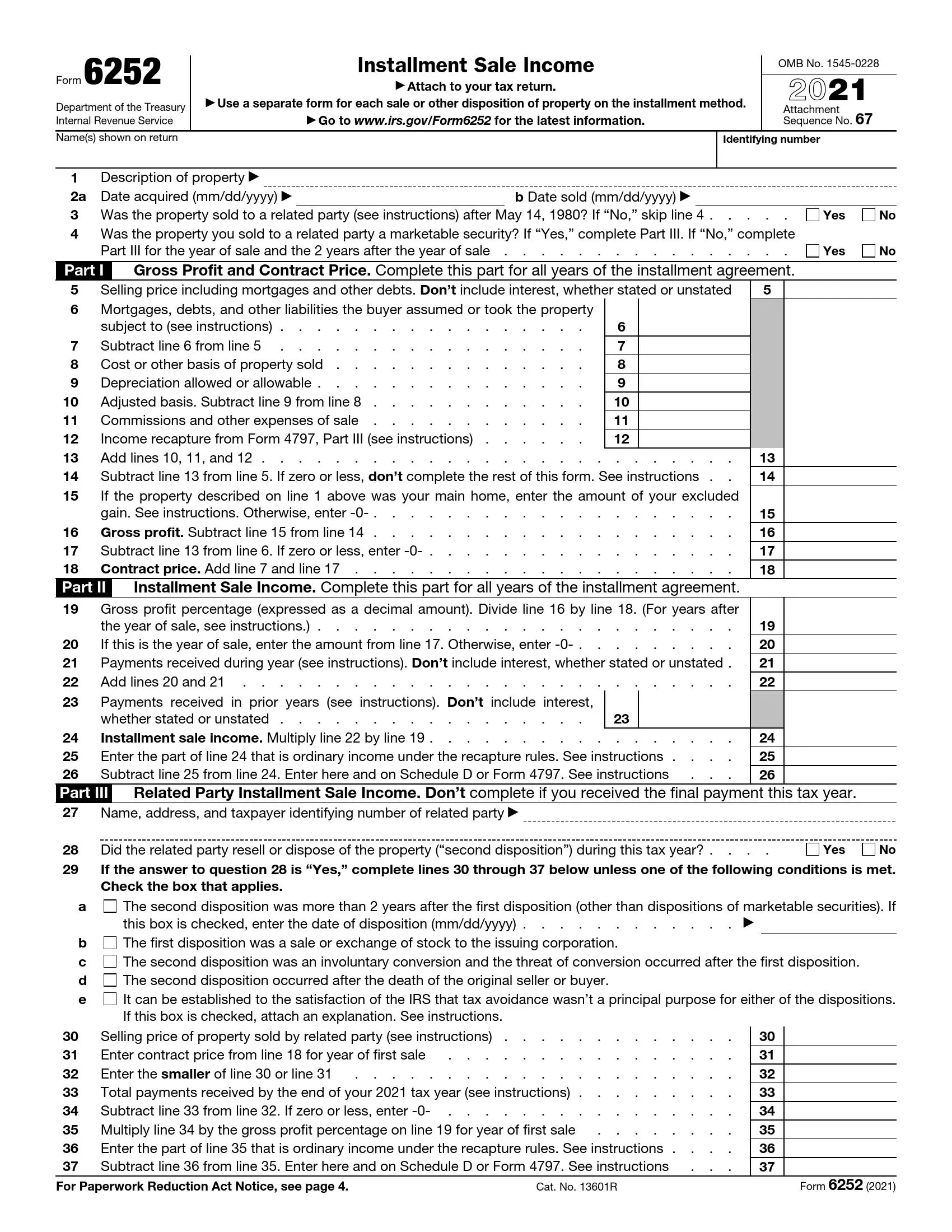

IRS Form 6252 is a tax document used by taxpayers to report income from installment sales. An installment sale is a sale of property where at least one payment is received after the tax year in which the sale occurs. This form allows taxpayers to defer the recognition of income over the period in which the payments are received rather than recognizing the entire gain in the year of the sale. This can be beneficial in managing tax liabilities, particularly for large sales where recognizing all income at once could push the taxpayer into a higher tax bracket.

The primary purpose of Form 6252 is to calculate and track the income received each year from a qualifying installment sale. It requires details of the original sale, including the selling price, cost basis, and the dates and amounts of payments received. This information helps the IRS ensure taxpayers correctly report their income throughout the installment payments. By spreading the tax burden over several years, taxpayers can reduce the overall impact of taxes due to fluctuations in annual income levels.

Other IRS Forms for Self-employed

If your business sells or exchanges business property, you can familiarize yourself with some other IRS forms that might be required by the IRS.

