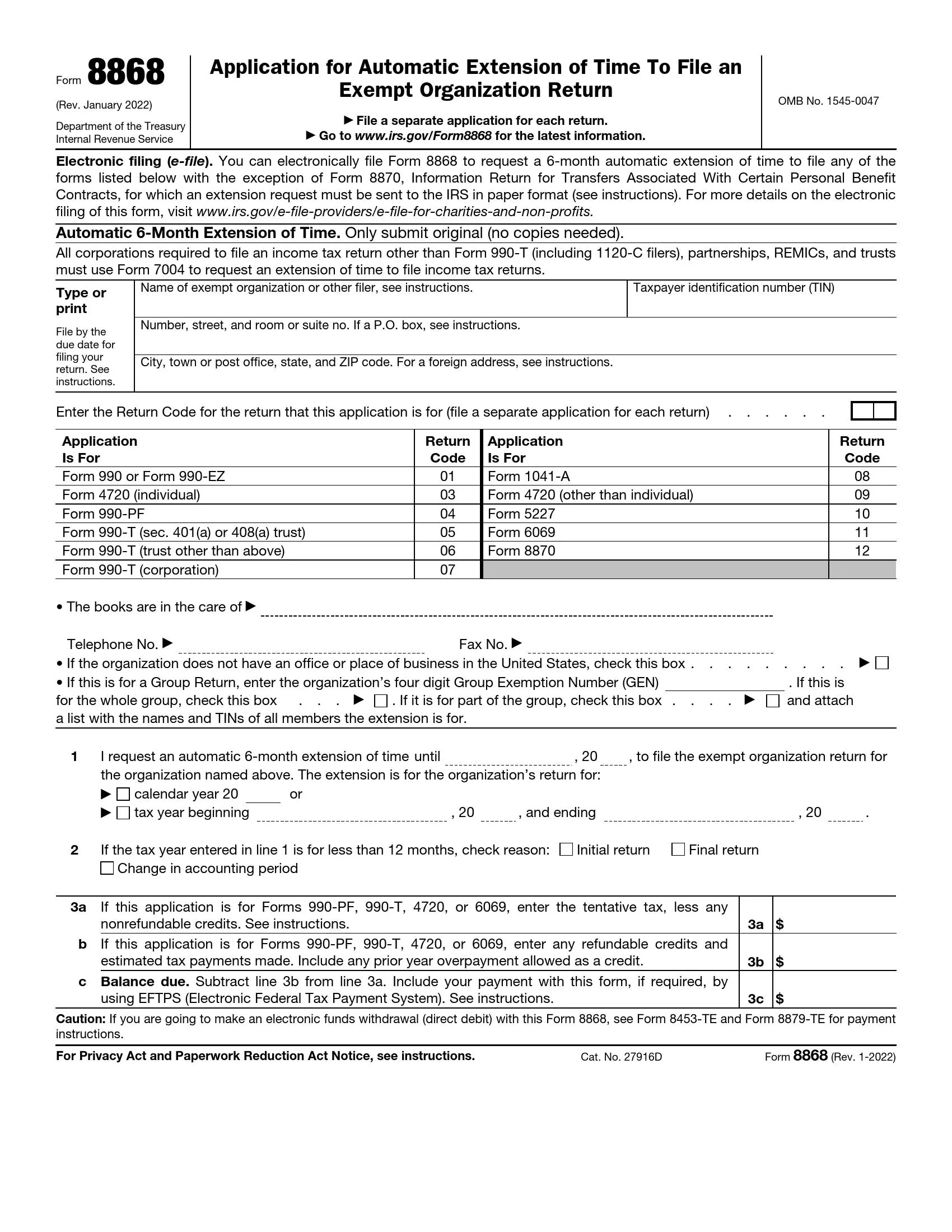

IRS Form 8868 is a document used by nonprofit organizations, charities, and other tax-exempt entities to request an automatic extension to file their required annual information return or notice. The form can be used to extend the deadline for filing forms such as Form 990, 990-EZ, 990-PF, and others related to nonprofit tax obligations. The initial extension grants an additional six months, allowing organizations more time to gather necessary information and ensure their filing is accurate and complete.

The primary purpose of Form 8868 is to help tax-exempt organizations avoid penalties for late filing of their annual tax documents. By filing this form by the original due date of their return, organizations can secure more time to comply with reporting requirements without incurring financial penalties. This is valuable for organizations that need additional time to compile detailed financial data, complete audits, or resolve governance issues that could affect the information reported on their tax forms.

