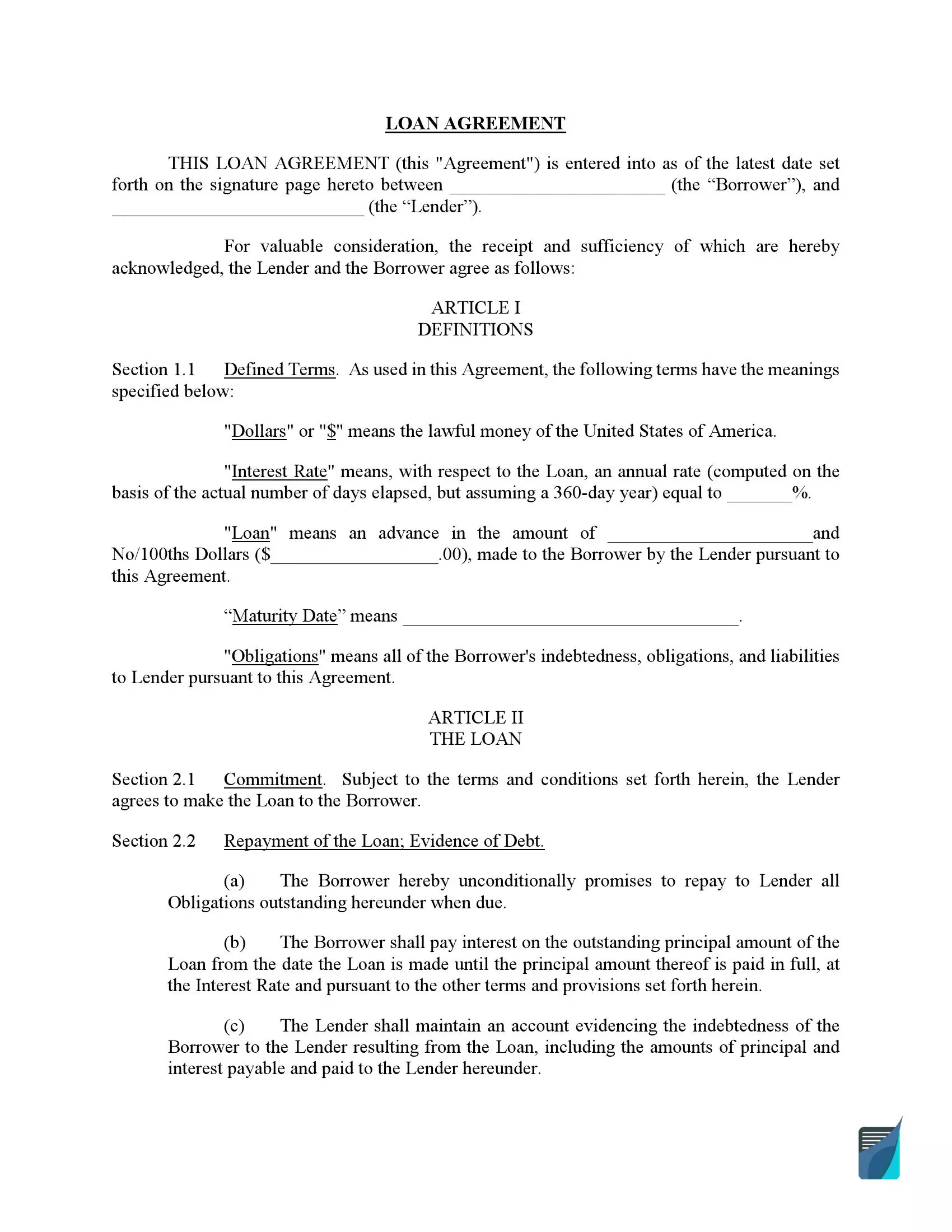

Loan Agreement Template

A loan agreement is a document that includes the terms of relations between a lending party and a borrowing party. In the majority of situations, a lender creates the agreement, meaning that they are responsible for including all of the important terms in the contract.

In this article, we will focus on what should be included in a loan agreement and where to get a free template that will let you save time when creating the document.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

- What is a Loan Agreement?

- When Might You Need a Loan Agreement?

- Benefits of Using a Loan Agreement

- Secured vs. Unsecured Loan Agreement

- What Are the Components of a Loan Agreement?

