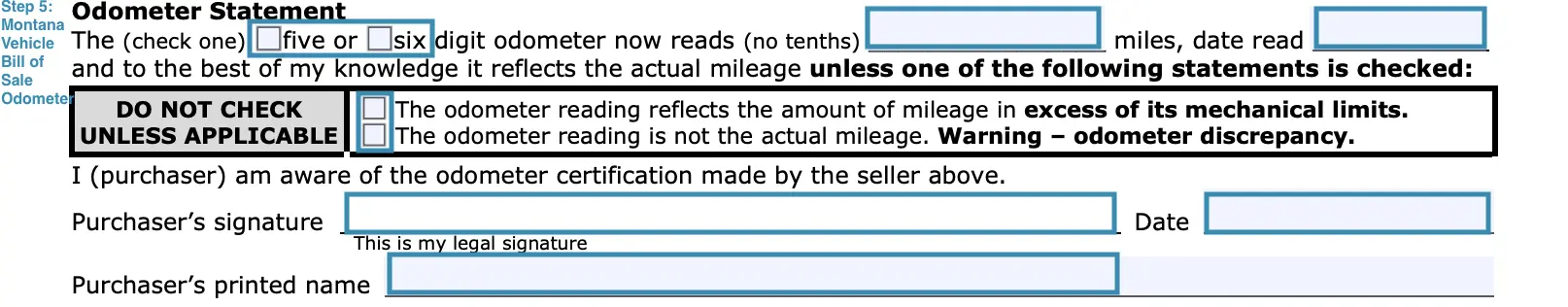

Step 5.

