Form 1042-S is a tax document used by payers to report amounts paid to foreign individuals and entities subject to income tax withholding in the United States. This form is crucial for documenting various types of U.S. source income paid to non-residents, including royalties, dividends, scholarships, and service compensation. The purpose of Form 1042-S is to ensure compliance with U.S. tax laws regarding the taxation of income earned within the United States by individuals and entities that are not U.S. residents or citizens.

The key role of Form 1042-S is to provide the IRS with detailed information about the income paid and taxes withheld from payments to non-residents. This form helps manage and monitor U.S. payers’ tax obligations and withholding responsibilities to foreign parties. It’s a record for the IRS and an important document for income recipients, who may need it to comply with their country’s tax regulations or claim benefits under tax treaty agreements between their country and the United States. Proper use of Form 1042-S ensures that all parties accurately report international transactions, maintaining transparency and legality in cross-border financial activities.

Other IRS Forms for Individuals

On our website, you can find more IRS forms for foreign and US citizens that are used for various life occasions.

How to Complete the Form

Every tax form may seem daunting due to its size and a great number of complicated terms that might be unclear for some individuals. Therefore, we advise you to seek legal or tax advice to ensure the correctness of the submitted information and avoid penalties in the form of fines. Typically, they can be imposed on you if you fail to submit the form on due time, if there are mistakes or inconsistencies in the form, or if you fail to deliver it to the payee (your employer). The sum you must pay for each form varies from the cause of your failure.

As a rule, the minimum penalty amount is 50 US dollars. Even if you delay the submission, you can be given a second chance. If you fail to send the form within a month after the due date, the penalty amount increases. The maximum amount that can be imposed on you is 280 US dollars for each form (in case of big delays and failure to send correct forms by August 1), which may seem a considerable sum if you have a lot of papers to submit.

We hope that you will find the instructions we provide in this article useful and insightful. In case you don’t find free legal assistance and cannot afford to hire a professional to complete the form on your behalf, you can use the guide below. However, if you still have any doubts or questions after reading the article, contact tax specialists from official organizations by phone or email. The official website of the IRS has a FAQ section where you can get an answer by inserting the information you need into the search field or scroll down to see the most common questions.

The IRS allows you to use substitute forms, but prior to creating such a document, you must compare it with the official template issued by the IRS and make sure that it has the content and format identical to the official variant. Keep in mind that each page must contain only one form.

With the help of modern technologies and access to the Internet, you can obtain a document template within a few seconds. There are several options for you: you can visit the IRS official website and search the form there, or you can make use of our advanced form-building software, which serves as your personal legal assistant to download the current template (or generate your own). Even if you have chosen the second option, we recommend downloading the instructions that are created by the IRS and relevant for 2022 on the above-mentioned online source.

