Maryland Bill of Sale Form

Maryland bill of sale form is a document used for private purchases between individuals to record all details of such purchases in this state. This form can be used to prove legal ownership and is required during registration procedures in the MDOT MVA.

We offer a customized bill of sale templates designed for the State of Maryland and tailored for different purposes. You can also create a personalized document that would suit your needs in under ten minutes via our builder.

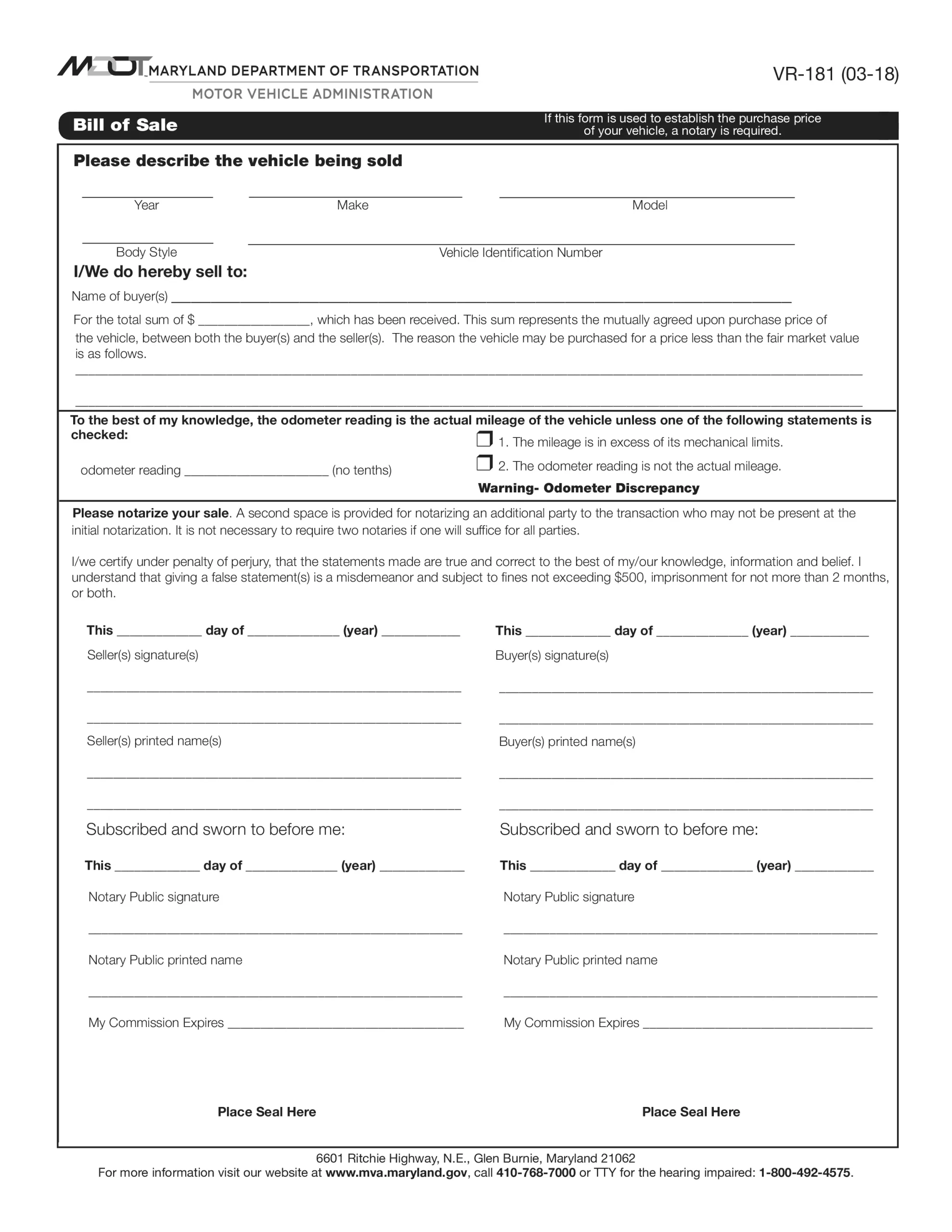

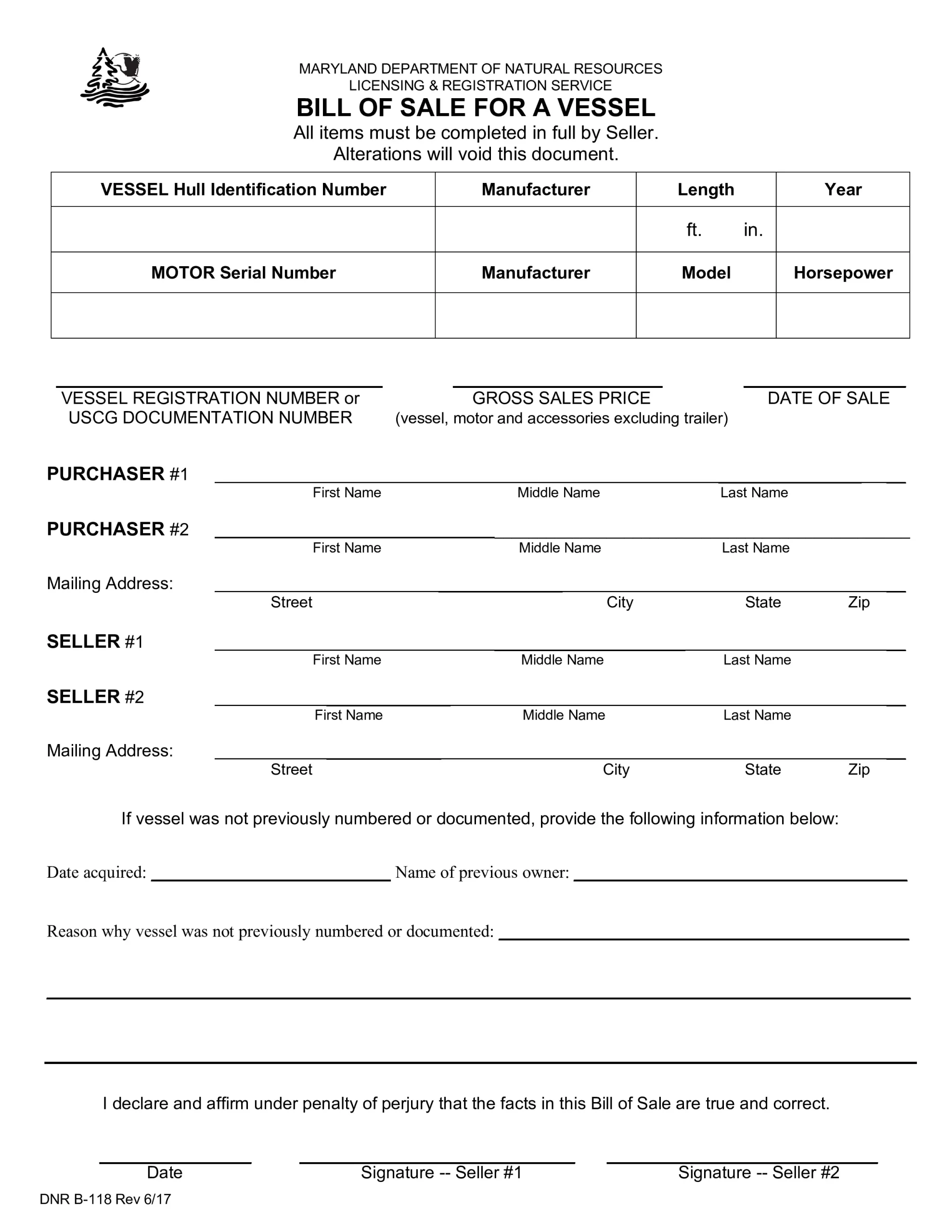

Additionally, there are two official forms that you can use in Maryland: Form VR-181 – for vehicles and Form B-118 – for boats. Both of them are available for download further below. You will need to get a notarized bill of sale to register your vehicle.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Document Details

| Document Name | Maryland Vehicle Bill of Sale Form |

| Other Names | Maryland Car Bill of Sale, Maryland Automobile Bill of Sale |

| DMV | Maryland Motor Vehicle Administration |

| Vehicle Registration Fee | $135-187 |

| Bill of Sale Required? | Yes |

| Avg. Time to Fill Out | 7 minutes |

| # of Fillable Fields | 38 |

Maryland Bill of Sale Forms by Type

Depending on the circumstances and types of transactions, there are different types of bills of sale that you can use in MD. You may wish to choose the appropriate bill of sale template below based on the transaction you’re conducting.

