Form 1310, titled “Statement of Person Claiming Refund Due a Deceased Taxpayer,” is a form individuals use to claim a refund on behalf of a deceased taxpayer. This form is necessary when a refund is due to someone who has passed away, and the refund check needs to be issued to another person, such as a surviving spouse or the estate’s executor. Form 1310 provides the IRS with the information needed to ensure the refund is properly issued to the correct individual, detailing the claimant’s relationship to the deceased and whether they are legally entitled to the refund.

The primary purpose of Form 1310 is to facilitate transferring the tax refund of a deceased person to the appropriate beneficiary or legal representative. This form helps the IRS verify the identity and legal status of the person claiming the refund, preventing potential fraud and misallocation of funds. By accurately completing and submitting Form 1310, individuals can efficiently manage the tax affairs of the deceased, ensuring that any owed refunds are properly redirected and settled according to legal and tax regulations.

Other IRS Forms for Individuals

Different life situations might happen, and you might have to file various IRS forms. Check what other IRS forms you may need.

How to Fill Out and File IRS Form 1310

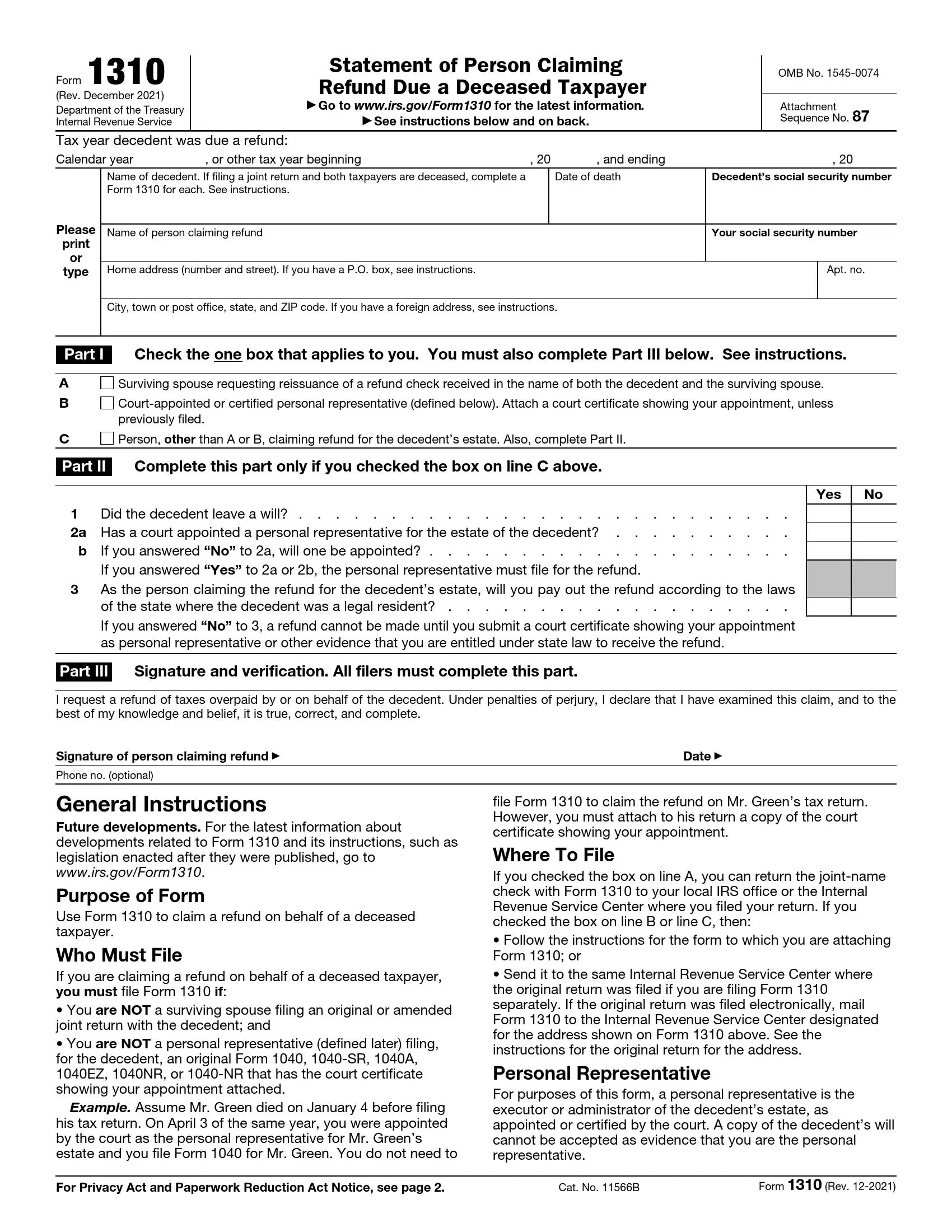

The document consists of three general sections and an authorization part. You are empowered to download the needed form on the IRS official web portal. Also, we offer our PDF-building software to generate and print out the updated template so that you could avoid spending much time browsing for the required paper. Follow our illustrated guidelines to fill out Form 1310 with minimal effort.

