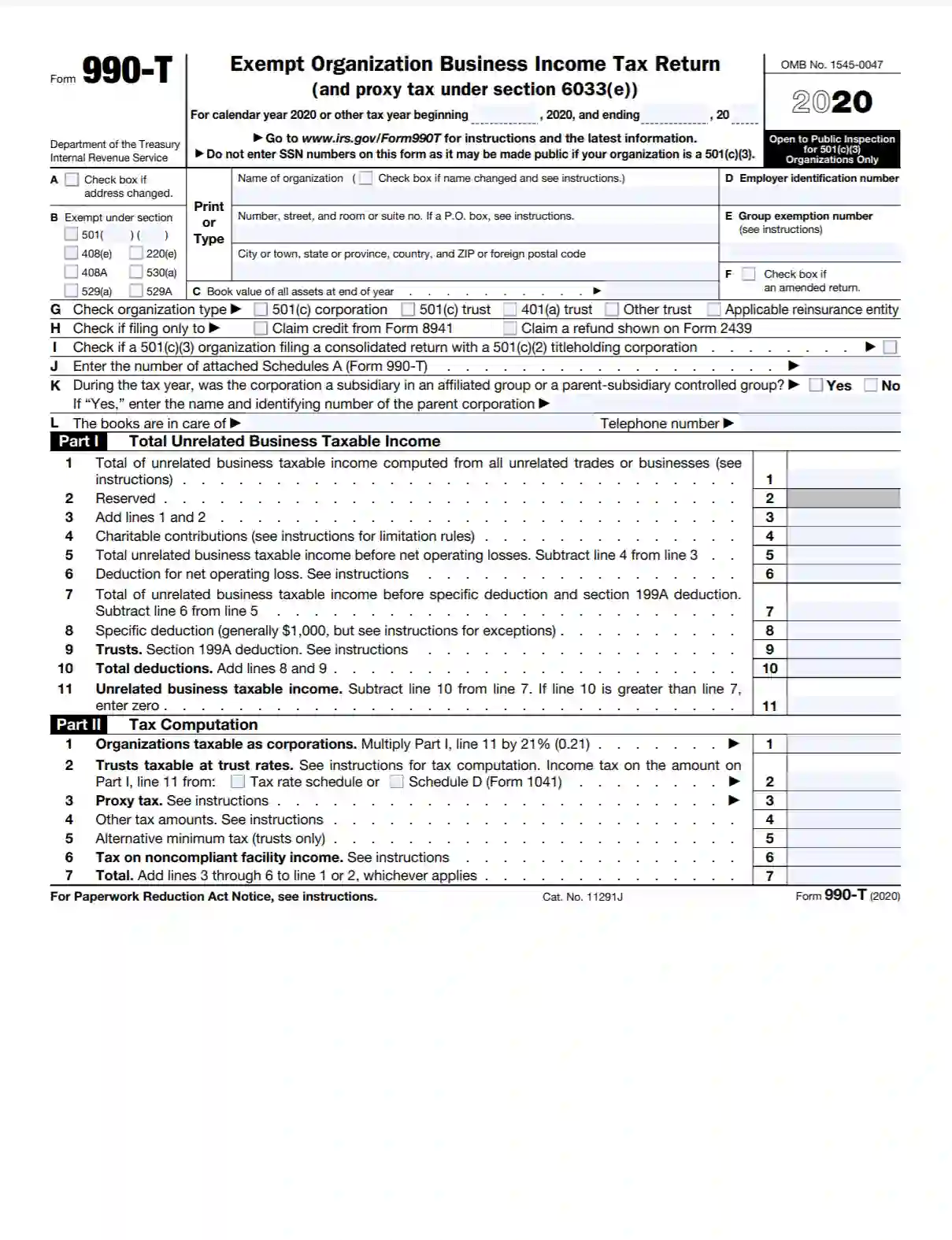

IRS Form 990-T, titled “Exempt Organization Business Income Tax Return,” is used by tax-exempt organizations to report and pay income tax on unrelated business income. This form is necessary when a tax-exempt entity generates income from a trade or business activity that is not substantially related to its exempt purpose, as such income is subject to income tax to ensure fairness in the tax system. Key elements that need to be reported on Form 990-T include:

- Gross income from unrelated business activities,

- Deductible expenses directly connected with conducting the business,

- Net unrelated business taxable income after deductions.

This form allows tax-exempt organizations to calculate and report their tax liabilities for these non-exempt activities. Filing Form 990-T helps maintain the integrity of the tax-exempt status by ensuring that organizations are properly taxed on commercial activities outside their charitable, educational, or other tax-exempt purposes.

Other IRS Forms for Charities and Nonprofits

If you are an owner of an exempt organization, you might find some other IRS forms necessary as well.

Guide to Fill out 990-T

The latest 990-T edition consists of two pages that include the introduction for general information about the organization and five following parts.

- Fill in all the boxes and sections

Check box A only if the address of your organization changed! And be attentive when filling the box B – it defines the type of your organization.

- Indicate taxable income

The next two parts of the 990-T form – Part I and Part II – contain the calculation of the taxable income and different kinds of taxes to be paid by the organization. Fill in the boxes, if necessary.

- Fill out the tax and payments section

Complete the boxes in Part III, “Tax and Payments” section, if needed. You may leave some of them empty.

- Provide supplemental information in Parts IV and V

Sign and date your application. Now the 990-T form is completed and ready to be submitted.

In addition to the 990-T form filling, you may also need to prepare various supplementary schedules. Use our form-building software to fill out the forms accurately and properly to embrace legitimacy and effect.