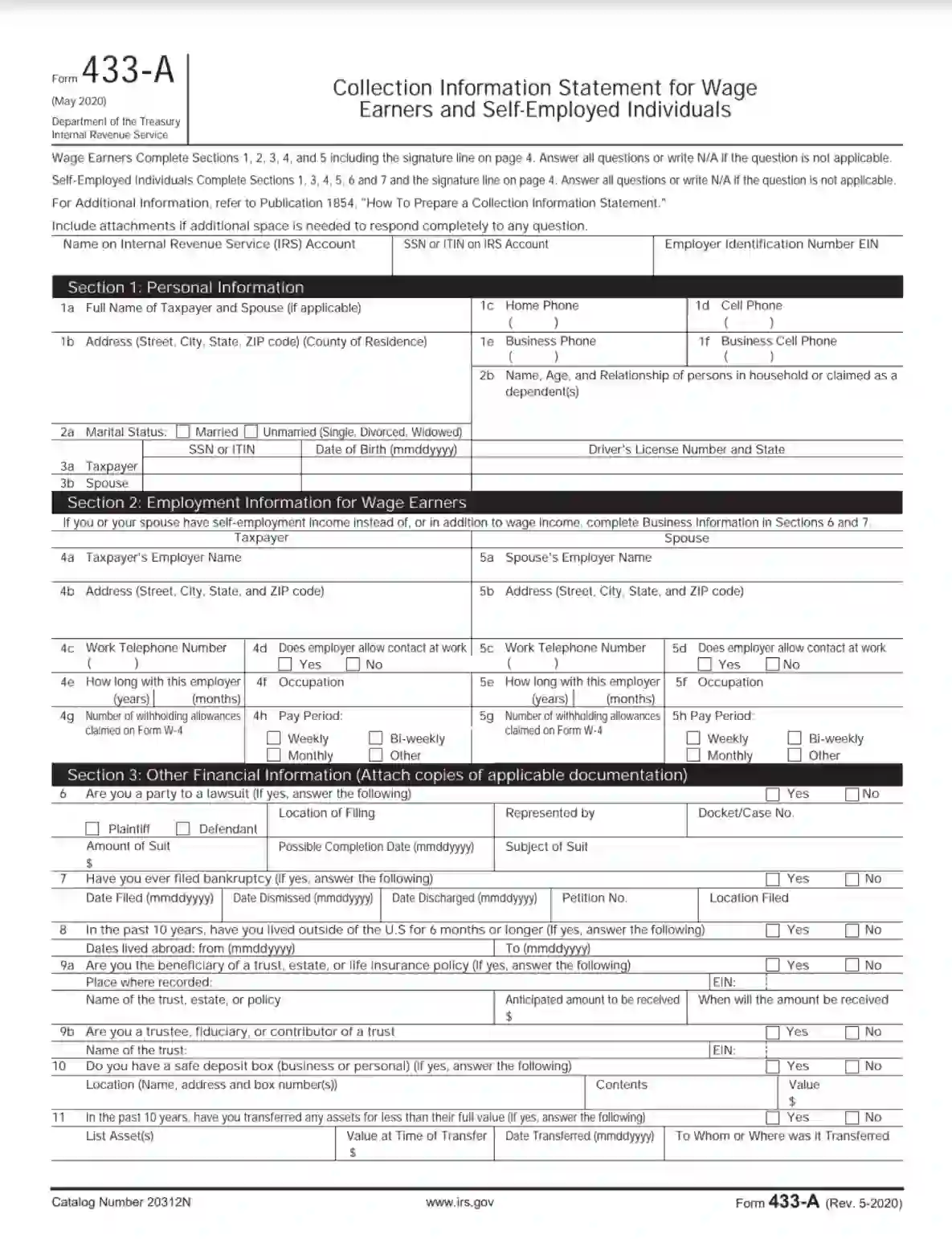

Form 433-A is a crucial document the Internal Revenue Service (IRS) uses to gather financial information from individuals who owe taxes and seek to resolve their tax debt through installment agreements or other collection alternatives. This form is typically used by individuals who cannot fully pay their tax liabilities and must negotiate a payment plan with the IRS.

Form 433-A requires detailed information about the taxpayer’s income, assets, expenses, and liabilities. This includes information about employment, bank accounts, investments, real estate, vehicles, and monthly living expenses. By providing this information, taxpayers enable the IRS to assess their financial situation and determine their ability to pay their tax debt. Based on the information provided on Form 433-A, the IRS may approve an installment agreement, offer in compromise, or other collection alternative to help the taxpayer resolve their tax debt in a manageable way.

