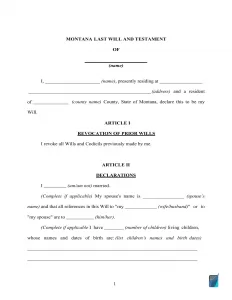

Montana Last Will and Testament Form

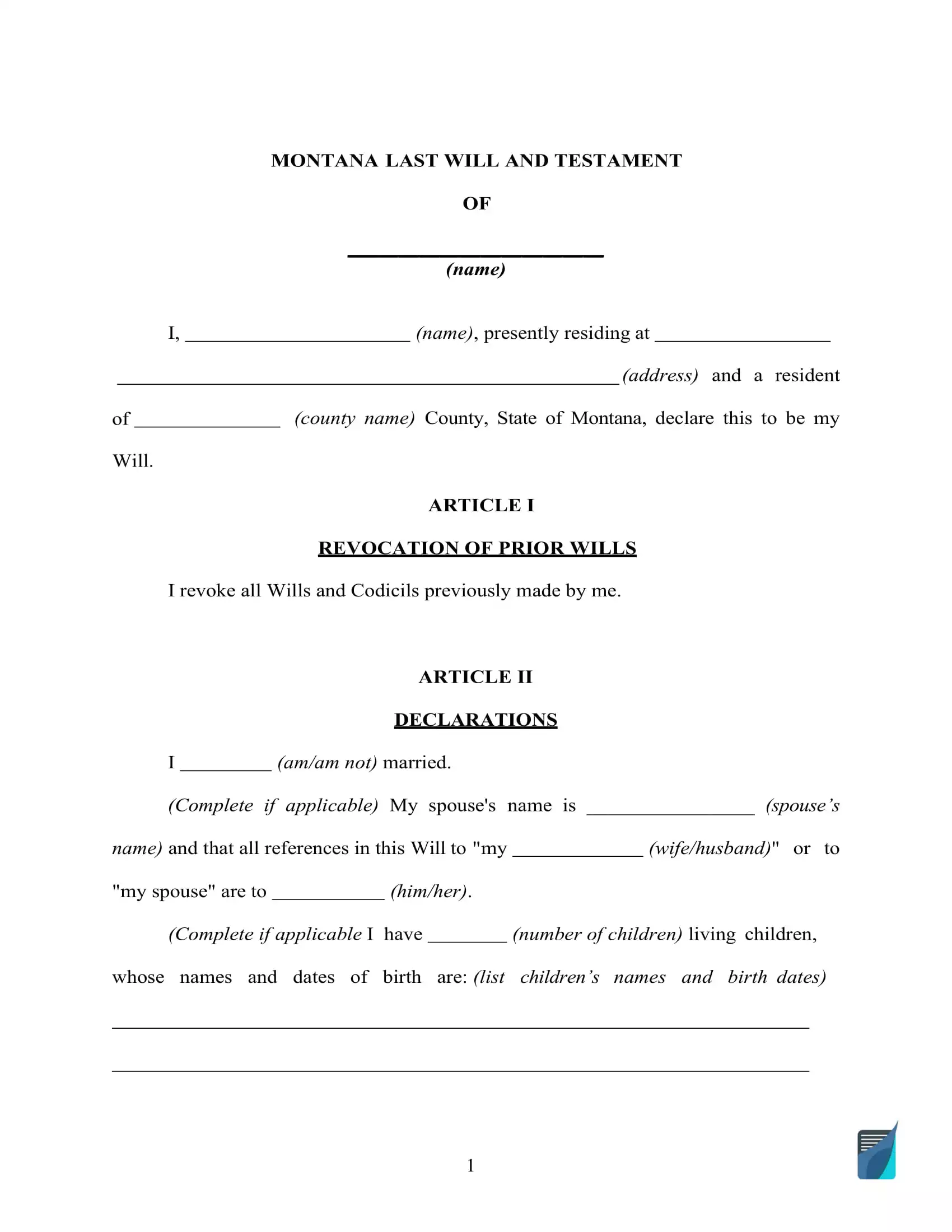

A Montana will is a document containing the final wishes of its creator (the testator) and determining exactly how and by whom their assets will be used in the event of their death. The document must be signed by two adult witnesses to be valid in this state with an option to be notarized and made self-proving for faster probate.

