Form 14039 is a tax document known as the Identity Theft Affidavit. It is used by taxpayers to report suspected identity theft to the Internal Revenue Service (IRS) and to request assistance in resolving issues related to fraudulent use of their Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN). The form helps the IRS investigate identity theft cases and take appropriate action to protect the taxpayer’s account and prevent further fraudulent activity.

The form requires taxpayers to provide detailed information about the suspected identity theft, including:

- Their personal information, such as name, address, SSN or ITIN,

- A description of the fraudulent activity,

- And any supporting documentation, such as copies of identity theft-related notices or correspondence.

By submitting Form 14039, taxpayers alert the IRS to potential identity theft and initiate the process of resolving the issue. The IRS may use the information provided on the form to place identity theft markers on the taxpayer’s account, issue an Identity Protection PIN (IP PIN), and work with the taxpayer to correct fraudulent tax filings or other unauthorized activity.

Other IRS Forms for Individuals

Identity thefts might happen to the best of us, as well as various other life situations. Read what other IRS forms are commonly used by our website visitors.

How to Fill Out the Template

If you encounter tax fraud like this, document completion and sending are compulsory. And if you need to create the document, you have to find the proper template first. It can be found either on the Service’s site or here. We offer convenient form-building software that will generate the IRS Form 14039 for you quickly.

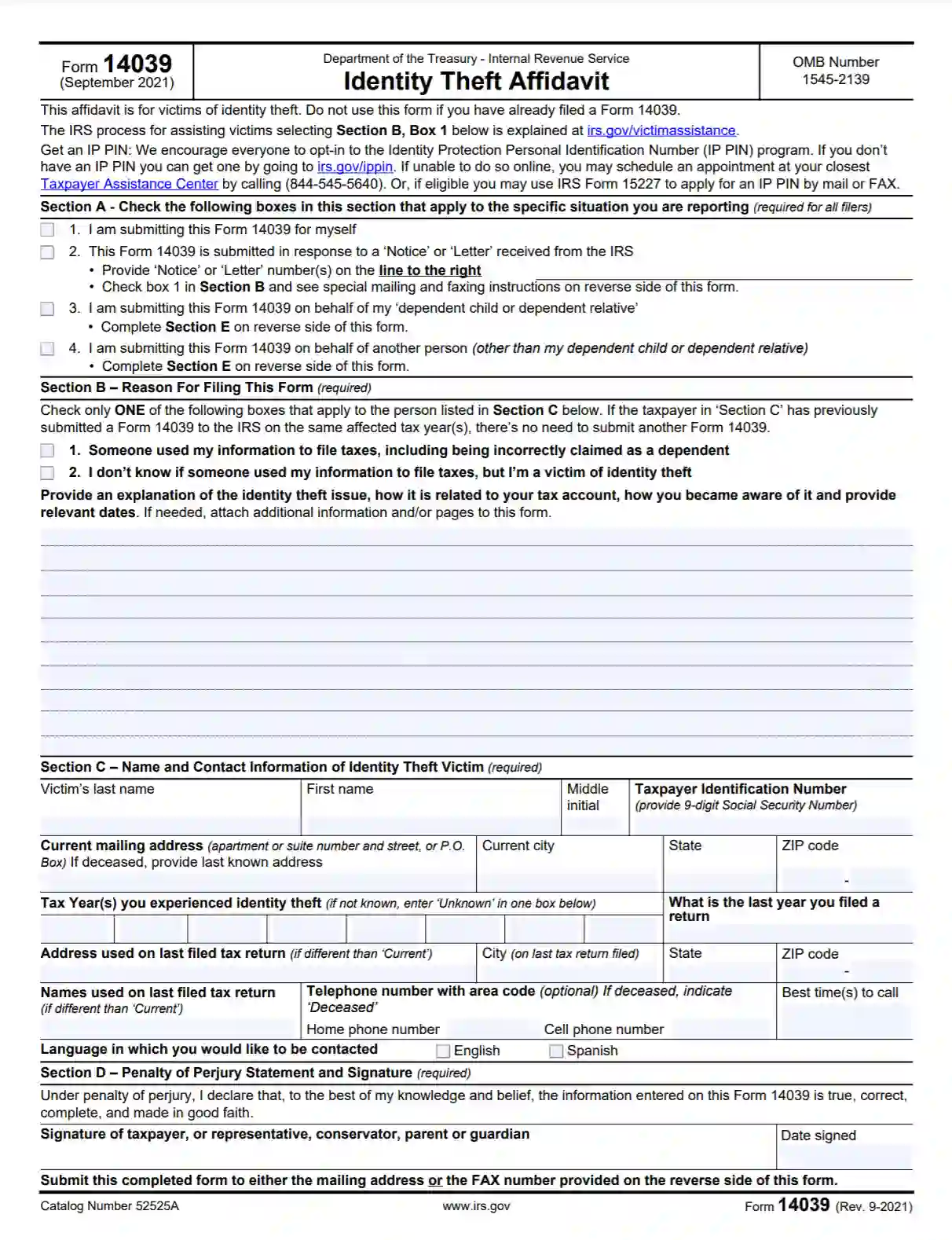

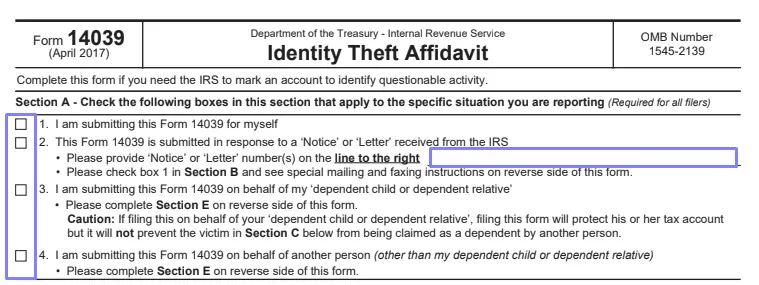

1. Identify Yourself

In the first section, you will indicate who you are in this case and define which form’s part you must complete. You have four options here:

- A person who had faced the fraud and identity stealing

If this is the suitable answer, your sections to complete are B, C, and D.

- A person who completes the template for someone else

Besides mandatory sections B, C, and D, you should complete Section E.

- A person who creates the form for their dependent relative or child

The same applies in this case: you must fill out sections B, C, D, and E.

- A person who replies to any notice or mail you got from the Service

You should write the notice’s or letter’s number in the designated line on the right. You will then check Box 1 in Section B. The template’s instructions ask such claimers to check the Service’s guide on the form completion. You still should complete sections B, C, and D because they are obligatory for every claimer.

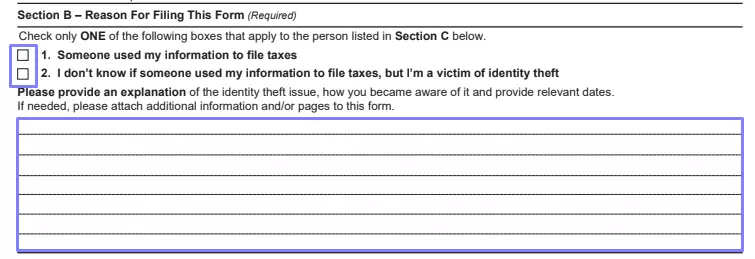

2. Complete Section B

You will specify the reason why you are filing the document in this section. Choose among two options (either someone provided your personal details for taxes filing or you are an identity theft victim). If you pick the second option, explain how that happened by adding details to the lines below.

3. Provide the Victim’s Information

You should add the victim’s (or yours) info, so the Service understands who is claiming. Write the last name, first name, and middle initial. Insert the taxpayer identification number: the template requires providing SSN (social security number, nine digits).

Further, enter the mailing address the victim currently uses. If this form is created for a deceased, insert the last known address. Write the city, state, and postal code below.

List the years when identity thefts occurred. You might not know the years particularly; enter the word “unknown” then. Indicate the last year when the victim submitted their tax return. If the return contained another address or names, place the previously used names or address (with the city, state, and postal code) in the designated fields.

Enter the victim’s domicile and mobile phone numbers. If the person for who you file the form is dead, write “deceased.” If not, outline the best time to call on the right, near your phone numbers.

Lastly, you can choose in what language the victim wants to communicate with public authorities: either English or Spanish. Mark the option the victim prefers.

4. Sign and Date the Form

This is another mandatory section that all claimants should complete. Here, you will sign and date the form, proving that you have given the truthful information. If something is incorrect or untrue, you may face various sanctions, as it usually happens if someone lies in their legal forms.

Place your signature on the left and the current date on the right.

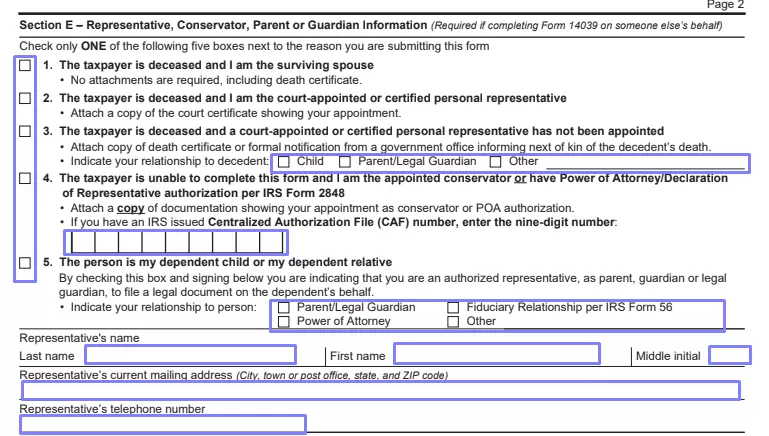

5. Fill Out Section E (If Applicable)

As we have told above, not everyone needs the following section, and you should complete it only if you represent someone who faced theft by completing this form. Mark one of the five boxes you see below. They describe your relations with the person for who you are completing the form.

The first three boxes are used if the person is deceased, and you are either their spouse or legal representative. In all cases, you shall provide the death certificate alongside this form. If you are the person’s legal representative who was not chosen by the court, define your relationship to the decedent (whether you are a parent, a child, or someone else: specify).

Box 4 is used if the person is incapable of creating this record by themselves. You have to obey the Service requirements listed under the box description and write your Centralized Authorization File (or CAF) number if you have any.

You should pick Box 5 if the form is completed on behalf of your dependent kid or another family member. Check the box below describing your relationship. Write your full name, mailing address, and phone number.