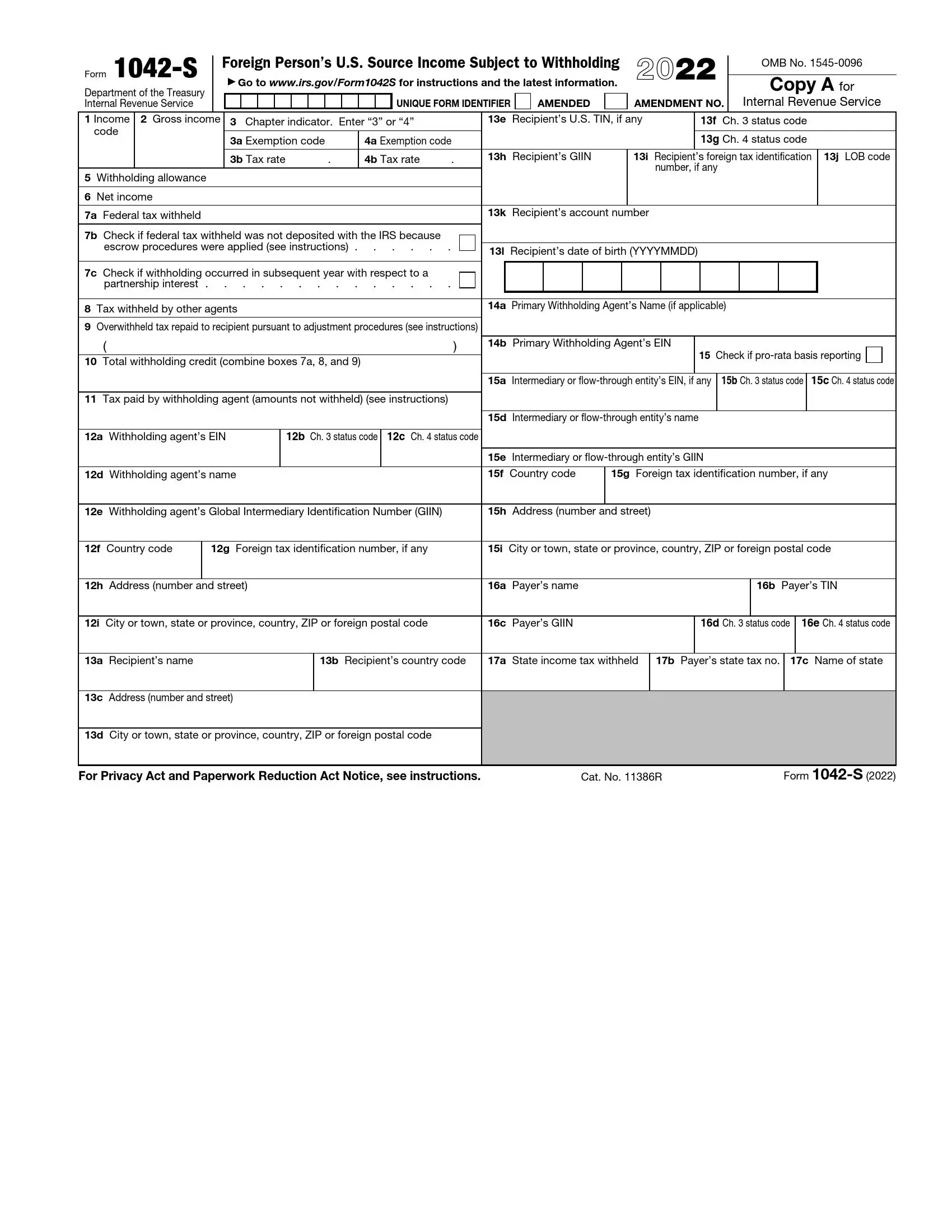

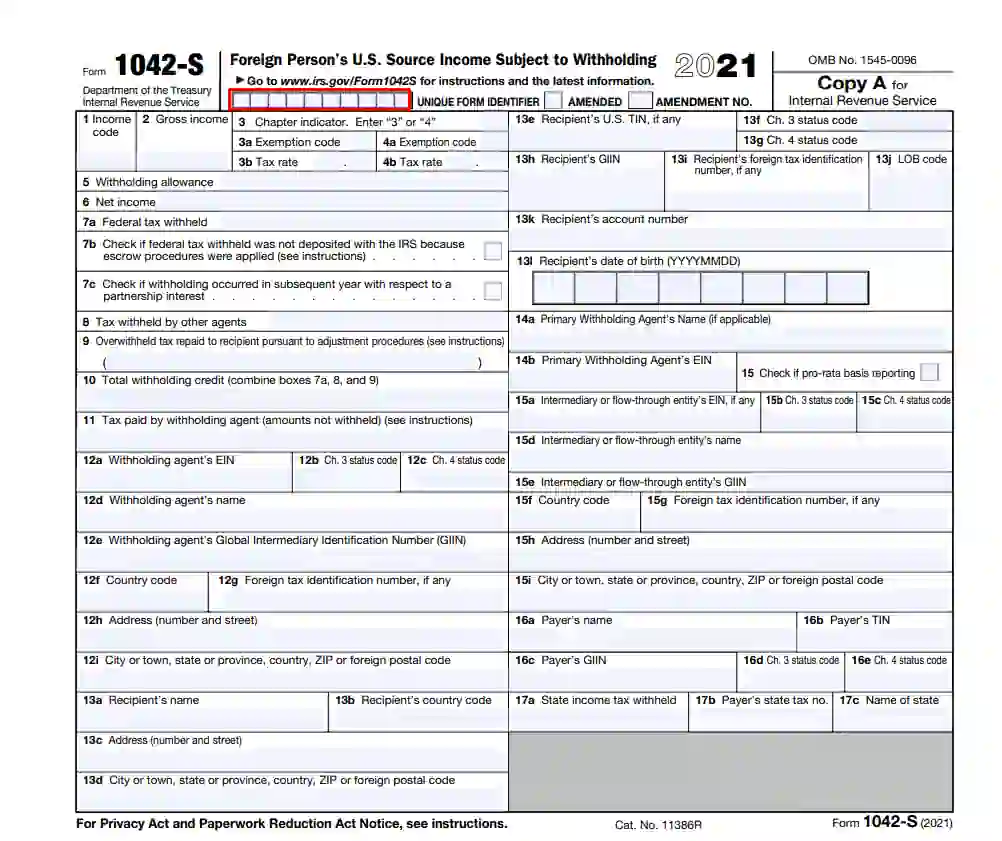

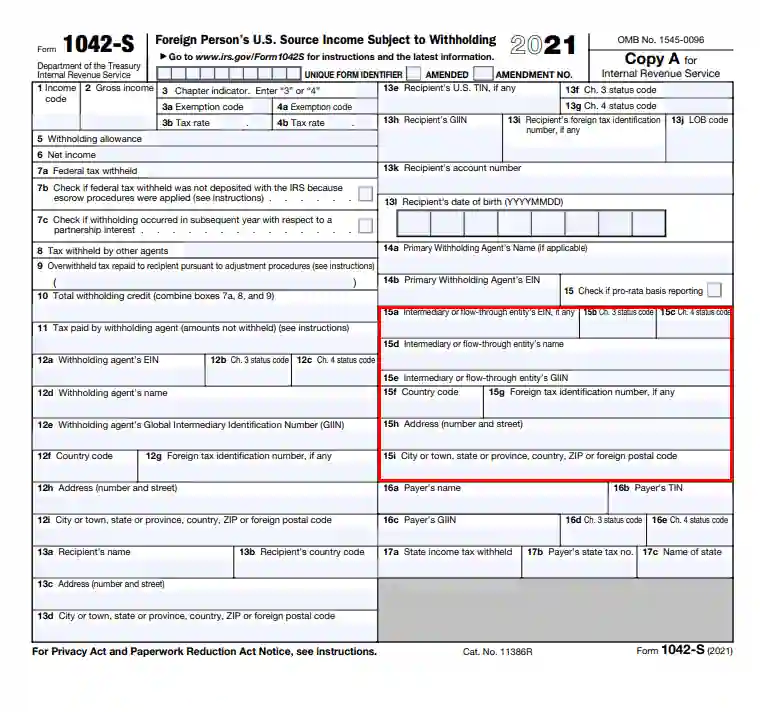

Once you have downloaded the form, you can start completing it. The form consists of eight pages, five of which have identical copies of the document. Other pages contain the filing requirements written in English, German, French, and Spanish, the list of various codes for different types of income, etc. The form structure may seem complex, but we hope that our guide below will make every part of the document clear to you. Try to follow the instructions in sequential order. Do not fill out the sections randomly.

Assign an Identification Number

First and foremost, as a withholding agent, you must insert a unique ten-digit number in the boxes at the top of the document. This number is also known as the Unique Form Identifier. It helps tax agents to understand which information is being changed and which form is the original one.

Specify If Your Form is Amended

Near the UFI, you can find two boxes. The first one is an amended checkbox. If you find out that you have made a mistake in the form after submitting it to the Service, you are allowed to make amendments to it and send a correct file later. If the form you are currently filling out is a new correct variant of the original, tick the box. Then, you must indicate how many times you have already changed the original. If it is the first time you make amendments, insert “1” in the next box.

