New Mexico Bill of Sale Form

New Mexico bill of sale is a helpful form that confirms the purchase and sale of any personal property between two private parties. Although the bill of sale forms are optional during the sale, they can prove that transactions are legal.

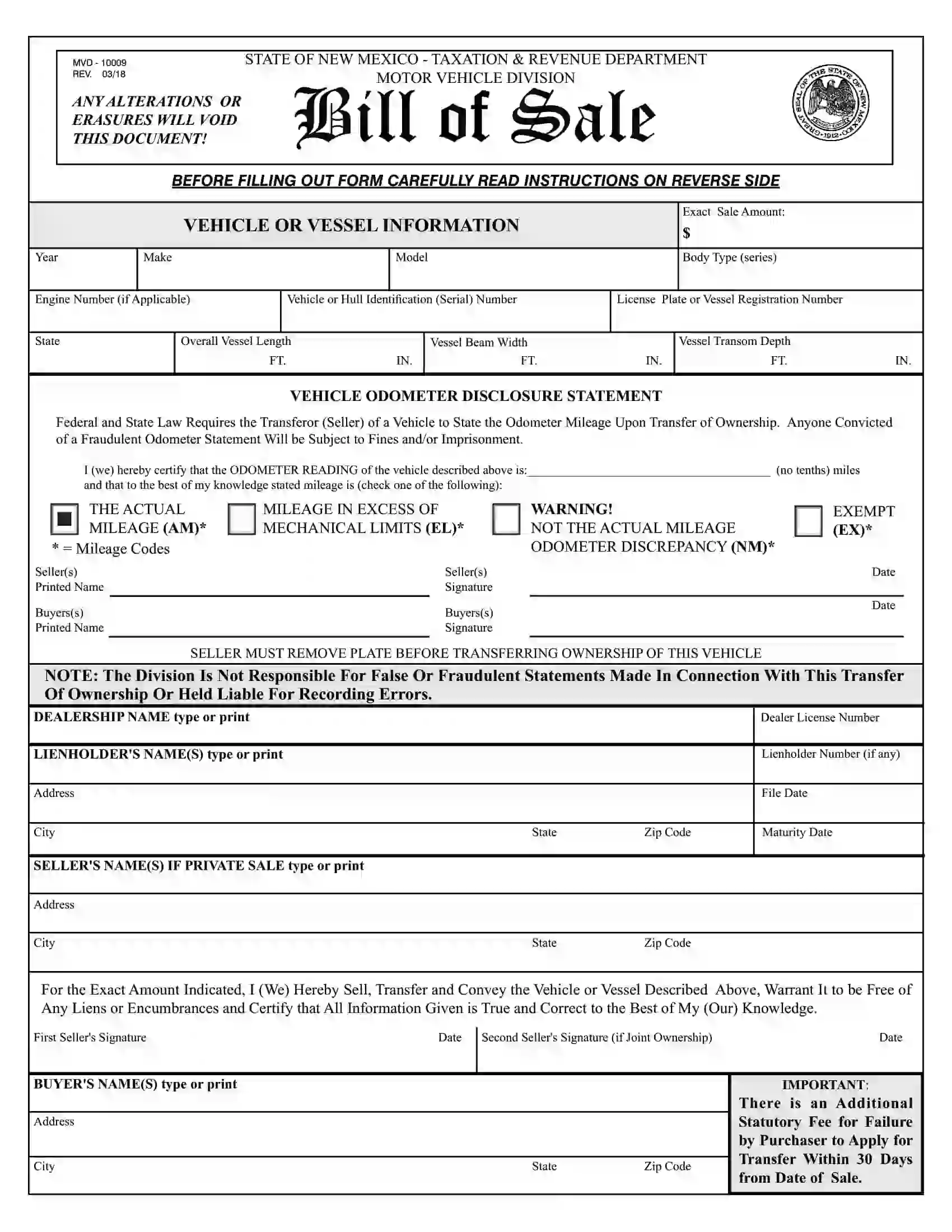

Our website provides a variety of New Mexico bill of sale forms appropriate for different transactions. If you want a personalized document, use our simple editor for customization and add additional fields. Form 10009 is an official bill of sale recognized by New Mexico MVD and used during vehicle transactions. This New Mexico bill of sale form and other official documentation are available below.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | New Mexico Vehicle Bill of Sale Form |

| Other Names | New Mexico Car Bill of Sale, New Mexico Automobile Bill of Sale |

| DMV | New Mexico Motor Vehicle Division |

| Vehicle Registration Fee | $27-62 (1-year registration) or $54-124 (1-year registration) |

| Bill of Sale Required? | Yes |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 41 |

New Mexico Bill of Sale Forms by Type

New Mexico bill of sale forms exist for each specific personal property to be sold. Scroll down to get the appropriate New Mexico bill of sale document required for your case—whether it’s a car, watercraft, gun, or other property you plan to sell or purchase.