If you’re searching for a fillable Montana will template, you can find one below in PDF and DOC, as well as some recommendations regarding last will creation and requirements.

Montana Last Will Laws and Requirements

| Requirements | State laws | |

| Statutes | Title 72 – Estates, Trusts, and Fiduciary Relationships; Chapter 2 – Intestacy, Wills, and Donative Transfers | |

| Definitions | 72-1-103. General definitions | |

| Signing requirement | Two witnesses | 72-2-522. Execution — witnessed wills — holographic wills |

| Age of testator | 18 or older | 72-2-521. Who may make a will |

| Age of witnesses | 18 or older | 72-2-525. Who may witness |

| Self-proving wills | Allowed | 72-2-524. Self-proved will |

| Handwritten wills | Recognized if meeting certain conditions | 72-2-522. Execution — witnessed wills — holographic wills |

| Oral wills | Not recognized | |

| Holographic wills | Recognized if meeting certain conditions | |

| Depositing a will | Possible with the Montana Clerk of District Court’s Office (No fee) | 72-2-535. Deposit of will with court in testator’s lifetime |

How to Make a Montana Will

1. Think about your possible choices. Before starting, you may want to determine if you’re going to use the services of an attorney (usually if you have a lot of assets) or prepare the whole thing yourself. If you wish to create a last will on your own, you can fill out a free will template or get it done via our step-by-step document creator. The latter provides more flexibility and options, which usually results in a more personalized will.

Please, read relevant Montana laws and requirements carefully before writing a last will.

2. Indicate your details. Establish the testator and their particulars: full name and address (city, county, and state). Review the information you entered and the rest of the passage.

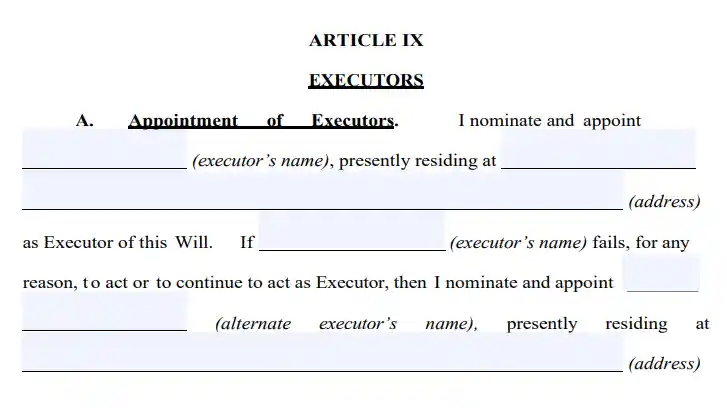

3. Designate the executor. In this particular part, you must establish who is going to execute your will by filling out their full name, as well as their city, county, and state of residence. Most states have specific policies concerning the out-of-state agents and executors, which typically would mean extra headache and paperwork. But, in Montana, there are no such limitations. Yet, it is usually recommended to designate a person who resides in the same state as you.

Your personal representative might be chosen from friends, family members, or attorneys. The best option for your case is determined by the persons involved and the circumstances. Before selecting an executor, it’s a good idea to think about your estate planning goals and the implications of each option.

It may well happen that your main personal representative will not be able to execute your will because of a sickness, death, disinclination, or some other reasons. In this case, the court can choose its own agent to handle the duties. In order to prevent that, it is possible to select an alternative executor.

