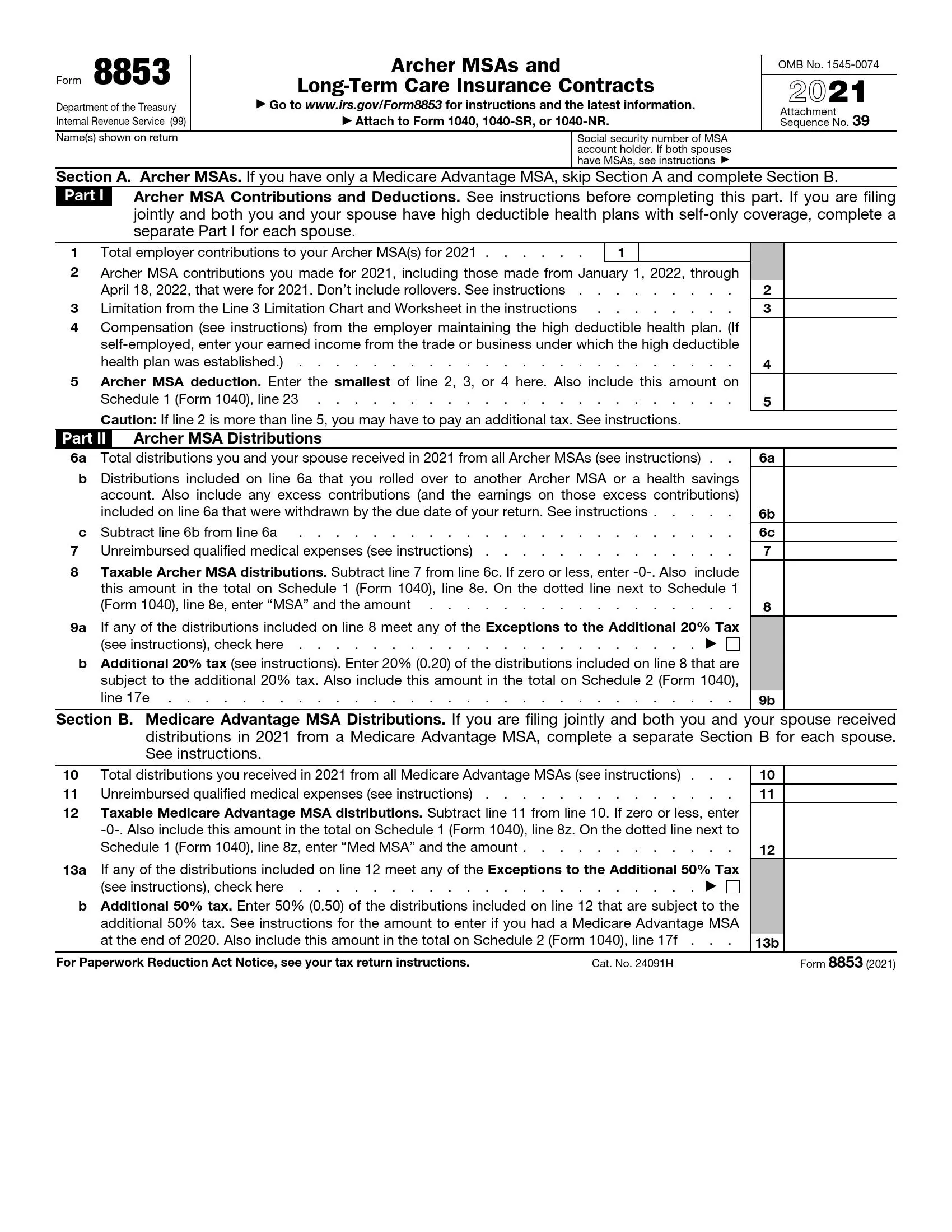

IRS Form 8853, titled “Archer MSAs and Long-Term Care Insurance Contracts,” is a form used to report contributions to medical savings accounts (MSAs), specifically Archer MSAs, and to provide information regarding distributions from these accounts. The form is also used to report information about long-term care insurance contracts. Taxpayers with an Archer MSA or who have paid premiums on a qualified long-term care insurance contract use this form to calculate and report deductions related to these expenditures and any taxable distributions or earnings.

The main purpose of Form 8853 is to ensure that individuals accurately report all required details about contributions, distributions, and earnings related to Archer MSAs and long-term care insurance contracts. For Archer MSAs, this includes calculating the deduction for contributions and reporting any taxable earnings on distributions that are not used for qualified medical expenses. Long-term care insurance contracts involve reporting insurance premiums that qualify for a deduction.

How To Fill Out This Template

Filling out any tax documents requires care, understanding some financial nuances, and other knowledge. Approach such a process with mindfulness, and if difficulties arise, use the support of tax specialists. To be eligible for the Archer MSA, you must be an employee of a small company or self-employed. Besides, you are not dependent, and you must not have other health insurance. As a rule, such a savings account serves as a convenient tool for paying for high-cost medical services.

There are cases when an individual becomes disabled or incapacitated. In either case, this person is unable to participate in any activity due to physical or mental disorders that may even lead to death. Meanwhile, in case of the owner’s death, several extra conditions apply to the medical savings account management. If the deceased has a spouse designated as the beneficiary, the Archer MSA continues to operate. The spouse fulfills all activities related to the account. If there is no living or assigned beneficiary, the agreement is no longer valid.

Get the Relevant Form Template

The Internal Revenue Service website has sections with tax forms. Download the template for this application and carefully fill in all points.

Provide General Information

Any tax document requests information about you. Enter your first and last name, as well as your social security number. If you are applying with your spouse, write the social security number on your first tax return.

Archer Medical Savings Account

Start completing the form from the first section if you have this account through your employer. The amount that relates to the deduction from this account may be limited. Note that if you and your spouse have made contributions in addition to any employer contributions, there will be an additional tax.

Enter the total amount of the employer’s contribution to this account, as well as your donation. When entering the data, be sure to receive compensation from the W-2 form provided by your supervisor.

The second part of this section includes information about all distributions. These distributions include any money you have transferred from a medical account to another savings account. It also consists of any money that you received as payment for medical services during the year. By the way, keep in mind that Archer-type distributions included in income are subject to an additional 20 percent tax. The only exceptions are death, disability, and the age of 65.

Complete the Section about Medicare Advantage MSA

The second section of the tax return applies exclusively to medical savings accounts and the Medicare Advantage program. Fill out all the necessary information if you have an advantage under such a plan. All the lines in this section refer only to this program and not to other types of accounts.

Enter the total number of distributions received during the year and the total non-refundable expenses. If you are filing a joint tax return with your spouse and you both have either an Archer TSA or a Medicare Advantage MSA, fill out two separate forms.

To become a member of this program, you must be enrolled in Medicare and have an HDHP that meets the Medicare guidelines. Only Medicare may make these contributions.

Insurance Contracts

The final stage of filling out the form is the section on insurance contracts. For a better understanding, read some of the concepts and carefully write down the information. You may also use our form-building software if necessary.

So, the policyholder is an individual who owns income under an LTC, life, or another insurance contract. Indeed, the insurer must regularly report on the profit, even if the payment is assigned to a third party.

Enter the first and last name of the insured person and the social security number. Answer the questions provided regarding the receipt of any payments under the insurance contract in the current year. There is also the question of a terminally ill person. In general, this is an individual who has supporting documents from a doctor about the presence of incurable diseases.

Next, fill in the lines, taking into account the attribution to them. Enter the total amount of the death benefit, select a specific contract period, and calculate the taxable insurance amounts.

After filling in all tax information, check the entered data several times and the amounts.