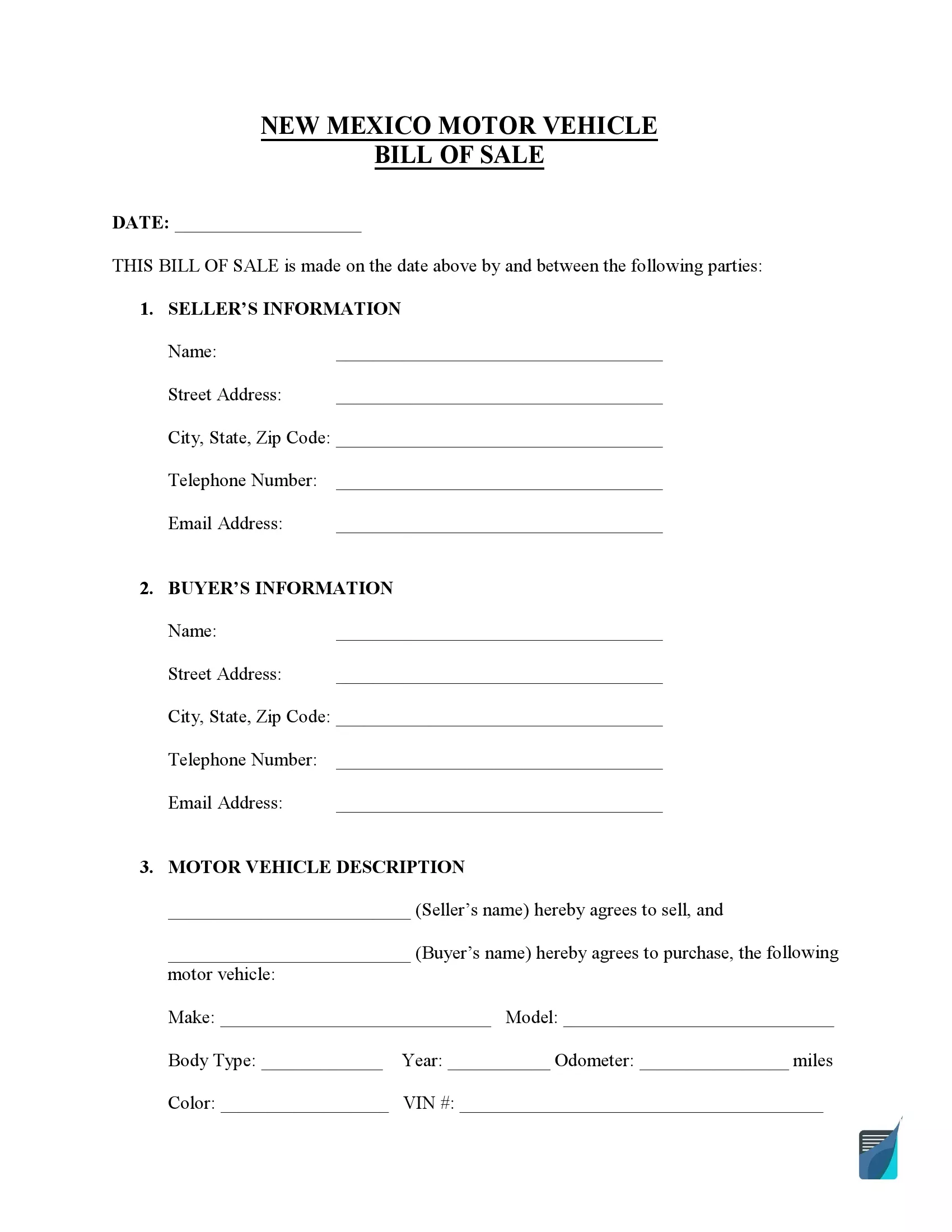

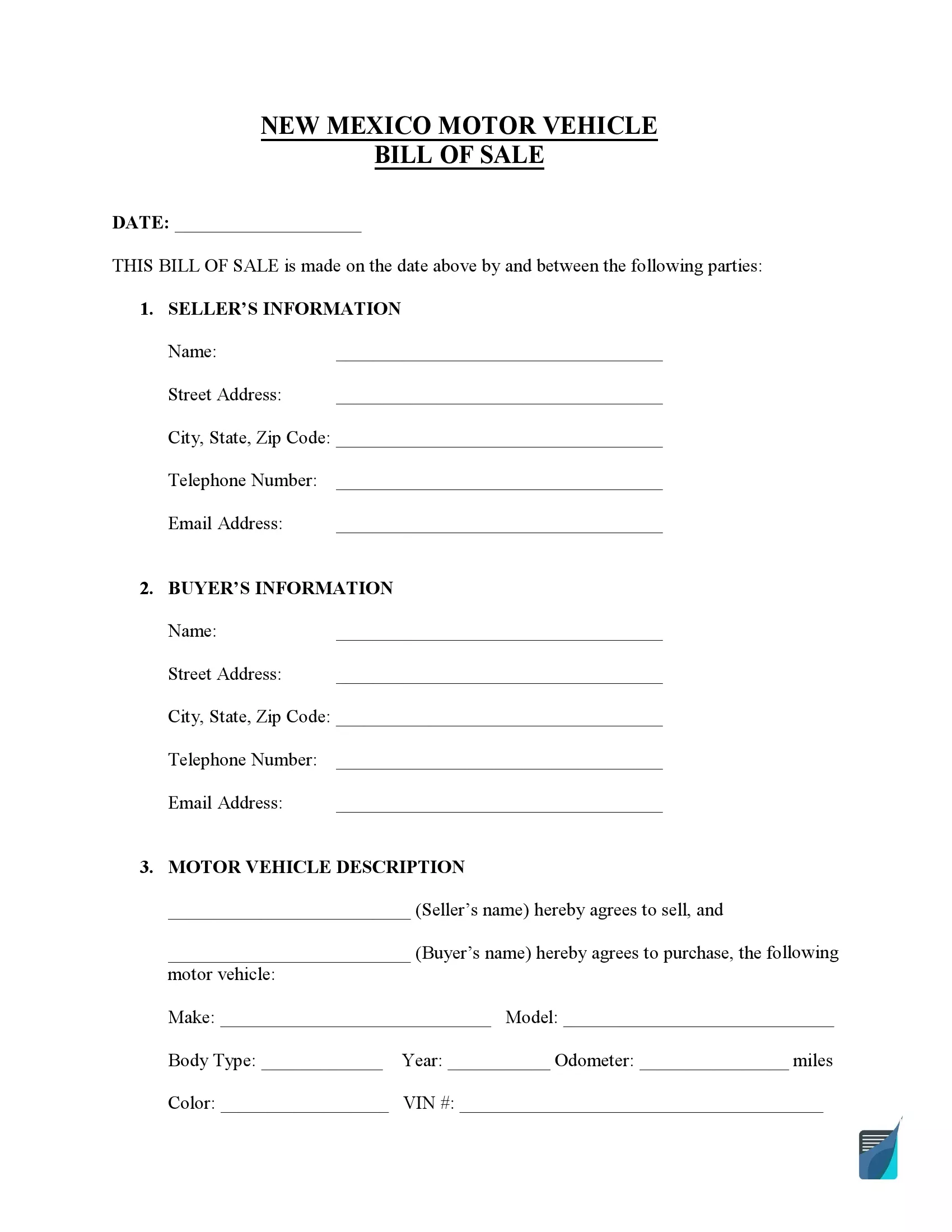

Use a New Mexico bill of sale for a vehicle to confirm that the transfer of ownership during the transaction is legal. Once you purchase a vehicle, you have 30 days to title and register it with New Mexico DMV. Vehicle registration is active for a year and must be renewed in time.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