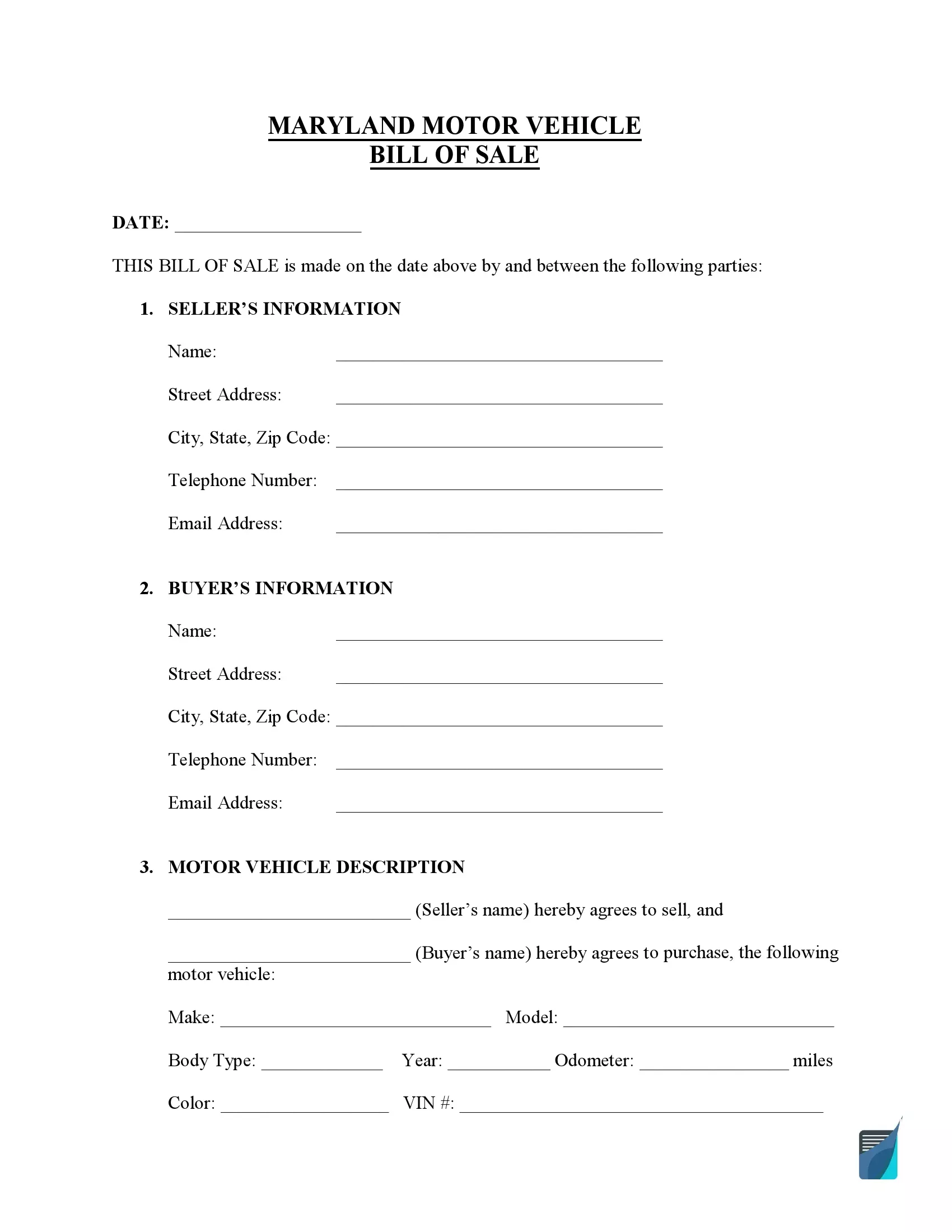

Maryland motor vehicle bill of sale is used for private vehicle sales and is required during titling and registration procedures. The form must be notarized to be valid. You’ll have 60 days from the minute of the transaction or when you relocate to Maryland to register the vehicle.

| Alternative Name | Car Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Required |

