IRS Form 4797 is a tax form used in the United States by individuals, partnerships, and corporations to report gains or losses from the sale, exchange, or involuntary conversion of certain business property. It primarily applies to assets used in a trade or business, such as real estate, machinery, equipment, and vehicles. This form allows taxpayers to report these gains or losses separately from other income or losses on their tax returns, ensuring accurate reporting and calculation of taxable income.

When filing Form 4797, taxpayers must classify the transactions as either ordinary or capital gains or losses, depending on the nature of the property and the holding period. The form provides specific sections for reporting various transactions, such as sales of depreciable assets, like equipment or vehicles, and exchanges of like-kind property. By accurately completing Form 4797, taxpayers can ensure compliance with IRS regulations and optimize their tax liability by appropriately deducting losses or claiming favorable tax treatment for gains related to business property transactions.

Other IRS Forms for Corporations

The Internal Revenue Service requires taxpayers to report various financial information. Check what other information you might need to report in IRS forms.

How to Fill Out IRS Form 4797

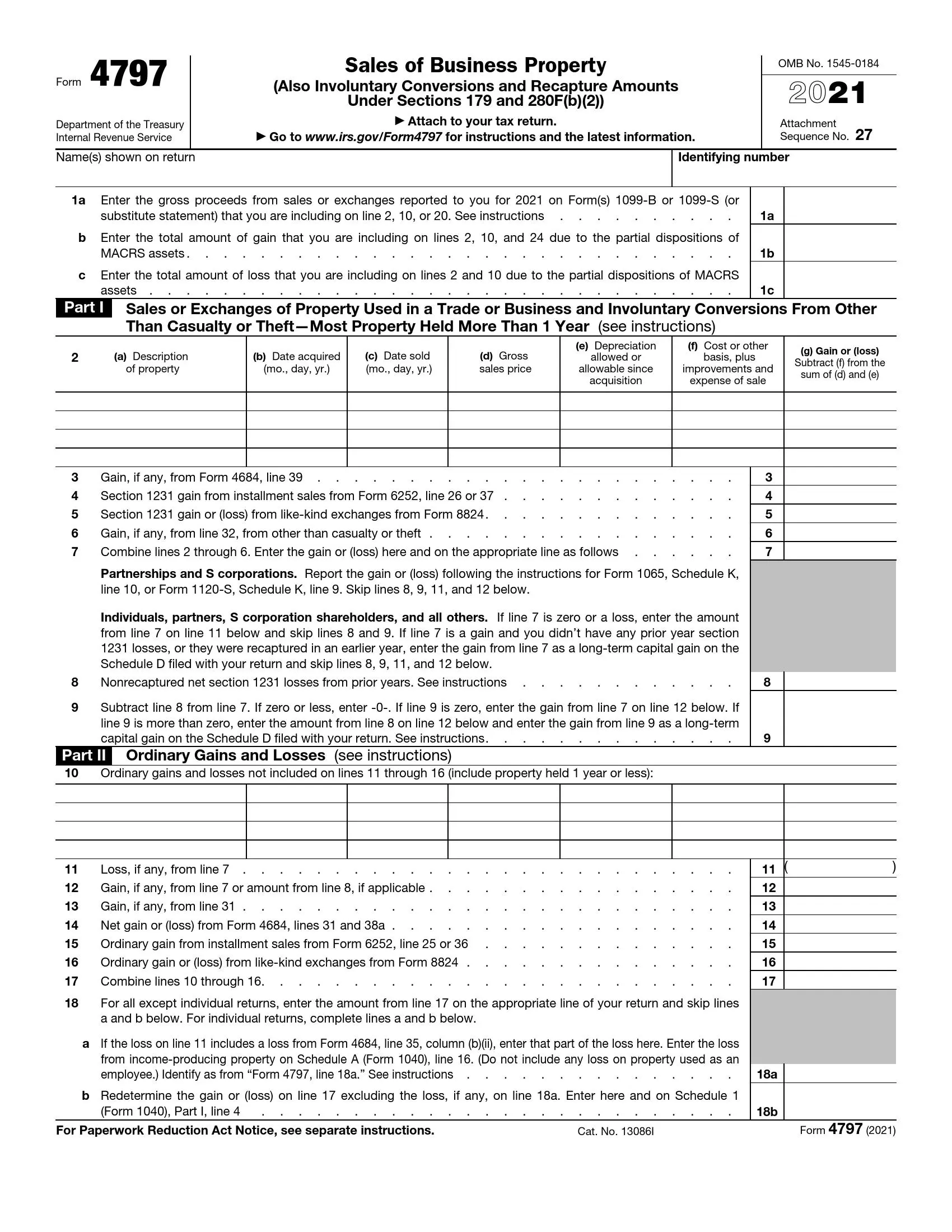

IRS Sales of Business Property Form 4797 comprises two pages and doesn’t contain the authorization part. The preparer needs to cover 35 Units of the document considering the service instructions and file the paper to report the full profit from trading or transferring the realized equity.

Each Part of the 4797 document aims to comprise info for the trade situations based on the seller’s category and asset’s classification. Therefore, ensure you complete the correct part, predetermined to describe your situation. Should you have any doubts, it is recommended to seek professional assistance.