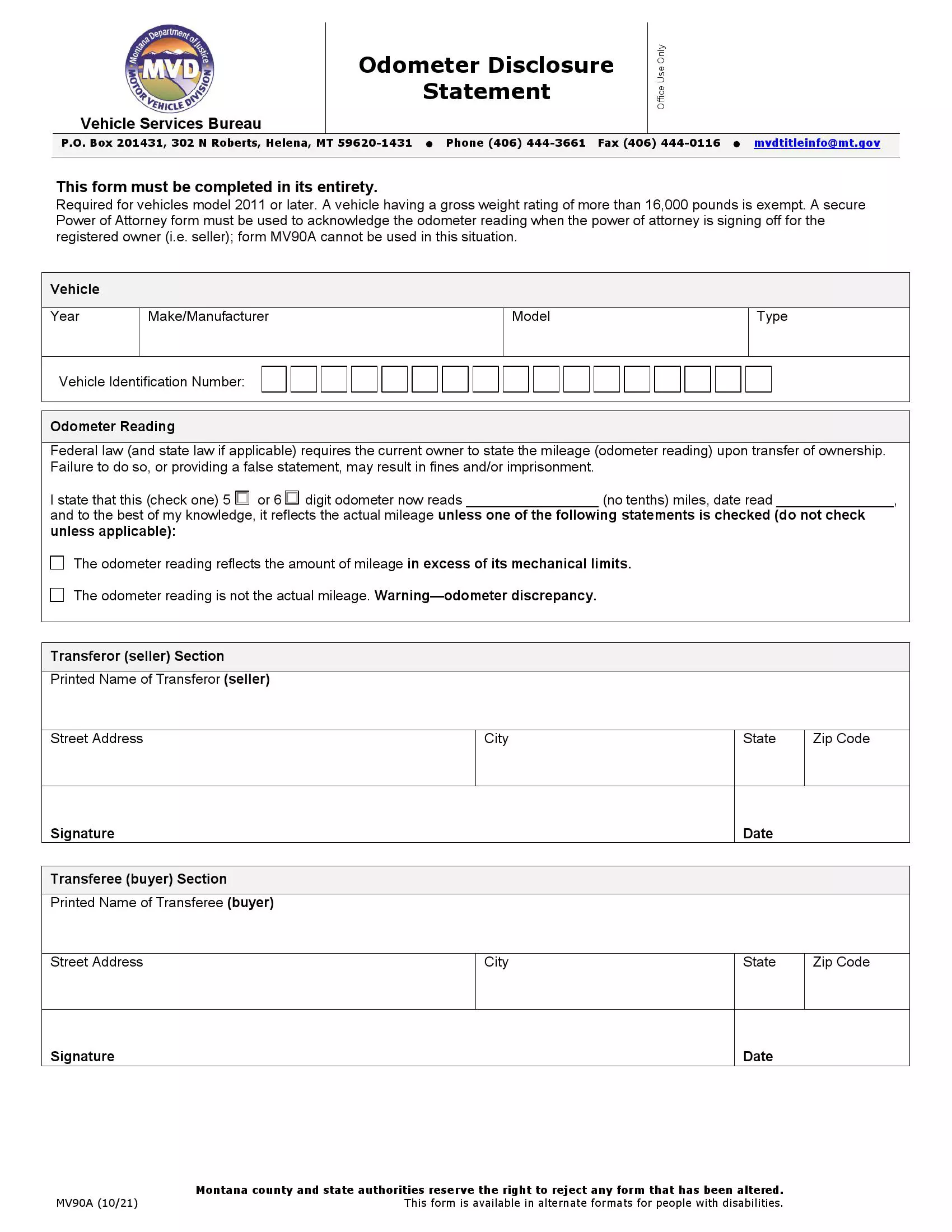

The next step is to disclose the odometer reading. You’ll need to provide the latest five or six digits of mileage and the reading date. If the numbers do not reflect the actual mileage, select the reason for it. Then, the purchaser must sign this section to confirm that they acknowledge the actual state of the vehicle.

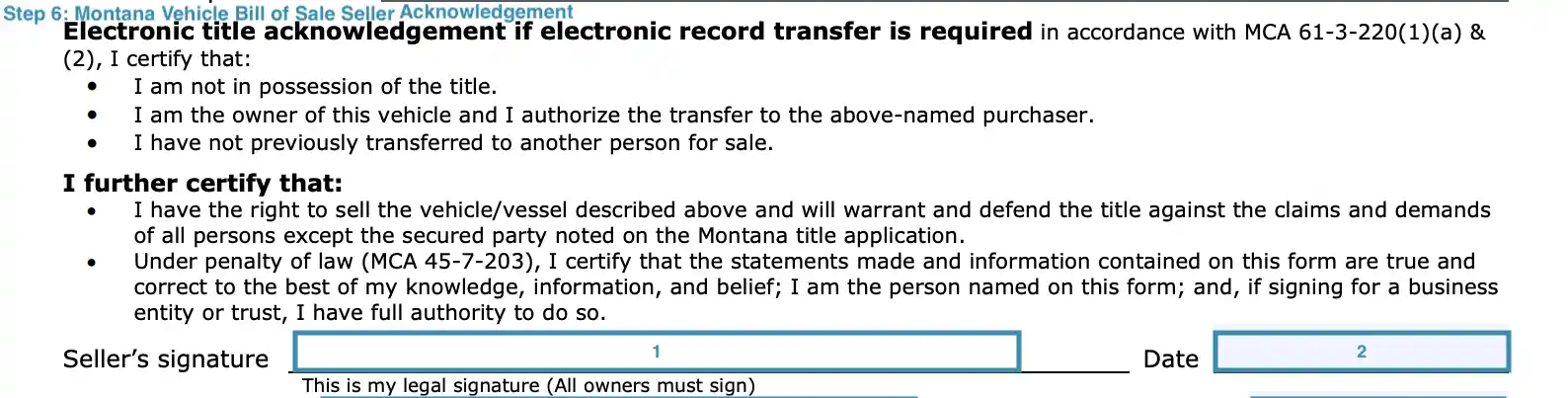

Step 6.

The acknowledgment part is required to certify that the seller has full right to sell the vehicle and that the information provided in the document is true and correct. The seller leaves a signature and date of signature under the statement to do that.

