General Warranty Deed Form

With a warranty deed, the owner of a real estate object, be it a house, flat, or land, conveys their property rights to a different party and guarantees that he or she holds a clear title, meaning it is free from claims. If there are any problems with the property that occurred in the past, for example, pending settlements, ordinances, or easements, the party that transfers the property will compensate the new owner for all the losses.

The ownership is transferred through the deed form. When a beneficiary to a warranty deed gets hold of the duly filled document, he or she becomes the legal owner of a real estate object. Either party can be an individual or a company.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

When to Use a General Warranty Deed

Any type of deed transfers property, but legal and financial risks are distributed differently between the old and the new owners. Despite most states requiring a deed to be recorded, USA registration is not constitutive. It means that the registration does not complete the transfer of property. A deed is recorded with a land register to let the general public and various financial organizations know who the owner of the property is and to reduce the possibility of fraud.

The fact that a deed is registered does not necessarily mean that there were no problems with previous property transfer acts. It is essential to check that there were no gaps in the property history, that all taxes were paid, and there are no other debts related to the property. It is quite a complicated task to fulfill.

Real estate transactions

When two parties who do not know each other well transfer some property for money, the general practice is to use a warranty deed form. At the same time, the seller agrees to sign a warranty deed when he or she is well aware of the property history. By signing it, the person takes full responsibility for everything that occurred before he or she became an owner.

To be sure that the title is free from any claim before purchase, it is in the interests of a buyer to carry out a title search in advance. For example, the purchaser needs to be sure that there is no mortgage on a house or that last year’s property tax was properly paid. In other words, he or she tries to check that they can trust a present owner and they are not engaged in any kind of dishonest behavior or negligence.

The problem is that a property seller might not be aware that something illegal might have been done in the past, either with an intention or by mistake. If it is discovered later, the legal rights might be challenged, or the title becomes unclear. When the property is conveyed with a general warranty deed, such events will definitely disturb the new owner’s peace, but the old one will bear all the associated costs.

Not registering a deed might result in some discrepancies in tax accounting. A warranty deed needs to be registered in a Registration Office, but it does not give any warranties to a beneficiary. A general warranty deed is the best type of deed for this party since it takes the risk of possible encumbrances away, contrary to other deeds.

General Warranty vs. Special Warranty Deed

The difference is that with a special warranty deed, a seller guarantees that there were no encumbrances during his or her ownership. Such a document is less desirable for a buyer since it gives less protection. A seller might insist on such a form when the grantor owned the property for a short period, they do not possess enough information about it, and acquired it with a document that does not guarantee the real property against third-party claims. Naturally, the seller does not want to cover the risks of the purchaser if any claim appears in the future. If the grantee discovers some problems in the property history after the warranty deed is signed, he or she will be the one to solve them.

Some states do not recognize special warranty deeds as legitimate, and the only document to use in this case is a general warranty deed form.

What Is a Statutory Warranty Deed?

A statutory warranty deed is a shorter form of a warranty deed. It does not contain a promise to defend a title against all claims, but the guarantee is assumed and can be legally claimed. Although the form is different, both documents imply the same thing. Both give maximum protection to a buyer of a real estate object.

Since the shorter form is simpler but gives the same safety, it is quite common.

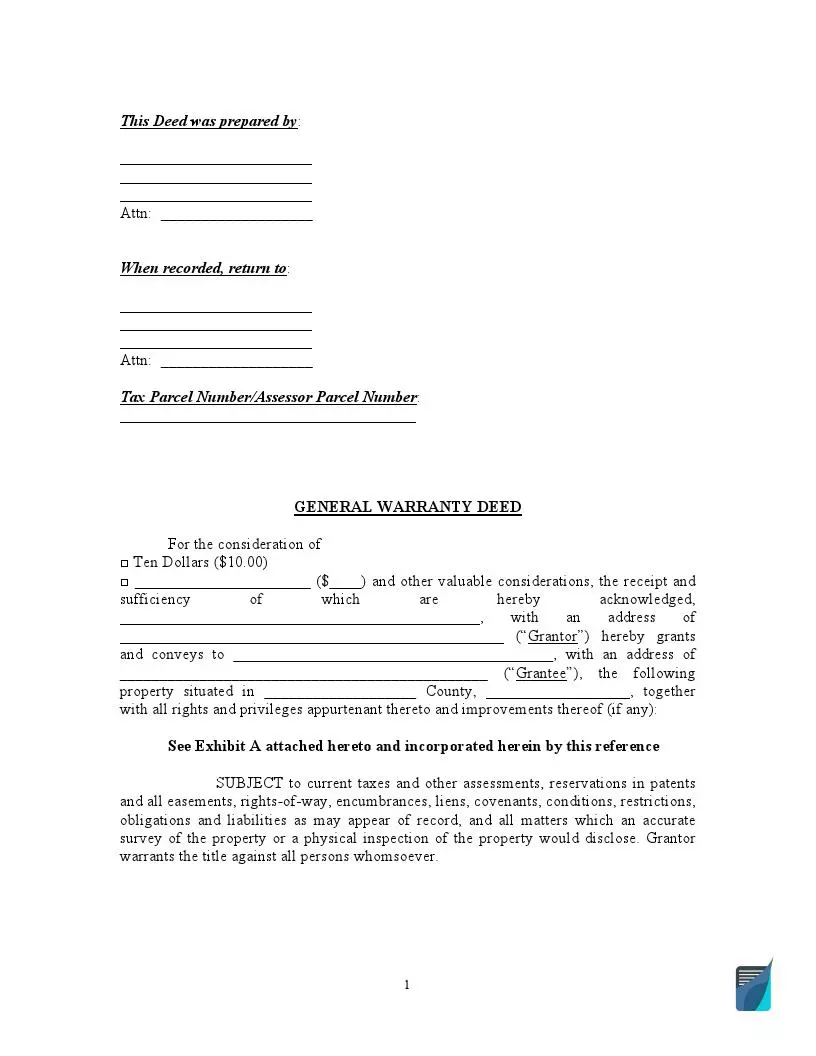

What Should Be Included in a General Warranty Deed?