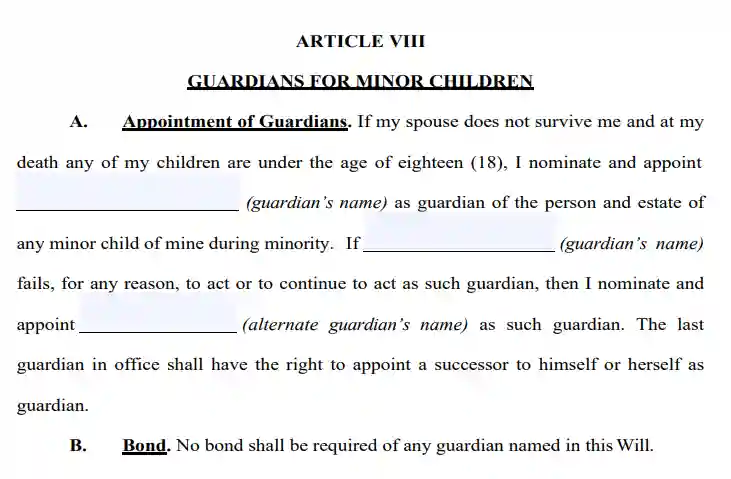

4. Indicate the guardian (optional). It’s possible to appoint a trusted person as a guardian in case you’ve got underage or dependent children that need to be looked after. If there are no instructions regarding who should take care of your kids, the guardian will be selected by the court.

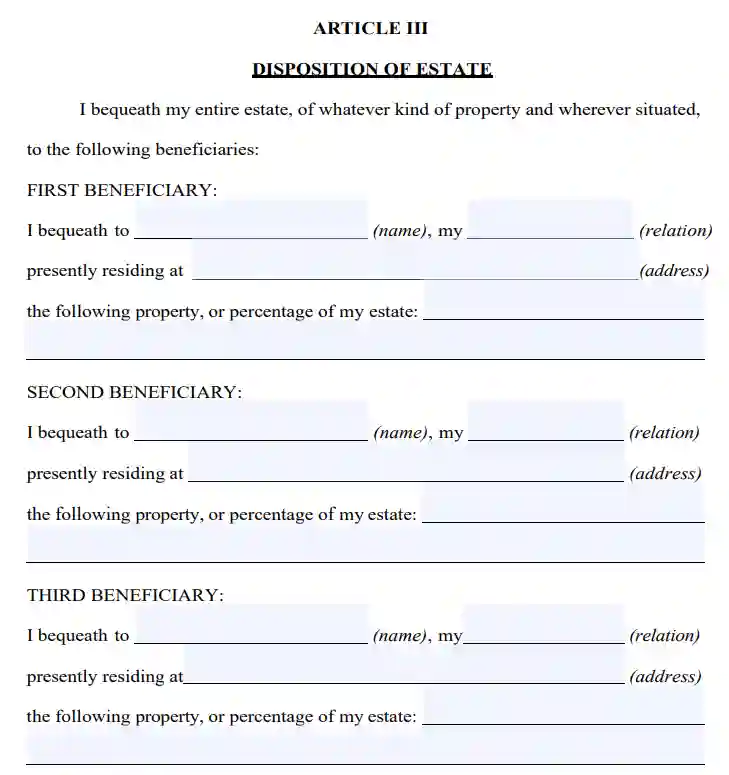

5. Establish your beneficiaries. Now you indicate those who are going to receive your property. Fill in their full names, places of residence, and your connection to them (e.g., spouse, child, friend, etc). If you want to, you can make donations to charitable organizations via your will by making them your beneficiaries.

6. Designate property. Write down your property and explain the way you want to distribute it among your inheritors. Such property can include cash, shares, real estate, business ownership, money for arrearage, as well as any material items of monetary value that you own. However, jointly owned and trust assets, along with your life insurance, can’t go in your last will and testament.