Other IRS Forms for Charities and Nonprofits

If your organization needs more time to file the return, Form 8868 will be of help. In case of other situations that often happen to non-profit organizations, you might need one of the following IRS forms.

How to Fill Out IRS Form 8868

As there are two ways you can fill IRS Form 8868, you can stop your choice on the one you like the most. You can either fill the form on your own with the assistance of detailed guidelines you can find further, or you can utilize our form-building software with an included PDF editor.

Using the form-building software with an included PDF editor gives you the opportunity to save your time and be sure no mistakes will be made.

At the same time, if you follow detailed guidelines attentively, there won’t be room for mistakes, as well.

Check the Specific and General Guidelines

That’s an essential step to do before filling any legal papers. To protect yourself from possible legal issues or with the form confirmation by the supervising body, we advise you to get acknowledged with guidelines on the completion of this form before filling it. It will save both your nerves and your money.

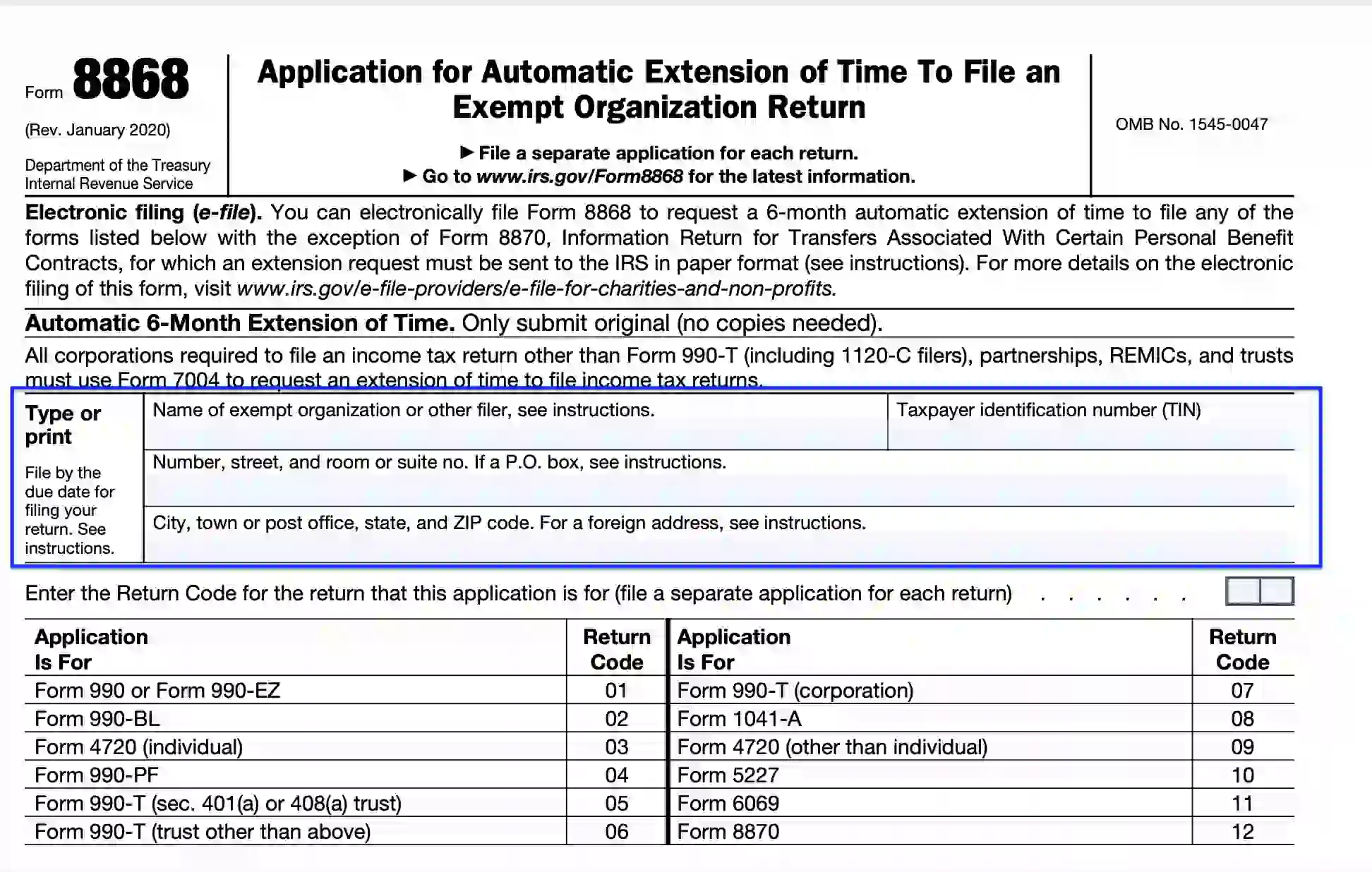

Give the Data on the Organization

Type or write down the full name of the organization (according to the general and specific guidelines), taxpayer identification number (TIN), the full correct address of the organization, including street, number, room number, post office or town, city, zip code, and state.