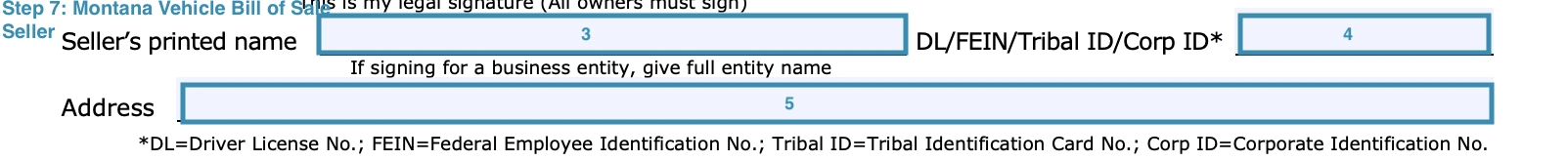

Step 7.

Provide the information about the seller, including as follows:

- Seller’s Printed Name

- DL, FEIN, Tribal ID, or Corp ID Number

- Address: Street, City, State, and Zip Code

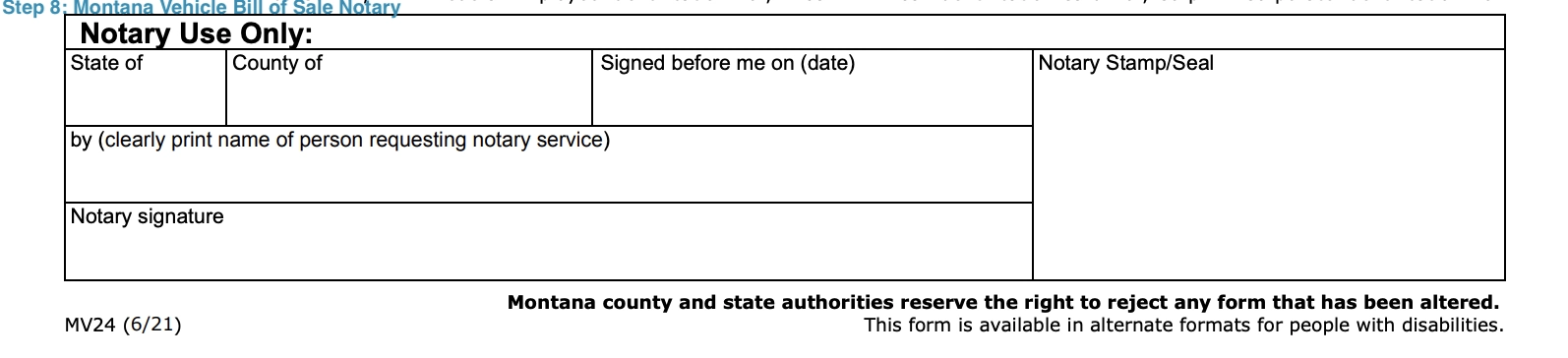

Step 8.

You will have to notarize the document when selling or purchasing motor vehicles. A notary public fills out this section.