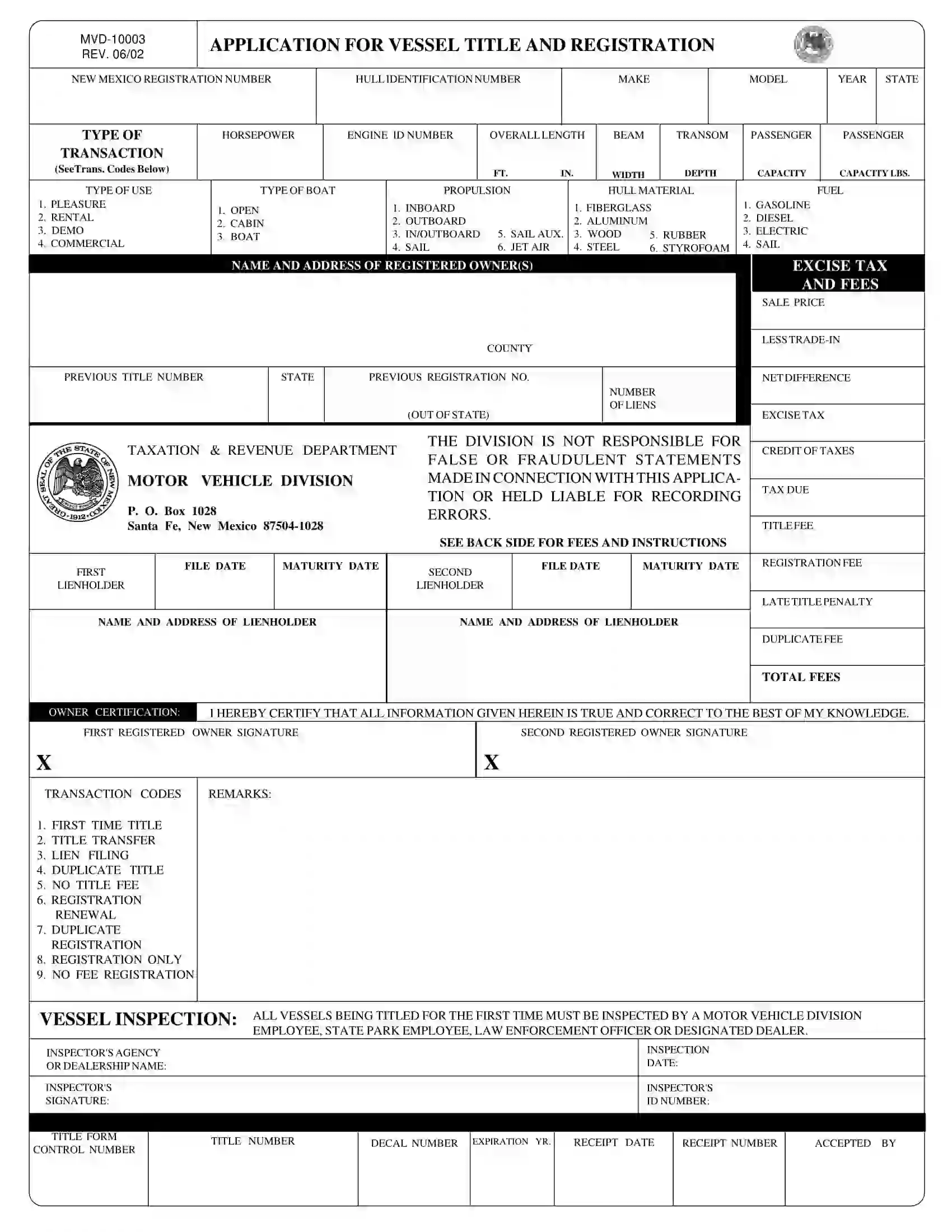

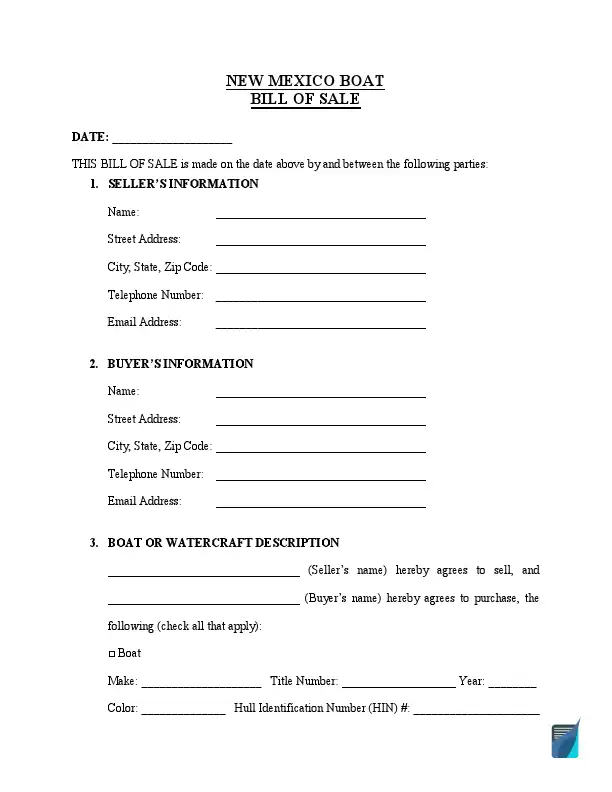

Fill out a New Mexico boat bill of sale form while selling or buying the watercraft to conduct a proper title transfer. It will be easier to title and register the vessel with this document. Purchased vessels must be registered in New Mexico under 30 days in NM Motor Vehicle Division. The title is also required if the vessel size is 10 feet or longer.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