| Notarization | Required |

| Download | PDF Template |

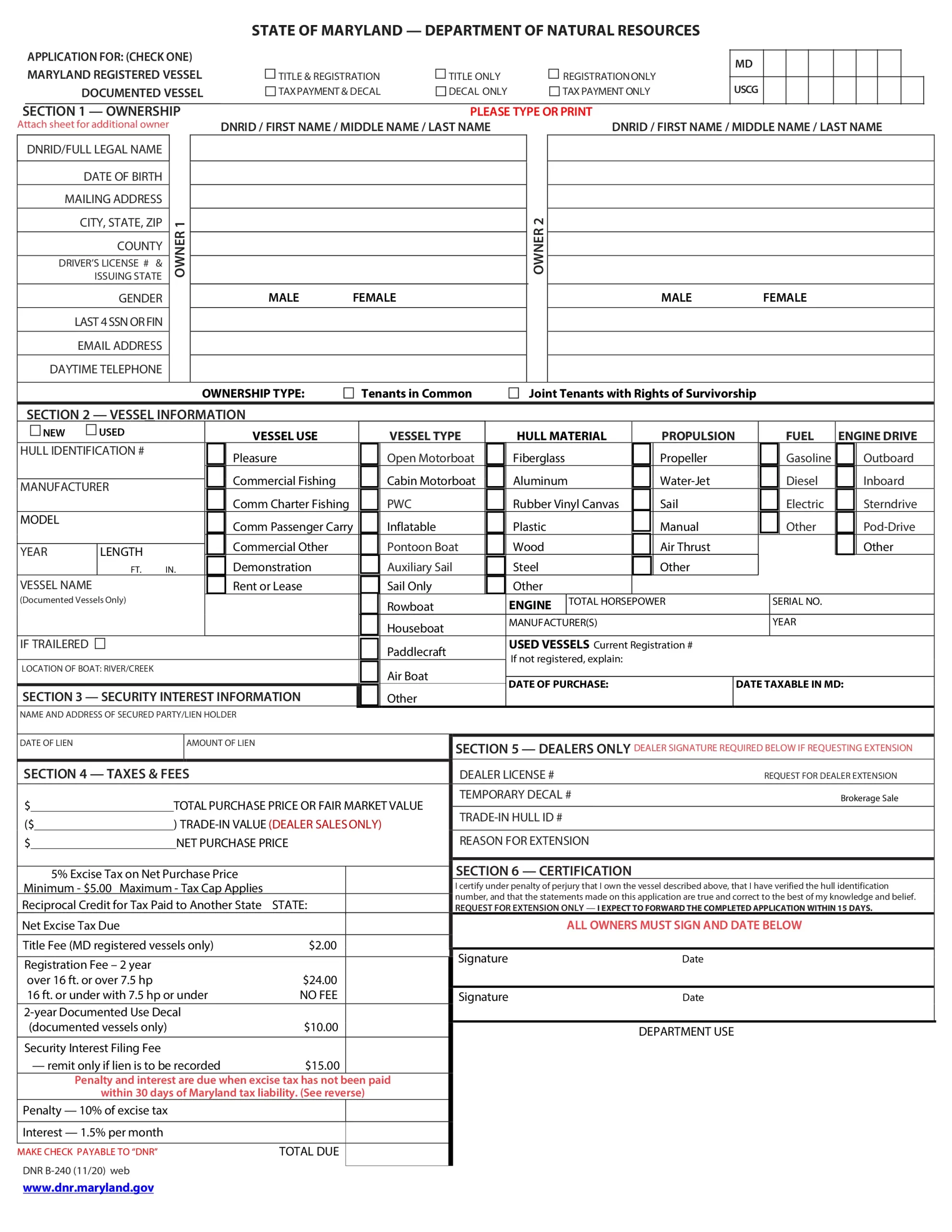

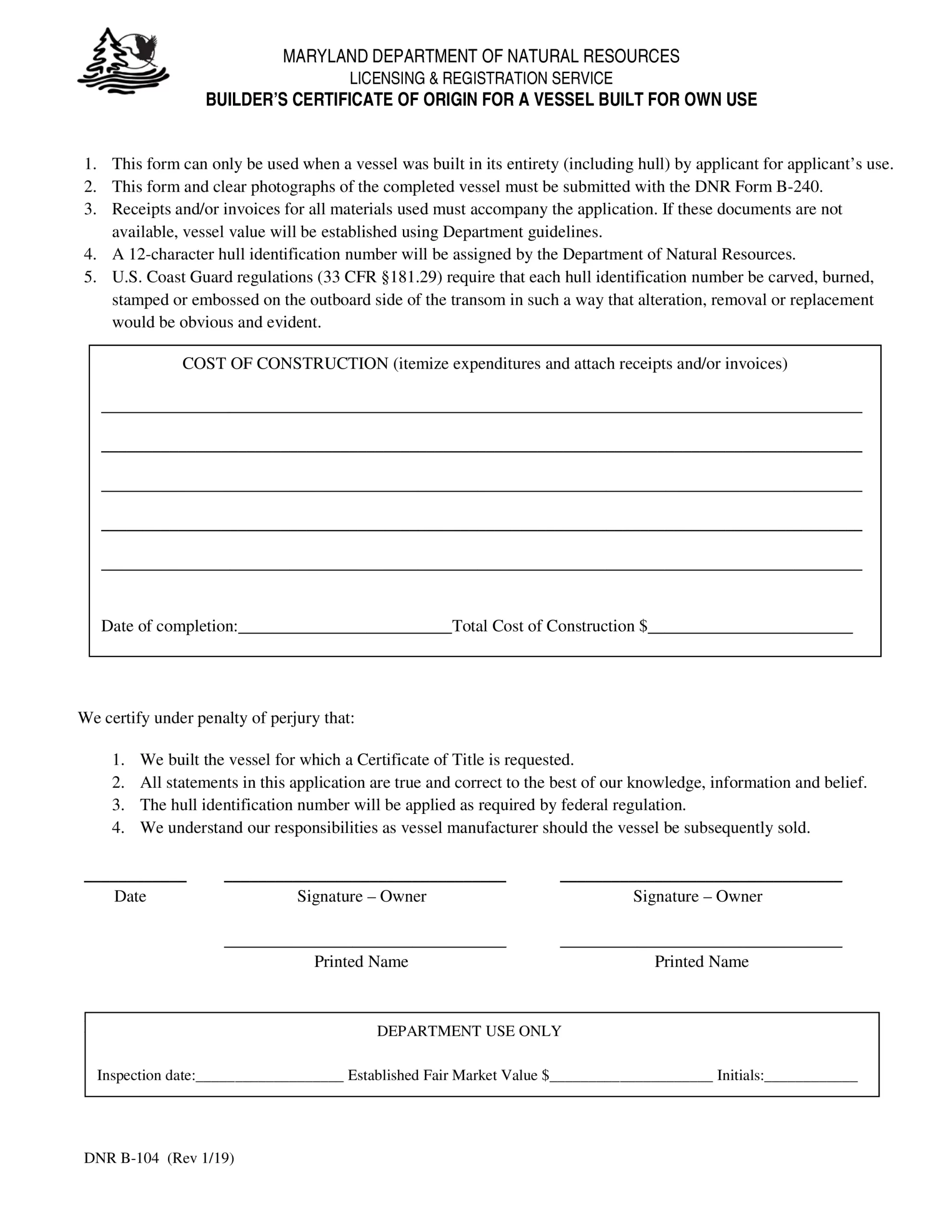

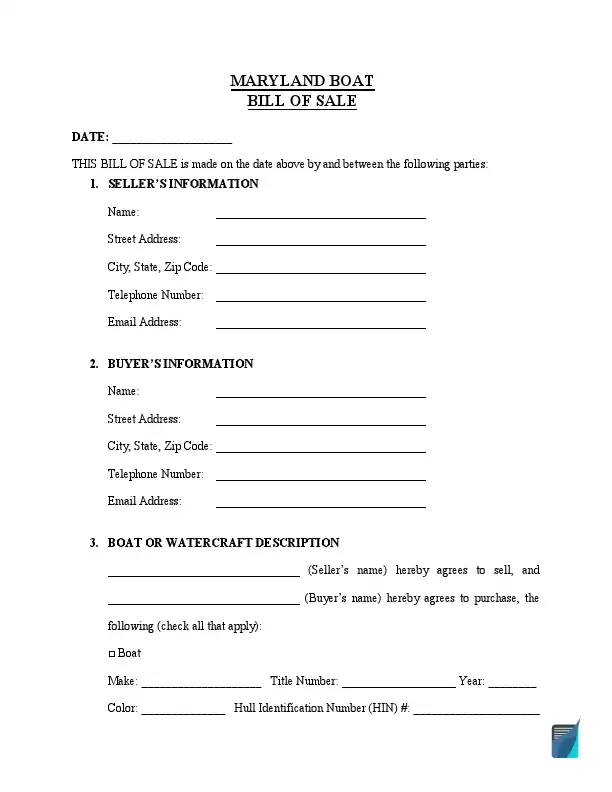

Maryland boat bill of sale form records the information of a watercraft being sold to another party and has legal proof of the deal completion. The buyer will have 30 days to register the vessel in the Department of Natural Resources. Registrations of boats in the state of Maryland are usually valid for twenty-four months. They will be required for all commercial and recreational vessels.