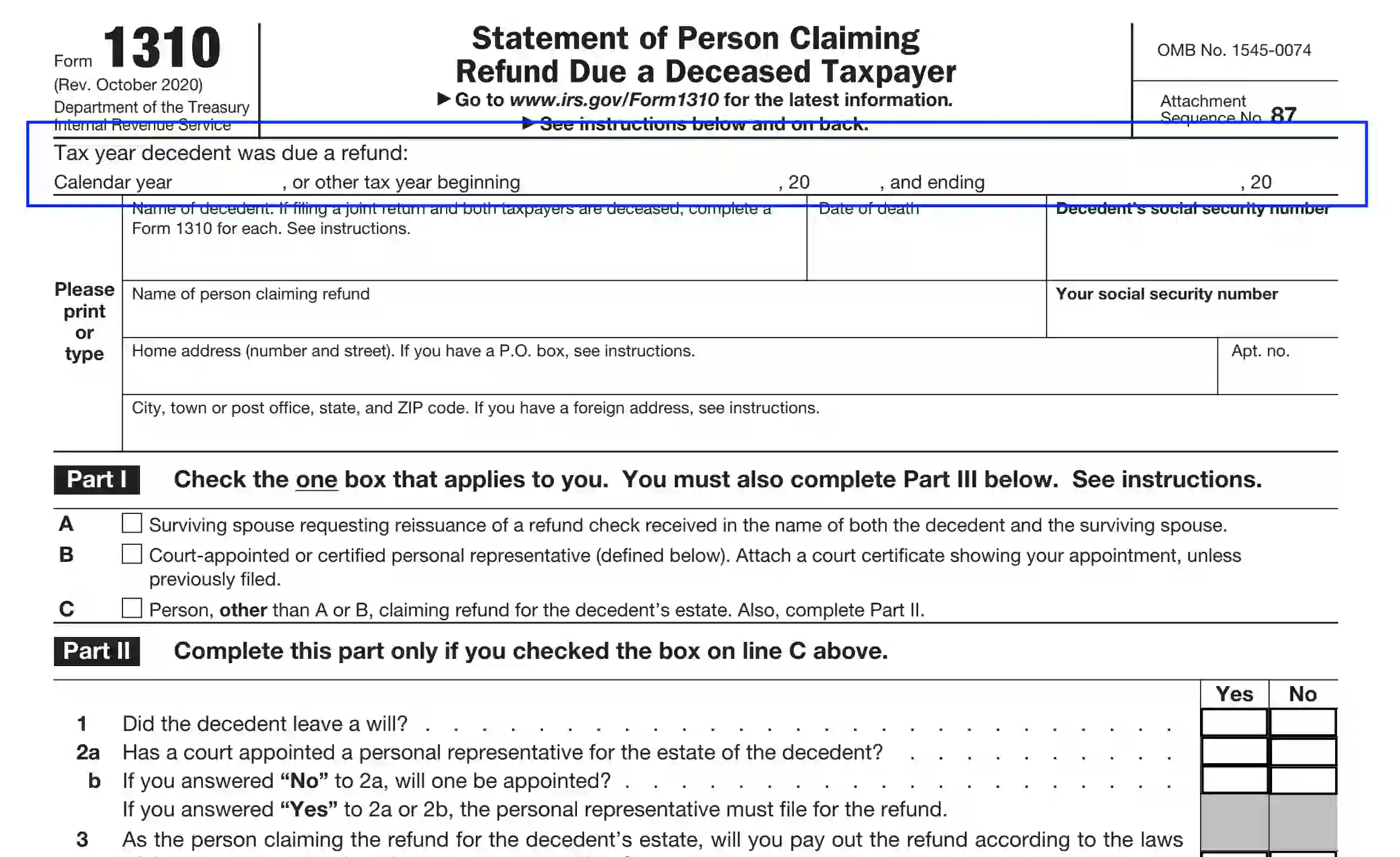

Specify the Tax Year

Begin completing the document by entering the tax year the deceased was eligible for a refund; insert the year or any other period specifications.

Complete the Heading Part

Here, the preparer needs to enter the claimant’s and the decedent’s personal and tax data. Disclose the following info step-by-step:

- The decedent’s name;

If the applicant is preparing a joint template claiming a refund for both deceased spouses, make sure to file two separate 1310 Forms.

- Date of death;

- Decedent’s SSN;

- The claimant’s name;

- Claimant’s SSN;

- Living address, including the unit and apartment number, street, city, state, and ZIP

If the claimant has an address outside the US territories, submit the required info avoiding abbreviations and contractions. Enter the city, province (region), and country. Also, include the postal code details.

- O. Box, but only in case the correspondence is not delivered to a living address.

All data must be printed or typed in black ink. The applicants should avoid handwriting and colorful materials.