Provide Information Regarding Income and Taxes

We have visually divided the document into several large parts. The first essential part to complete is devoted to the income received by the employee and withheld taxes. Start with Section 1 (or Box 1) and include the specific code to define the type of your income. The code should consist of two digits. Look through the IRS instructions to find the appropriate code. All types of income are gained from governmental sources; that’s why they are taxable. The most common codes are “01” (for interest paid by US obligors), “29” (for deposit interest, “30” (for OID), “06” (for dividends paid by US companies), “35” or “34” (for substitute payment).

Section 2 requires that you insert the gross value of the income received by the payee in US dollars. Include the withheld tax in this amount. Remember that one Form 1042-S is used for one type of income. In Section 6, insert the total amount of net earnings.

In Sections 3-4b, specify the Chapter under which the taxes are withheld (insert the appropriate number). If your income is not subject to taxes, provide a specific code identifying the reason for exemption. One of the most common reasons is that the payment is made not from US sources (Code “03”). The full list of exemption codes is included in the detailed IRS instructions. Besides, include the tax rate of withholding. Do not write the percent sign. If the tax rate is 10 percent, write “10.00” in the box.

Box 5 is completed only under the condition that you have entered the following codes in Section 1: 16-20, 42.

Sections 7a-11 provide information on the withholding amounts, including the total amount of taxes paid. Read the instructions in the form carefully to understand what you should write in these boxes.