This warranty deed should include:

- The names of the parties who alienate and receive a real estate object. The person who conveys the property is called a grantor. He or she guarantees the one who receives it, a grantee, against any risk of encumbrances. There are cases when the grantor who owns the property and the grantee are the same person. There could be multiplied beneficiaries in a deed. For example, the house owner might want to share it with a child; then, they can name themselves as a grantor and his child and himself as two grantees.

- Precise characterization of the property being transferred, called legal description. It is vital to have the address and/or parcel number specified correctly to make the deed legitimate. The parcel number has to be carefully checked with registration authorities to avoid possible mistakes.

- The amount of money paid for the property, if it is being sold, is called consideration. It has to be mentioned even if the property is transferred as a gift. Under such circumstances, commonly, it equals a token $10.

- In the states where it is required that a grantor signs a deed in presence of another person, a line where witnesses have to sign is added. For example, in Florida, warranty deeds have to be signed in front of two witnesses, while in New York State, there is no need for a witness to sign a document at all.

- Typically, general warranty deeds are verified by countersigning and contain a notary field where a notary public signs.

Some additional fields might be included when necessary:

- The grantor might include some rights of using the property after transferring it to the grantee. Such stipulations, if included in a deed, are called easements.

- The property owner might issue a deed that lets him use it until his or her death by adding life estates into the document. Then, the grantee becomes a remainderman who has the legal right to the property but cannot use it until the seller’s death. The person who uses it is called a life tenant. He or she does not have any authority to sell the property. Contrary to a will, the advantage of applying this legal form is that when the life tenant dies, the property does not become part of his or her estate and does not have to go through probation. It is immediately transferred to the remainderman. The danger of such a covenant for the life tenant is that the grantee’s debts unrelated to the property can result in a lien placed on the property while the life tenant is still alive and using it. The life tenant is responsible for paying taxes, but if he or she fails to do it, the beneficiary is charged.

- The grantor can also stipulate their right to use the land’s subsurface resource by claiming mineral rights in warranty deeds.

Frequently Asked Questions

How does a warranty deed need to be signed?

A warranty deed has to be signed by the person or people who convey the real property. If there are multiple owners, they all have to sign the deed to legitimize it. Other signatures in a warranty deed depend on the location. In some states, the document must be signed by the grantee. Quite commonly, the deed must be countersigned by a notary public to be legalized. Occasionally, it must be signed by a person witnessing the signature of the person transferring the property.

Does a warranty deed prove ownership?

A warranty deed is a formal legal document for transferring real property. It legally says that one person hands the ownership over to another person, and if it turns out that he or she does not have the right to do so, they are the ones responsible for correcting the title.

When signed according to the law of a state, warranty deeds are used as proof of ownership. It is in the interests of a buyer to record a warranty deed in a Registration Office for giving public notice to those who might be interested in the title. Nevertheless, even after the registration of the deed in the office, the conveyance might be challenged if some legal mistakes in previous property documents get discovered.

What is the difference between a warranty deed and a quitclaim deed?

When a property is transferred with a quitclaimed deed, the party who gives it away does not warranty against any possible liens. It is used when the property is transferred without any escrow, for example, between family members.

If a relative gives a property away for nothing, this person does not want to be held responsible for gaps in its history resulting in potential losses. When a person is buying real estate, it is against his/her interests to accept quitclaim deed terms.

Can a warranty deed be contested?

The ownership of the property is transferred through the deed. As long the grantor possesses the deed, he or she can destroy it and stop all the legal consequences.

When the deed is in the buyer’s hands, it can be revoked if the buyer gives his or her consent to do so. If the deed has not been recorded, it can be revoked by destroying it. If it has been recorded, the buyer will have to sign a letter to authorize a Registration Office to rescind the deed. Suppose the new owner refuses to revoke the deed. In that case, the next step for the seller is to contest it through a lawsuit claiming a lack of capacity, undue influence, or mistake, but it is rather complicated.

What is the vendor's lien?

If it is agreed that a buyer of a property does not pay a seller its full price before a deed is signed, it is encumbered with a vendor lien. The parties agree on a certain paying scheme. If the new owner fails to meet the payment deadline, the seller might claim the property back. Thus, the seller does not transfer the property until the amount due is fully paid off.

Do I need a lawyer for a warranty deed?

Legally, you are not obliged to hire a lawyer to compose a deed. At the same time, it is legal to pay a lawyer for advice or the service of preparing it. The deed could be a very simple one-page document, and you can get all information about the legal requirements online, as well as download free warranty deed forms with blank fields to fill out. But if there is a tiny mistake in a final general warranty deed form, the transfer can be questioned.

If you want to do a title search and examine public records to determine and confirm legal ownership, it is better to hire a lawyer to help you. A scrivener’s errors in a legal description and more substantial inconsistencies might result in undermining or even invalidating a warranty deed and require rewriting it.