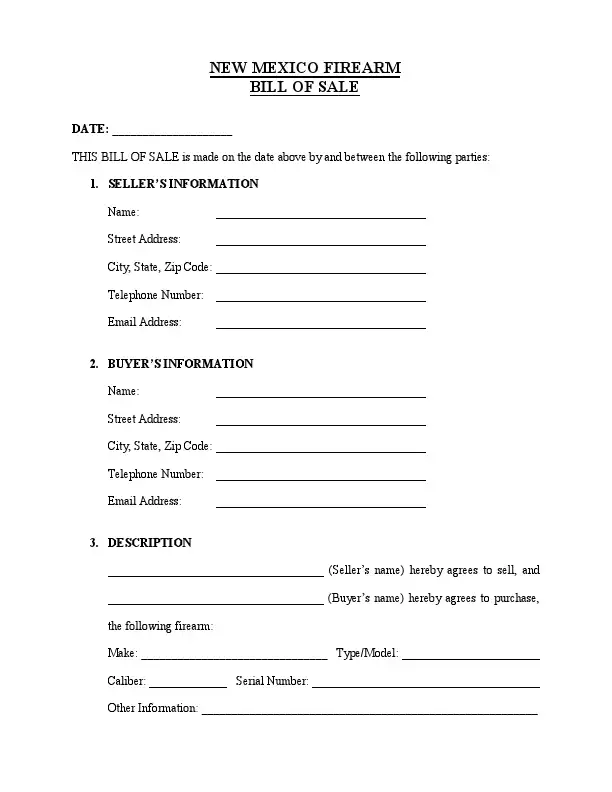

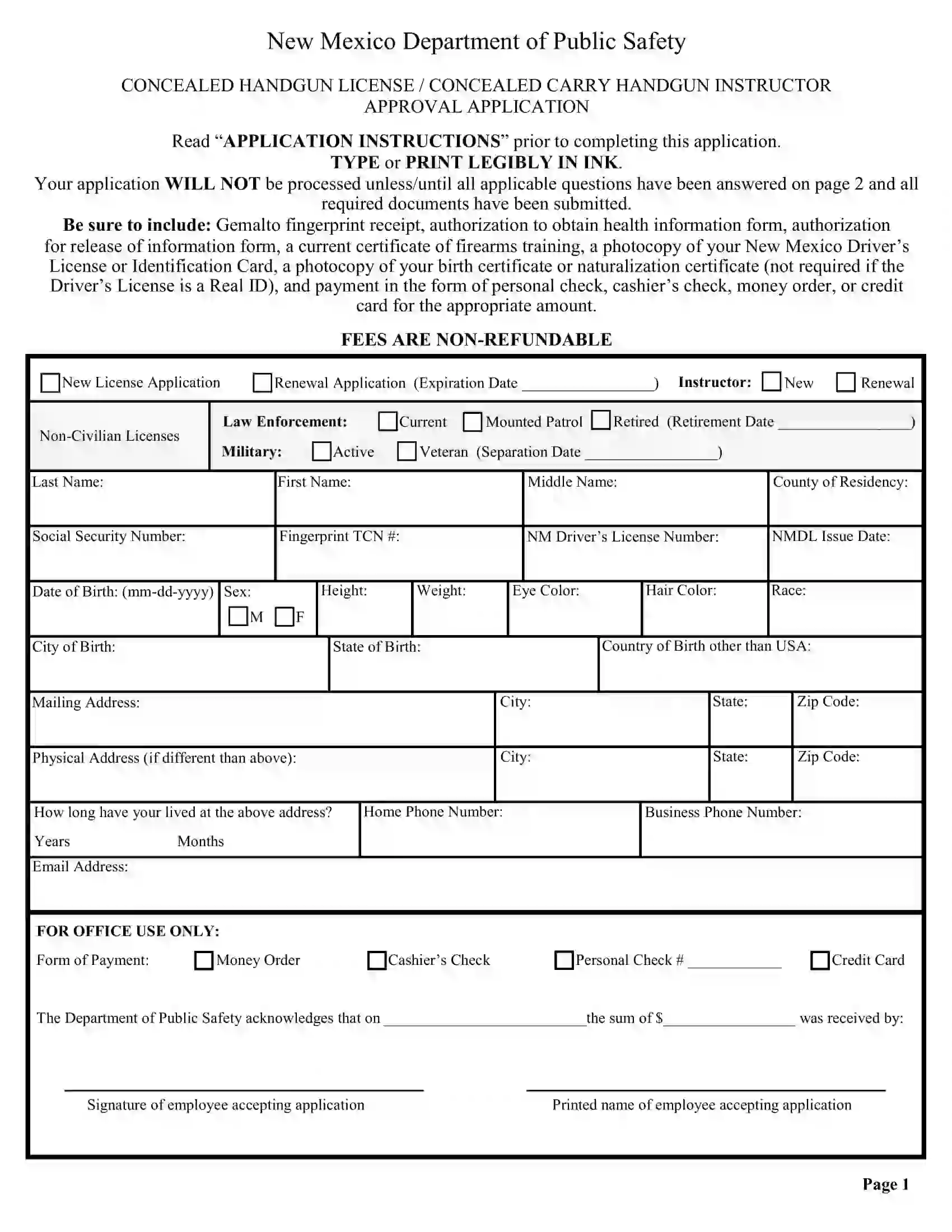

Fill out a New Mexico gun bill of sale to ensure a safe and legal firearm transaction between a seller and a buyer. New Mexico is an open-carry state, so a license is required for people who want to possess and carry a gun. The license for concealed guns in New Mexico remains in force for four years after being issued.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

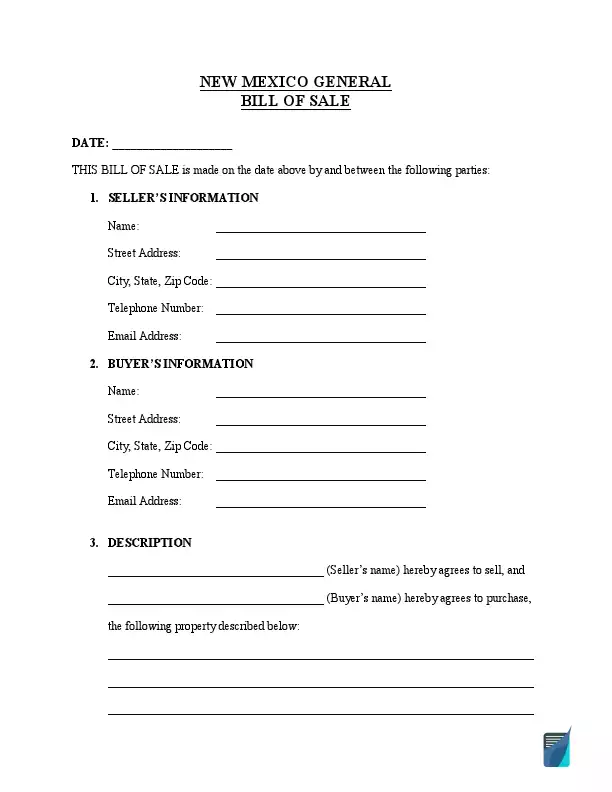

A general bill of sale is applicable for any transaction you intend to perform. This form is less specific than others, so make sure you add all important information regarding the item to be sold.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Optional |

| Download | PDF Template |

How to Write a NM Vehicle Bill of Sale

A New Mexico bill of sale for a vehicle is used during the vehicle ownership change due to sale or purchase. This form is usually required to prove the owner’s rights during vehicle registration in the DMV. If you are to use this document for your needs, feel free to look through this simple guide to avoid any errors.

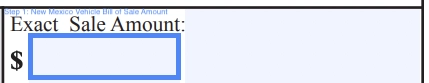

Step 1. Provide the sale amount

In the first section, you need to identify the price that both parties agree on for the transaction to happen.

