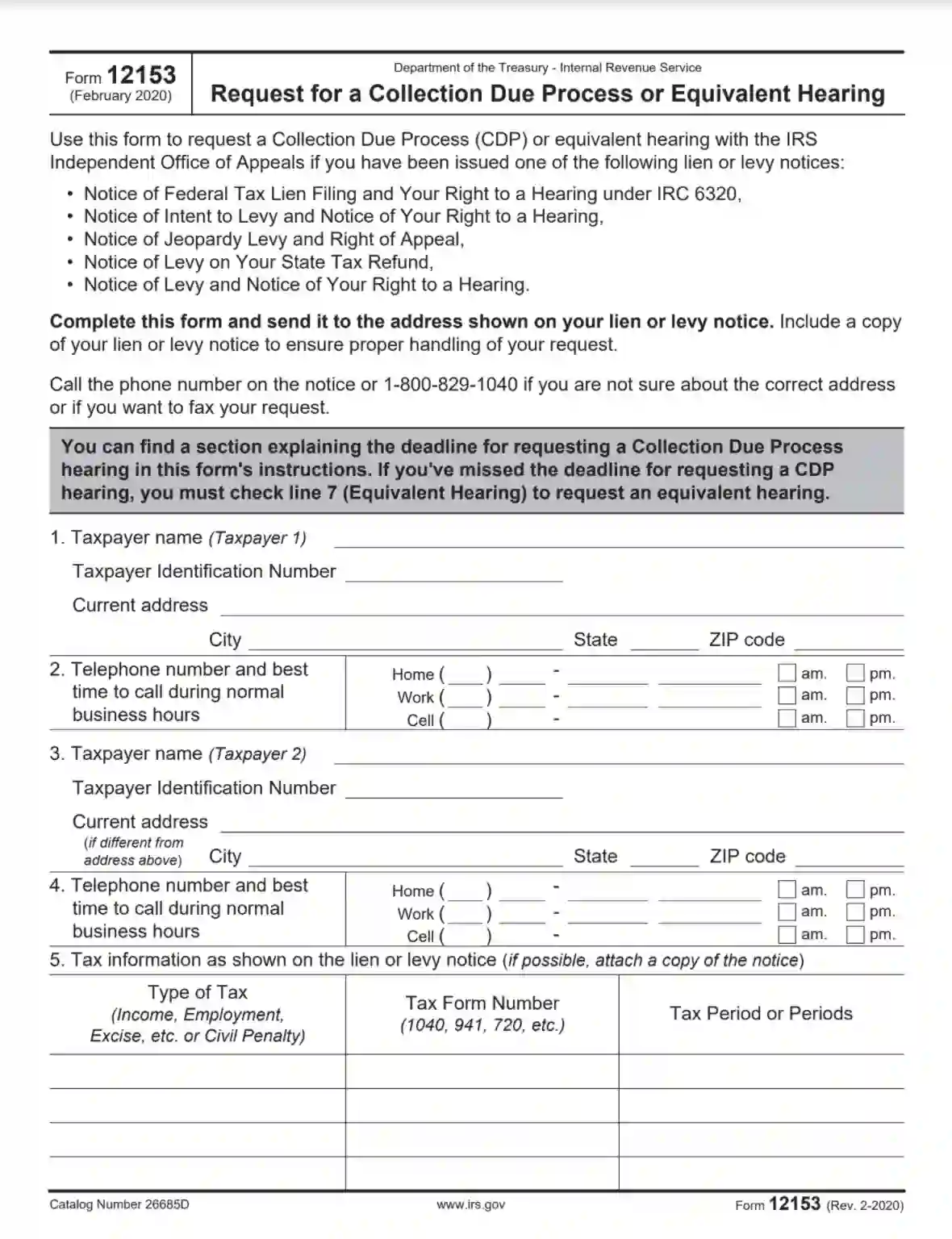

Form 12153 is a tax document called a Request for a Collection Due Process or Equivalent Hearing. It is used by taxpayers who have received a notice of intent to levy or seize assets from the Internal Revenue Service (IRS) and wish to request a hearing to address the matter. The form allows taxpayers to appeal the proposed collection action and present their case to an independent appeals officer, allowing them to resolve disputes with the IRS before enforcement actions are taken. The form requires taxpayers to provide various details, including:

- Their name, address, and taxpayer identification number (TIN),

- The tax periods and tax types for which the collection action is being proposed,

- The reasons for requesting the hearing,

- And any additional information or documentation supporting their case.