Register the Return Code of the organization choosing between the numbers of forms listed in the template. Choose the right form, and write down its return code in the blank box.

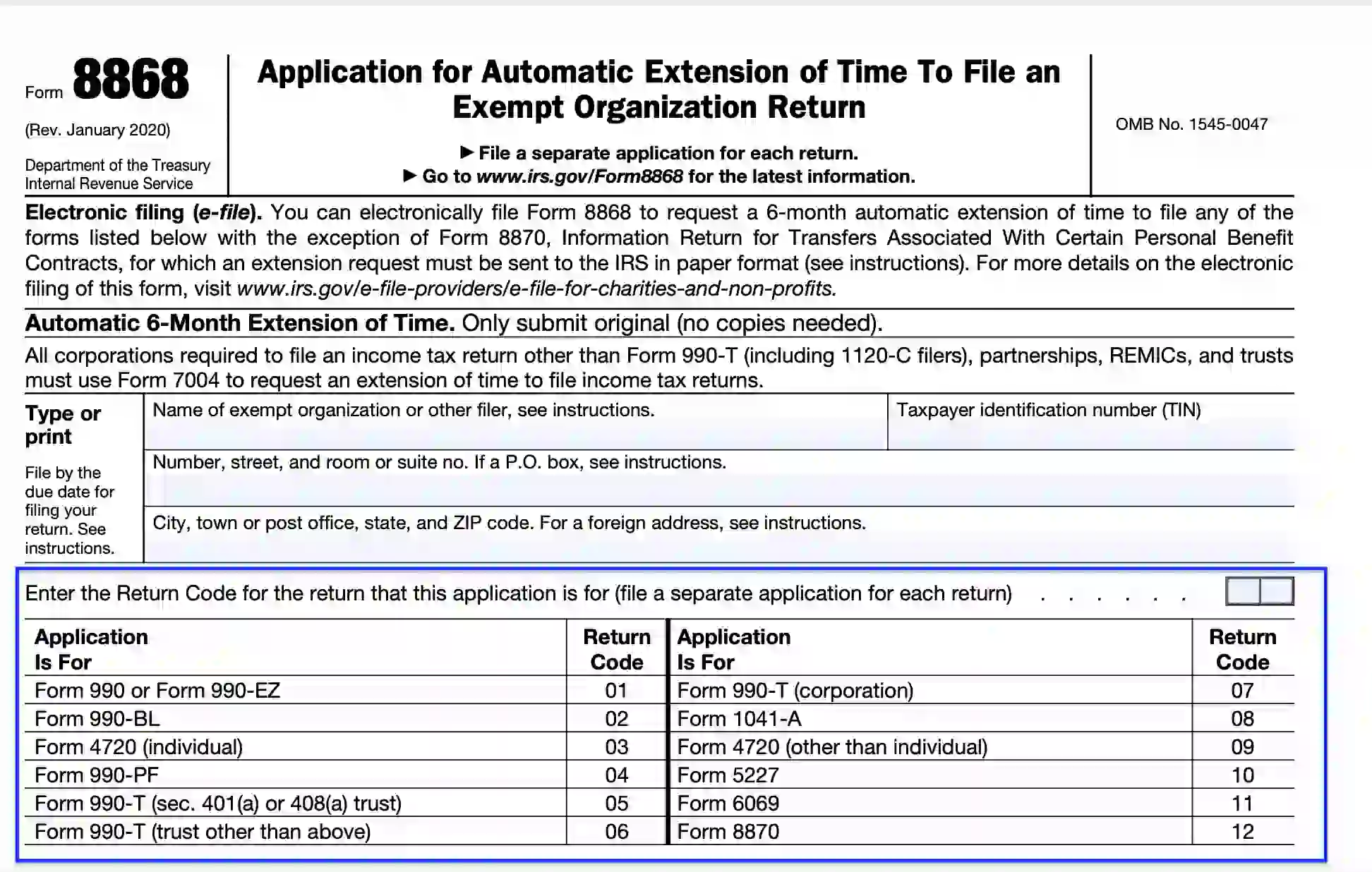

Enter the name of the person responsible for keeping records in safety. Enter their telephone number and fax number.