How to Fill Out IRS Form 6252

IRS Form 6252 includes three parts devoted to different types of incomes from the sale. We will explain the proper way of filling out all 37 lines of the form in this guide. If it seems difficult for you to enter the data by yourself, you can use special completing software on our website. It will allow you to avoid mistakes during the filling process.

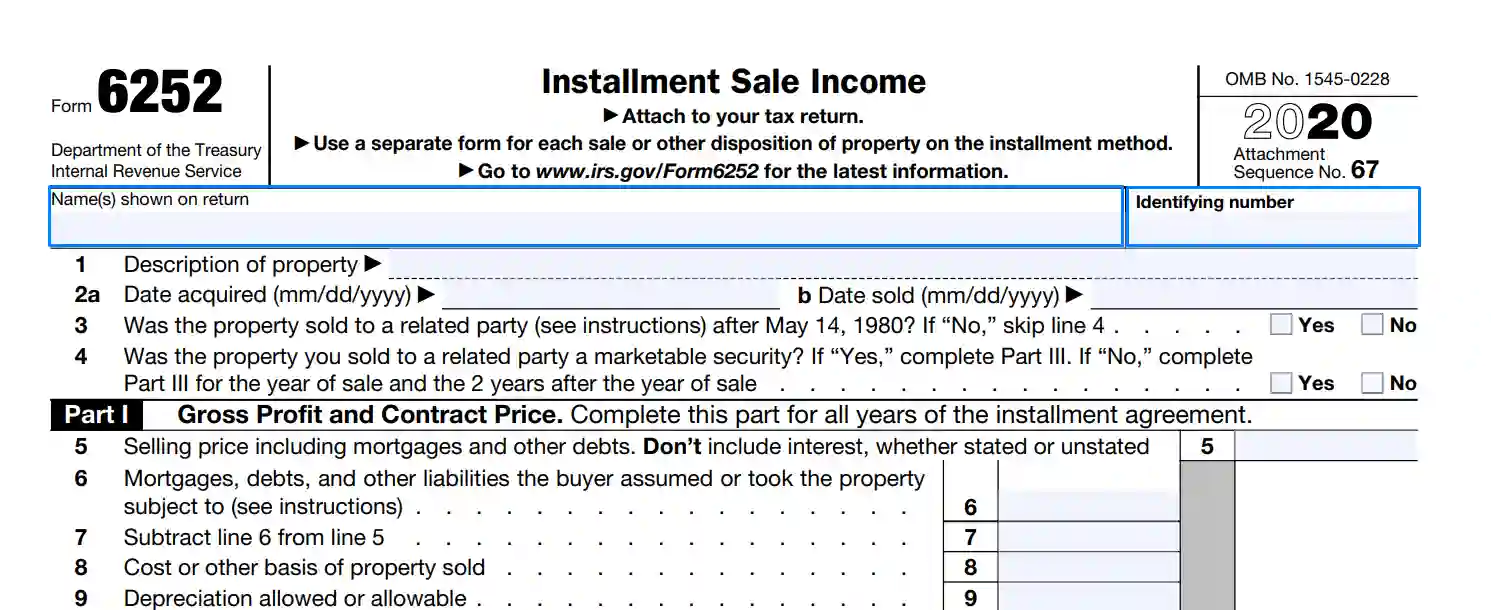

Identify yourself

Write in your name and identification number as they are stated in your year tax report.