Form 12153 helps taxpayers exercise their rights to due process and ensures that they have an opportunity to resolve tax disputes with the IRS through an impartial review process. It is an essential tool for taxpayers facing collection actions, providing a formal mechanism to address issues and potentially reach a resolution without further escalation.

Other IRS Forms for Individuals

Some documents are not accepted electronically by the IRS, and IRS Form 12153 is one of them. It should be taken into account before you start filling it out. Learn more about other IRS forms for individual taxpayers.

How to Complete the Document

What you need to do first is to obtain the relevant template. Usually, taxpayers get it directly from the IRS or its official website. We recommend making use of our advanced form building software to get the necessary form without leaving our website. Besides, our PDF editor allows you to check all the information for accuracy.

The paper contains four pages, only two of which you need to fill out. The IRS does not provide a separate book with instructions for the form. Instead, it provides all the necessary information inside the form. Take your time and read the last two pages to get a full understanding of the procedure.

Below, you will find a comprehensive guide on completing the form. Although the form has a lot of instructions, we advise you to follow it step by step to avoid any mistakes that may lead to rejection or other confusing situations.

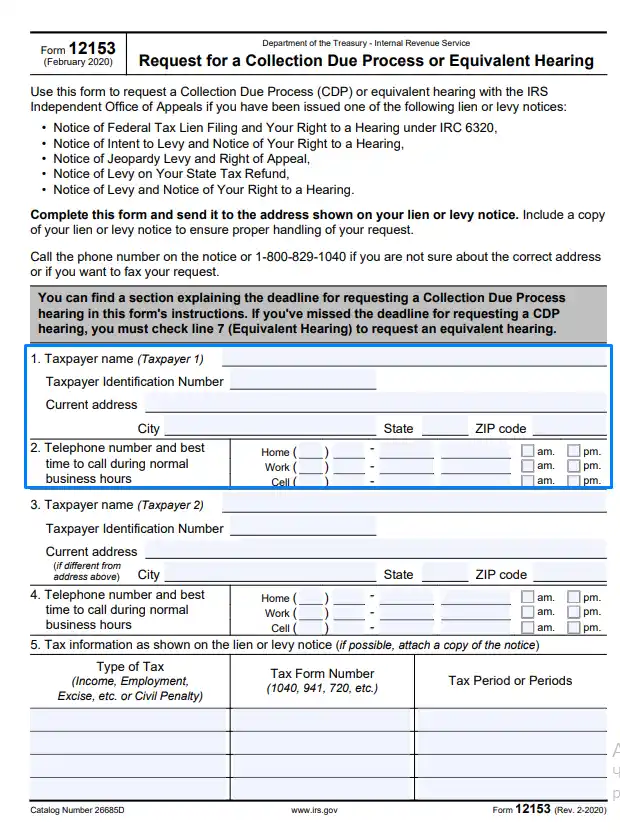

Enter the Taxpayer’s Personal Details

After you have read the instructions at the beginning of the document, you can proceed to the first part: add your full legal name, Taxpayer Identification Number (or TIN), and physical (current mailing) address, including the state city and a ZIP code.

Leave contact details and specify the time that is most convenient for you to receive phone calls. You can include home, work, and cell numbers.

Add Personal Data for Taxpayer 2

In this section, you are required to include basic information about the second taxpayer (if there is any). The list of details comprises the same items as the first part of the form: the name, address, phone numbers, best time to call. Mind that you do not need to write the address if it is not different from the address in the first part.