Check the box if the organization doesn’t have a business in the territory of the USA. Also, state the organization’s belonging to the group of other organizations. If the organization requests a Group Return, type the Group Exemption Number (GEN). If the whole group of organizations (of which the organization filing the declaration being the part of) or some organizations from this group request the extension of the time for filing the declaration, check the right boxes.

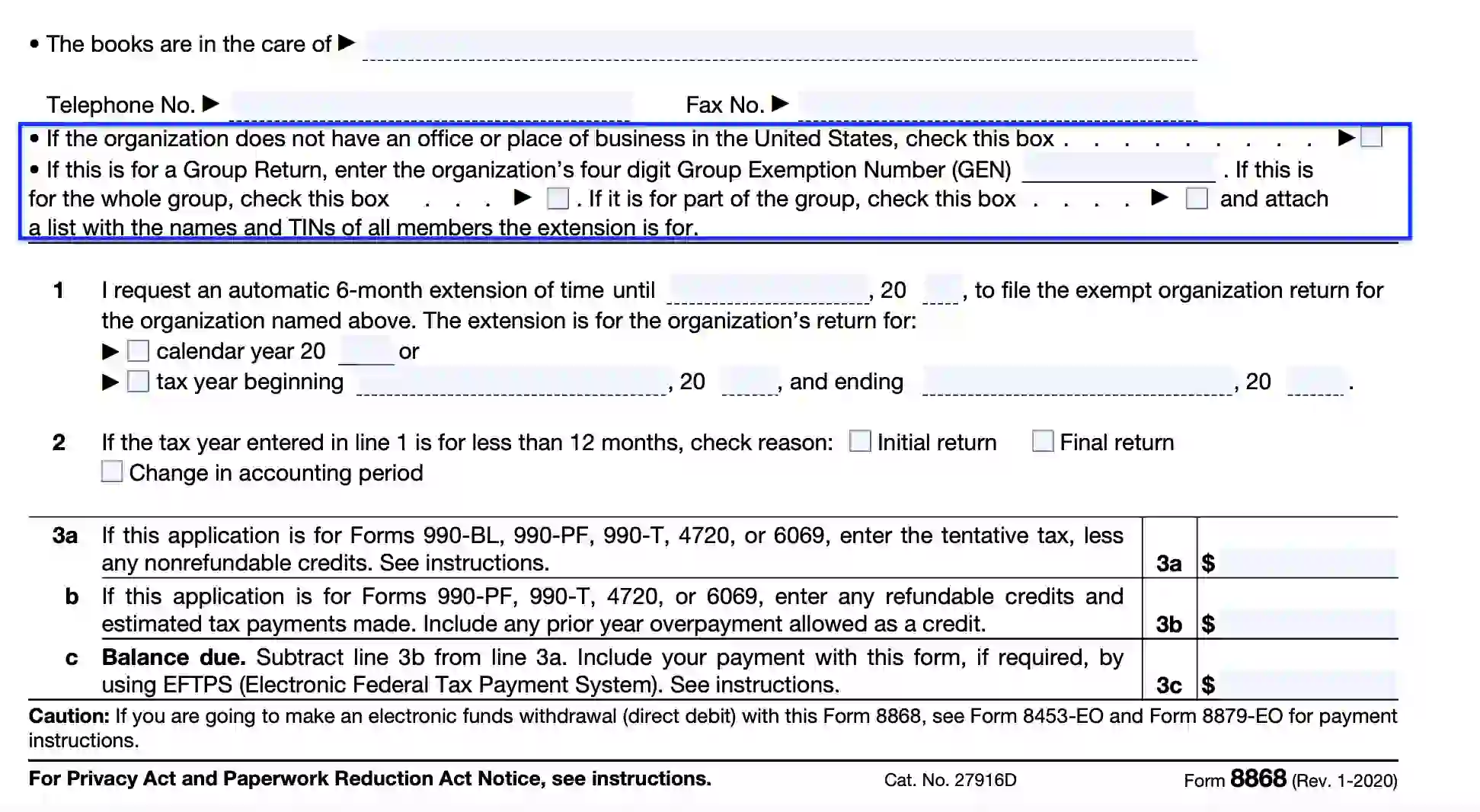

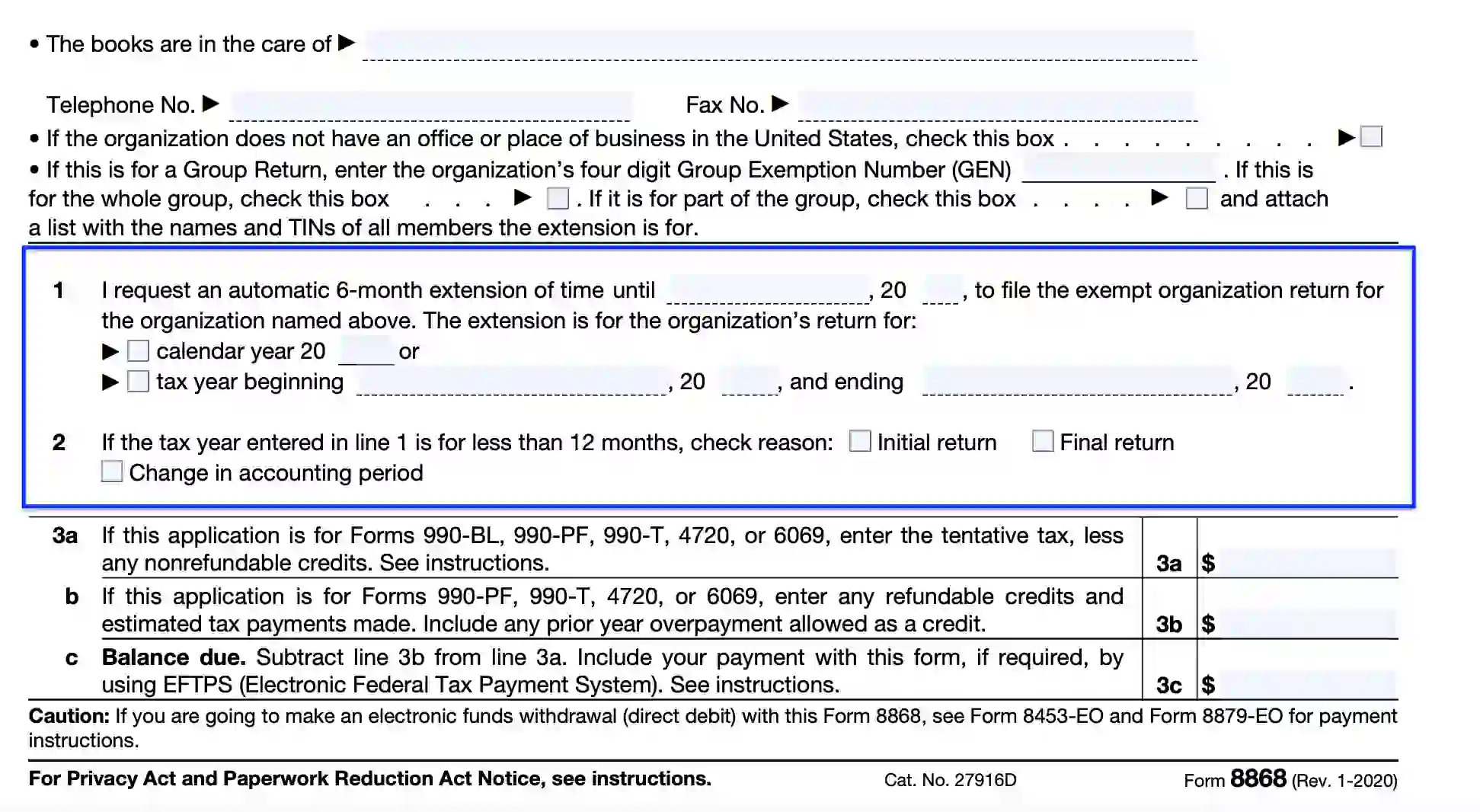

Insert the Extension Information

The person filing Form 8868 needs to complete this part of the form template. This person has to type the period needed for filing the declaration to be extended. The calendar year and the beginning of the tax year have to be stated.

If you choose the tax year less than 12 months, choose the reason for checking the right box. Choose between the following options:

- Final return

- Initial return

- Change in the accounting period

Choose the right option among the given options describing the form you’re filing the application. Depending on your choice, type the sum of a tentative tax, refundable credits, and overpayment for the prior year.

Do it with the assistance of the Electronic Federal Tax Payment System (EFTPS), if needed.