Other IRS Forms for Trusts and Estates

Here are some other IRS forms that you might need if you are a wage earner or a self-employed individual.

How to Fill out IRS Form 433-A

The revised version of the form consists of 7 sections and six pages. You can get the form template online on the official IRS website or use our ultimate form-building software to create and customize any official form you need. We follow the refreshments and always renew the guidelines and form template on our website.

We have also outlined some useful tips and recommendations on the form compilation below. Following them, you will be able to fill out Form 433-A effortlessly, section by section.

Please note that wage earners and self-employed individuals have to fill out different sections of the form. Depending on your employment status, check what sections you need to fill out at the top of the form before proceeding to the filing process.

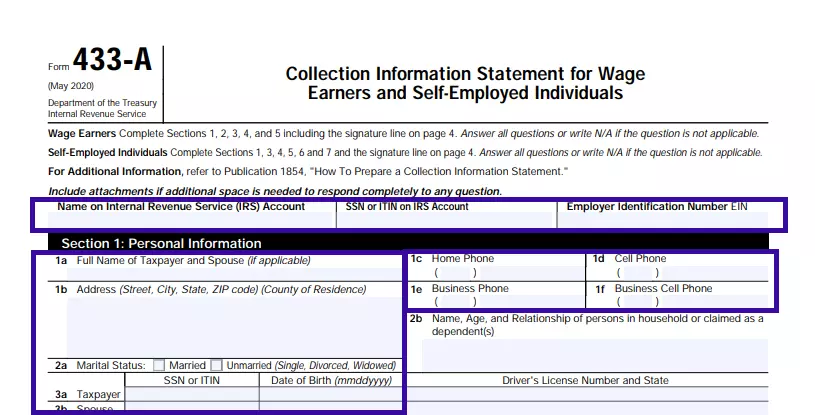

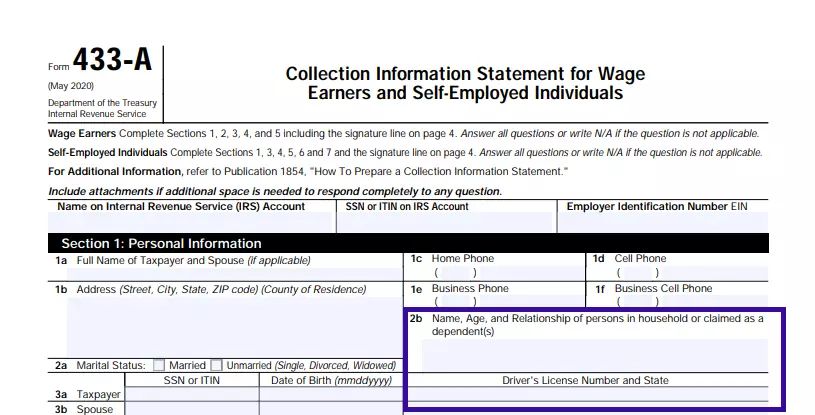

Provide Personal Information

The first section of the form is entirely dedicated to the applicant’s personal info. Here, you must submit your and your spouse’s (if currently married) full legal names, physical address, marital status, date of birth, SSN or ITIN, and all kinds of contact numbers (including home, personal daytime, and business phone numbers). Please note that if you are married, you need to submit the same information about your spouse.

Enter the quantity, name(s), age(s), and relationship(s) of dependent household members, if any. Also, you need to submit your driver’s license number and state of issue.

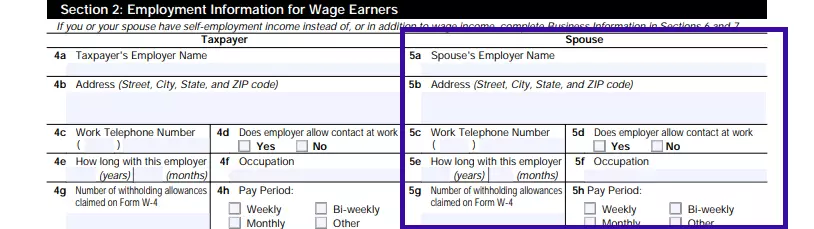

Indicate Your Employment Situation

Section 2 is only meant for wage earners to fill out. In the respective blank lines, the applicant must fill in their employer’s name (of both you and your spouse, if married), the business office address, work contact number, employment period and occupation, the quantity of withholding allowances claimed by Form W-4.

Again, if married, provide the exact same info on your spouse as well.

Submit Relevant Financial Details

Section 3 of the tax compromise application form implies the submission of information related to the applicant’s current financial situation in some way. For example, the IRS needs to know if you currently are party to a lawsuit, have recently declared bankruptcy, have lived outside the US over the last ten years, or if you have a safe deposit box. If any of the suggested statements is true, you will have to supply legal proof and attach additional documentation.