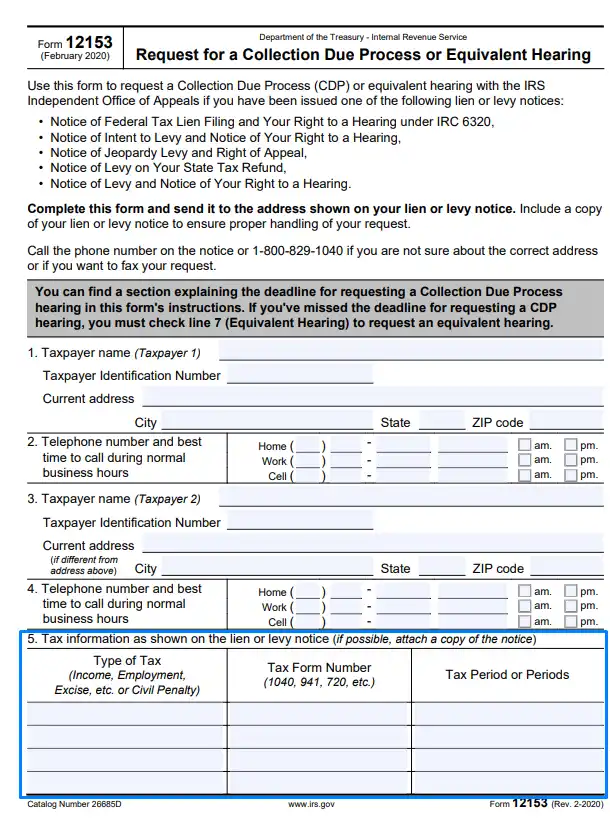

Provide Tax Information

Here, you, as a taxpayer, must include details with regard to your taxes: state whether it is an individual income tax or any other type of tax (the left column), indicate tax form number (the column in the middle), and specify the tax period(s) (the right column).

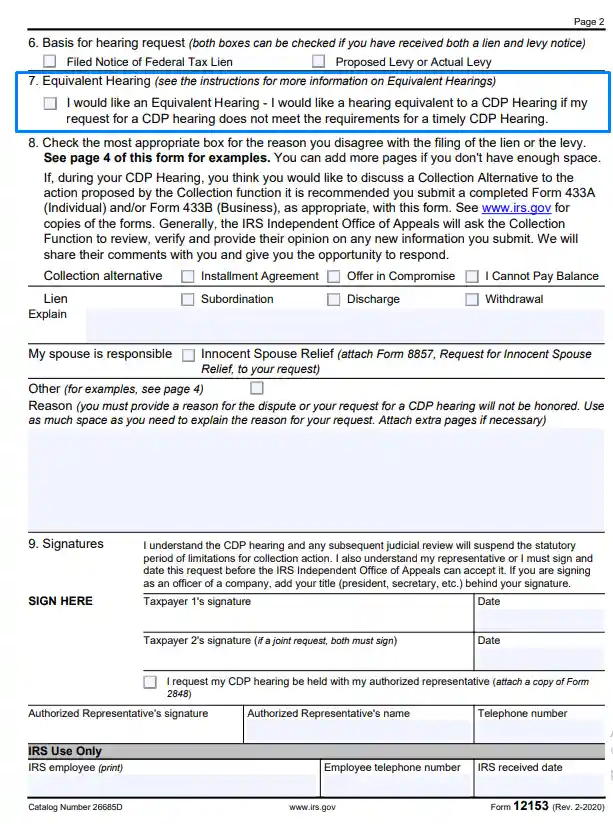

Specify the Ground for Your Request

As we have mentioned above, before the IRS actually seizes your assets, you will get a series of certified letters of two types: the Federal Tax Lien Notice and Levy Notice. In this document part, you can state what letter you consider as a basis for your request. If you have received both types, you can check all the boxes provided.

Request for Equivalent Hearing

Here, you need to check the box only if you have failed to file the form due date for a CPD hearing. Please, read the instructions provided on the last page of the form to get more details.

State the Reason for Your Request

In this section, you need to explain why the IRS does not need to enforce the collection of a debt or to put a lien. If you can suggest alternative ways of dealing with the debt, choose them among the boxes.

There are two alternatives for collection actions:

- Installment Agreement — a payment plan according to which you make payments every week or month until your debt is paid in full

- Offer in Compromise (also known as OIC) — a type of settlement that states you are going to make a payment smaller than the actual debt amount.

If you cannot pay your taxes due to the following reasons, check the third box (“I Cannot Pay Balance”):

- Incurable mental or physical illness

- Excessive medical bills

- Unemployment

- Expenses exceeding your income, etc.

If you want to offer other methods of dealing with the lien against your property, you can do it in this section of the document. You are provided with three options:

- Discharge — removing a particular property from the lien

- Withdrawal — removing the Lien Notice from public records

- Subordination — making an IRS lien secondary to a non-IRS lien

Keep in mind that you have to write the reason for your request. For example, you are allowed to withdraw the lien if you have agreed to an Installment Agreement method of debt paying.

If you think that your spouse (either former or current one) should be liable for the debt, you can check the box to claim that you are an innocent spouse. In this case, send Form 8857 along with Form 12153.

The large blank section below is meant to state the legal reason to request a CPD hearing. For example, if you have paid your debt in full or part of your taxes, indicate it here.

Sign the Form

Before signing the form, double-check the information you have provided and read the statement in the signature section. Finally, put your signature and the current calendar date. The second taxpayer is to do the same if it is a joint request you are filing.

If you appoint a representative to attend a CPD hearing with you, they also need to validate the form with their signature. Don’t forget to include the representative’s name and phone number.