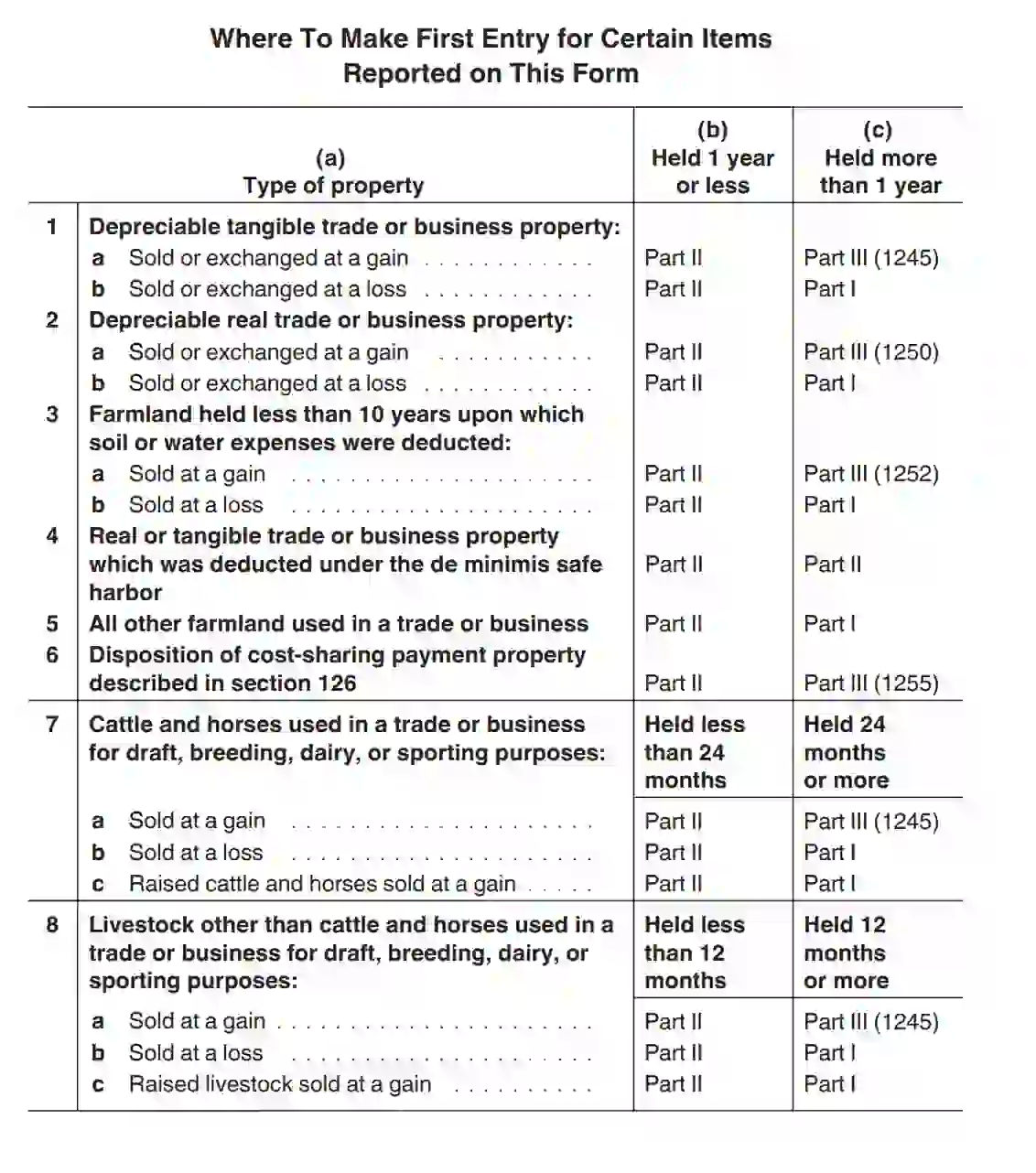

Begin with generating an up-to-date template. You can browse for the needed document on the official IRS site or use our advanced form building software to draft a required PDF file instantly. See the table below to understand your starting point.