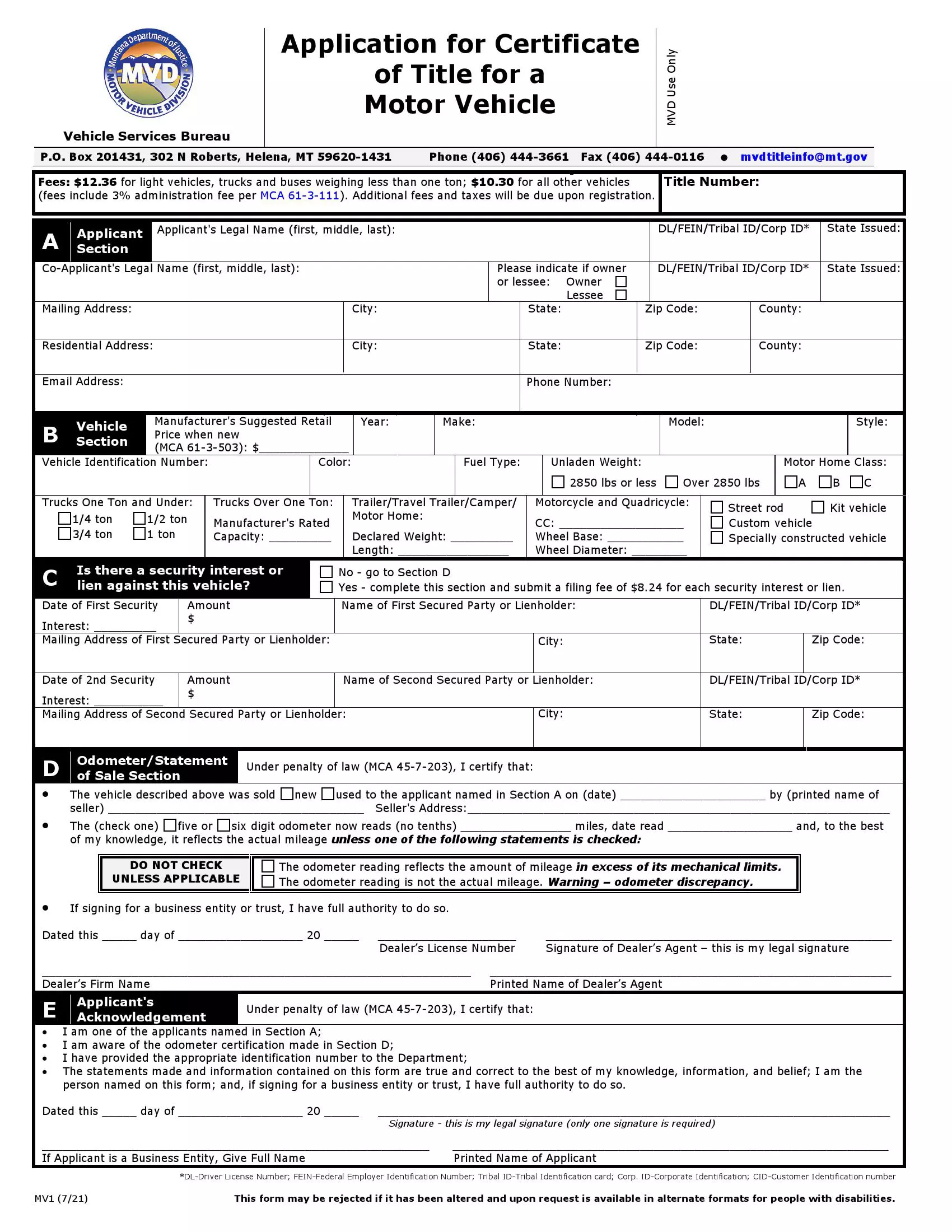

Registering a Vehicle in Montana

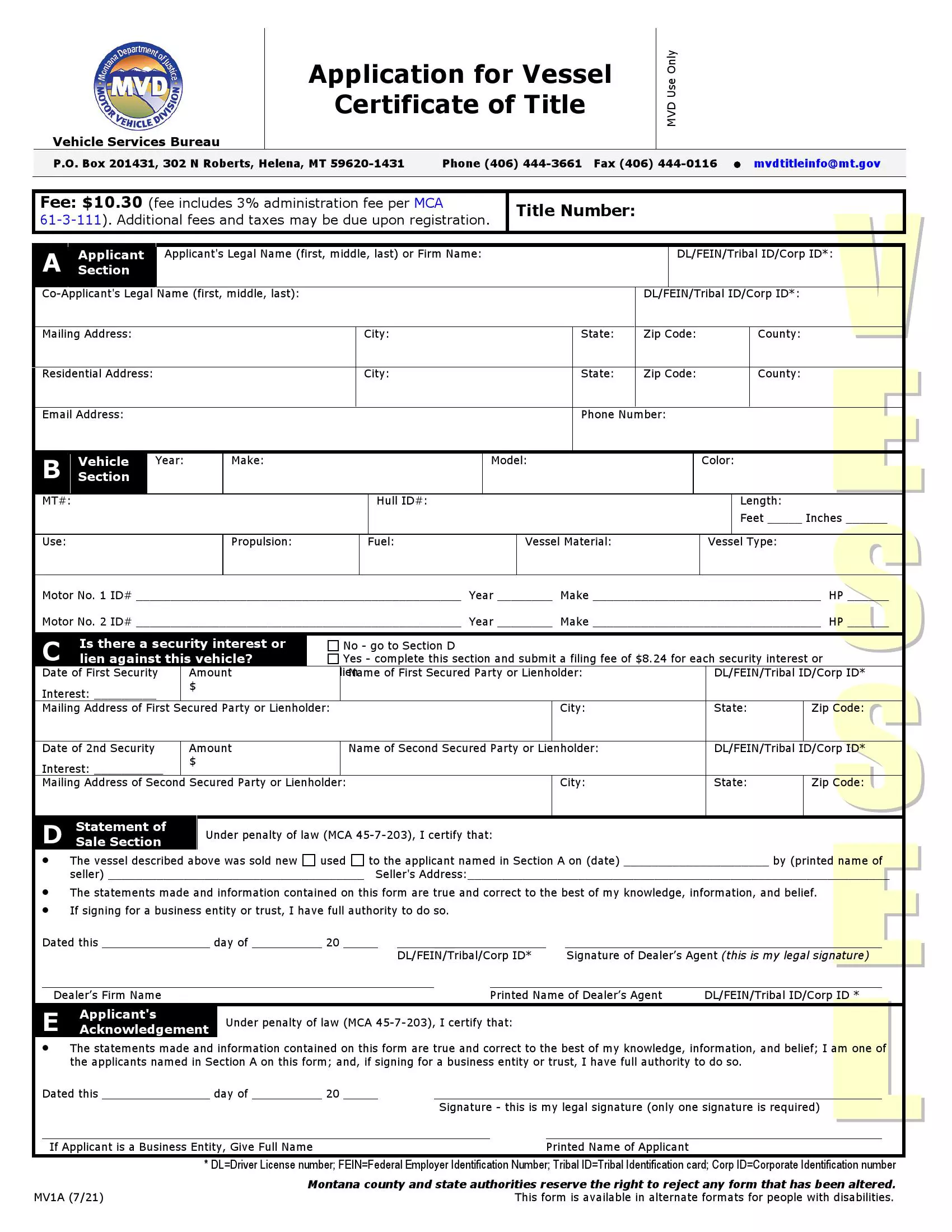

At the time of purchase, buyers and sellers should be aware that an official Odometer Disclosure Statement (MV90-A) is necessary for the legal motor vehicle title transfer. This paper, along with other documentation and fees, is required at the time of vehicle registration. The full document package for the initiation of registration includes:

- Application for certificate of title

- Certificate of title from the seller (including signatures and odometer details at the time of purchase)

- Vehicle bill of sale form (notarized)

- Buyer’s proof of liability insurance

- Driver’s license

- Odometer Disclosure Statement (Form MV90-A)

Fees vary by the vehicle type, age, weight, and the length of registration time. Passenger cars and pickups, along with other light motor vehicles, are subject to registration rates based on their age, where a vehicle 0-4 years of age will cost $217. Fees for the vehicles aged 5 to 10 years drop to $87, and for vehicles older than 11 years, buyers will pay $28. All registration fees are subject to a 3% administration fee that is not included in the above amounts. Montana does not have a state sales tax but has a personal property tax with a rate of 0.16%.

