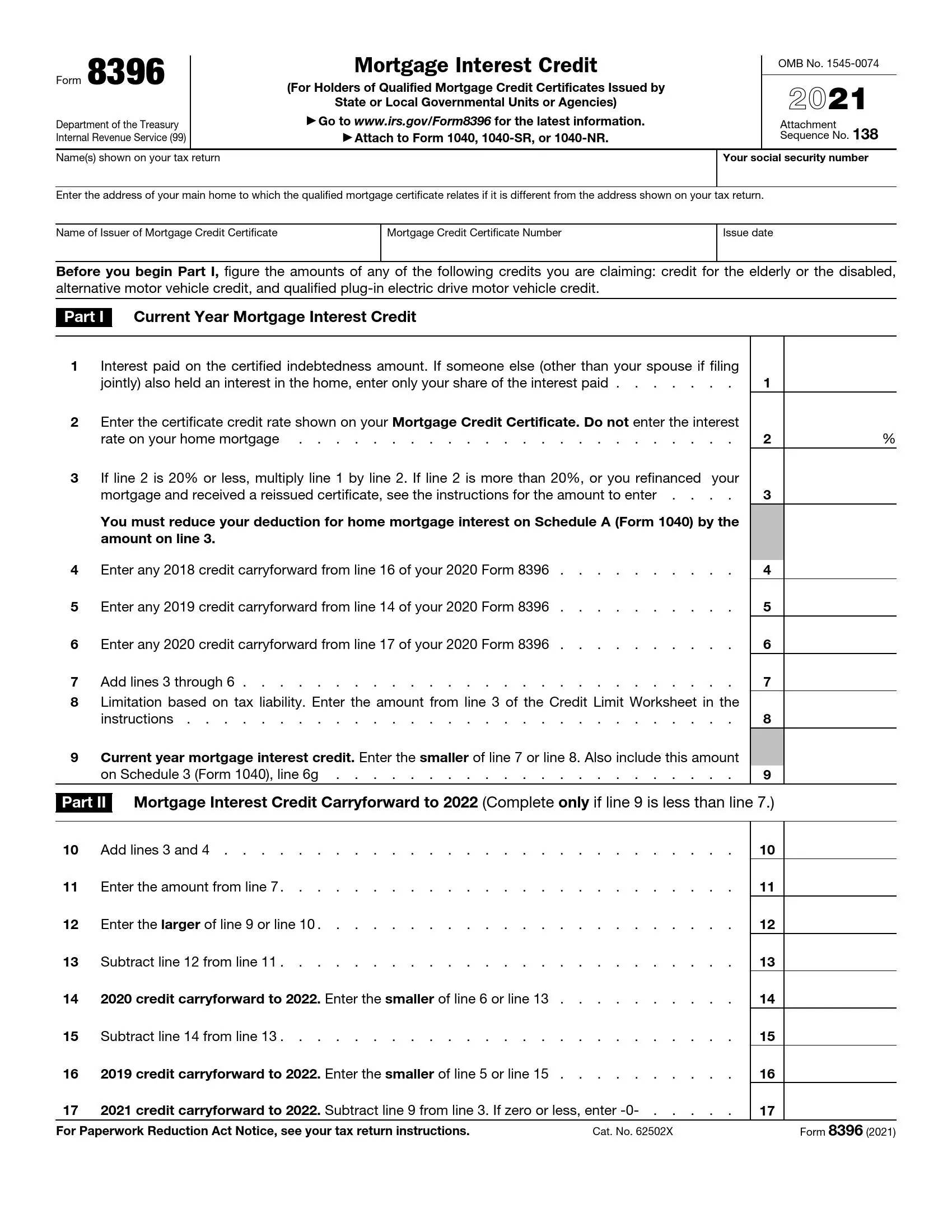

IRS Form 8396 is a U.S. tax form homeowners use to claim the mortgage interest credit. This credit is intended to assist individuals with moderate and lower incomes in affording homeownership by reducing their tax liability based on a percentage of the mortgage interest they pay. The form calculates the amount of the credit based on the interest paid and the mortgage credit certificate (MCC) rate provided by the state or local government.

To use this form, homeowners must have a valid MCC from a state or local governmental agency or a qualified lender. The credit can be directly subtracted from their total federal income tax liability, providing significant financial benefits to eligible taxpayers.

How to Fill out Form 8396

It is relatively easy to complete this template in comparison with many other forms proposed by the Service. You will have to work with numbers that define your interest, previous credits, and other figures. The form consists of two pages: you have to fill out the first page and a small part on the second page. However, the second page is added mostly for instructions you are welcome to use.

If you do not feel like working with numbers and believe that you may fail or make mistakes, it is recommended to ask a tax expert for a consultancy or even for the form completion instead of you. You will just have to provide them with all the required numbers. Remember that you cannot add untruthful or incorrect data in the form; the Service imposes various punishments for such deeds.

We have added a brief manual so you know what lines in the form you should fill out. Read each line attentively before you write anything in there. Again, in case of any doubts, it is better to pass the task to someone else who has enough knowledge.

1. Find the Relevant Form Template

Before entering any data anywhere, you have to ensure that the template you are using is correct. It must have the current year on top (right-hand side). You can get IRS Form 8396 here: our form-building software will generate it for you easily. The form is also available on the Service’s official site, but you may spend a lot of time there while you look for it.

2. Add Your Personal Info

Even though you will attach this document to your tax return (1040, 1040-SR, or 1040-NR Form), you still have to introduce yourself to the Service. You have to fill out six lines here.

Step by step, indicate your name (the same as in your return), SSN (or social security number), the address of the property for which your MCC had been issued (if it differs from the address you had entered in your return). Then, state who had issued the certificate, its number, and the date when you received it.

3. Read the Suggested Form Statement

You will see a statement telling what numbers you have to prepare for the form’s first part. Read it carefully and do what you are asked to do.

4. Count the Current Year’s Credit

You will calculate the current year credit in Part I. Insert interest paid on the amount described in the first line, then add the required numbers from your certificate. Below, provide calculations as asked. Use the Service’s guide to figure out the result you should enter in the form. Use your previous 8396 Forms to write numbers in the following lines.

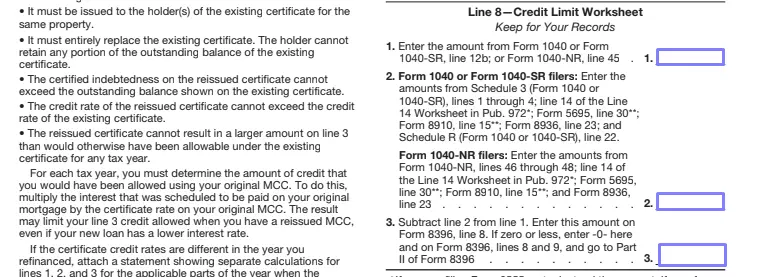

Then, scroll to the current form’s second sheet and fill out a worksheet there. You will keep the worksheet in your archives, but you have to fill it out to take one number from there and add it in Part I. In line 9, you will define the current credit. Copy the result from here to your tax return (the template gives info on where exactly you should copy it).

5. Complete Part II (If Needed)

In the heading of Part II, you will see a condition that obliges you to complete this part. Read it and understand if it is applicable (you should get back the first part and compare some numbers).

Basically, by completing Part II, you will define the credit you will carry to the next year. Every line here demands various calculations from you. Follow the template to provide correct numbers and determine the carryforward amount.