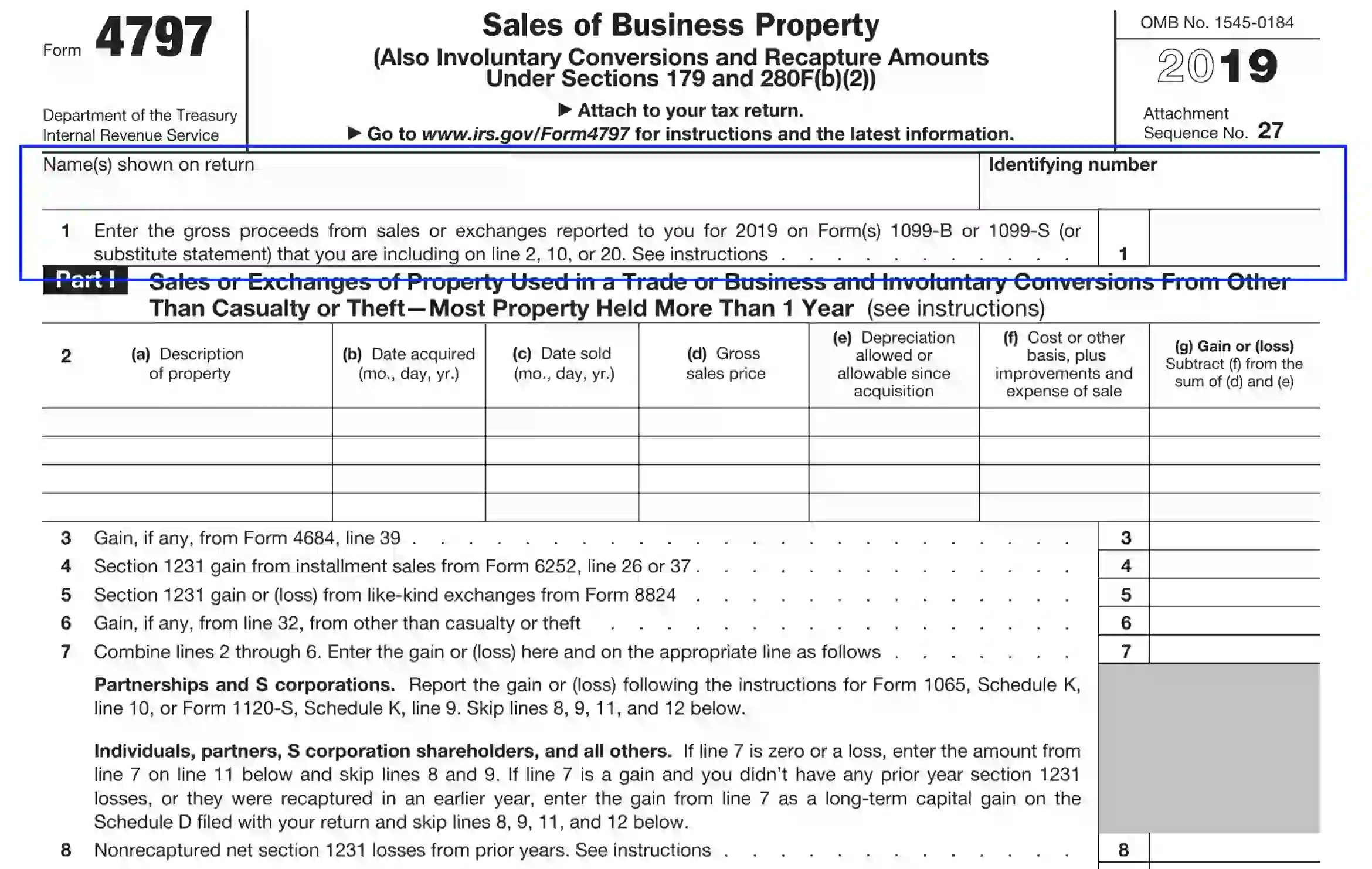

Identify Yourself

Enter the name(s) of traders as indicated on the return form. Also, include the ID number. After you complete this introductory part, proceed to Unit 1 and insert the full gross costs, including profits from trading real estate listed for 2020 and interests from securities or commodities listed for 2020.

Components of gross sales price cover the following aspects:

- Monetary funds before discounts

- The fair market value of assets

- Liabilities or mortgage assets

Part I

Part I is eligible to submit transactions defined by § 1231, Title 26 of the U. S. Code (Property Used in the Trade or Business and Voluntary Conversions).