Define and Assess Your Assets

In the following section, you need to define personal assets, and it concerns all applicants, regardless of where you are a US citizen or a foreign resident, obliged to pay taxes and subject to the US jurisdiction.

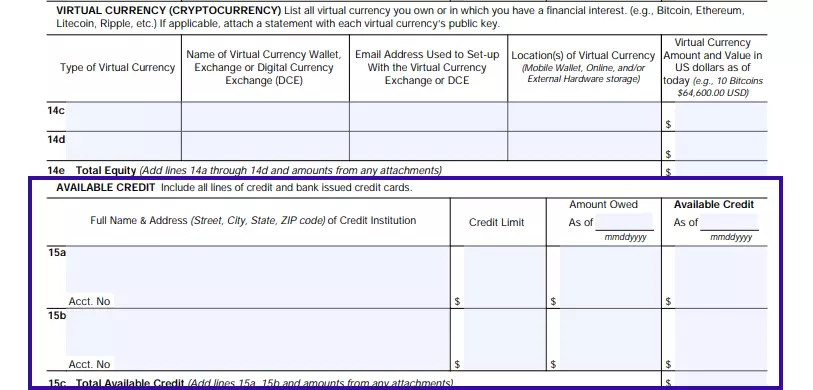

The IRS would like to know if you have bank accounts, receive investment interest, possess virtual currency, have life insurance, or credit obligations. You need to fill in all the respective blank boxes and indicate the type of asset or financial obligation, amount, total value, and contact info of the issuing or responsible institution. Please ensure to fill in accurate and reliable information so that the IRS could check and confirm it.

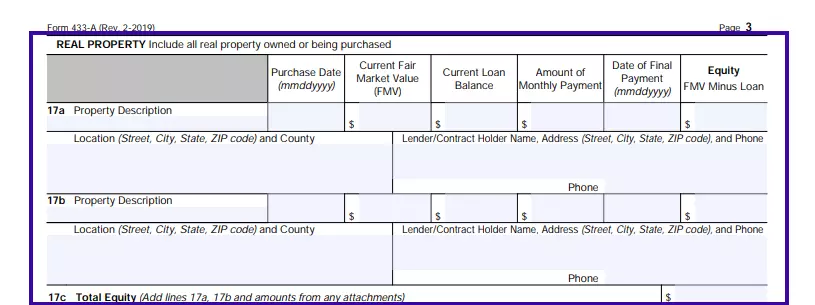

Furthermore, you will also need to indicate if you have any real property in possession and estimate its total market value, as well as insert info on personal vehicles and other valuable assets (meaning, expensive furniture, jewelry, artwork, antiques, and other respective collections).

Indicate Your Monthly Income and Expenses

Here, you must describe in detail the gross monthly income and expenses of your household. Each line in this section has to be calculated and filled in individually. The form suggests a detailed instruction below the blank lined, which you can use to comprehend the requirements better. We strongly advise you to read these instructions before you fill out any financial information in this section.

You and your spouse (if applicable) have to put your signatures at the bottom of this page as a sign of your official confirmation and compliance with the submitted financial data.

Enter Related Business Info

If you are a self-employed taxpayer, you need to fill out Sections 6 and 7. If you own a business entity or a sole proprietorship, you will need to indicate its type, legal status, and all the respective information concerning this particular business of yours. The required information may include EIN, business name and address, contact info and website page, average monthly payroll, frequency of tax deposits, and the number of employees.

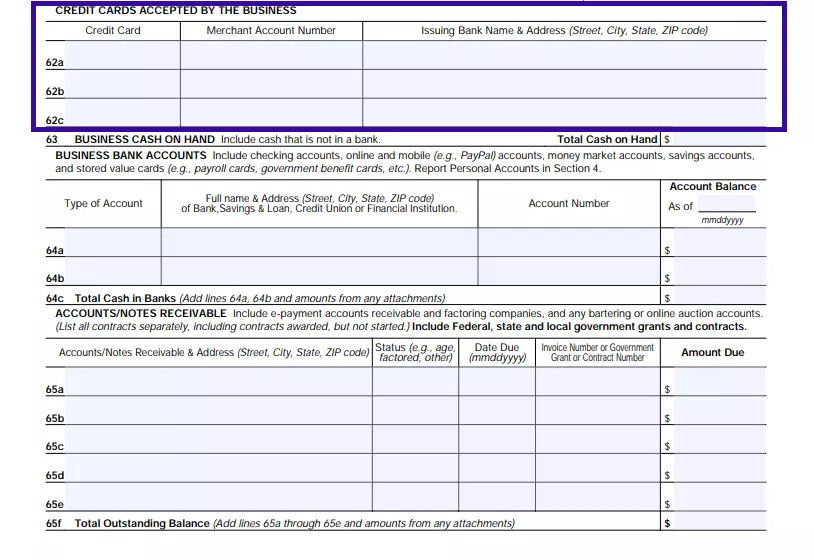

If your business accepts and operates transactions involving credit cards, please include such info in the table as shown below.