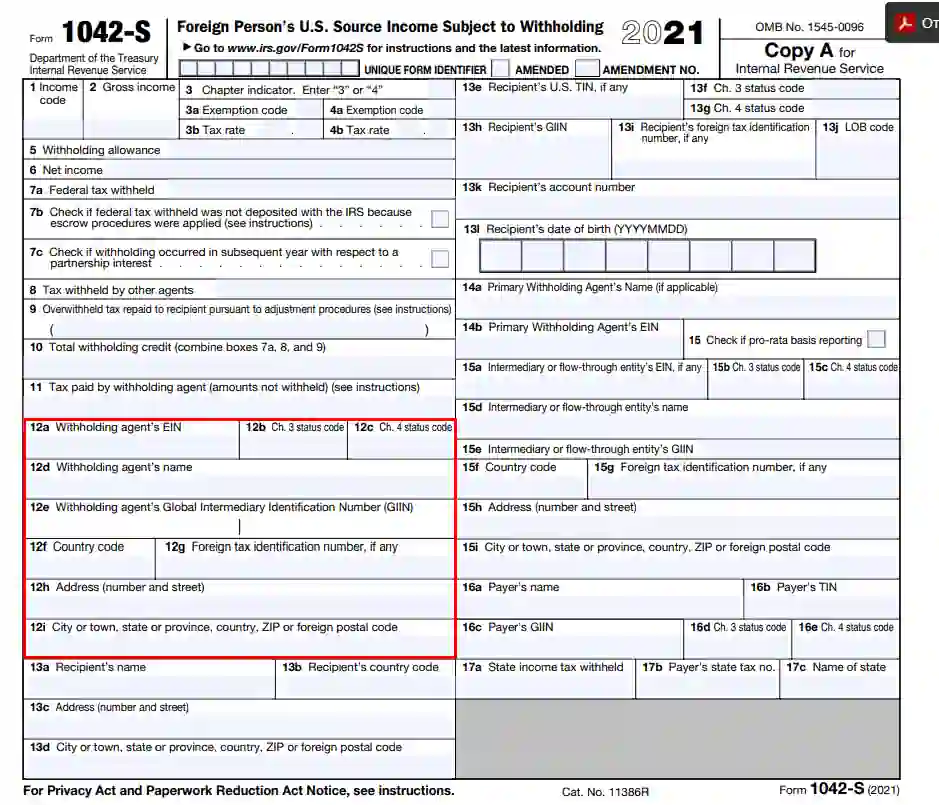

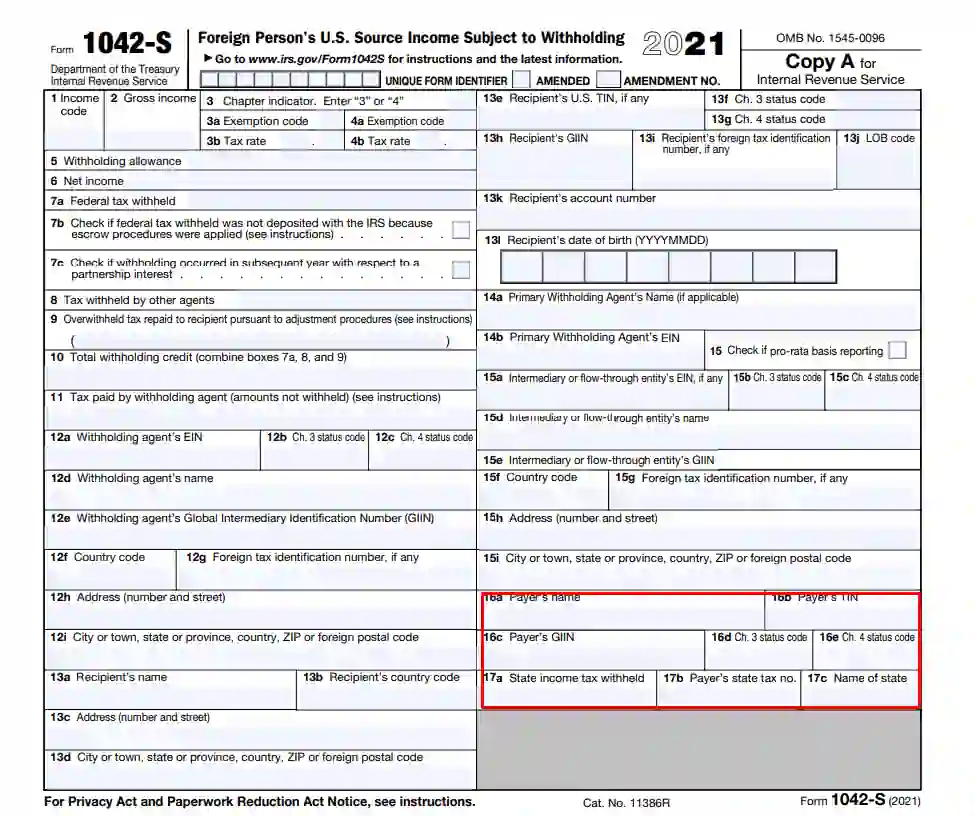

Enter the Withholding Agent’s Details

In the next massive part of the form, you are to introduce yourself. In the first line of this part, insert your EIN (also known as Employer Identification Number), which should consist of nine digits. If you do not have it, visit the Service’s official website and apply for it online. It is the most convenient option. However, there are many other ways of how you can get an EIN: you can contact the IRS by phone or send an application form (Form SS-4) by fax or mail. Indicate your status code under Chapters 3 and 4 as well.

Then, provide your full legal name, country code, foreign TIN (if you have any), and physical address in the boxes below. The address should include the number, street, city, state, and ZIP code.

In Box 12e, enter the GIIN (that stands for Global Intermediary Identification Number) consisting of 19 characters. Check the number several times to ensure its correctness.

Introduce the Recipient

The next part starts at the bottom of the left column and continues at the top of the right one. Here. You need to give basic information about the recipient (or payee) and insert the following details: the payee’s name, country code, full residential address, US TIN and Foreign TIN, GIIN, account number, date of birth, LOB (limitation on benefits) code, and status code for each chapter. Pay attention to the correct format of the date of birth.