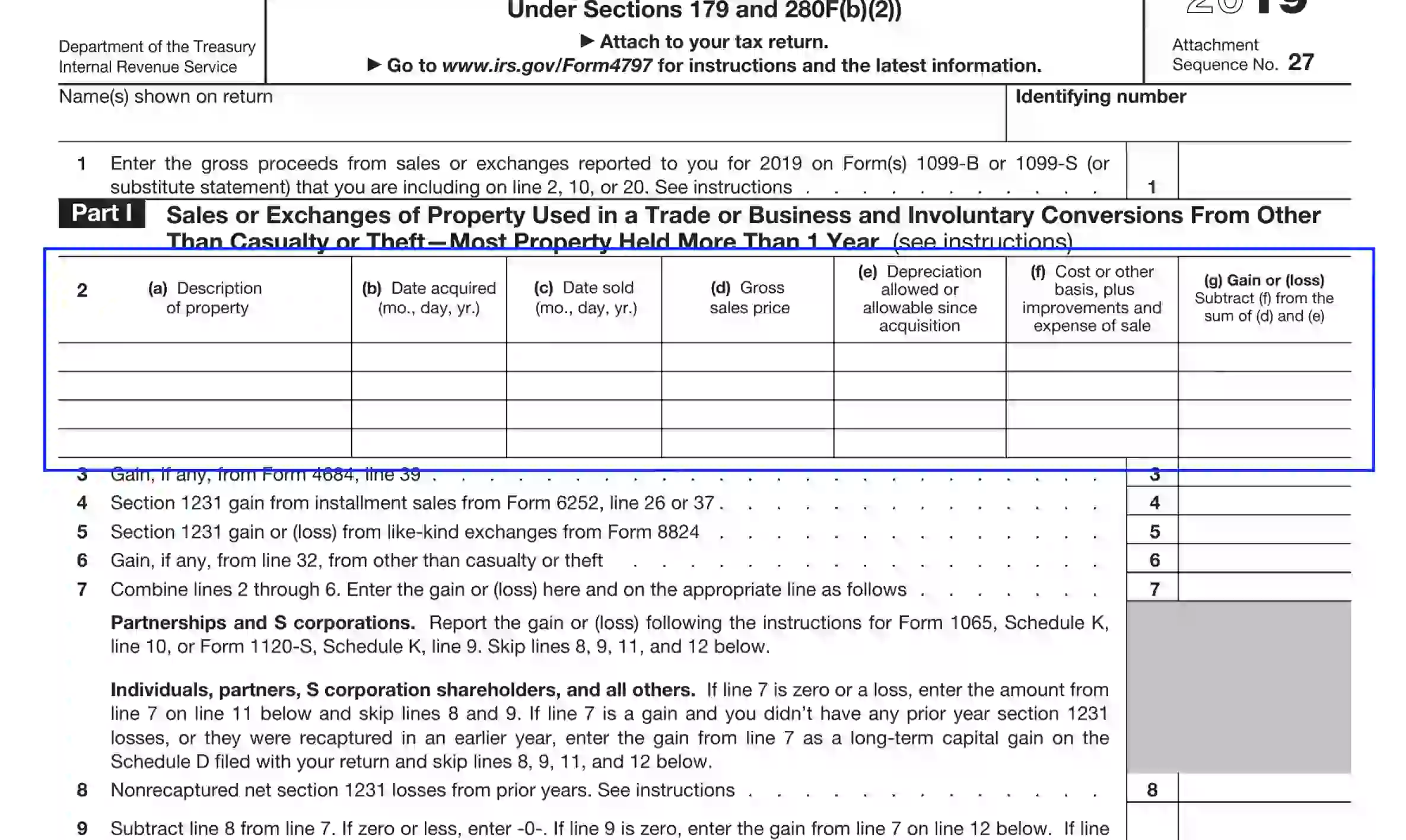

Complete the Table of Unit 2

In this section, the preparer should provide the following data to fill out the table:

- Estate description

- On which date the assets were bought in a month-day-year manner

- On which date the property was traded (sold or exchanged). Ensure to use a month-day-year format.

- Gross sales price

- Residual value at the moment of trading

- Sales costs and expenses

- Income or loss amount should be calculated by subtracting column D from column E values.

Fill Out the Rest of Part I

Here, you should complete Units 3 through 9 by entering the required data. Note that some additional IRS forms and schedules filed along with the preparer’s return might be needed to report the necessary values. Insert the amounts opposite each statement. Make sure to have these documents to the fore:

- Form 4684 is used to file about involuntary transfers from thefts and accidents.

- Form 6252 is needed to report gains obtained via installment sales.

- Form 8824 is used to report the exchange of assets and estate for like-kind business property.

- Schedule D is attached to the return 8949 Form to describe capital gains and losses.

- Form 1065 and 1120-S, the same as Schedule-K of each document

S corporations and partnerships are also obliged to provide either gain or loss data confirmed in these papers.