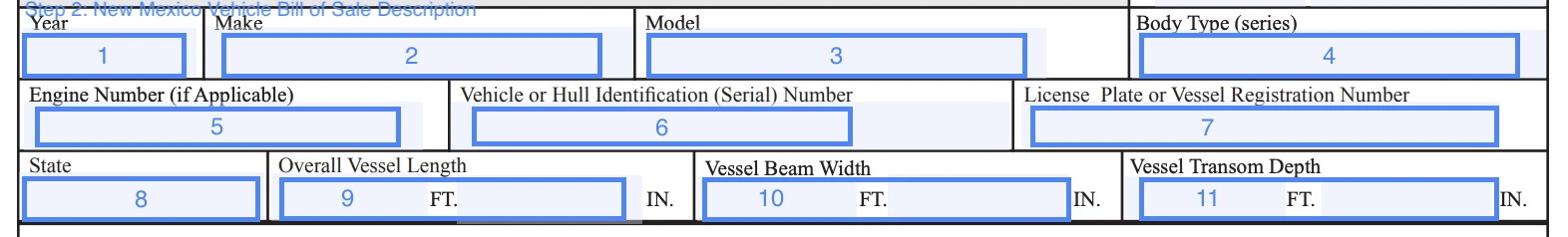

Step 2. Enter the details of the vehicle

As this form is used both for watercraft and motor vehicle transactions, you need to fill out the corresponding fields:

- Year

- Make

- Model

- Body type

- VIN (Vehicle Identification Number)

- The license plate

- State

You can leave out the details required for vessel sales (overall vessel length, vessel beamwidth, and vessel transom depth).

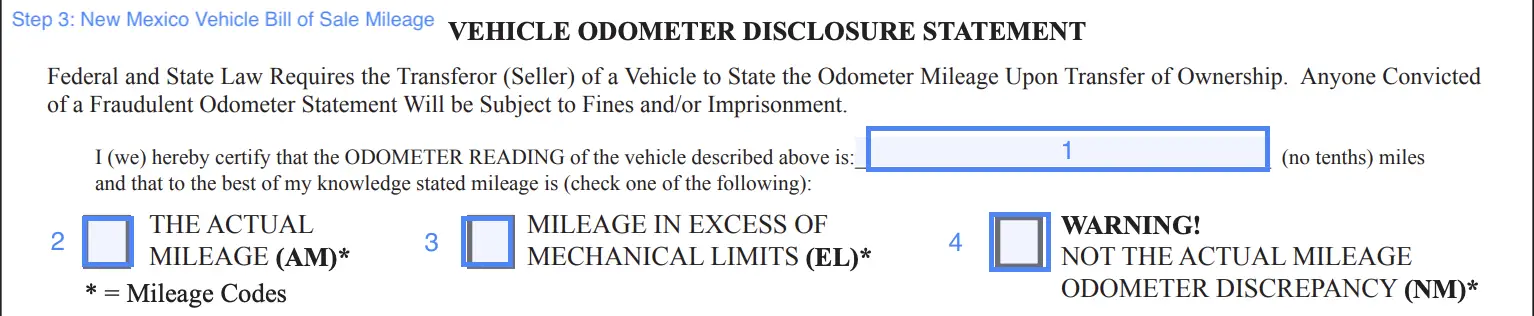

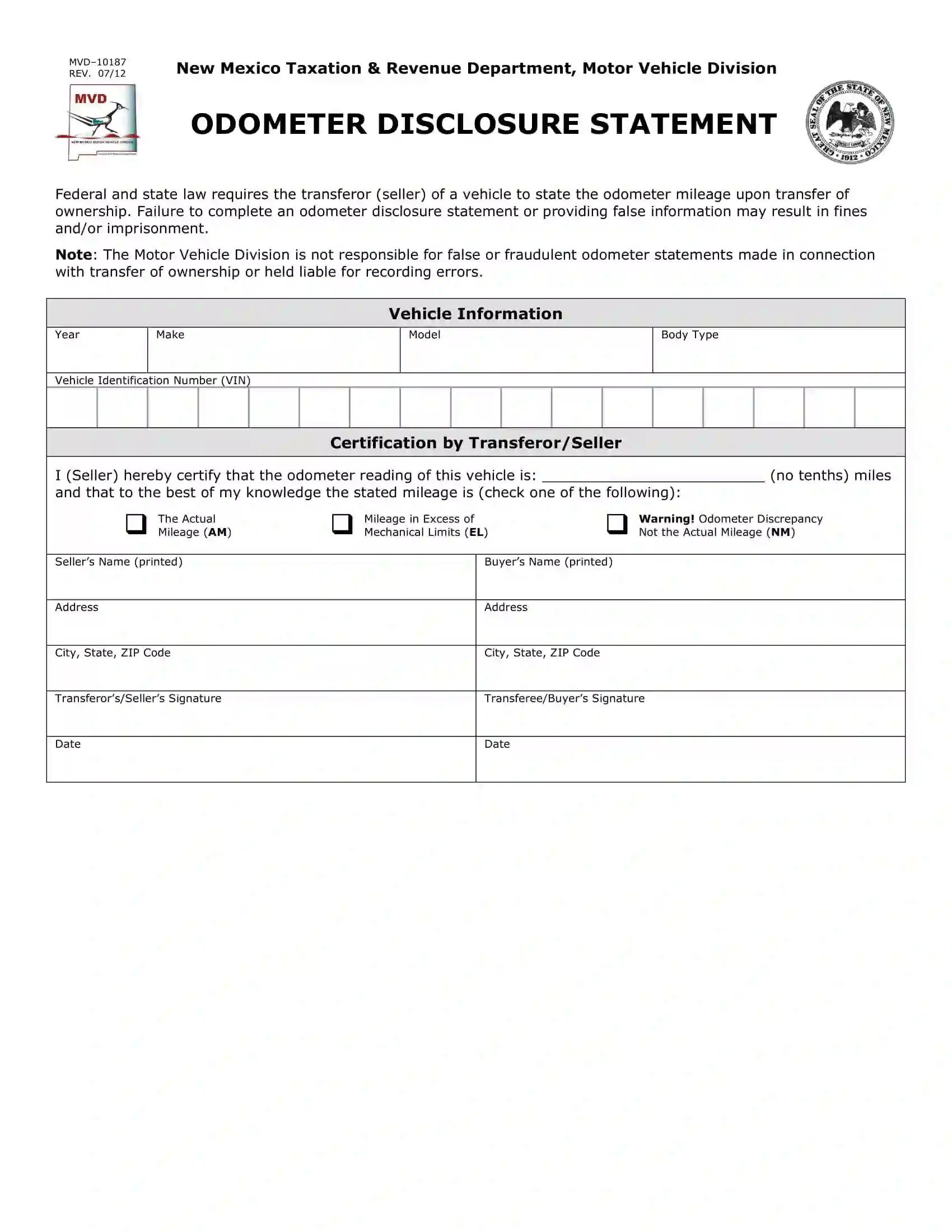

Step 3. Indicate the vehicle odometer reading

The seller is required to inform the purchaser regarding the actual state of odometer mileage of the vehicle. Indicate if the number provided is actual mileage, more than mechanical limits, or is not correct due to odometer discrepancy by selecting a corresponding checkbox.