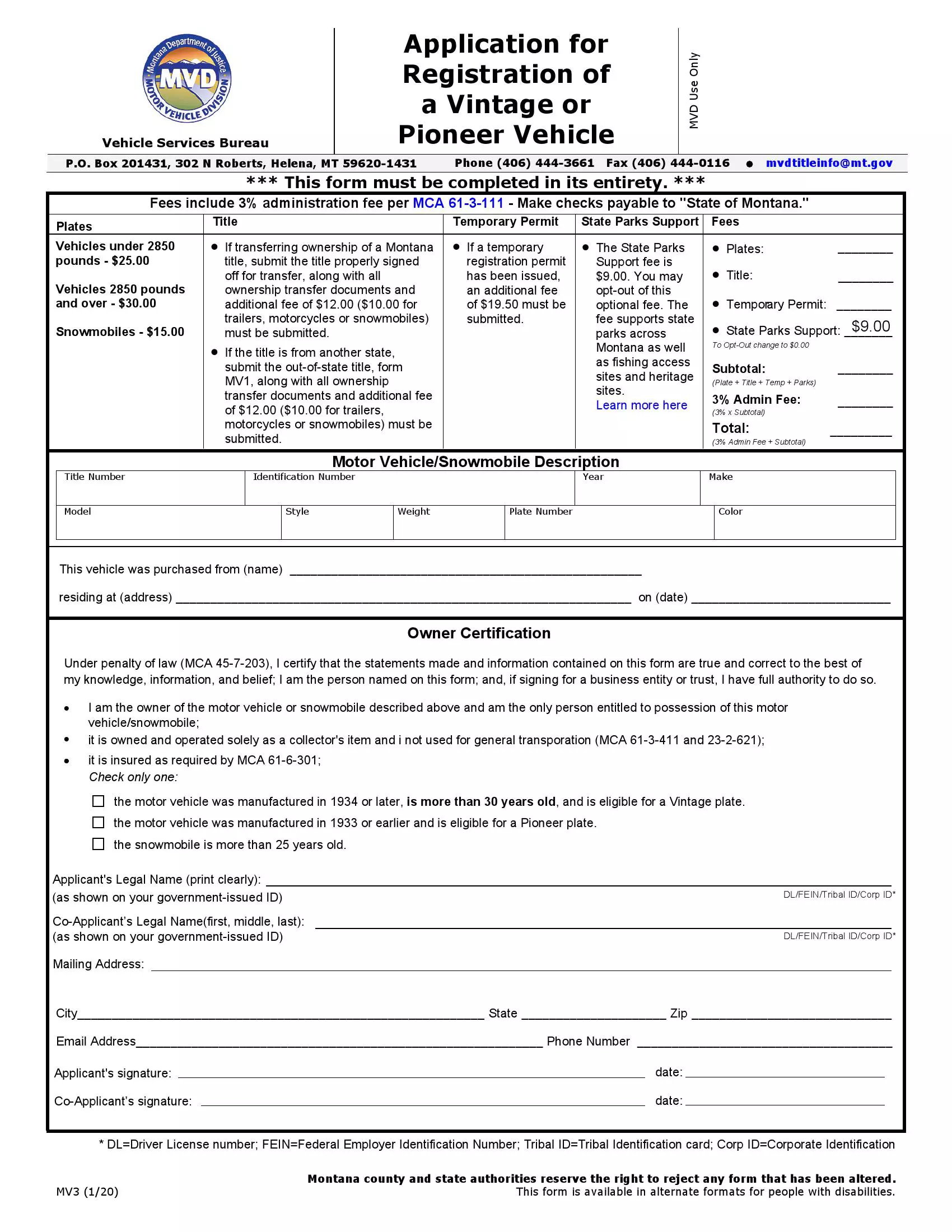

Fees for standard license plates are $10.30 for newly-issued plates that have the design from January 2010. Personalized plates can be purchased for an additional fee of $25 after filling out the Application for Personalized License Plates (MV8). Antique plates are available for motor vehicles more than 30 years of age, and Application for Registration of a Vintage or Pioneer Vehicle (form MV3) must be filled out and accepted for completion.