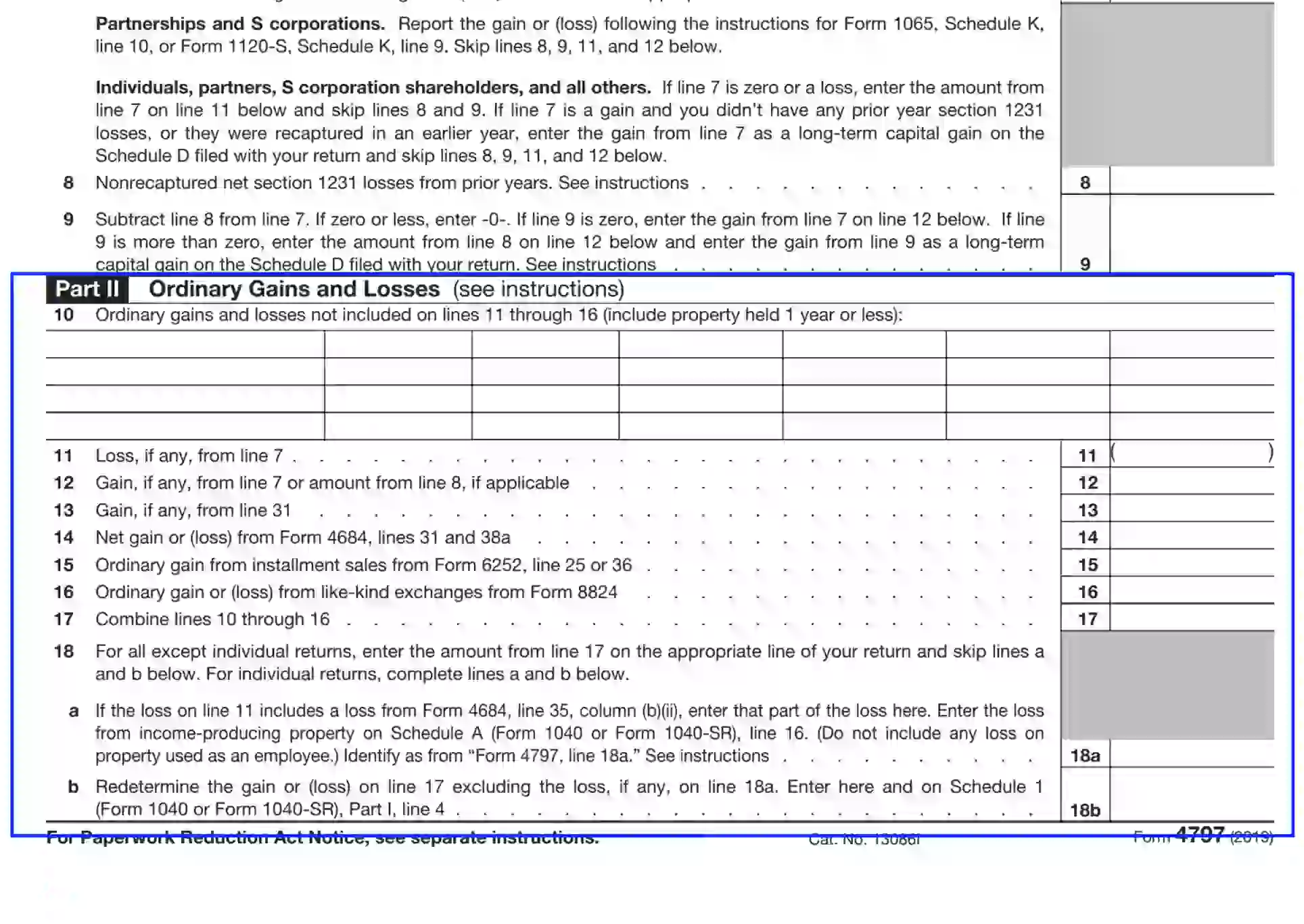

Part II

Units 10 through 18 require that the preparer describes their profits and expenses if the transaction cannot be reportable in Part I or Part III of the respected document. Also, if the estate or assets are not reportable in Schedule D, ensure to submit the needed gains and losses in Units 10-18.

If the Form 4797 preparer has gained profits from disposal of or selling their partnership interests, they need to consider Publication 541 (Partnerships), provided by the IRS on the official webpage.

Submit Ordinary Gains and Losses

If there are any profits and expenses not covered by Units 11 through 18, enter the valid data using the table in Unit 10. Also, you need to report the expenses from a qualifying disposition of real estate investments or business assets. IRS Publication 544 regarding Abandonments might be of assistance if you need more details.

