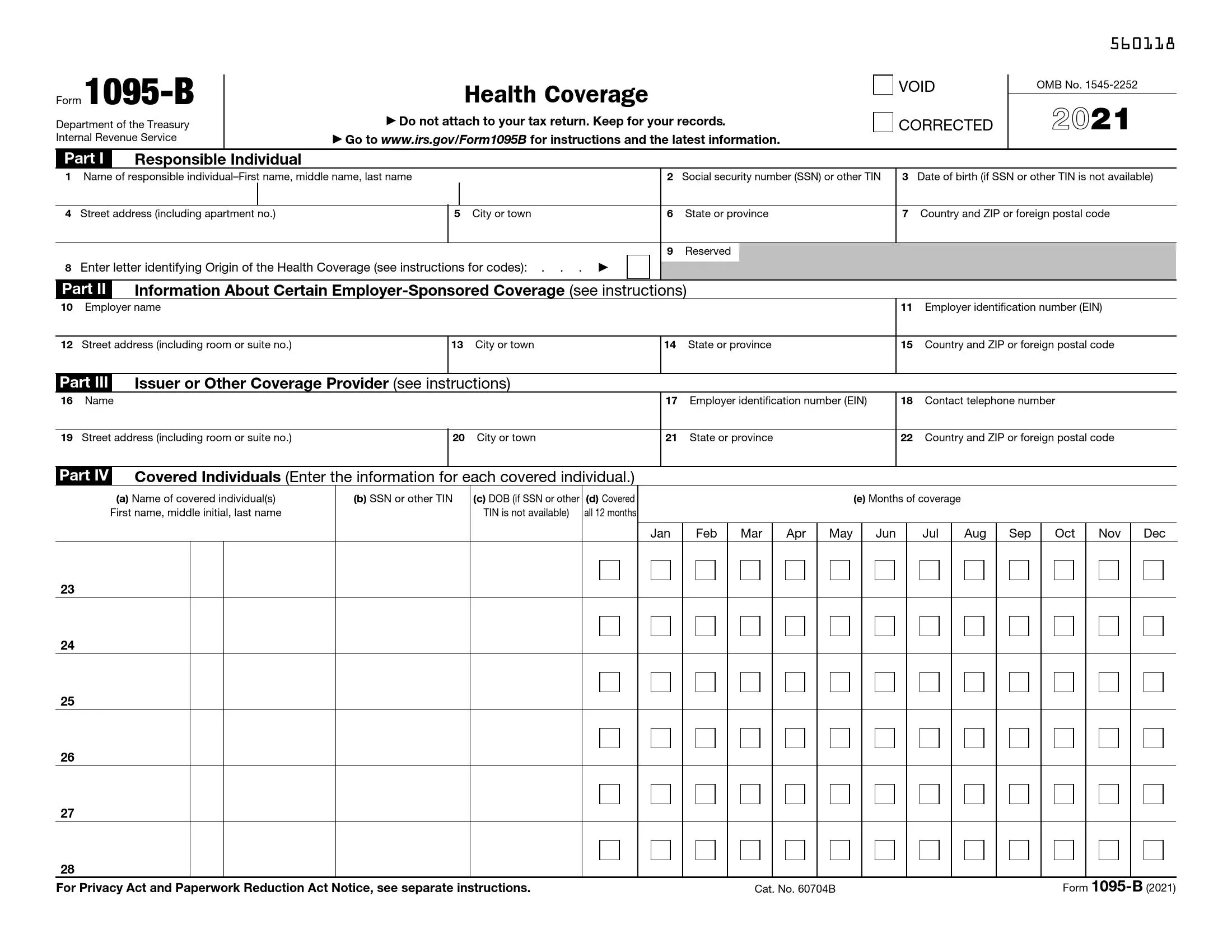

Form 1095-B, titled “Health Coverage,” is a tax document provided by insurance companies and other health coverage providers, including small employers and government agencies like Medicare or Medicaid. It confirms that individuals and their families had health insurance coverage during the year. This form lists information such as the type of coverage, the months during which the coverage was in effect, and the individuals covered under the policy. Form 1095-B is critical for individuals to prove that they met the Affordable Care Act (ACA) health insurance coverage requirements, helping them avoid penalties for not having health insurance.

Form 1095-B serves as proof of health insurance coverage when individuals prepare their federal tax returns. Although the individual mandate penalty for not having health insurance was reduced to zero at the federal level, this form may still be required for state tax purposes in states that have their health insurance mandates. Additionally, Form 1095-B helps individuals confirm that the coverage reported by insurers matches their records, ensuring they have documentation to support their tax filings and state insurance requirements. This form plays a crucial role in maintaining compliance with healthcare reporting requirements and assists taxpayers in managing their health insurance information.

Other IRS Forms for Individuals

Along with the form to report information about health coverage in your family to the IRS, there may be some other IRS forms for individual taxpayers that you might need. Check the forms we prepared for you below.

How To Fill Out IRS Form 1095-B

It is not complicated to complete this paper: it will take you approximately 1 minute based on the information in the official instruction. Here is a comprehensive guide on filling it out line-by-line.