- What Repayment Options Are Available with a Loan Agreement?

- How to Fill out a Loan Agreement Template

- Frequently Asked Questions

What is a Loan Agreement?

A loan agreement is used in situations when money, goods, or services are provided by a lender to a borrower with the condition that the latter will make a payment in the future under the terms agreed by the parties. The agreement typically states that the debt will be repaid or otherwise, the lender will let the court settle the argument in order to regain the lent amount of money.

When Might You Need a Loan Agreement?

Life occasions where a loan contract might be needed vary. Here are some of the situations when the agreement is a must-have:

- when lending money for business

- when lending money for equipment purchase

- when leasing equipment

- when taking a commercial mortgage loan

- when taking a mortgage loan

- when taking a personal loan, etc.

Benefits of Using a Loan Agreement

In every situation connected with lending funds, a loan agreement plays a crucial role. With the use of the document, both parties get legal protection in case the other breaches the terms of the contract. Among the unbeatable benefits the parties get when they enter into a loan contract are:

1. Absence of ambiguity. When there is a loan agreement in place, all the important details of the loan are put in it. The agreement is proof that parties have agreed on repayment conditions, interest rates, fees, etc. This ensures the parties know each other’s expectations.

2. Elimination of changes. The agreement helps make sure there won’t be a situation where a lending party wants to raise the interest rate or fees without a borrower’s consent, or where a borrower pays after the due date or fails to pay at all.

3. Helping come up with the best deal. A borrowing party clearly sees from the loan agreement what they should pay and how to avoid extra charges such as early repayment penalties or application fees.

4. Acting as proof for tax purposes. For a borrowing party, it is important to prove to the IRS that a loan is not a gift that might be taxable. A loan agreement acts as proof that money received as a loan is tax-exempt.

Secured vs. Unsecured Loan Agreement

A loan agreement can include provisions about two types of loans: secured loans and unsecured loans. The principal difference in these two types of agreements is that in the first, there is a provision that the loan is secured by any sort of collateral — any material object of high value (car, real property. etc.) when in the second, there is no protection of the loan. A secured loan agreement lets a lending party be sure that if a borrower fails to repay the loan, they will take possession of the collateral. In the agreements that do not set collateral, a lender cannot take a borrower’s property in case the latter defaults on their obligations.

Oftentimes, a secured loan agreement is created when a borrowing party takes a car loan or mortgage. An unsecured loan agreement is common when borrowing money in the form of a student loan or personal loan.

What Are the Components of a Loan Agreement?

Considering there is no standardized form of a loan agreement and it is created by each lender at their discretion, agreements might vary. But regardless of who creates them, there are certain components that should be included in every loan agreement.

- Details about a borrowing party. This section should include the information about a borrower (person or entity) and their contact details.

- Details about a guaranteeing party. If the borrowing party involves a co-signer, the agreement should provide the details of such a party.

- Information about the transaction. This section of a loan agreement should contain details about the amount of money borrowed, interest rates, type of interest (compound or simple), conditions of repayment, etc.

- Information about collateral, if the collateral is involved.

- Maturity date. This is the date when lent money should be repaid in full.

- Repayment method. A borrower might repay debt in several ways — installment payments, by demand of a lender, paid all at once by a specific date, etc.

- Additional details, for instance, acceleration (the ability of a lender to move up the date of repayment of the loan).

- Governing law (for solving possible issues between the parties)

What Repayment Options Are Available with a Loan Agreement?

When you use a loan agreement, it is implied that a borrower will pay back money borrowed from a lending party. The way the repayment should be made depends on the lender who includes the respective provisions in the agreement. The type of loan also influences the terms of repayment.

For example, in a student loan agreement, money is typically paid back through periodic payments. These payments consist of both money originally loaned, on which basis interest and returns are calculated (principal) and interest — the fee for the ability to use borrowed money. A loan can also be fully paid in a lump sum at any time. Some federal student loans allow to postpone payments or even forgive loans to some categories of students. Typically, student loans are more flexible and a borrower might use various refinancing options, for instance, the ability to involve a private lender, such as a bank, who would pay off their loan and issue them a new loan under new terms.