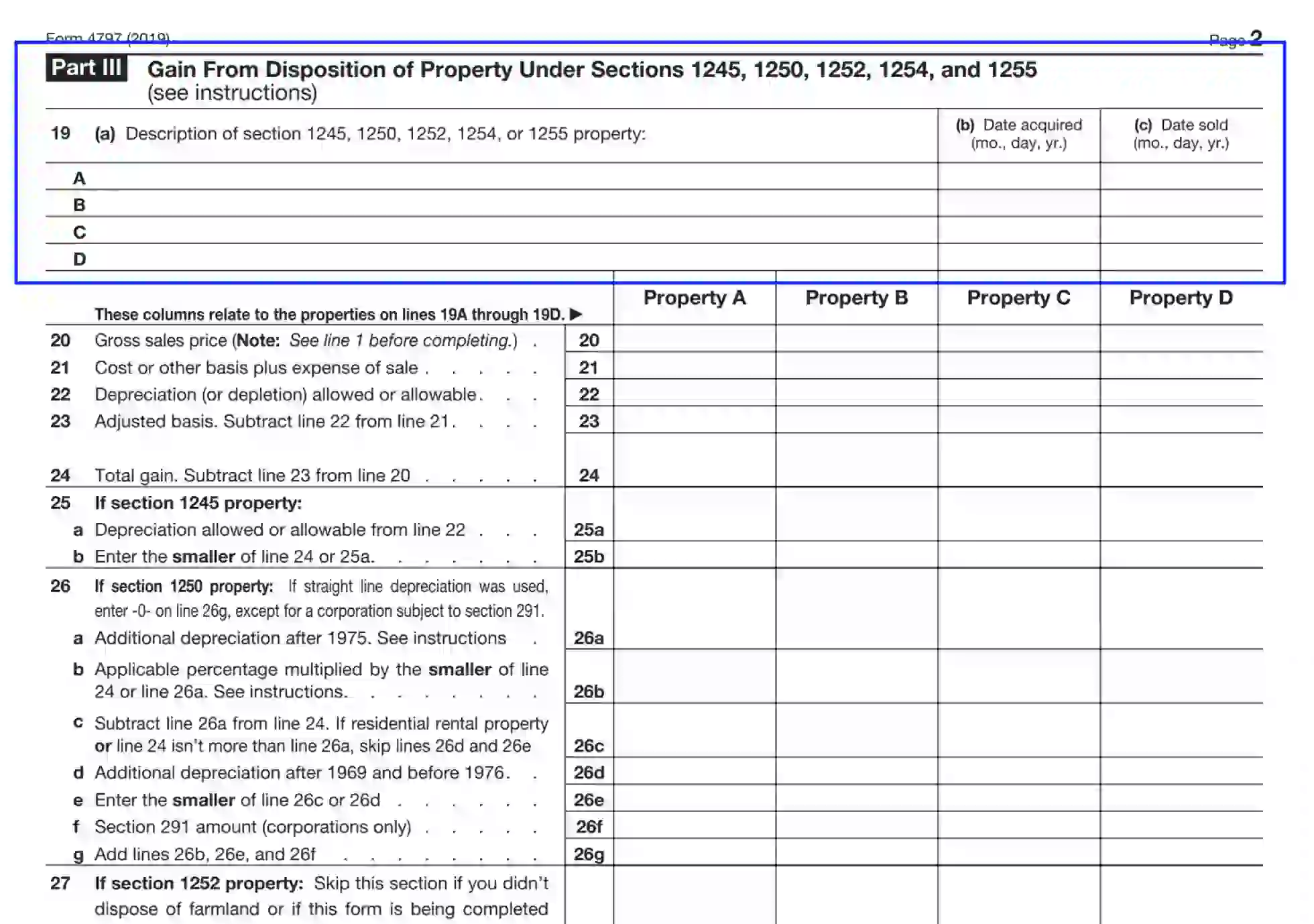

Part III

If the declarant puts the property in operation for a year and less, they need to fill out only Part II, dropping this section. If the assets in possession were traded through installments selling, the preparer needs to consider Form 6252 before completing Part III of the respected document. When some of the property is traded on an installment basis, while some not, the declarant may prepare two 4797 templates to report different types of sales separately.

