Form 1099-SA is a tax document that reports distributions made from a health savings account (HSA), Archer Medical Savings Account (MSA), or Medicare Advantage MSA. The form, titled “Distributions from an HSA, Archer MSA, or Medicare Advantage MSA,” details the distributions taken from these accounts during the tax year. It is crucial for individuals using these accounts to manage health-related expenses because it provides the necessary information to ensure these distributions are reported correctly on their federal income tax returns.

The primary purpose of Form 1099-SA is to inform the IRS and the account holder about the total amount of money withdrawn from medical savings accounts during the year. This allows the IRS to verify that the distributions were used for qualifying medical expenses and to ensure that these funds are not improperly taxed. This form helps taxpayers accurately report and substantiate the use of HSA or MSA funds, correctly calculating taxable income and potential penalties for non-medical withdrawals.

How to Fill Out Form 1099-SA

If you want to successfully write out any forms, make sure to use our form-building software to build all needed forms. But now, let’s get back to the completion of form 1099-SA; utilize this document in case you want to get your tax returns.

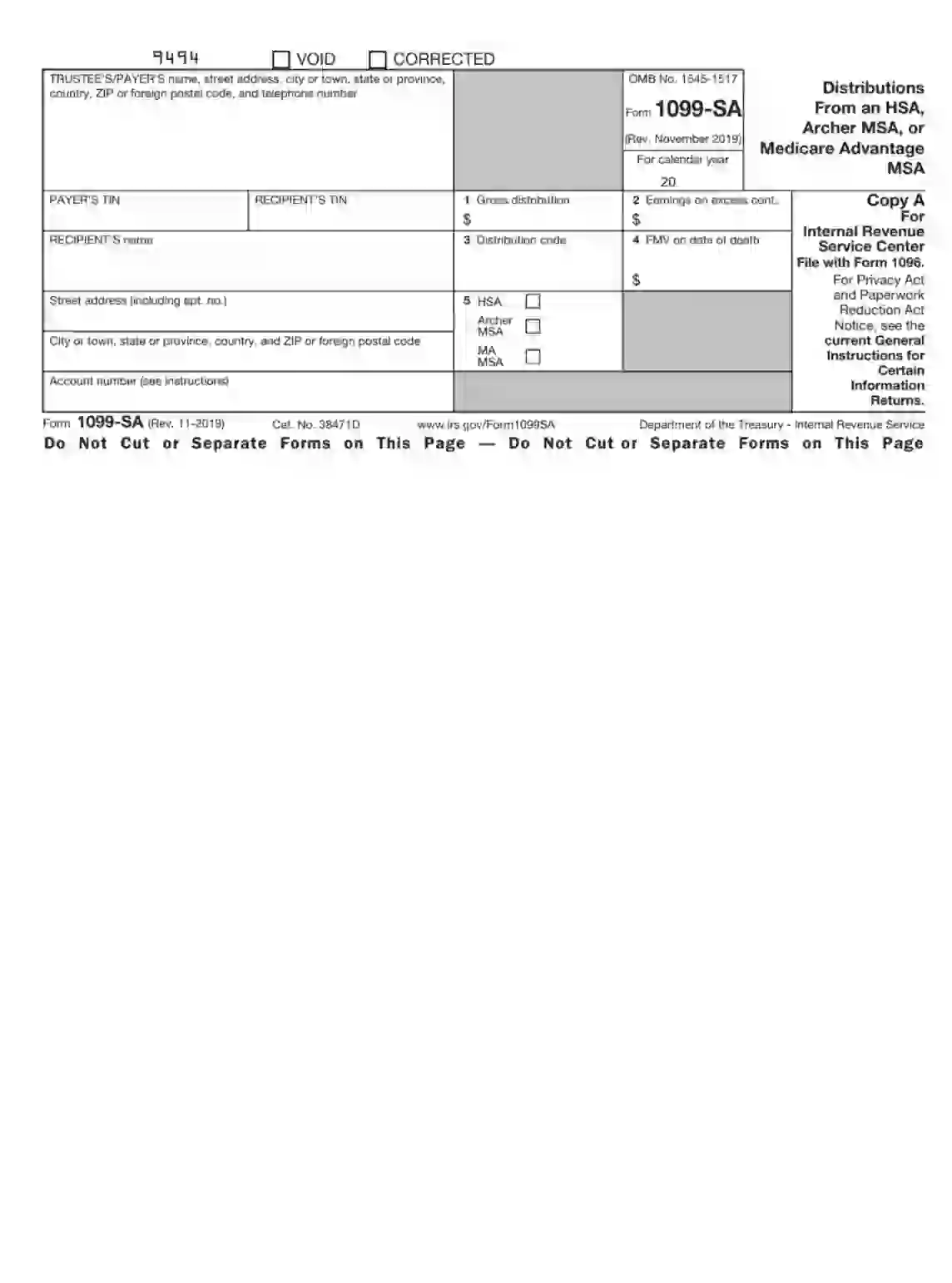

First of all, we can see that the form consists of 5 pages. The first page is dedicated to IRS Center and is called Copy 1. The next page is Copy B, and it is assigned to the Recipient; the next page includes instructions for the Recipient (also called Beneficiary). The next page is called Copy C, and it is assigned to Trustee or Payer; the next page, subsequently, includes instructions for Trustee or Payer.

In general, all of the pages with filling-out sections have a similar structure. Let’s review how to write them out:

1. Fill out the first section that is connected with comprehensive data about the Trustee or Payer. Provide the name of the latter one, their address, city, state, and country, where they live. Make sure to enter postal code and cell number;

2. In the two following sections, fill out the Taxpayer Identification Number of both the Payer and the Beneficiary (the last four digits);

3. In the next segment, fill out the name of the Recipient;

4. In the next section, one should enter the data about the street address of the Beneficiary, including the number of the apartment;

5. In the next part, one should fill out the city, state, and country and postal code of the Beneficiary;

6. Then proceed to the next segment, where one should write out the Account Number. This number can show the account or other unique number that is dedicated to the Payer in order to distinguish the account;

7. Afterward, fill out Box 1, which is dedicated to Gross Distribution. This field will show the dollar sum of money that you took out of your HSA during the year;

8. Then write out the information in Box 2, which is connected with Income from Excess Contributions. Your Trustee should report the dollar sum in this section if you had spent more than you were allowed to on your Health Savings Account;

9. The next box is dedicated to the Distribution Code. There are many options that could possibly be chosen:

- In case your distribution was used to pay for the regular medical expenses, you should put Code 1 to indicate that it was a normal distribution;

- One should utilize Code 2 if they have any excess distributions;

- Utilize Code 3 if one made distributions after the account owner was disabled

- Distribution of Death is assigned to Code 4. It can be used in the year of death or the year after death;

- For a prohibited transaction, use Code 5;

- Utilize Code 6 for the distribution of death after the year of death to a Non-Resident Reciever.

10. In the next box, one should put the information that is dedicated to the Fair Market Value of the total HSA account at the date of death (if applicable);

11. Finally, in the next box, one must indicate which account should be used: HSA, or an Archer MSA, or an MA MSA.