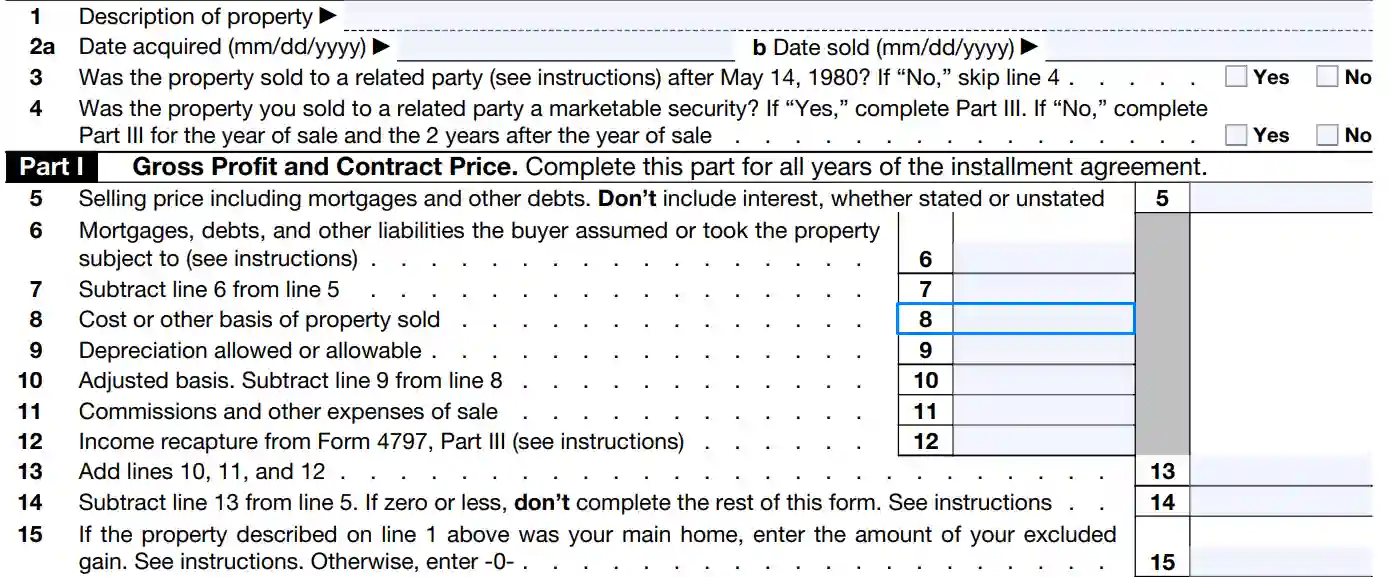

Provide data about the sold property

Enter the description of the property in line 1, including the code from 1 to 4 according to this classification:

- Sale for a timeshare or residential living — code 1.

- Sale of a personal estate for personal staying — code 2.

- Sale of the property produced in farming or trade — code 3.

- Other types of sales — code 4.

Fill in the date when you bought it and the date of sale in lines 2a and 2b.

Answer questions about related party

If you sold the ownership to a related party after May 4, 1980, you should check the box “Yes” in line 3. If it is not your situation, check “No” and go to line 5.

Then, answer the question in line 4 if the sale was performed with a related party.

Clarify sale price

You should enter the amount of money you have received or will receive for the property, including mortgages, in line 5. Do not put here numbers for any interests.

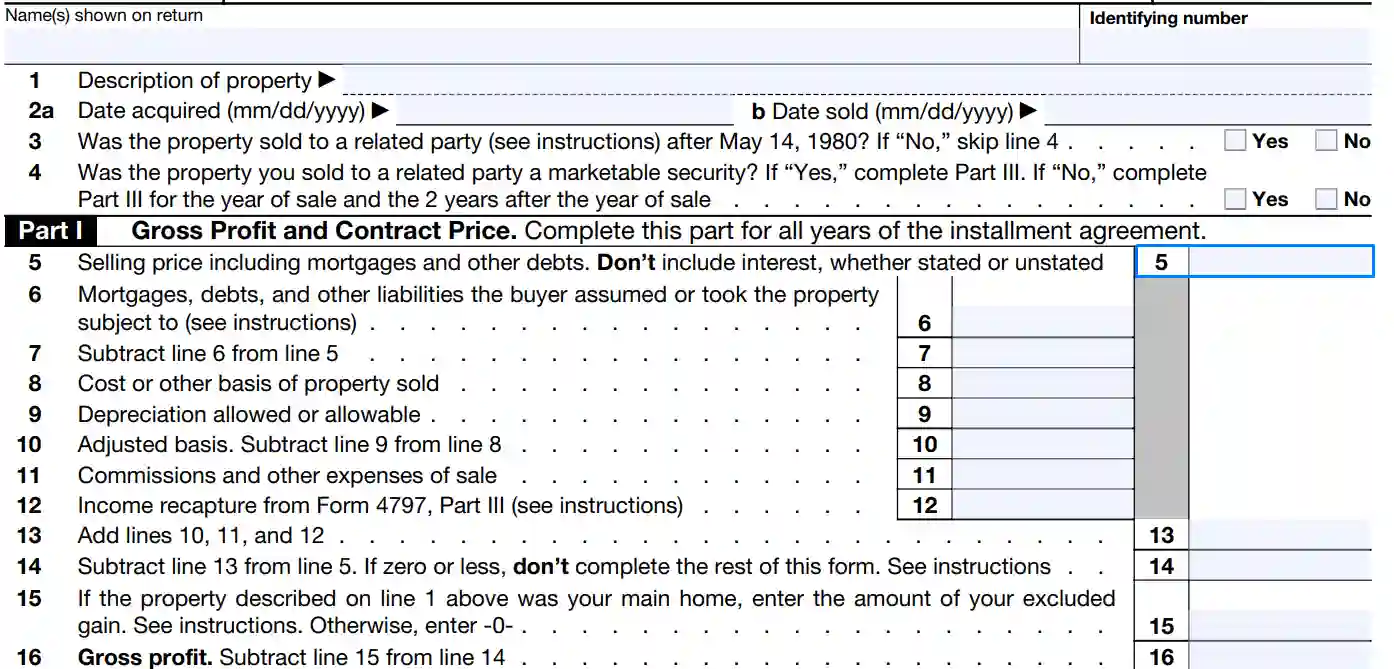

Give information about mortgages and calculate remains.