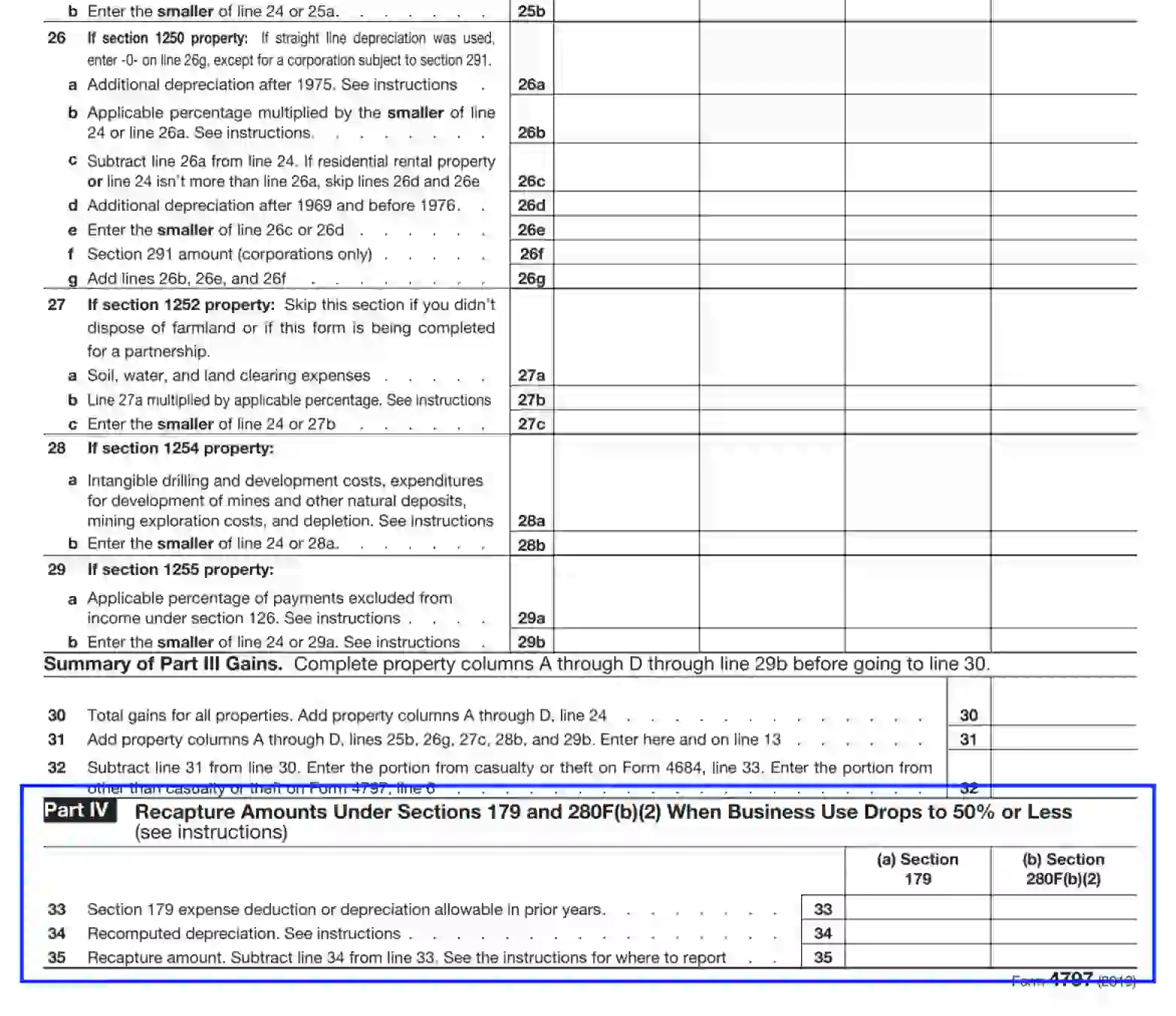

Part III of Form 4797 is designed to reflect the ordinary profit on disposal of an estate and to calculate the recapture amounts.

Describe the Property in Unit 19

Use the table to submit the assets relying on the classification defined by § 1245, § 1250, § 1252, § 1254 § 1255 of the U. S. Code. Describe the asset type (select A through D), provide the date of acquisition and the date of transaction, entering the month, day, and year.

Fill Out the Gain Disposition Table in Units 20-29

To complete the table successfully, the preparer needs to enter the requested info considering the property category described in Unit 19. Comment upon each statement of sections 20-29 and fill out your answers in the correlating slots to the right. The statements demand rather straightforward information. Once you are finished with these sections, move on to the summary units.