| Alternative Name | Vessel Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

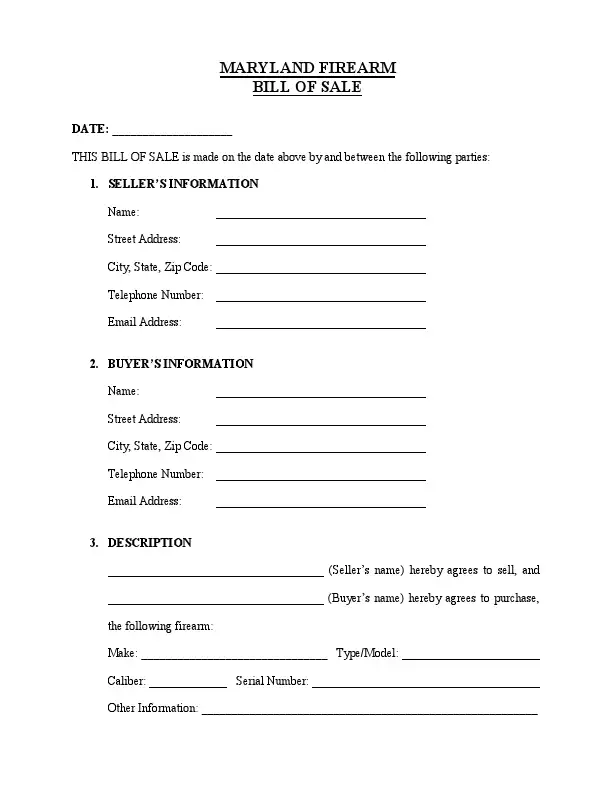

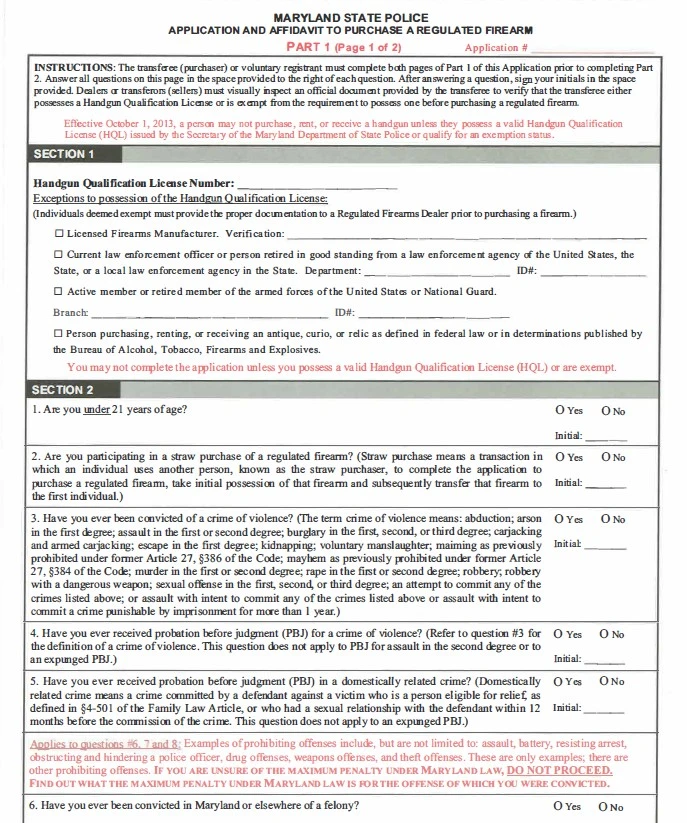

Use this gun bill of sale template to document the essential details of a firearm transfer. Maryland Public Safety Section 5-106 states that only a licensed dealer can sell firearms. Individuals are now allowed to open-carry handguns in Maryland without a license. To buy a gun, you would need to get a state permit first, issued by the police department, which also involves a background check.

| Alternative Name | Gun Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

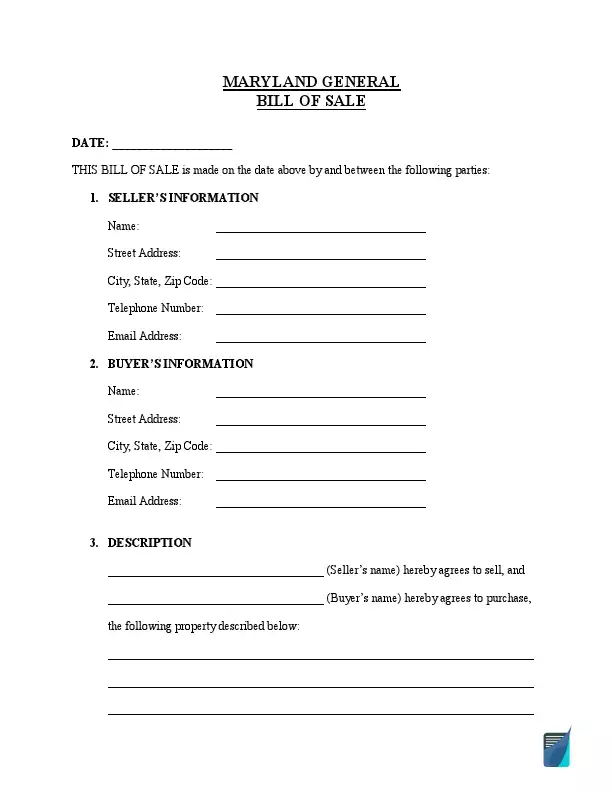

A general bill of sale may be applied for nearly any property type. Ensure the description of what is being offered for sale and the purchase terms are carefully detailed, as this form is less customized.

| Alternative Name | Generic Bill of Sale |

| Seller’s Signature | Required |

| Buyer’s Signature | Optional |

| Notarization | Optional |

| Download | PDF Template |

How to Write an MD Vehicle Bill of Sale

You can benefit from the official bill of sale template, also called Form VR-181. This is an essential document in the legal process of operating vehicles, as stated by the Motor Vehicle Administration (MVA). Maryland official vehicle bill of sale is evidence of ownership and is usually needed for registration or title change.

The bill of sale form requires the buyer’s and seller’s information and the details about the vehicle, including the vehicle identification number (VIN), make, and model, and must be notarized when signing. If you want to ensure you complete the correct document, follow the instructions below.