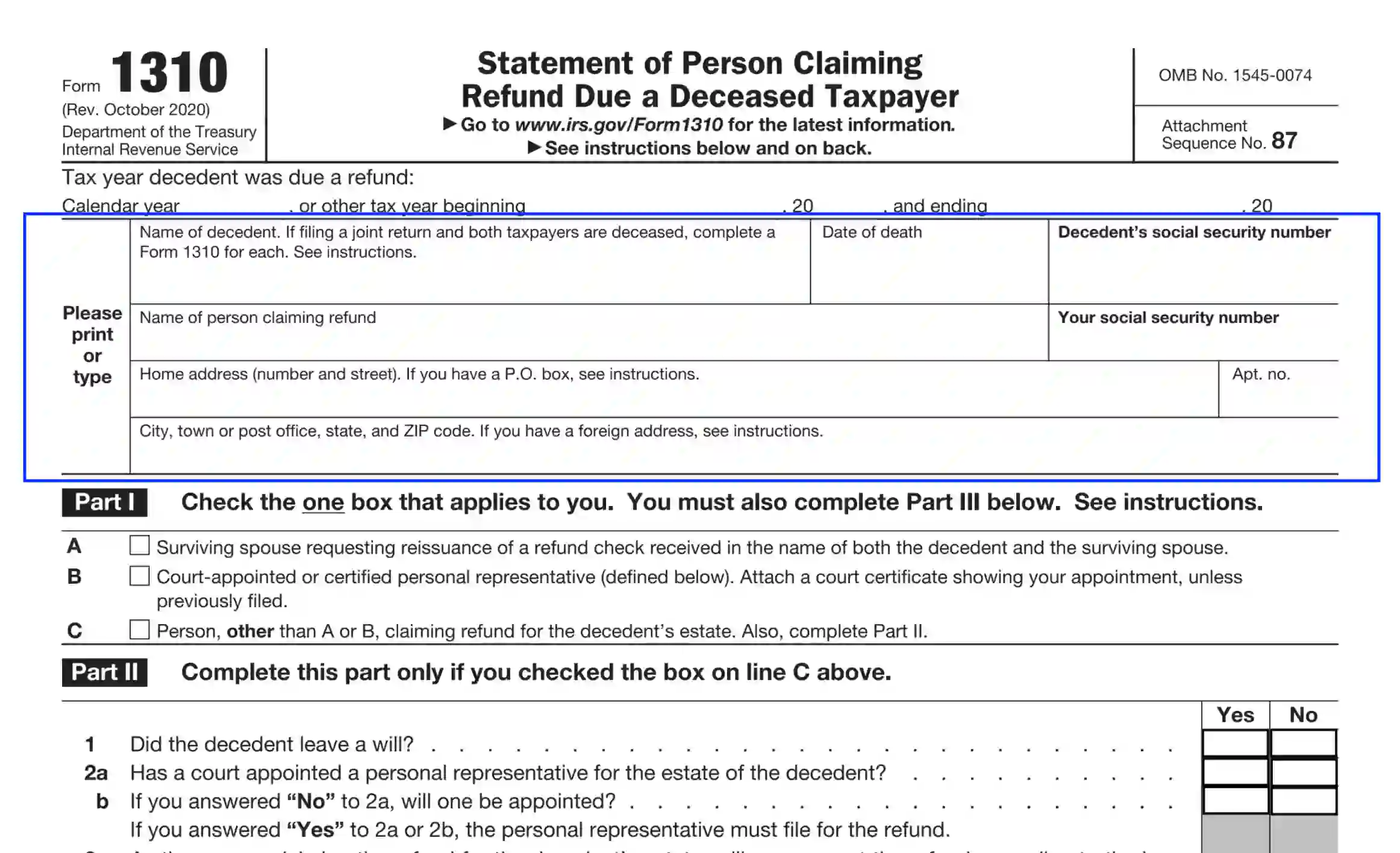

Identify the Status of the Claimant

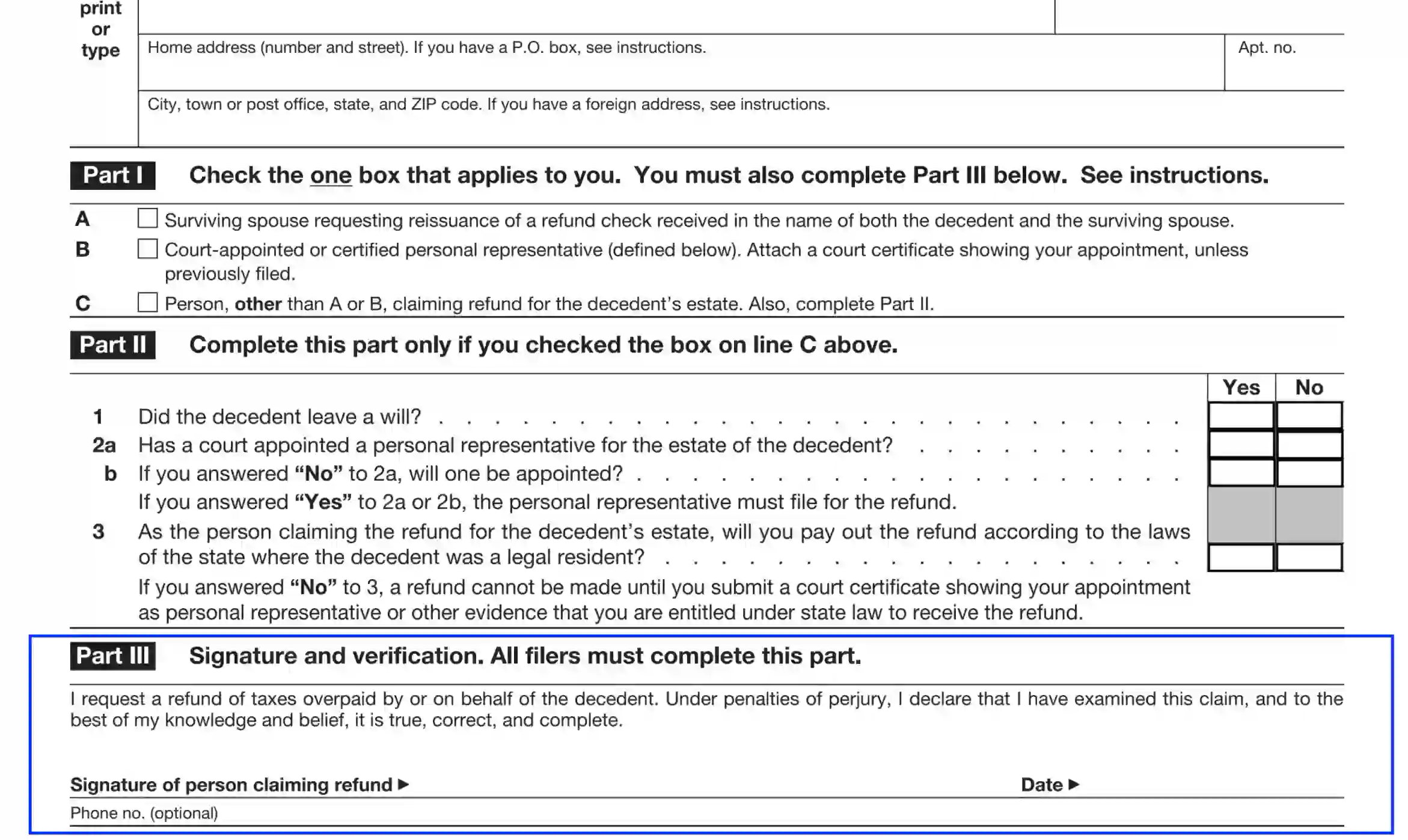

In Part I, the preparer should define the status and relation the claimant has, as well as their grounds to apply for the deceased’s refund. You are entitled to select one option that suits your case the most:

- Alternative “A” is executed by the surviving spouse who has received the compensation check in their name and the name of the deceased. After filing the respected 1310 report, the surviving spouse will be granted a new paycheck.

- Select option “B” if the claimant is a court-designated representative and can provide licensed appointment proof. If the certificate has already been filed with the IRS, disclose the corresponding note in the form as follows: “Certificate Previously Filed.”

- Select alternative “C” if you, as the claimant, are neither the surviving spouse nor the designated-by-law agent. In this case, you also need to have the death certificate or other death proof provided by the government at hand. You mustn’t attach and file the death certificate and keep it for your records to declare if requested.

If the applicant is qualifying for the A or B status, proceed to Part III and authorize the form. If the claimant has selected alternative “C,” let them complete Part II before signing the paper.