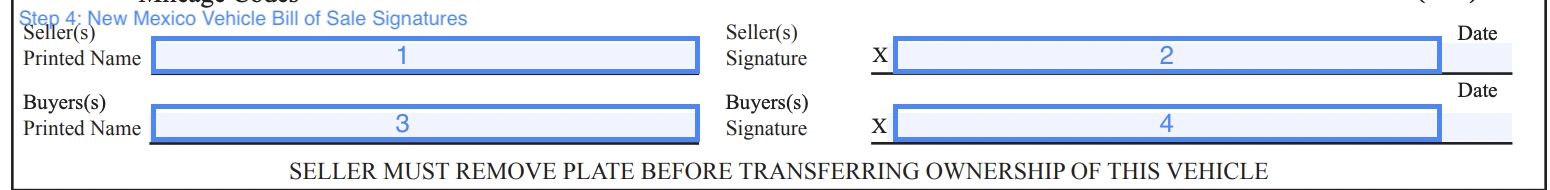

Step 4. Provide parties’ signatures

Both the seller and buyer must sign the document to indicate their awareness regarding the odometer reading. Provide the date of the signature and the printed name of the parties who sign the document.

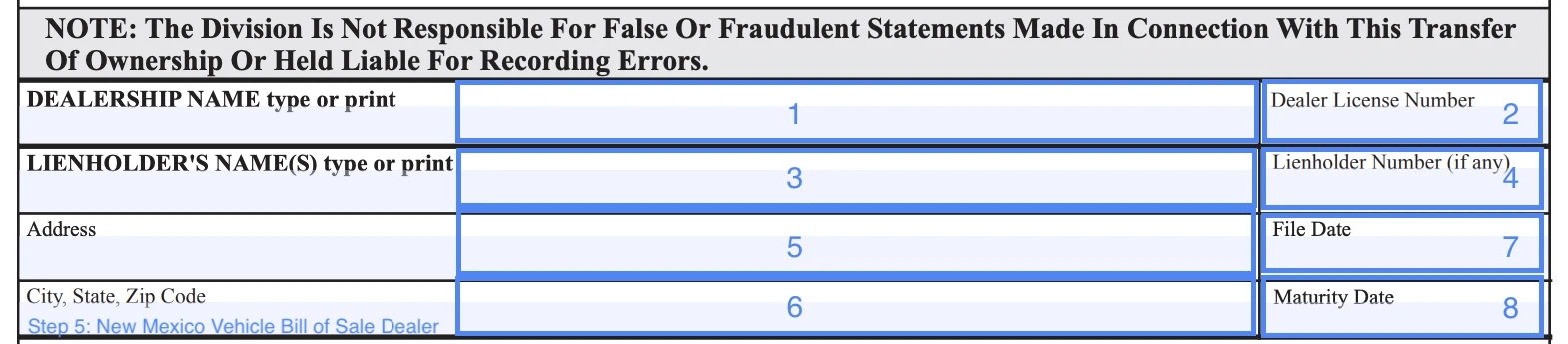

Step 5. Enter the seller’s information (for dealers)

If the purchaser is getting their vehicle through the official dealer, the latter must provide the complete information, including:

- Dealership Name

- Dealer License Number

- Lienholder Name (if any)

- Lienholder Number

- Address

- City, State, Zip Code

- File Date

- Maturity Date

Skip this step if the seller is a private party.

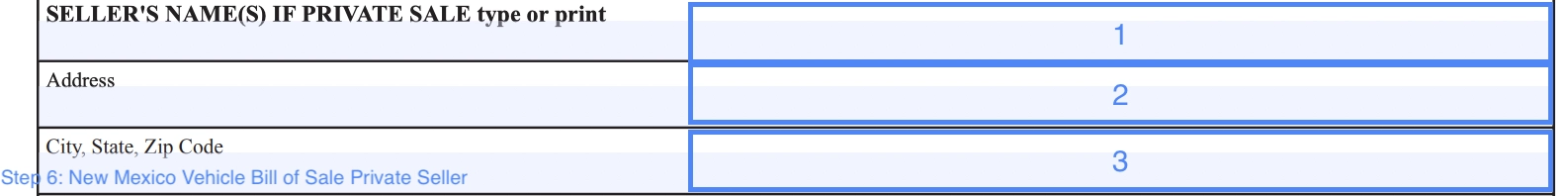

Step 6. Enter the seller’s information (for private sales)

If the purchase occurs between two private parties, the seller must fill out this section, providing their personal information, including:

- Full name

- Address

- City, State, Zip Code

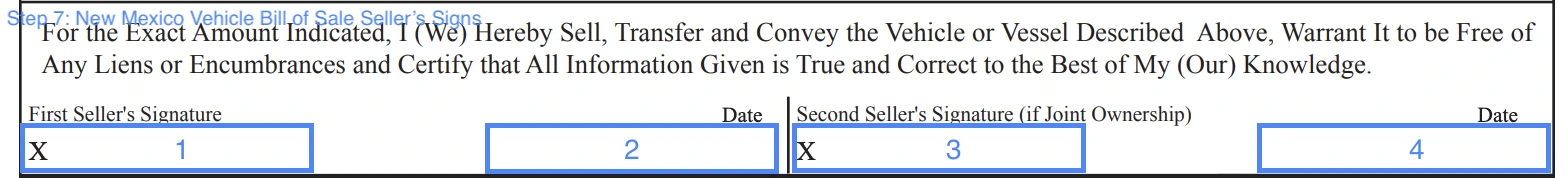

Step 7. Provide the seller’s signature

The signature from the seller is required to indicate that the transfer of the vehicle is warranted and that all provided information is accurate. Both sellers must sign the document if there is more than one seller or the vehicle is under joint ownership.

Step 8. Identify the buyer’s details

In the last part, you need to provide the purchaser’s name who buys the vehicle and their address (street, city, state, and zip Code).

There are no strict rules on whether this form must be notarized in the state, so the form will be considered valid without the notary public’s signature.