Relevant Official Forms

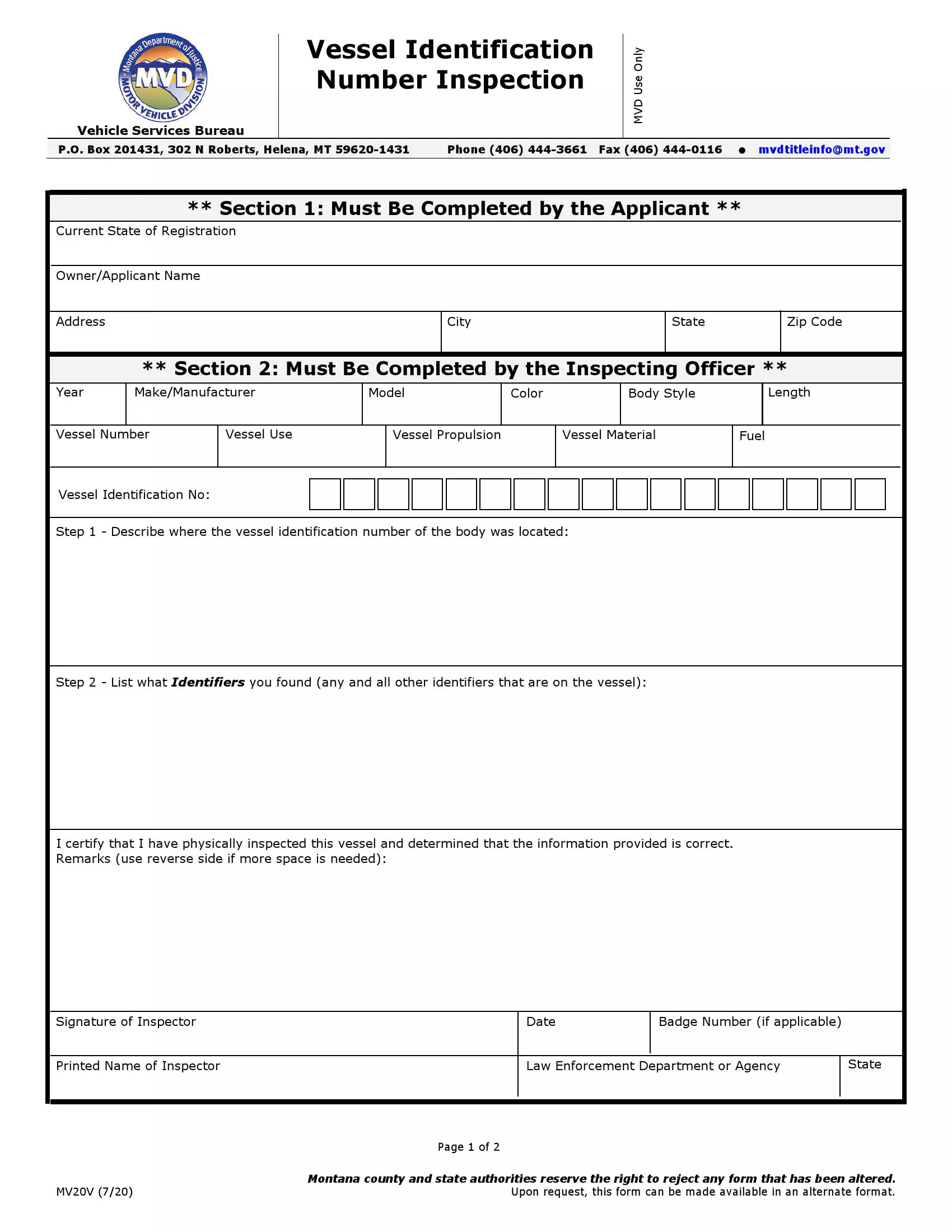

Vessel Identification Number Inspection is used to verify the boat identification number.