If you have some completion issues, please use the software on our website to ensure you fill it out correctly.

1. Fill In Personal Data

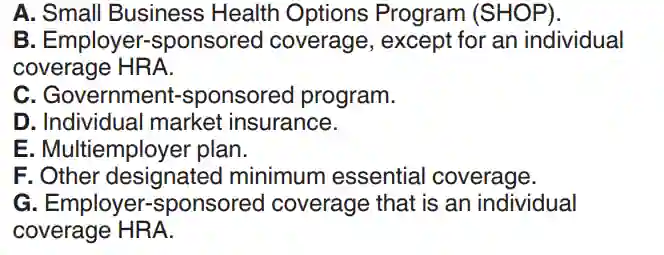

You need to enter the name, contacts, and social security number of the responsible person in the first part of the form. A responsible person is a taxpayer or a trustee of a person whose name is indicated in the insurance. If you do not mark SSN, you should fill in the birth date in line 3. As regards Box 8, you should put the letter based on the type of your insurance. The list of the letters is below.

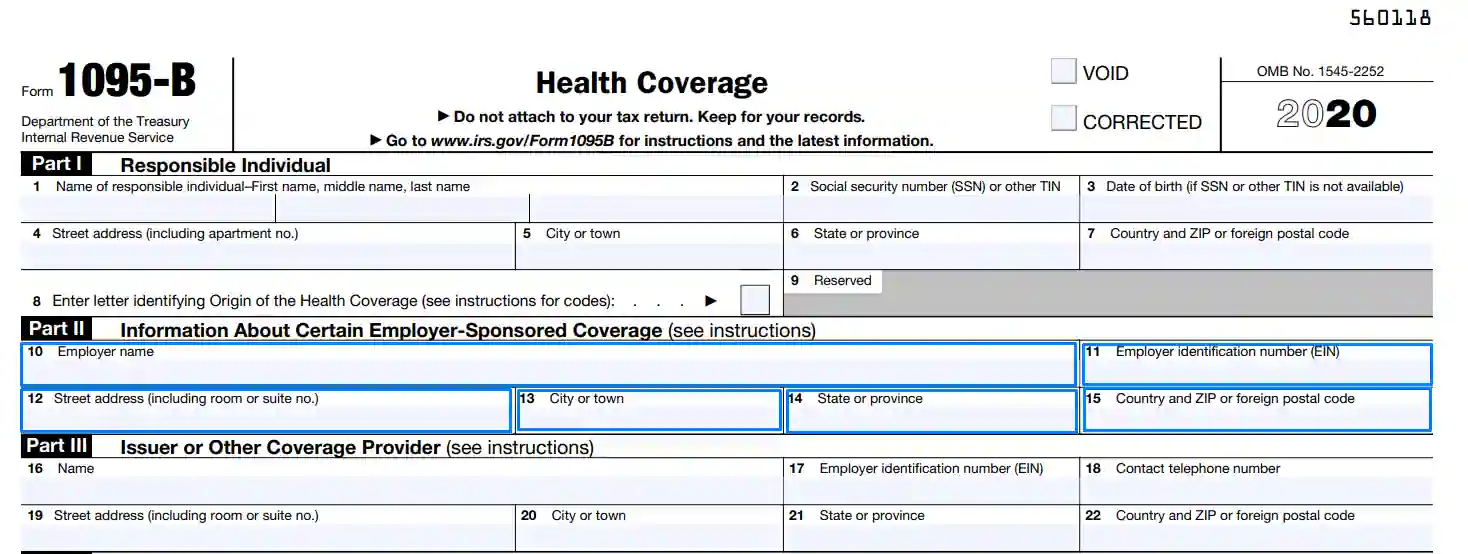

2. Enter Information About Employer

The second part is not required for everyone — fill it only if the employer is the provider of coverage for you or your family. Rely on Box 8 you completed earlier to clarify whether you need to use Part 2 or not if you enter letters A and B except for group-based plans and self-insured coverages.

Here, you need to indicate the name and detailed address of the employer and their EIN.

3. Describe Provider of Insurance

You should give the information about the insurance company in the third part of this document. Introduce the name and physical address of the insurer here. Do not forget to put the contact telephone number of the provider in box 18 to make it possible to contact the insurer. Write its EIN in line 17.

4. Introduce Other Insured People

If the coverage is available for family members, you should fill in all the same data for them. Give the names and identification numbers for each person having the insurance. Provide date of birth in part C of the table if you do not enter the TIN of the person.

The right part of the table is dedicated to the dates of insurance coverage. Check the box in column D if the person was protected for the whole year or put ticks to particular months of when the insurance was used.

5. Use Additional Page (Optional)

If there are more than six insured members of the taxpayer’s family, fill the table on the last page in the same way you did in step four.

If you want to correct data in the form but you have already sent it, you can use the new one. Complete it again and put the cross in the box with corrections. Then you should file it to the same address as the previous one.

Where to File Form 1095-B

You can file the form online or via mail. If you choose the second option, you can find the suitable address of the IRS below. As regards the electronic way of filing, you can upload it on the website of the IRS.