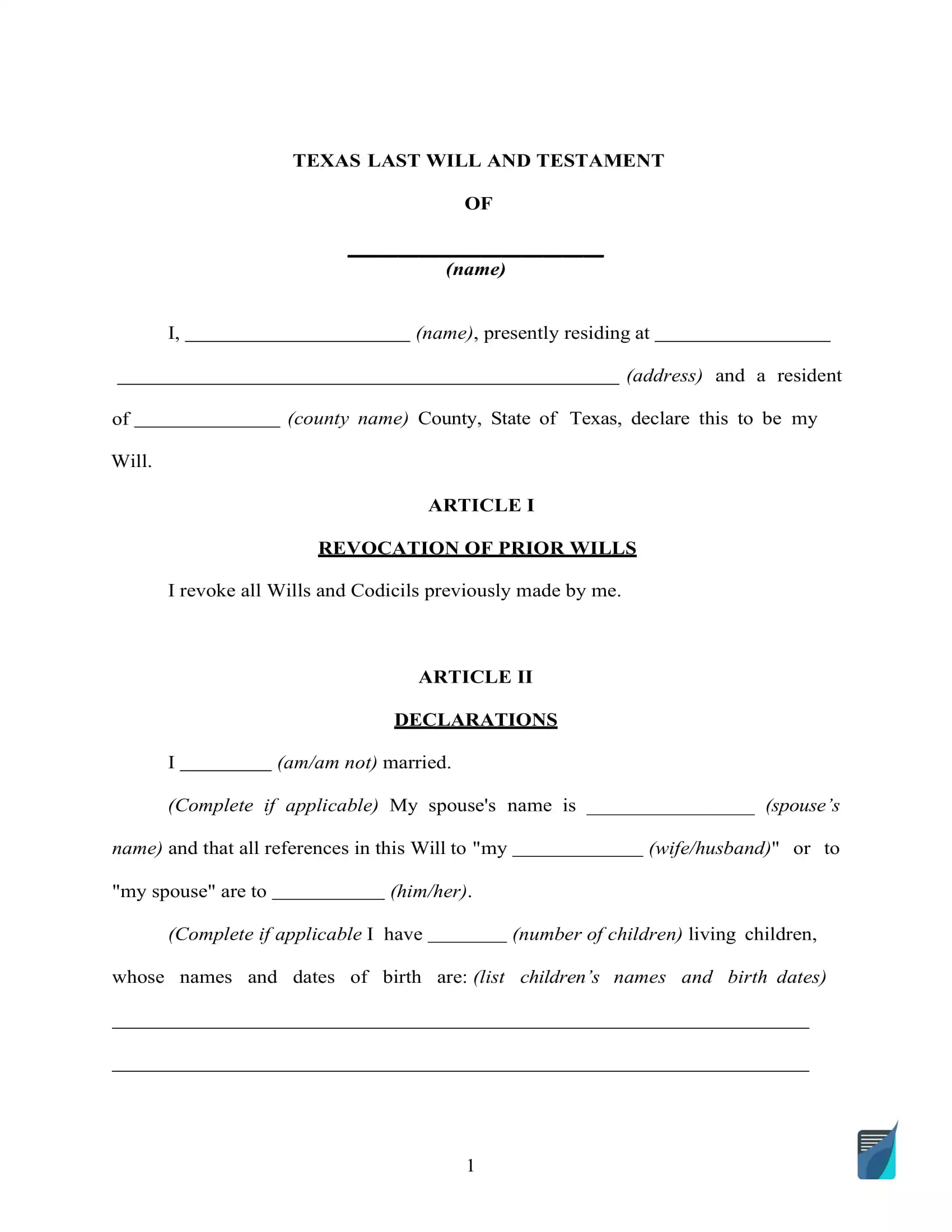

Free Texas Last Will and Testament Form

A Texas last will is a document containing the last wishes of its owner and determining precisely how and by whom their assets will be used in case of death.

Even when you haven’t got too many assets, a last will and testament will help your family situation and end up being critical to all your family members upon your passing.

In case you’re seeking a printable and fillable Texas last will and testament form, you can find one on this page, in addition to the tips on last will preparation and solutions to frequently asked questions.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Texas Last Will Laws and Requirements

| Requirements | State laws | |

| Statutes | Estates Code, Chapter 251 – Fundamental Requirements and Provisions Relating to Wills | |

| Definitions | Chapter 22. Definitions | |

| Signing requirement | Two witnesses | Sec. 251.051 Written, Signed, and Attested |

| Age of testator | 18 or older or a minor in some cases | Sec. 251.001 Who May Execute Will |

| Age of witnesses | 14 or older | Sec. 251.051 Written, Signed, and Attested |

| Self-proving wills | Allowed | Sec. 251.101 Self-proved Will |

| Handwritten wills | Recognized if meeting certain conditions | Sec. 251.051 Written, Signed, and Attested |

| Oral wills | Not recognized | Sec. 251.051 Written, Signed, and Attested |

| Holographic wills | Recognized if meeting certain conditions | Sec. 251.052 Exception for Holographic Wills |

| Depositing a will | Possible with a Texas county probate court A fee is $5 | Sec. 252.001 Will Deposit; Certificate Sec. 118.052. FEE SCHEDULE |

How to Write a Texas Last Will

Get a Free Texas Last Will Template

| Related documents | Times when you might need to make one |

| Codicil | There are a number of slight modifications you wish to make to your last will. |

| Self-proving affidavit | You want the probate to be faster when the time comes. |

| Living will | You would like to express your wishes about the end-of-life medical treatment and life-prolonging measures. |

| Living trust | You would like to take care of your end-of-life affairs without probate. |

Last Will and Testament Forms for Other States