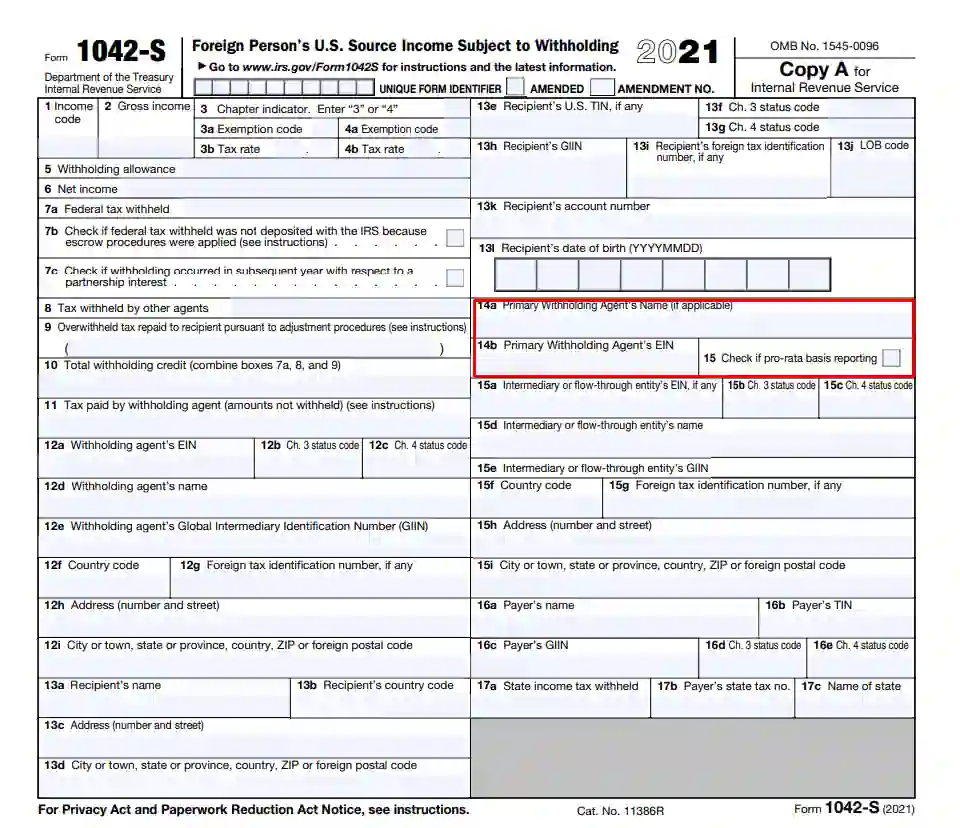

Fill Out Sections for Intermediary Agents

If you operate as an intermediary or pass-through business entity, you are to enter the full legal name of the principal withholding agent and then introduce yourself. Tick the box to indicate the pro-rata basis reporting.

As an intermediary or fiscally-transparent entity, provide the full entity’s name, indicate where it is located, and insert its country code, EIN (if you have one), GIIN, FTIN, and status code (the same details as those of the recipient and the withholding agent).

Proceed to the Payer’s Section

In the final part of the document, you are to add the payer’s name, TIN, GIIN, state tax number, status code, the name of the state in which they reside, and the amount of tax withheld from their income.

We hope that the content presented in this way no longer seems complex to you. However, we still advise you to hire a legal or tax specialist to go through this complex procedure and fill out the paper on your behalf. Legal assistance may help you save your precious time.

Once you have completed the form, you must find out what you need to do next. Below you will find more information about the filing procedure.

Submission Requirements

This form must be filed with the IRS by electronic services (through the FIRE system, specifically designed for accepting legal forms) or regular mail. If you have to submit a great number of such forms (250 or more) or act as a financial institution, you are obliged to make use of the system. If you decide to send the form via mail, obtain the correct address of the IRS office.

Apart from Form 1042-S, you are to submit other relevant forms, such as Form 1042. To learn more information about the filing process and required documents, visit the website you are already familiar with.

Another crucial thing to mention is the deadline. The official due date is March 15, regardless of the year. If you manage to deliver all the copies and amendments to the employee and submit the form to the Internal Revenue Service by the deadline, you are likely to avoid fines and other confusing situations.

If you cannot file the document by March 15, obtain and complete Form 8809 to apply for the extension of the period. Keep in mind that the form should be submitted before the deadline.