You need to fill the amount of money the buyer has from mortgages for this particular property in line 6.

Then subtract the value in line 6 from the value in line 5 and enter the result in box 7.

Describe the cost of the property

You should fill the cost of the property when it was bought and add all expenses for repairs and other modifications in line 8. Do not include the amount that was lost because of some accidents.

Enter the sum of depreciation connected with the property for the period from its purchase to its sale in line 9.

After that, compute the adjusted basis by subtracting the value in line 9 from the value in line 8 and fill it in line 10.

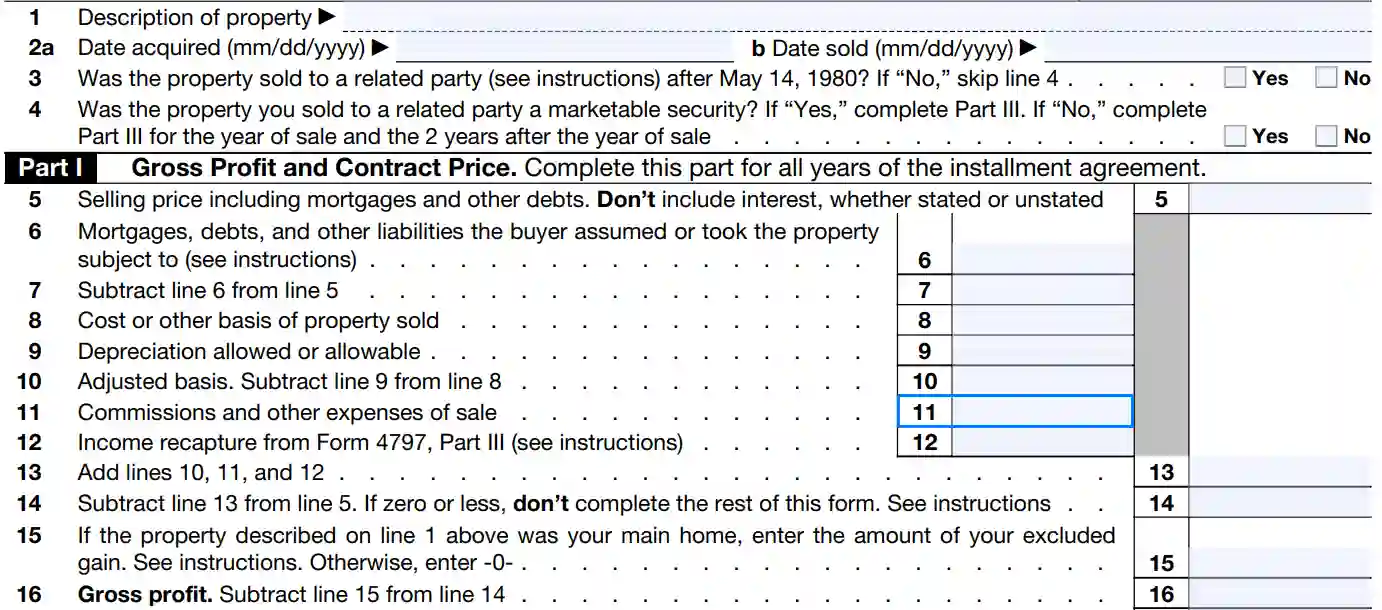

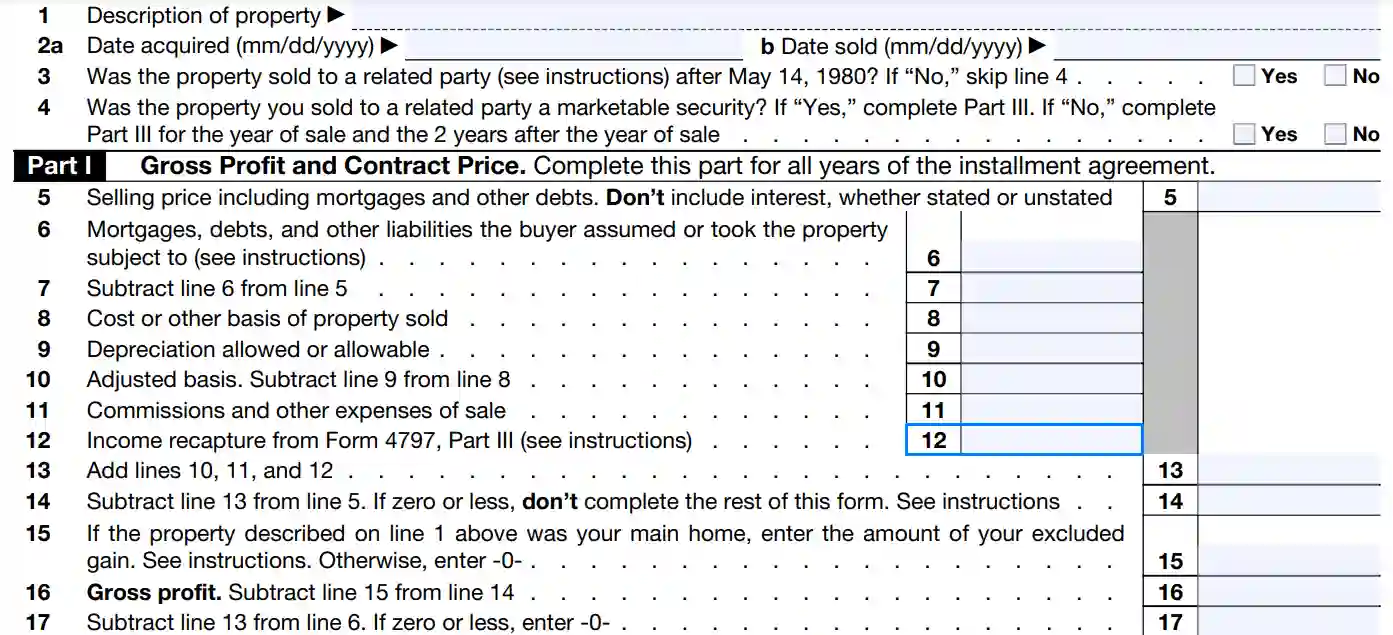

Identify expenses for the sale

Sum all the costs for advertisement, services of a lawyer, and other expenses connected with the sale of the property and write the result in line 11.

Put income recaptures

Find form 4797 or fill it and put the value from line 31 into line 12.

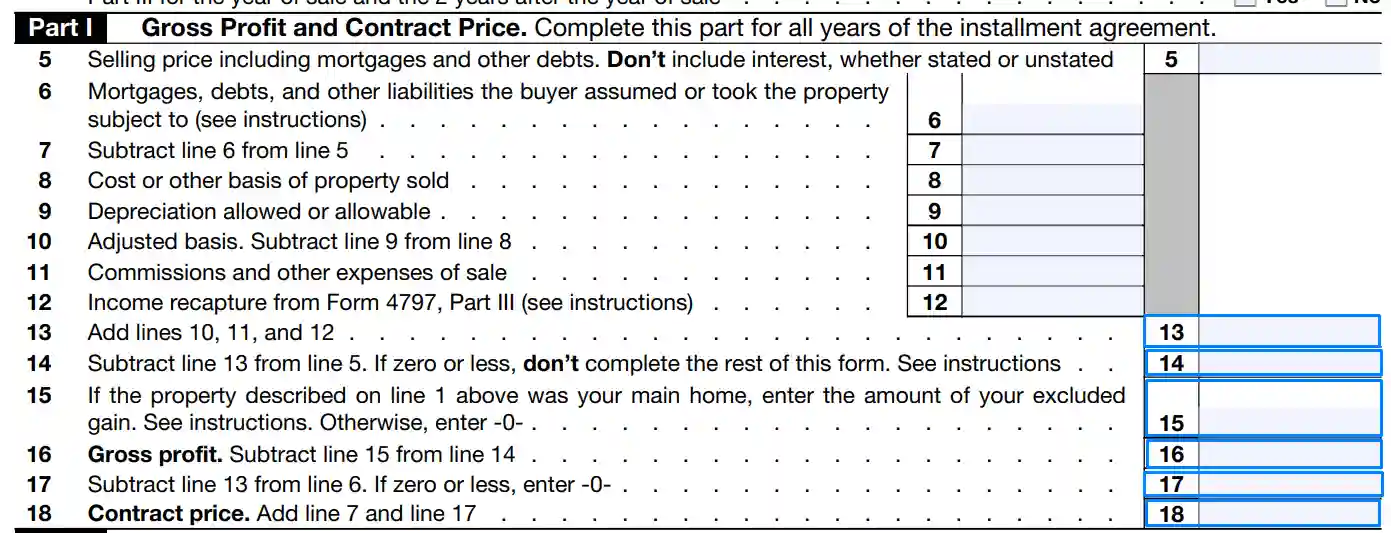

Calculate gross profit and contract price

When all the values are entered, you should make several computations:

- Sum values from lines 10,11 and 12 and put the result in line 13.

