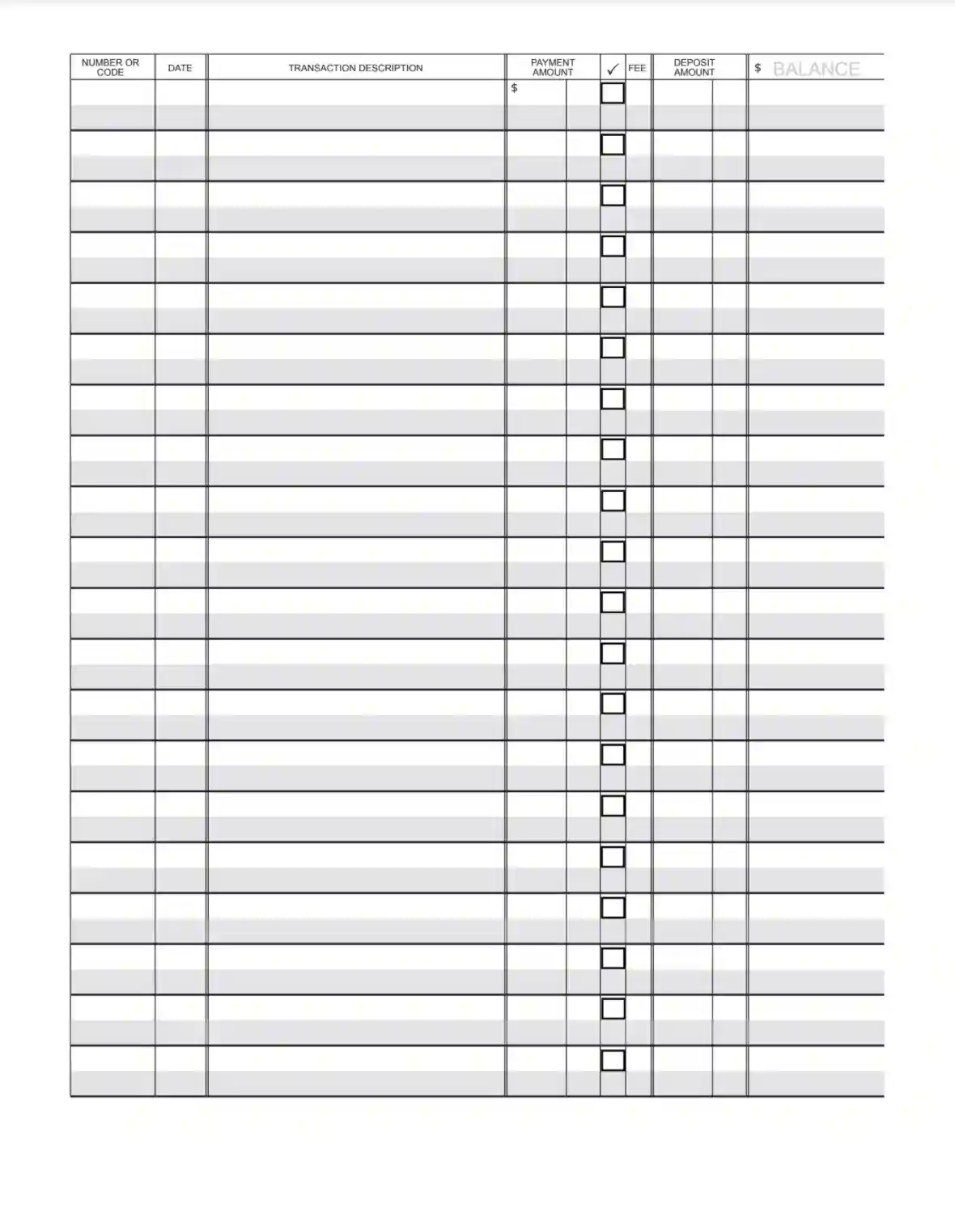

A Check Register Template is a document or tool used for recording all transactions involving a checking account, including deposits, withdrawals, and check payments. This template helps account holders maintain an organized record of their financial activities, ensuring they can track their spending, monitor account balances, and verify bank statements accurately. It often includes columns for the date of the transaction, check number, description, and the amount debited or credited, along with a running balance. By consistently updating the check register, users can avoid overdrafts, detect unauthorized transactions, and manage their finances more effectively.

The Check Register Template is especially useful for individuals and businesses who handle multiple transactions and need to maintain precise financial records. It serves as a personal accountability tool, complementing online banking systems and helping users ensure their records match those reported by their bank.

Other Charts and Tables

Need other charts and tables PDF forms? Check out the selection below to see what you’ll be able to fill out and edit with FormsPal. Moreover, do not forget that you can upload, fill out, and edit any PDF at FormsPal.

How To Complete This Journal

If you intend to use such a checkbook, carefully read the rules for filling it out. At the same time, update your check register every time you make a purchase. When filling out the form, record all amounts, transactions, and transfers so that you can control your budget as accurately as possible.

Main points of the magazine:

- Date

- Number or code

- Transaction description

- Payment amount

- Fee

- Deposit amount

- Total balance

So, first of all, number each transaction description. It is the first column. Specify the date of the financial transaction.

Next, you need to describe the purchase, indicating the amount spent. It allows you to analyze the financial situation of your business.

By the way, the table also contains a column about periodic contributions and a deposit to a personal account. In the end, you get the final balance.

You should also compare your check register with the latest bank statements to find any discrepancies.