If your company has one or multiple bank accounts, please enter their type, client number, amounts of money stored, and physical address. In case the company members or employees have any cash on hand (not related to the business bank account), do not forget to indicate that information in the table as well.

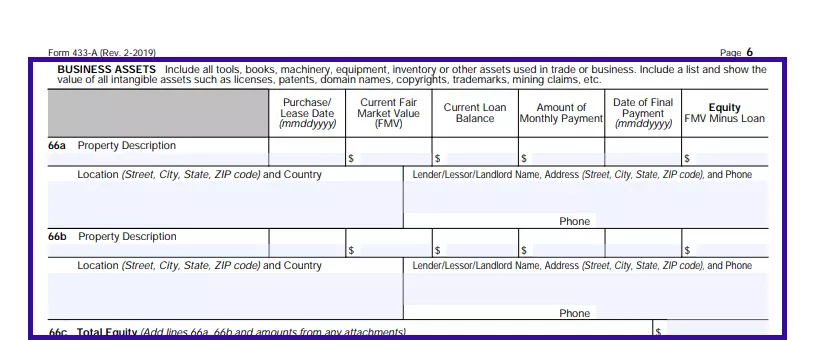

The following subsections are dedicated to e-payment accounts receivable (like bartering or online auction accounts) and business assets. The list shall include all existing contacts, including federal government grants and those awarded but not started (if any).

Submit the Required Proprietorship Info

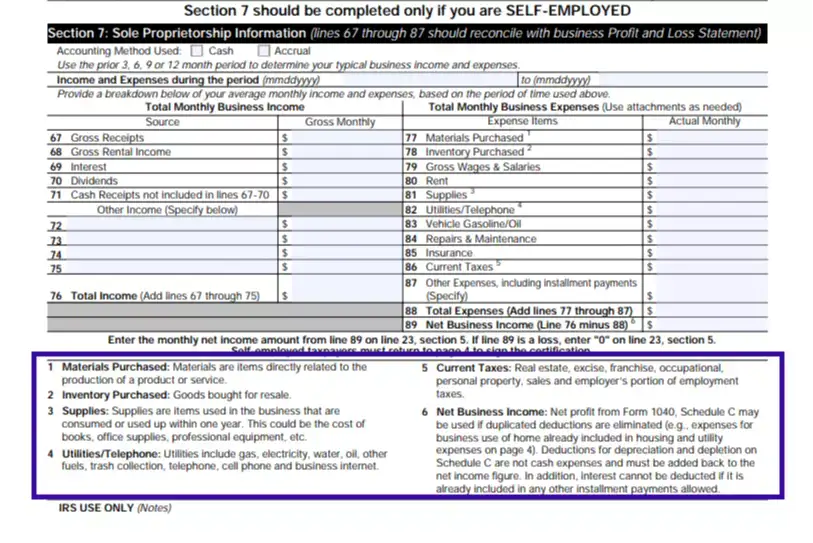

There are two tables you need to complete in this section. The first one refers to your gross monthly business income, and the second refers to your actual monthly business expenses.

Please check with the information and guidelines below the section to learn how to calculate the amounts properly.

Provide Supplemental Documentation

Indeed, you should prove all the information stated in the form so it would convince the IRS to provide you the tax compromise. Thus, depending on your employment status and assets indicated, you might need to attach the following documents to your completed Form 433-A:

- A copy of the most recent payment receipt from your employer (attach several copies if you have more than one employer);

- A copy of your most recent investment statement or retirement account;

- Copies of all statements from other related sources of income;

- Bank statements you have acquired over the past three months;

- Lender statement (if applicable), including payment amounts, balance, and monthly payroll;

- Copies and lists of Notes Receivable, if any;

- Delinquent legal status verification (if applicable) or local taxes report;

- A copy of completed and signed Form 2048 verifying a power of attorney (if the applicant wants to get legal representation);

- An original copy of a completed and signed Form 656.

Submit all of the attachments along with the completed Form 433-A, signed by you and your spouse, to the address indicated in the form or use the IRS electronic filing system.