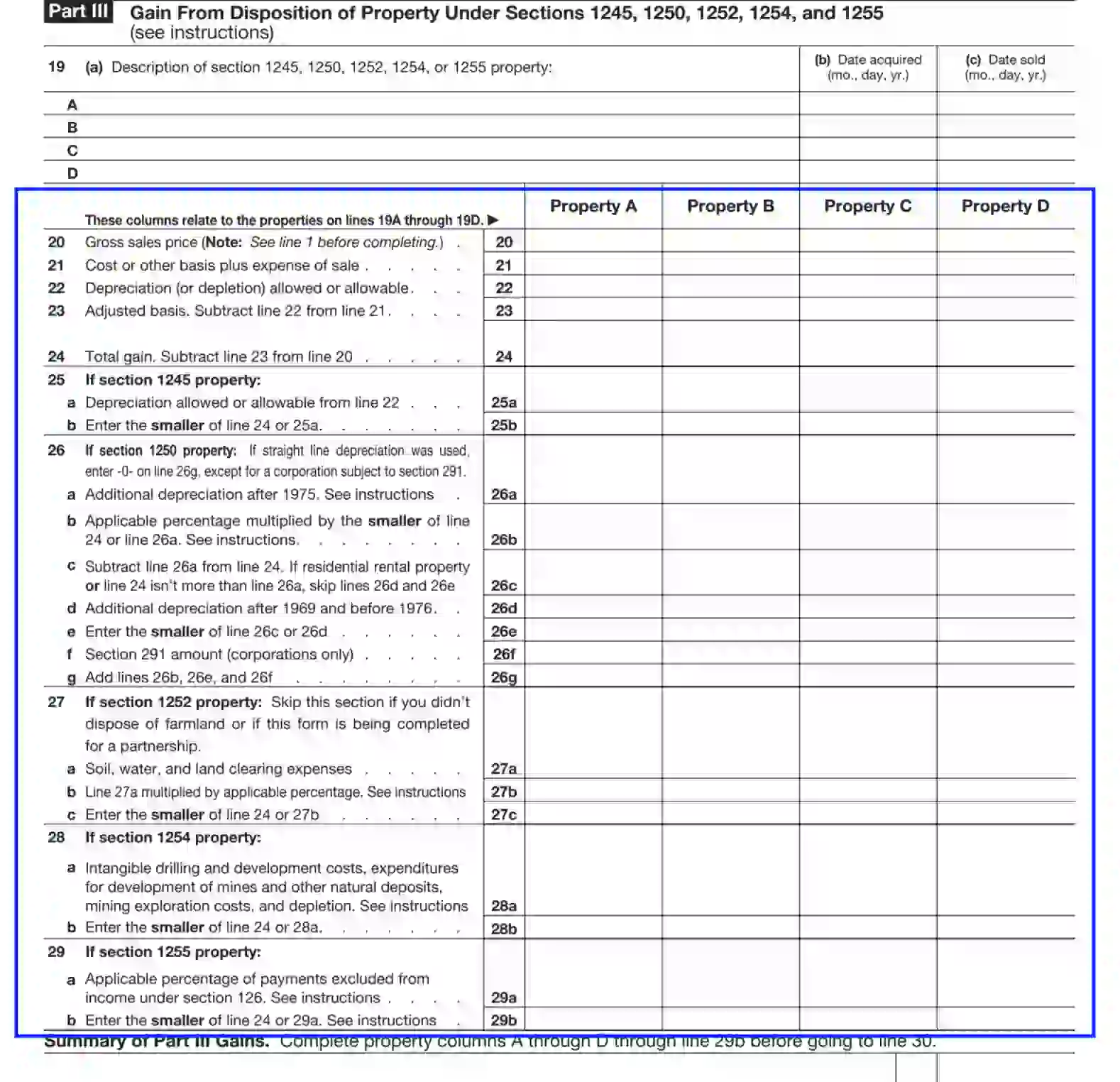

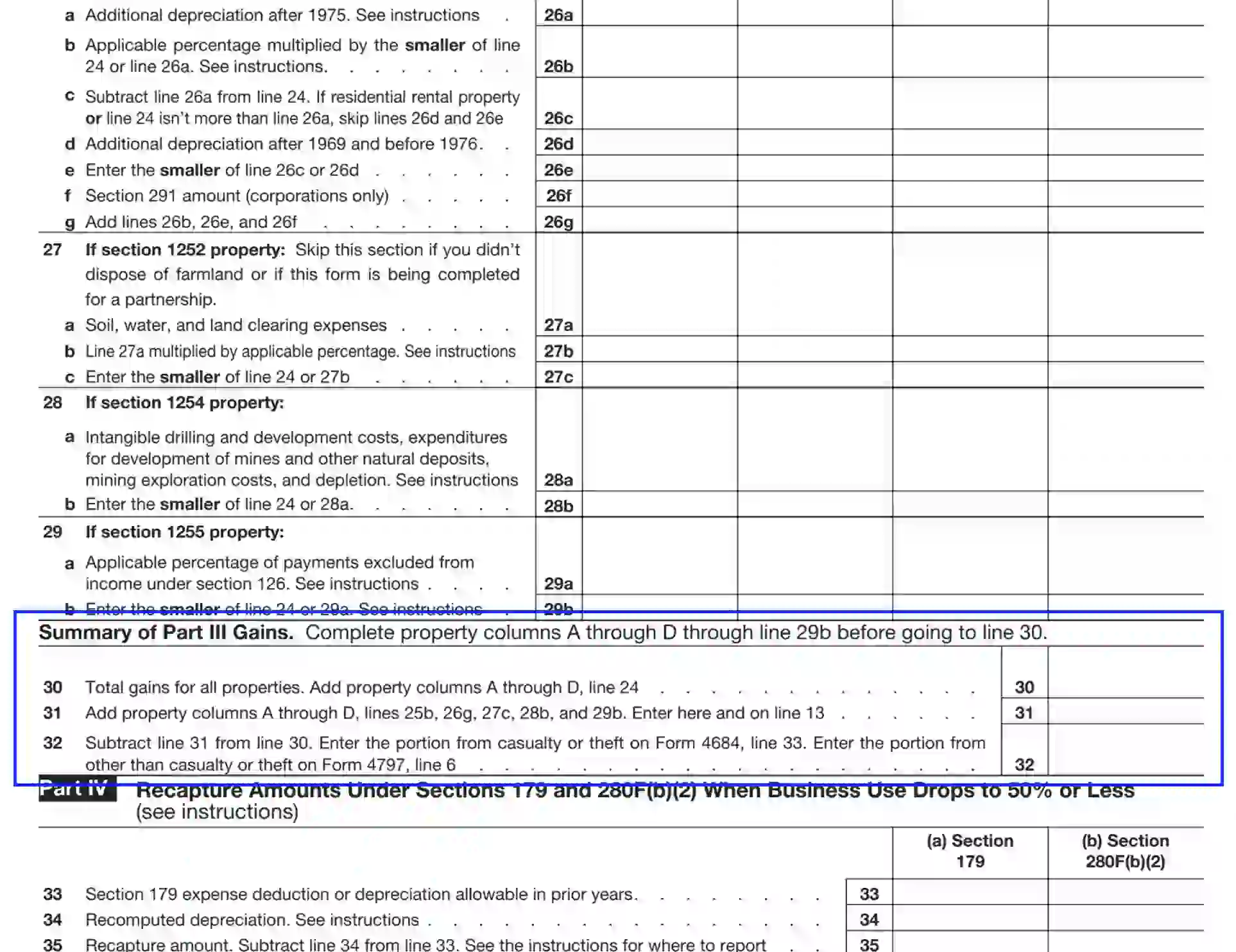

Submit the Summary of Profit Amounts

In this section, you need to calculate and report the profits from properties identified in A-D lines of Unit 19. It is vital to complete info of sections 20-29 prior to proceeding to line 30.

Define Recapture Amounts

Part IV consists of statements 33-35 and requires that the declarant submits their recapture amounts considering either § 179 or § 280F (b) (2) of the U. S. Code by entering the valid data into the referenced columns.

- Subsection “a” is under § 179

Use this subsection to report the recapture amount if the business use percentage does not surpass 50% at the deduction of expenses for assets and estate placed in operation after 1986.

- Subsection “b” is under § 280F (b) (2)

Submit the required info in subsection “b” if the property was placed in operation during the previous year, while the business use percentage does not surpass 50% in the current year. If you need more details, please, ensure to check out IRS Publication 463.

If the declarant possesses more than one asset or estate, they may use extra forms and attach the documents to the return paperwork.