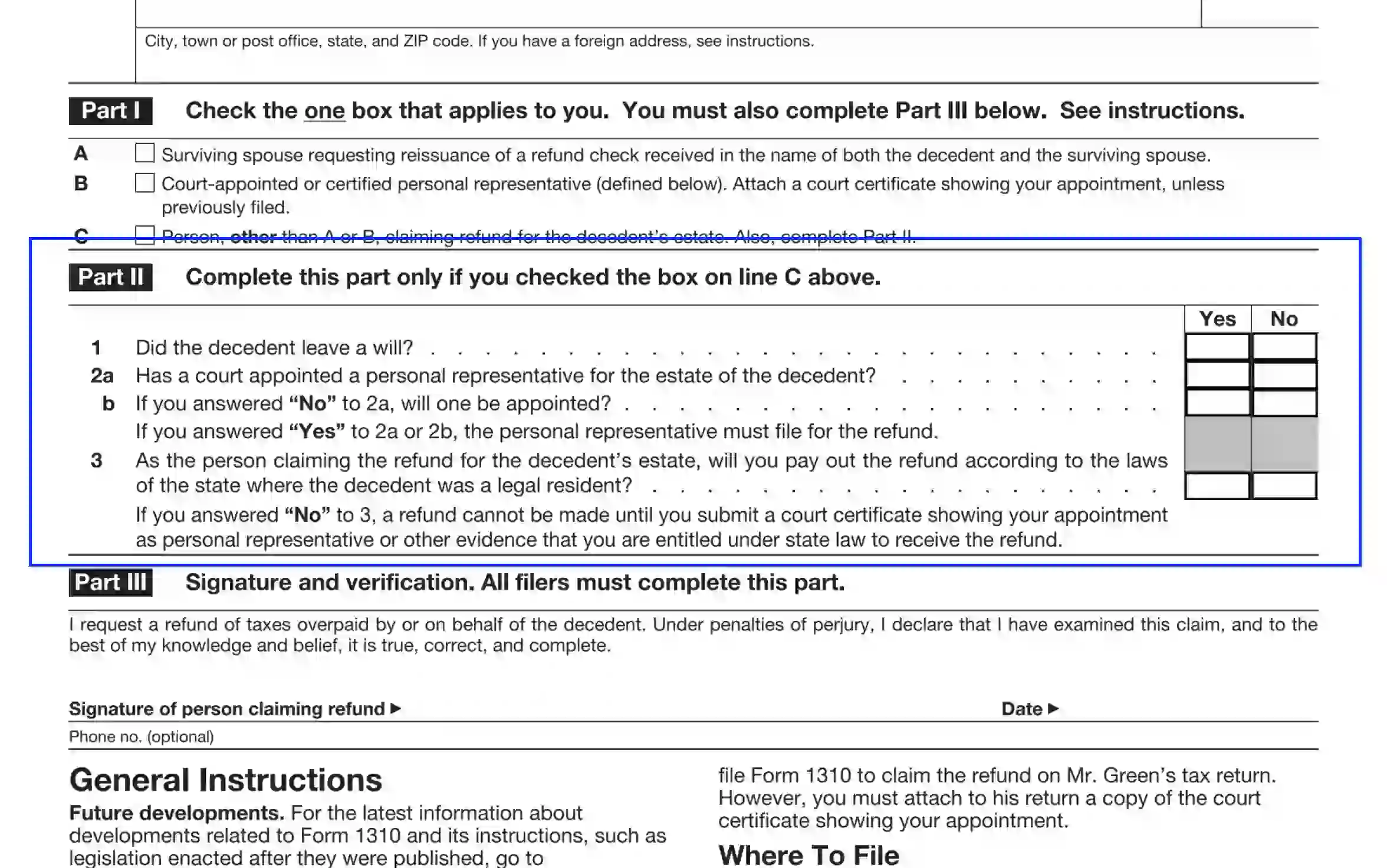

Answer to the Part II Poll

This section is tailored by the applicant if they are neither the decedent’s spouse nor the designated-by-court agent. Complete questions 1 through 3, selecting the appropriate “Yes” or “No” alternative. Here, you should clarify the following aspects:

- Possession of the valid will;

- Licensed agent presence;

If positive, the claimant is not eligible to apply for the refund.

- Real estate liabilities;

If the claimant applies for the deceased’s estate but refuses to pay the estate liabilities, they are not eligible to file this form.

Verify the Document

In the final part of Form 1310, the claimant should append their signature and place the current calendar date. Before authorizing the paper, re-read the disclosed info and sign it only if everything is authentic and correct.

Also, you are encouraged to enter the contact phone number. The request is optional; however, it is recommended to submit these details in case of emergencies and if additional paperwork is needed.

File the Paperwork with the IRS

The destination address depends on the variant the claimant has selected in Section II. If you are a surviving spouse and have checked the “A” alternative, you are allowed to serve the 1310 document to the district IRS department.

If you select the “B” or “C” alternative, ensure to attach it to the current tax report and follow the directions on the tax form or serve the completed 1310 form to the address where the initial tax return was sent.