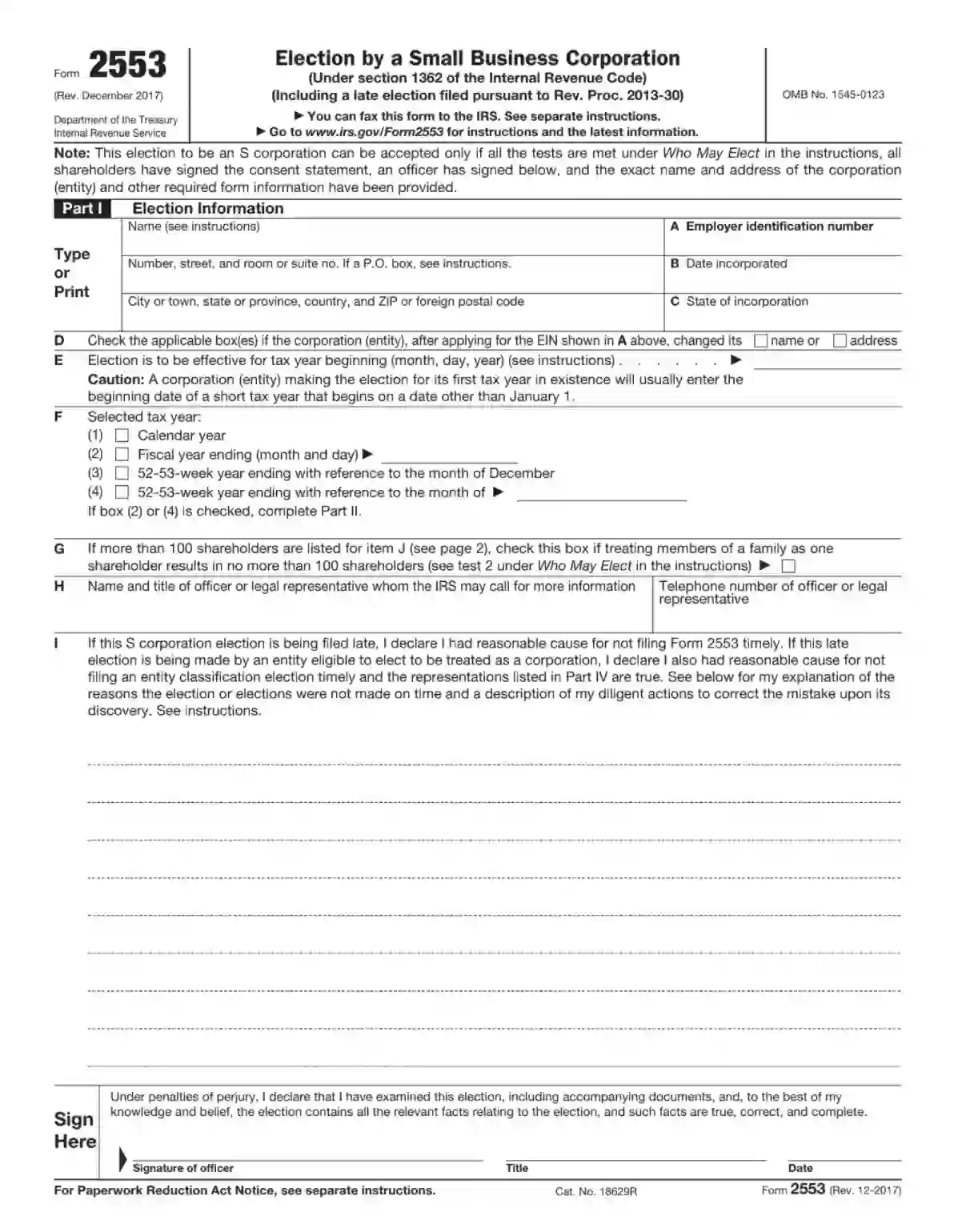

Form 2553, titled “Election by a Small Business Corporation,” is a tax form used by corporations and limited liability companies (LLCs) to elect to be treated as an S corporation for federal tax purposes. This election allows businesses to pass corporate income, losses, deductions, and credits to their shareholders for federal tax purposes. Shareholders report the flow-through of income and losses on their personal tax returns, which are taxed at their individual income tax rates. This can avoid double taxation on the corporate income, a characteristic of traditional C corporations.

