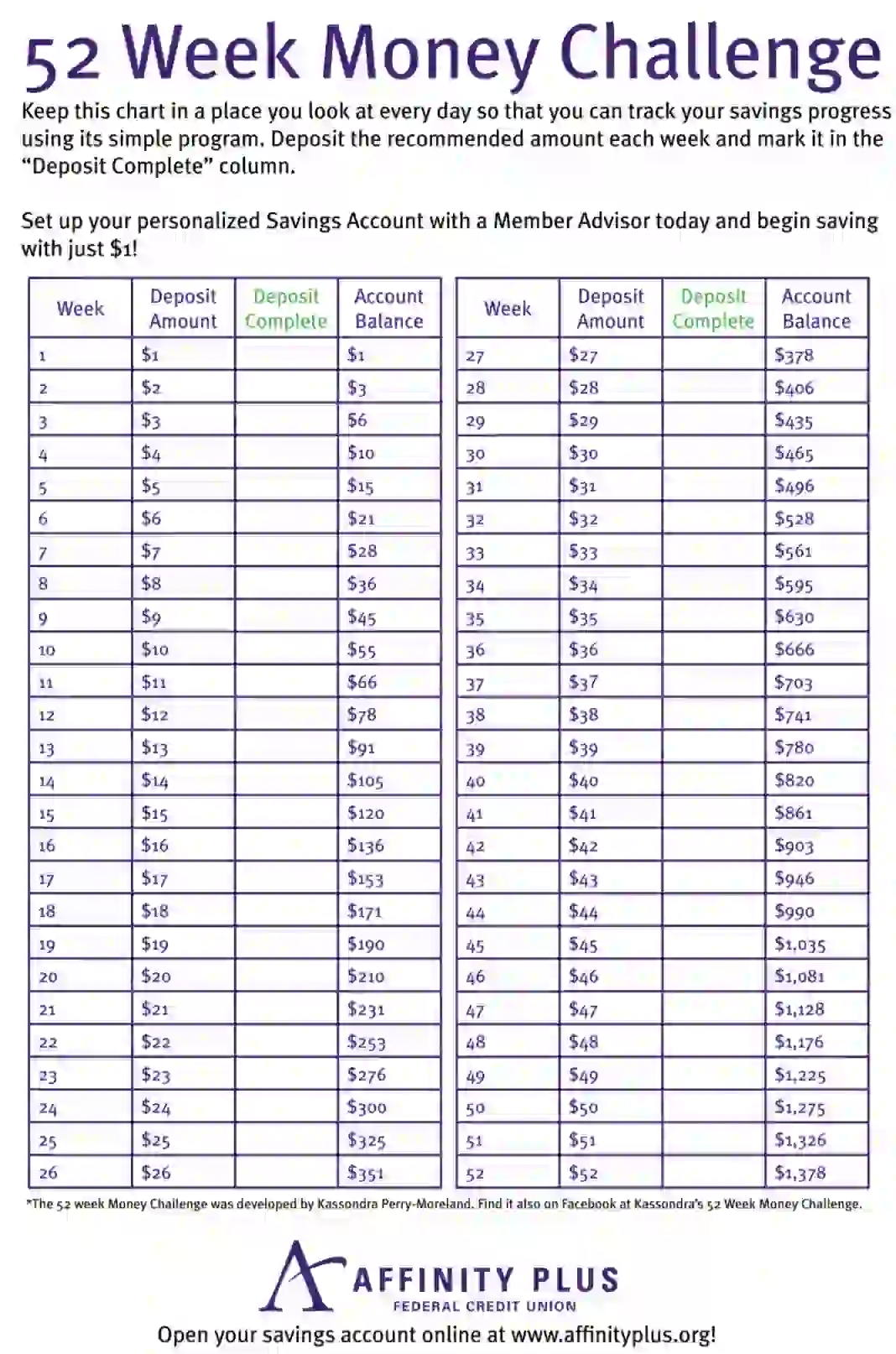

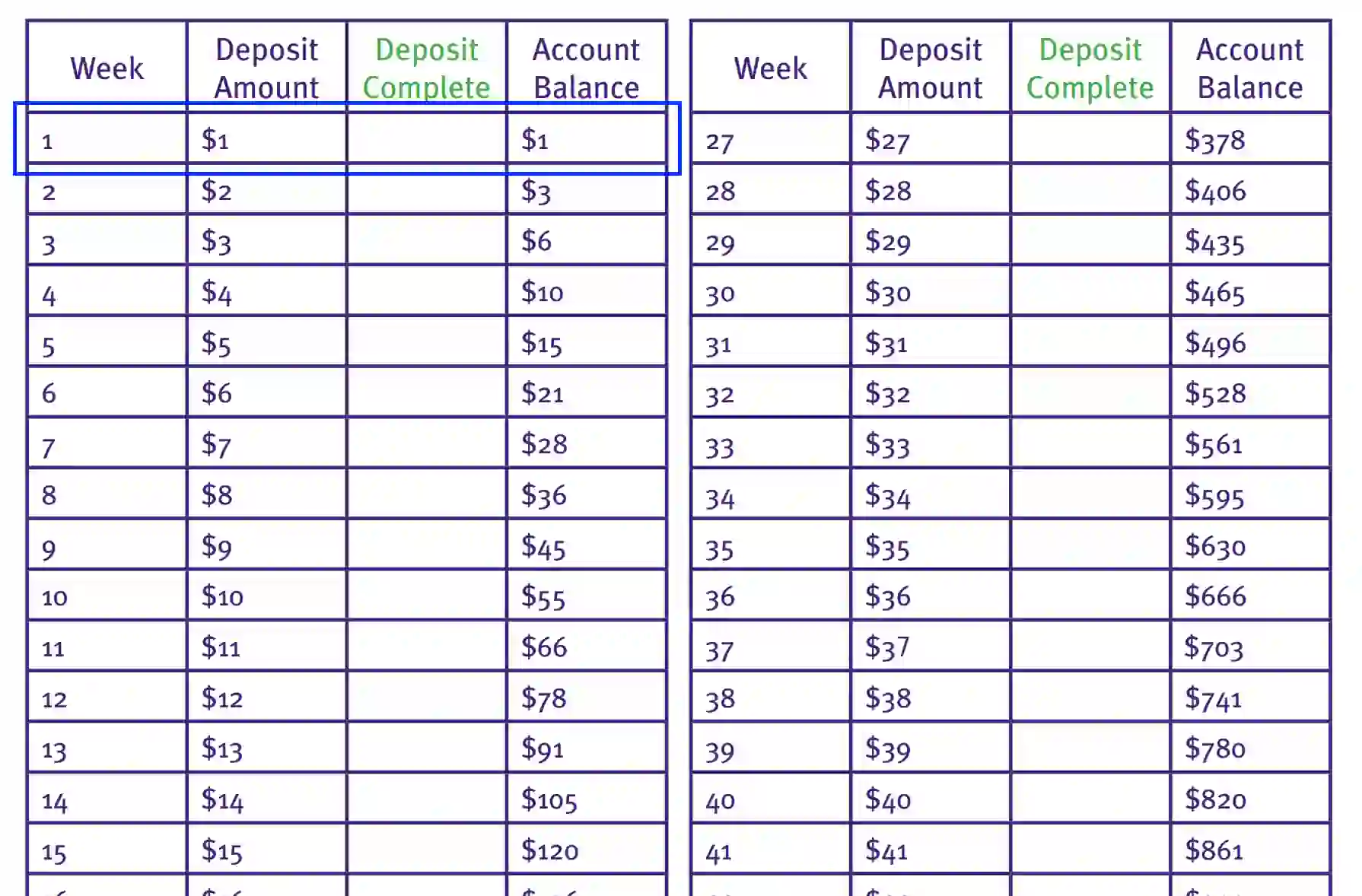

The 52 Week Money Challenge is a popular savings strategy designed to help individuals gradually increase their savings over a year. The process begins by saving a small amount of money in the first week, and then incrementally increasing the savings each subsequent week. For example, one might save $1 in the first week, $2 in the second week, and continue this pattern until $52 is saved in the 52nd week. By the end of the challenge, if followed consistently, the participant will have saved a total of $1,378. This method not only helps build a substantial savings fund but also cultivates a disciplined approach to financial management.

The challenge is particularly beneficial for those looking to create an emergency fund or save for a specific goal without feeling overwhelmed by high initial deposits. It’s adaptable, allowing participants to adjust the weekly savings amount based on their financial capability.

Other Charts and Tables

Look at some other charts and tables PDFs available for editing using our editor. Besides that, do not forget that you may upload, fill out, and edit any PDF at FormsPal.

Filling Out the Money Challenge Chart

Completing money challenge charts is pretty straightforward and doesn’t require specific skills and intimidating schemes. We inspire you to build a needed PDF file using our latest software and start your mini-accountant adventure, so you get a piece of change by the end of the year.

The chart consists of four columns:

- Week number, indicating what stage you are in at the current moment

- Deposit amount — the conventional investment one should make following the week number. Thus, for week one, this sum equals one USD, while during week 41, the challenged person should invest 41 USD.

- Deposit complete — check the slot if you managed to maintain the rules and provide the requested amount.

- Account Balance — the column shows how much money you have already saved following the challenge schedule.

The algorithm is intuitive: invest the funds and checkbox the periods to have 1,378 USD by the end of the self-contest. The final weeks might be challenging to accomplish as the sum rises period by period.

There is an alternative challenge system: you can invest money starting with the greater sum, meaning the last week investment will make one USD.

If you manage to fulfill the task, the reward will be beyond satisfying.