- Subtract the number in line 13 from the value in line 5 and fill the result in line 14. Make sure it is not equal to or less than 0. If it is the case, you should not file IRS Form 6252 but Forms 4797 and 8949.

- Use line 15 if the property was your main residence. Enter your gain that you want to be excluded from taxation. If it is not your main home, put zero here.

- Calculate gross profit by subtraction of line 15 from line 14 and fill it in line 16.

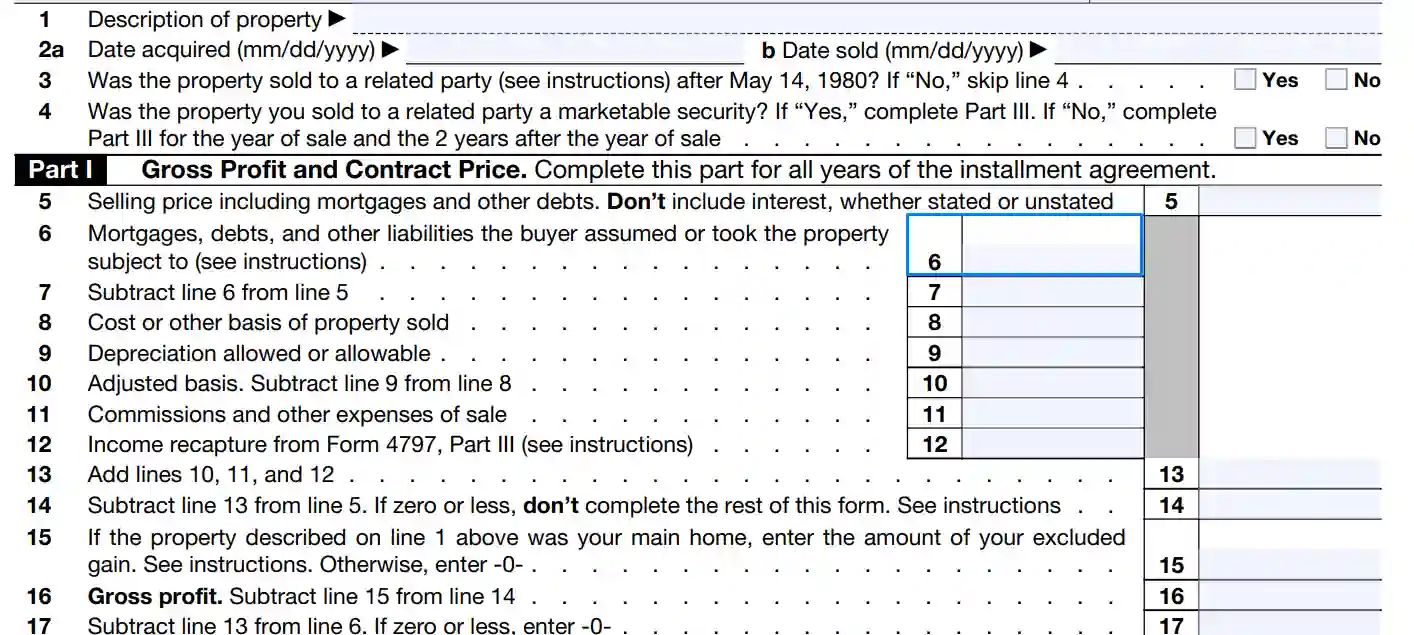

- Then subtract the number in line 13 from line 6 and put the value in line 17. If it is equal to zero or less, enter zero in this line.

- Calculate contract price using the sum of lines 7 and 17 and enter it in line 18.