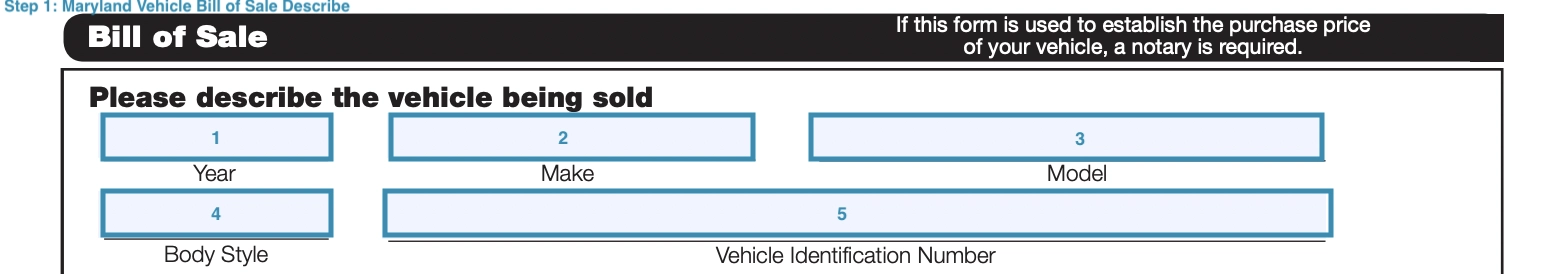

Step 1: Provide the information of the vehicle

For a proper vehicle transfer, the seller must describe it in detail. Include the following characteristics:

- Year

- Make

- Model

- Body style

- Vehicle Identification Number (VIN)

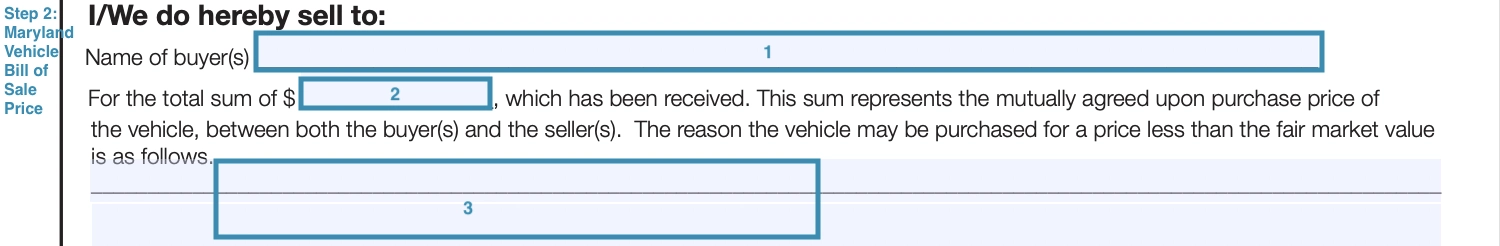

Step 2: Indicate the price of the vehicle

The price must be negotiated prior to the transaction between the parties. If the purchase price paid is lower than the fair market value, the seller must give an explanation for the difference. You’ll also need to name the buyer of the motor vehicle.