The purpose of Form 2553 is to give eligible corporations and LLCs the flexibility to choose a tax status that best suits their business structure and objectives. Filing this form timely — generally, no later than two months and fifteen days after the beginning of the tax year the election is to take effect — ensures that the IRS recognizes the S corporation status for the tax year. This election is crucial for businesses seeking to capitalize on the S corporation status tax advantages, such as the aforementioned pass-through taxation, which can result in significant tax savings for shareholders.

Other IRS Forms for Corporations

IRS forms for businesses are devised to let companies report various financial information to the Internal Revenue Service. Check if you have collected all the info you are required to report as an owner of a S-type business.

How to Fill out Form 2553

Carefully read the step-by-step instructions for filling out and submitting this form. Check the entered data several times. If necessary, use our form-building software to download and complete the up-to-date form template. Remember that you will be denied the status for providing false information.

1. Provide General Information

The first section contains information about your organization. Specify the company name, ADES, and employer identification number. The identification number is a digital code that identifies your organization among others for tax purposes. This code also confirms your identity and your data.

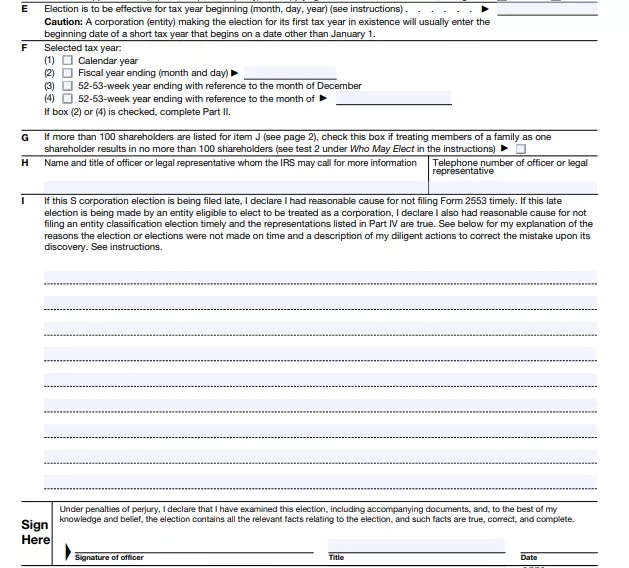

Next, you determine the date of application submission. Keep in mind the deadlines for filling out the documents. In the USA, there is a two-month period for the tax year. Select the appropriate item in the column for the tax year.

In case of late submission of the form, you may specify the reason in the same section. After filling out the form, be sure to sign the application. A signature is an official sign of your consent to the processing of the data provided.

2. Insert the Required Election Data

By the way, you also fill in the data about the shareholders, including their names, surnames, residential address, and number. In the form, specify the number of shares owned by each shareholder. In States with relevant laws, shares are public property. Therefore, the husband and wife are individual shareholders, even if their assets are owned in the name or managed by only one spouse.

3. Define the Tax Year

The second section of the form requires that the owners provide all the information and relevant documents regarding the tax year. Select the type of your corporation, as well as the appropriate option for tax payments. Each item contains a detailed description, but if necessary, you can use our form-building software.

In this section, you may also specify information about your business goal for the financial year. At the same time, attach a statement indicating the relevant facts and circumstances for the purpose.

4. Enter the Relevant Trust Information

As for this part of the application, specify the data about the qualified S-category division here. This part is intended for the so-called QSST elections. You may do it if you have transferred the corporate shares to the trust on or before the date of the S-status election.

QSST is a universal real estate planning tool put into effect in the event of an S-corporation shareholder’s death. In this case, the property passes into a trust with one beneficiary. If this does not apply to you, then leave the item blank.

The final section of this form is optional. You fill it out if you apply the deadline. At the same time, attach explanatory notes to the document. Keep in mind that each application form has lines at the top for the name and the identification number. Do not forget to specify this data.