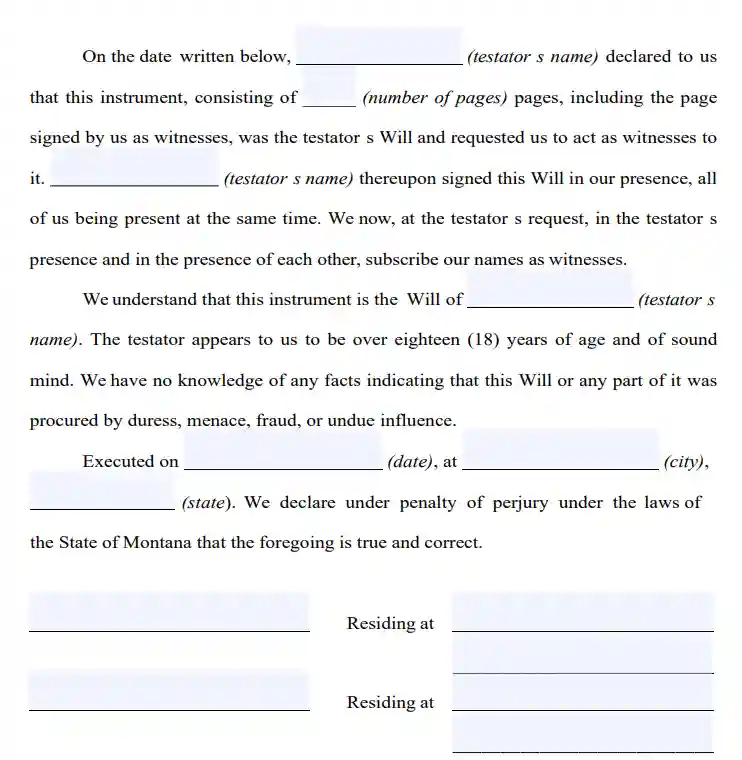

7. Continue with the witnesses putting the signatures at the end of the document. Montana Annotated Code (72-2-522) stipulates that no less than two witnesses have to sign a last will for it to be considered valid. Only somebody who isn’t your named beneficiary (or their spouse) and is of 18 years or more could be selected as a witness.

A small tip: consider selecting witnesses who are younger than you to make sure that they can be present in case the will is contested in the court or if any other problem takes place. After a careful review of every section in your last will and testament, all signatories (you and your two witnesses) must write their names and full addresses and sign the document.

Create a Free Montana Last Will and Testament

Frequently Asked Questions

Must I notarize my last will in Montana for it to be valid?

No, a last will can be valid without having a notary public certify it in this state.

Exactly what does it imply to be testamentary capable?

Testamentary capacity is a term used to describe the testator’s (the person writing the will) legal and mental ability to write and alter their last will and testament.

In Montana, to write a will, you have to be of sound mind and at least 18 years old (MT Code 72-2-521). “Sound mind” suggests that you are aware of what you are doing and what implications it can have. You must understand what a will is, how it works, what property you have, and who will get this property.

What does it mean to make my last will self-proving?

If you decide to add a self-proving affidavit, it’ll be rather advantageous as this document acts as an alternative for in-court testimony of witnesses at the time of probate, and it will remove the necessity to summon witnesses to court.

Is spouse disinheritance allowed in Montana?

No, you cannot disinherit your spouse completely as they have the right to an elective share.

Can I modify a typewritten will after I sign it?

Yes, you can. In Montana, you are allowed to revoke or adjust your last will at any moment. You can do so by attaching a codicil that contains the changes or by creating a completely new will.

In case I'm physically incapable of signing my will, what do I have to do?

Solely per your instruction and with you present can someone sign your last will (See Montana Estate Code). A notary public officer must also be present to acknowledge and sign the document with proper wording. (See MT Code 1-5-623. Signature if principal unable to sign.)

| Related documents | When to create it |

| Codicil | You wish to make a single or a few small changes to your last will. |

| Self-proving affidavit | You want to steer clear of potential problems in the probate court. |

| Living will | You want to express your wishes concerning the end-of-life treatment and life-prolonging procedures. |

| Living trust | You need additional privacy and safety when the time to distribute your assets comes. |