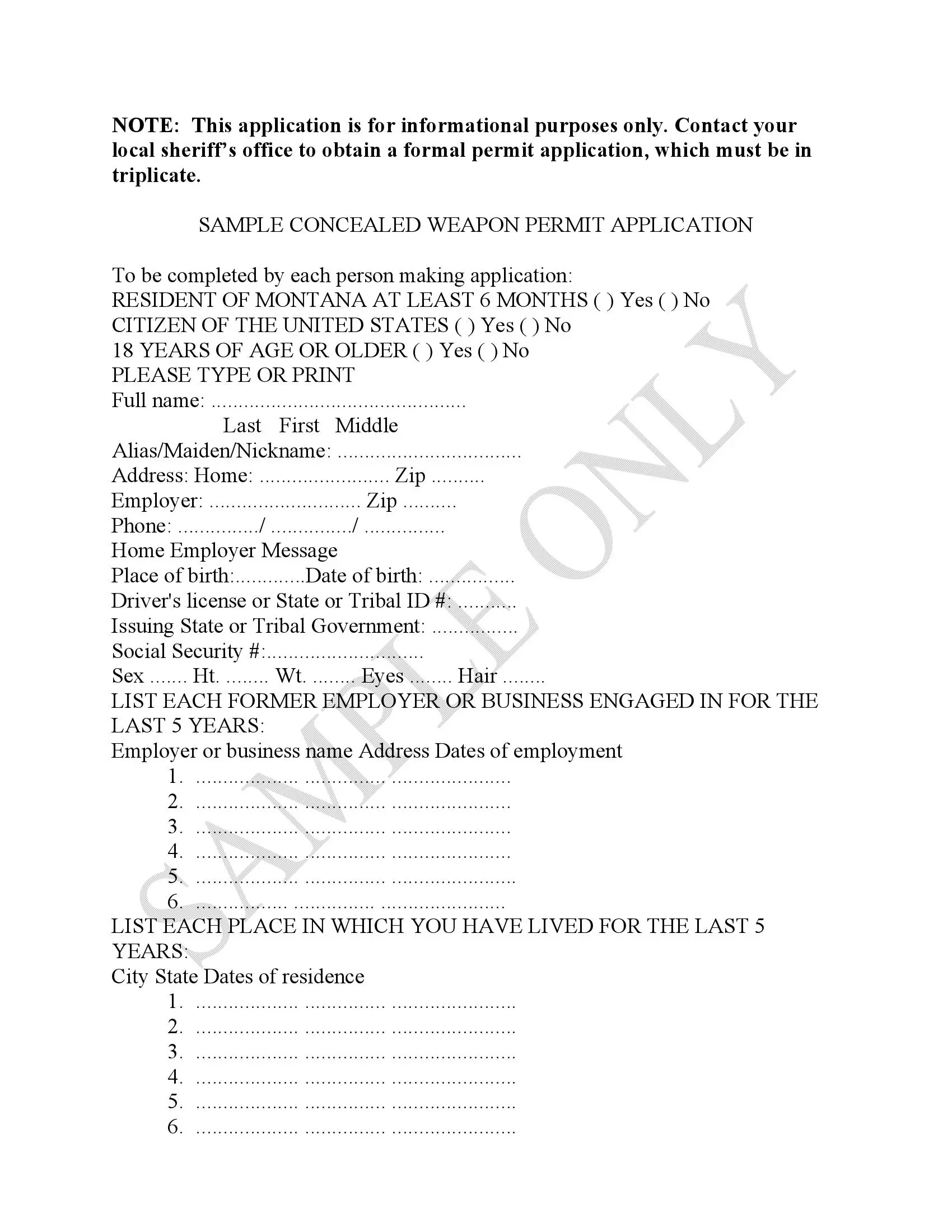

Use this sample to prepare yourself for a formal permit application, which you can obtain in your local sheriff’s office.

Short Montana Bill of Sale Video Guide