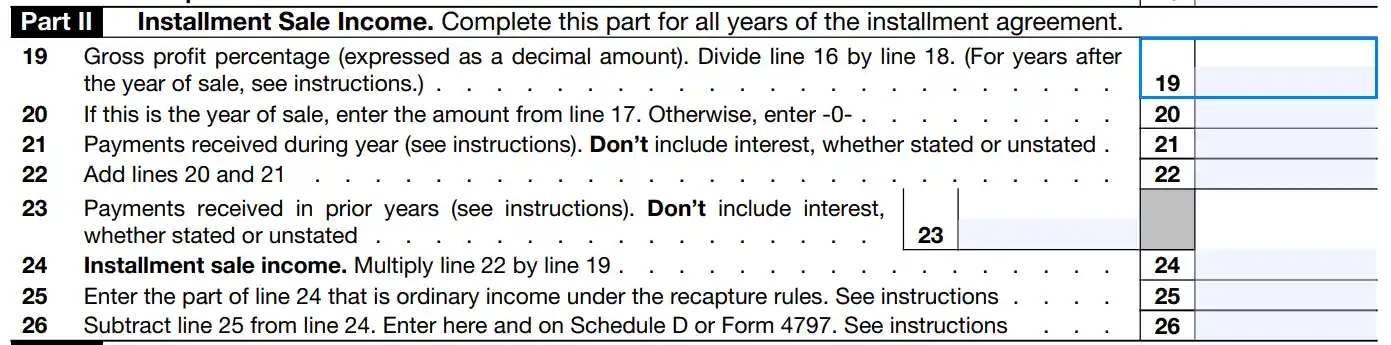

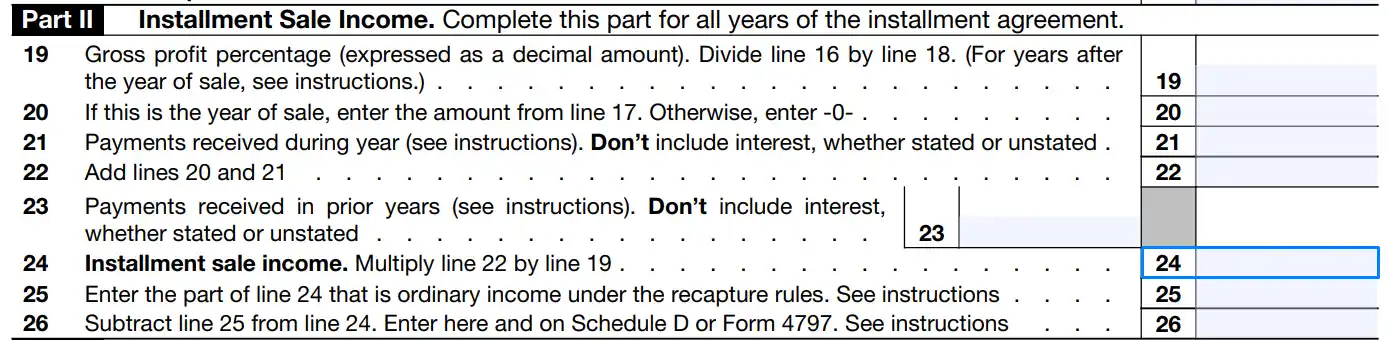

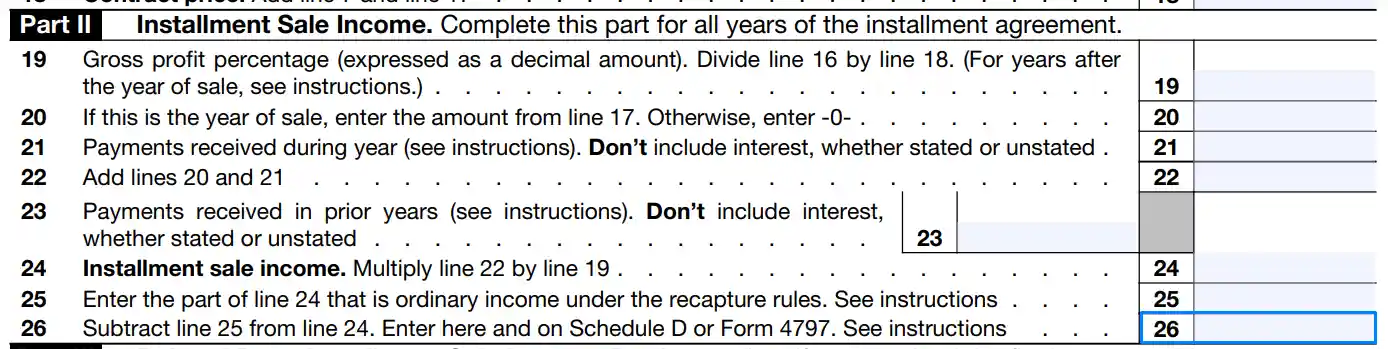

Compute gross profit percentage

You should divide the number from line 16 to the value in line 18 and put the result to line 19. Please, fill the decimal number rounded to 4 digits (e.g., 1.0000, 0.6740, etc.).

Give detailed info about payments

You need to fill several lines in Part 2 devoted to payments:

- Enter numbers from line 17 to line 20 if you sold the property this year. If sales were not during this year, put zero in line 20.

- Fill the sum of payments you have received during the current year from the sale of property in line 21. Do not add any interest to this value.

- Summarize lines 20 and 21 and fill the result in line 22.

- Calculate all payments you had gotten during the previous year for the sale of this property and put the number in line 23. Do not include interests as well.

Calculate installment sale income

You should multiply values from line 22 by percentage in line 19 and put this number in line 24.