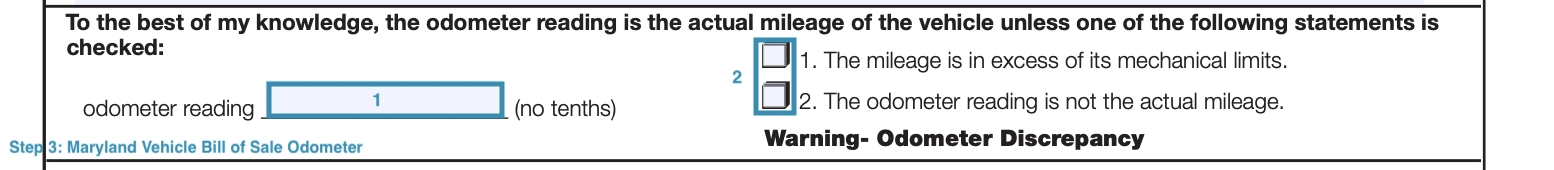

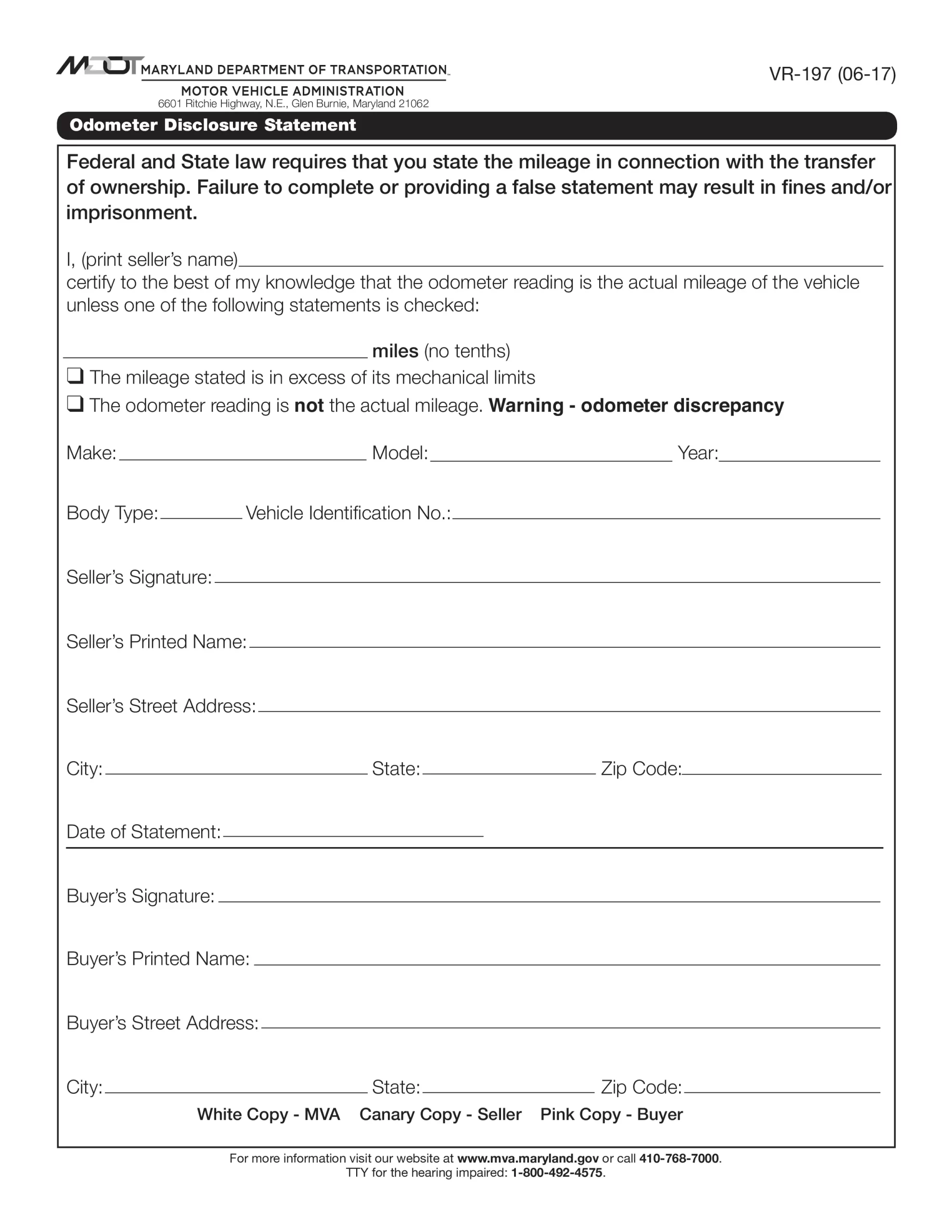

Step 3: Disclose the odometer reading

The seller must notify the purchaser regarding the actual mileage of the vehicle. If the odometer displays no actual mileage, you need to clarify this by selecting the corresponding checkbox.

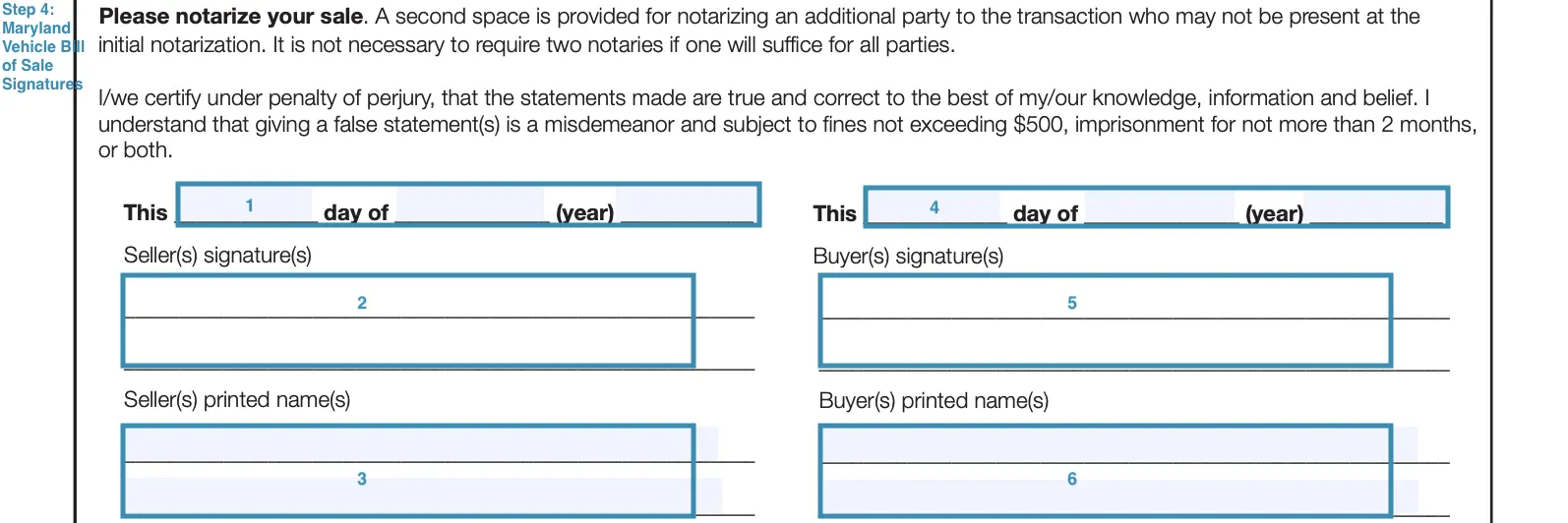

Step 4: Sign the bill of sale

The purchaser and the seller must sign the document. Make sure that you specify the date of the document and type the name of the parties in capital letters.

Step 5: Get a notary public signature

The official bill of sale in Maryland state must be notarized to be considered valid.