Registering a Vehicle in New Mexico

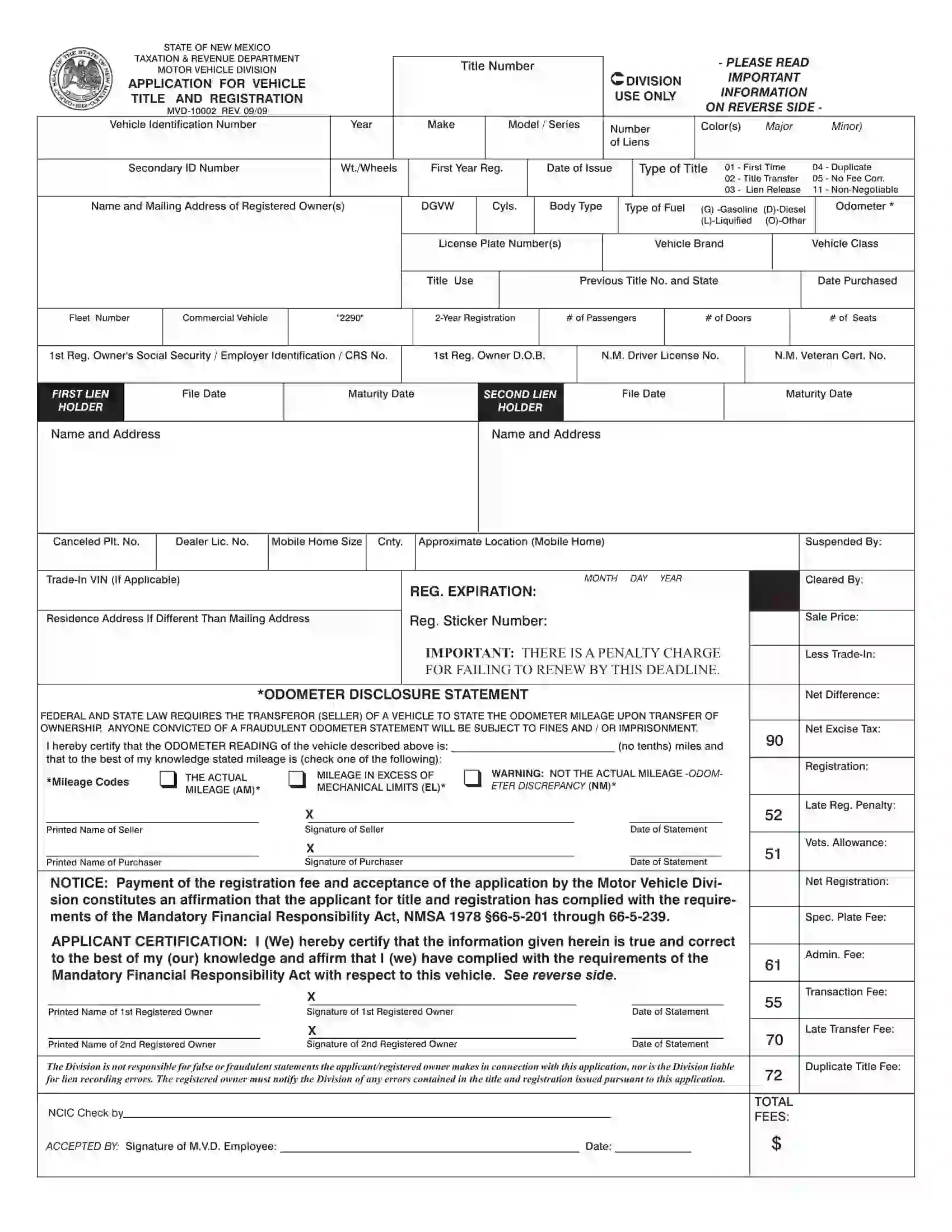

New Mexico bills of sale for motor vehicles are required to legalize the sale and register the vehicle. Those who want to register their newly acquired motor vehicle have to submit the relevant package of documents to a local MVD office:

- A certificate of title (the assignment of title section should be completed by the previous owner of the vehicle). The original form should be submitted, and no copies are accepted.

- An Odometer Disclosure Statement (form 10187) (the document should be signed by both the buyer and the seller to certify the current mileage of the vehicle)

- An accurately completed vehicle bill of sale

- A completed Vehicle Title and Registration application (MVD form 10002)

- Active proof of insurance (a copy of the insurance card)

- Proof of identity

- Receipts for the paid taxes and fees due for the vehicle’s registration

Fees for registered used motor vehicles in New Mexico are set depending on the vehicle type, starting from $27 to $62 (for one year) or $54-124 for two years of registration.

The seller must complete a Notice of Vehicle Sold form (MVD-10048) under Section 66-3-101(A) of NMSA 1978. This form should be mailed to the Motor Vehicle Division of Santa Fe or online. The document notifies the relevant state agencies that the vehicle previously owned by the seller has been transferred to another person and is no longer in this resident’s possession. The Notice should include the VIN of the sold vehicle, its make, model, model year, license plate number, and the date of the sale. The vehicle’s odometer mileage is also recorded in the Notice at the moment of transfer. Including incorrect details in the Notice is considered perjury per the Motor Vehicle Code and is legally prosecuted as a fourth-degree felony.

Relevant Official Forms

Odometer Disclosure Statement or Form MVD-10187 states the vehicle mileage and is required during the ownership transfer.