Describe recaptures

In line 25, you should enter the part of the amount in line 24 that was subjected to income recaptures.

Then subtract line 25 from line 24 and put the result in line 26. Do not forget to include it in Form 4797 or Schedule D if you should file them.

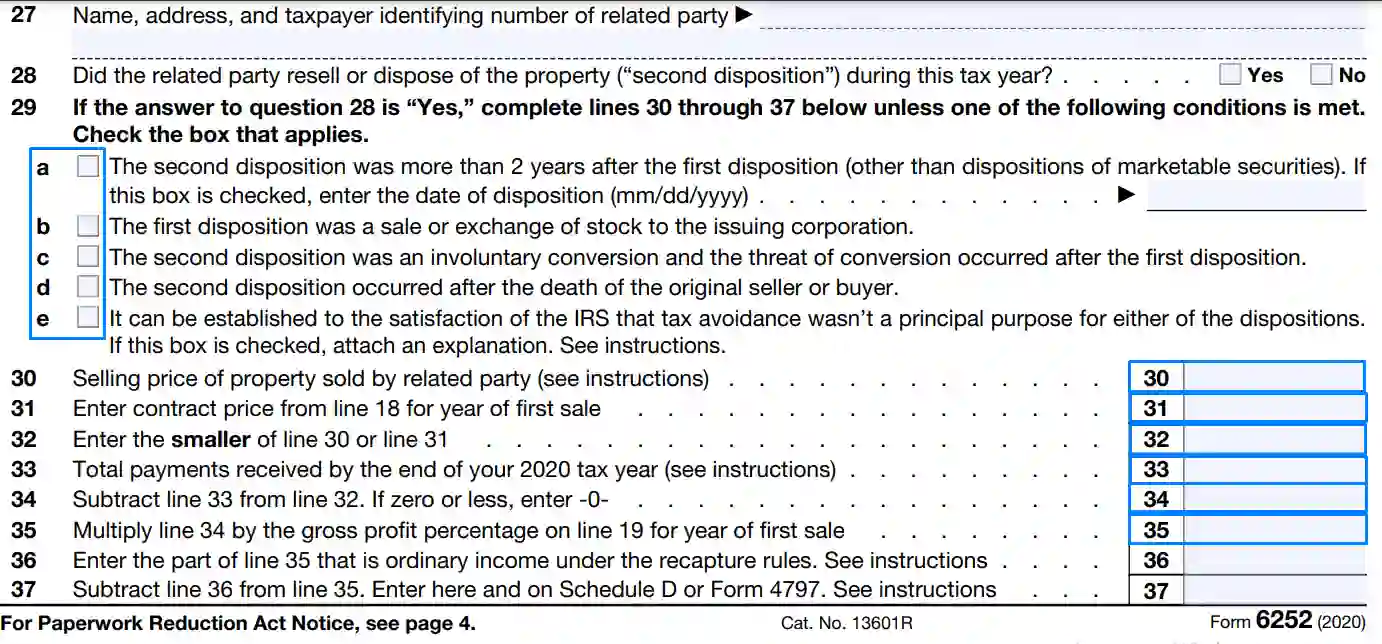

Provide data about related party

Pay attention to the third part of this form because you can skip it if you received the final payment during this year. In all other cases, you should fill lines 27-37.

Introduce the related party and enter his or her name, physical address, and identification number in line 27.

Answer the question about related party

Check the appropriate box in field 28 based on the actions of the related party for the current tax year. If the related party did not resell property during this year, you should answer “No” and finish the completion of the form. Otherwise, put a checkmark in the box “Yes” and continue to fill out IRS Form 6252.

Put data about dispositions for this year

In lines 29-37, you should clarify several points about the manipulations with the property by the related party during this year:

- Mark all boxes that apply to your case in field 29.

- Include price for the property at the moment of sale by the related party in line 30.

- Include contract price for the first sale in line 31. You can copy it from line 18 of this form.

- Choose the smaller value between lines 30 and 31 and put it in line 32.

- Copy values from lines 22 and 23, sum them up and put the result in line 33. If you did not complete part two, you can enter the amount of money you received for the sale of property during previous years.

- Compute the difference between lines 32 and 33 and enter the result in line 34. If the value equals to or less than zero, fill in zero in this line.

- Multiply the value from line 34 by line 19 and enter the result in line 35.

Clarify recaptures

You should make the similar to the second part procedure and enter the part of the amount from line 35 that was subjected to income recapture. Enter this value in line 36.

Then find the difference between numbers in lines 35 and 36 and write it in line 37 and form 4797 if you need.

Once you fill out the IRS Form 6252, you should check it and attach it to your annual tax return and file them together to the appropriate IRS department.