For instance, a home mortgage loan agreement generally requires repayment in the form of regular payments consisting of principles and interest. But such agreements might be less flexible. Refinancing might be available only for borrowers with an adjustable-rate mortgage. They have the ability to refinance their loan to a fixed-rate mortgage with a lower interest rate. A borrower might also face mortgage early repayment charges if they suddenly have enough cash to pay off the entire mortgage, which is not the case with student loan agreements.

How to Fill out a Loan Agreement Template

If you decide to use our free loan agreement template, all you have to do is download our form and fill it in according to our short guidelines.

Step 1 — Date and information about the parties

Start the document with the date placed in the top left corner of the document. Then, in the first section of the document, indicate the parties. Write down the name, address, and contact information for both borrower and lender.

Step 2 — Payment information

Next, include the information about the periodicity of payments (once a week, month, or with any other frequency). Indicate the start date of making payments.

In the same section, tell that payments made by the borrower are first applied to interest, and then to the principal balance. Mention the maturity date, which is the date when the total amount of the loan should be due and payable.

Step 3 — Loan amount and interest rate

Further, specify the loan amount, that is, the sum lent and then, write down the interest rate.

Step 4 — Prepayment

A loan agreement might set an early repayment charge. If there is no charge for early repayment, the agreement should state that the borrower can pay back at any time without penalties.

Step 5 — Extra fees

This section should state that if the borrower fails to make a payment set by the agreement, the borrower will have to additionally pay attorney’s fees and any other reasonable expenses the lender might bear if the borrower defaults on their obligations.

Step 6 — Governing laws

Next, the agreement should indicate what laws the parties deem governing.

Step 7 — Binding effect for successors

The document needs to also include the provision about the successors of the borrower stating that they are bound by the borrower’s promise to pay the debt. An important thing to include in this section is a statement that the holder of the agreement should give consent to assignment or delegation of any obligations in a written form.

Step 8 — Binding effect for successors

The last part of the document should be designated for the signatures of the parties — borrower and lender. Along with them, witnesses might acknowledge the moment of signing the document by putting their signatures beneath the signatures of the parties.

Frequently Asked Questions

What is a demand loan agreement?

A demand loan is a type of loan where a lending party has the right to demand full repayment of the loan at any moment. The option might be beneficial for both parties. For a lender, this is an opportunity to demand money back with the intention to make other investments or for any other purposes. For a borrower, it is an option to avoid charges for early repayment. This type of loan agreement is often used for investment loans, loans for new businesses, car loans, or when purchasing farm animals, used equipment, etc.

How does interest rate work on a loan?

When taking a loan, a borrower has the privilege of using somebody else’s money, for which they pay a certain interest. The interest is calculated as a percentage of a loan amount paid to a lender with the agreed periodicity. It is typically calculated for a year, but it might also be longer or shorter.

For instance, if a lender is lending $100 to a borrower at a simple interest rate of 3%, the interest amount (interest charge) will be $3 per year.

In the case of compound interest, that is, the interest earned from the original principal plus accumulated interest, the situation will be different. Based on the previous example, a borrower will have to repay $3 in the first year. If they use compound interest, in the following year, they will have to repay 3% of the first-year balance, which is $103, which results in $3.09 in this year. The balance at the end of the year will be $106.09. In the third year, a borrower has to repay an interest rate on the previous year’s balance, which will be $3.1827.

If you need a free loan agreement template, use a loan agreement form in PDF, DOC or ODT presented on our website. By using our free loan agreement, you will save time and effort — all you have to do is download the form and insert your information in the respected fields.

What is the difference between a loan agreement, promissory note, and IOU (I owe you)?

There is no big difference between a loan agreement and a promissory note as both documents set out conditions for repayment of debts and are binding and consequently, enforceable. However, a promissory note is generally an unsecured document that does not include protection of the loan such as collateral. It typically includes less specific and strict terms and puts fewer obligations on a borrowing party in comparison to a loan agreement. A promissory note is often created when parties have trust in each other and a relatively small sum of money is involved. But in cases of significant debts and parties being unfamiliar with each other, parties should go with a loan agreement.

In comparison to a loan contract, an IOU also sets a borrower’s obligation to pay back lent money, but it makes no promises on how or when the loan will be repaid. This is why it is the best option when it comes to leasing money to friends or family.