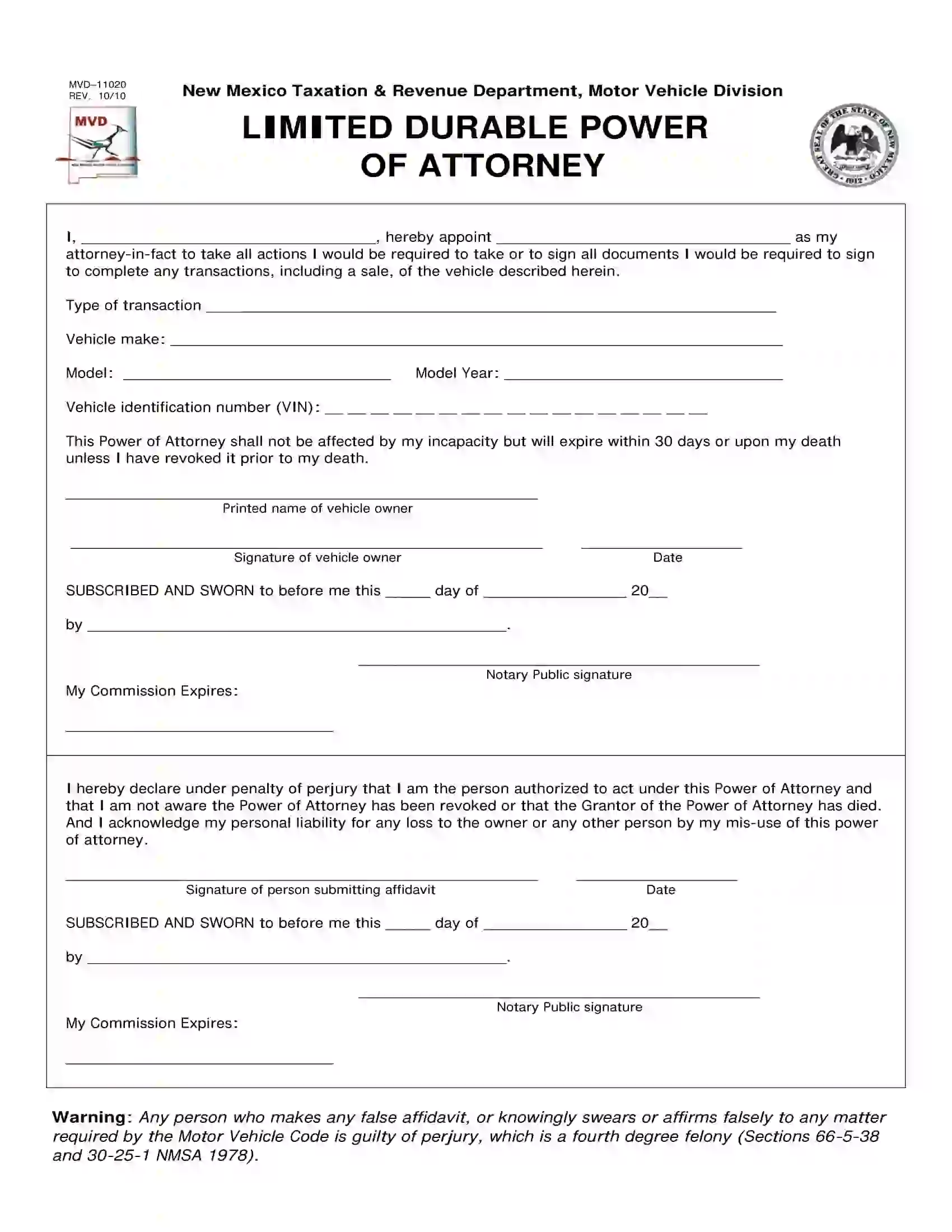

A vehicle power of attorney can give a limited right to represent another person regarding the vehicle matters.

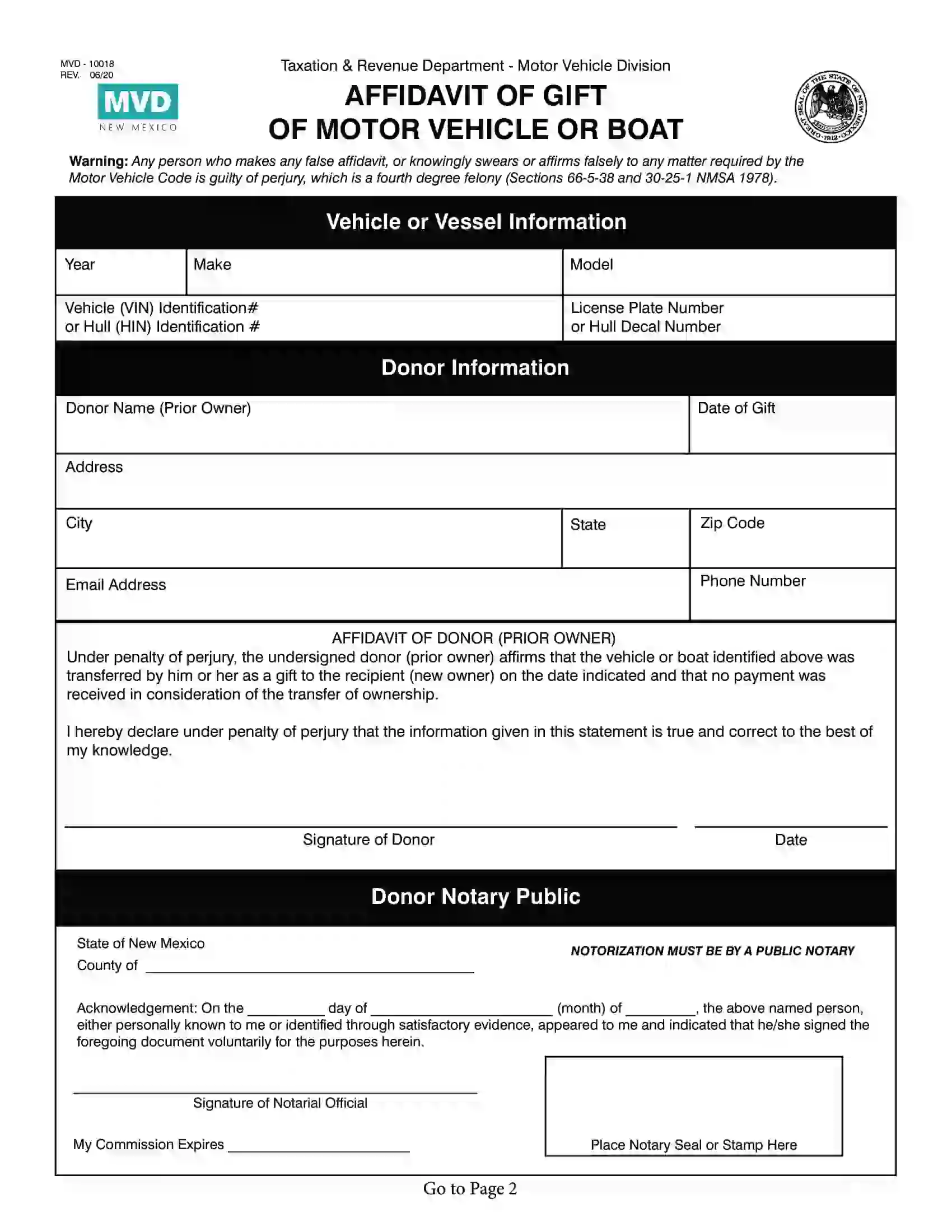

Affidavit of Gift of Motor Vehicle or Boat (Form MVD-10018) can be used when the owner transfers the vehicle’s or vessel’s title to another person without consideration, monetary or other.

Concealed Handgun License/Concealed Carry Handgun Instructor Approval Application (with instructions)

Short New Mexico Bill of Sale Video Guide

Other Bill of Sale Forms by State