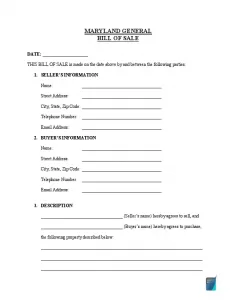

Registering a Vehicle in Maryland

When purchasing from a third-party provider, buyers must gather documentation and receipts of paid fees and present them to the MVA. The list of documents includes the vehicle’s title (which must be signed and dated by the seller), and the vehicle bill of sale, signed by both parties and notarized to have legal force. The buyer should also file an Application for a Certificate of Title by completing Form VR-005 to receive a new title for the acquired vehicle. Buyers are responsible for all fees, including taxes on purchase and registration fees, varied by the weight and type of vehicle. Additional documentation presented at the time of registration includes:

- Notarized bill of sale

- Proof of auto insurance with VIN

- Odometer disclosure statement

- Approved Maryland Safety Inspection Certificate, conducted at the licensed Maryland inspection station. These are only valid up to 90 days after the original date of inspection

- Registration fees (see details below)

- Payment for taxes (unless otherwise exempt)

Motor vehicle registration fees depend on the type of motor vehicle and its weight. Passenger cars and multi-purpose vehicles with shipping weights up to 3,700 pounds come with a fee of $135, and those over 3,700 pounds at $187, both including a $17 surcharge. All registrations last for two years. Taxes on the purchase take the vehicle’s Blue Book value into account, with a 6% charge on the total value of motor vehicles no older than seven years. Any vehicle older than seven years is taxed based on the purchase price. As stated by the state of Maryland, the minimum tax on motor vehicles is $38.40.

In either form, taxes must be paid at the time of registration unless otherwise exempt. If the vehicle is purchased out of state, buyers must show that taxes are paid, either showing a bill of sale or a tax receipt. Other exemptions include disabled or military veterans, exempt from paying taxes to register their motor vehicles.

Relevant Official Forms

Application for a Certificate of Title – used to apply for vehicle title and must be handed in-person in your local MVA office.

Odometer Disclosure Statement – a mandatory form used to disclose the actual mileage of a vehicle.

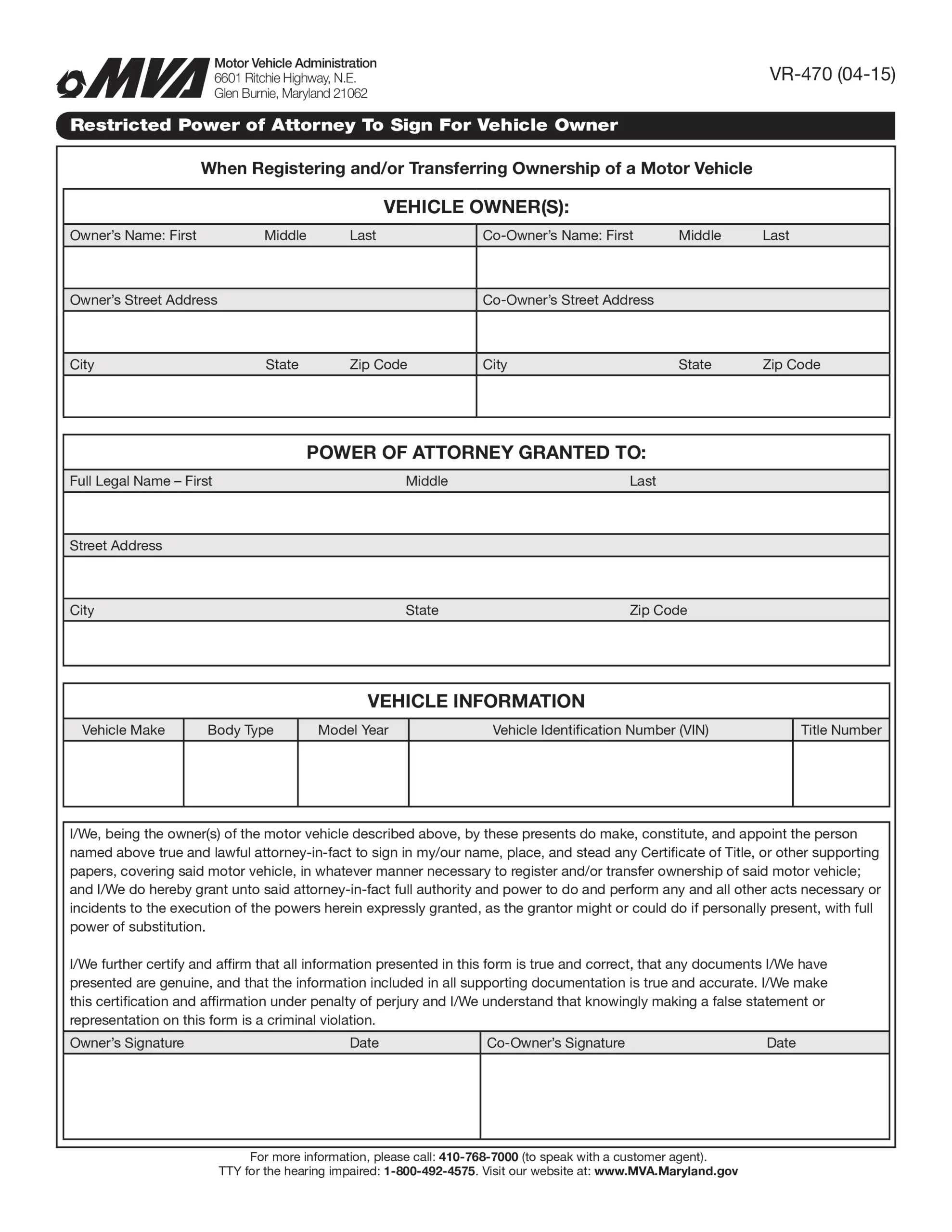

Limited motor vehicle power of attorney – assign another person to act on your behalf in vehicle-related matters.

A sample of the form you fill out when applying for a firearm permit (with questions asked by the MDSP). Provided only for informational purposes and should not be filed or submitted in any way.

Short Maryland Bill of Sale Video Guide

Other Bill of Sale Forms by State