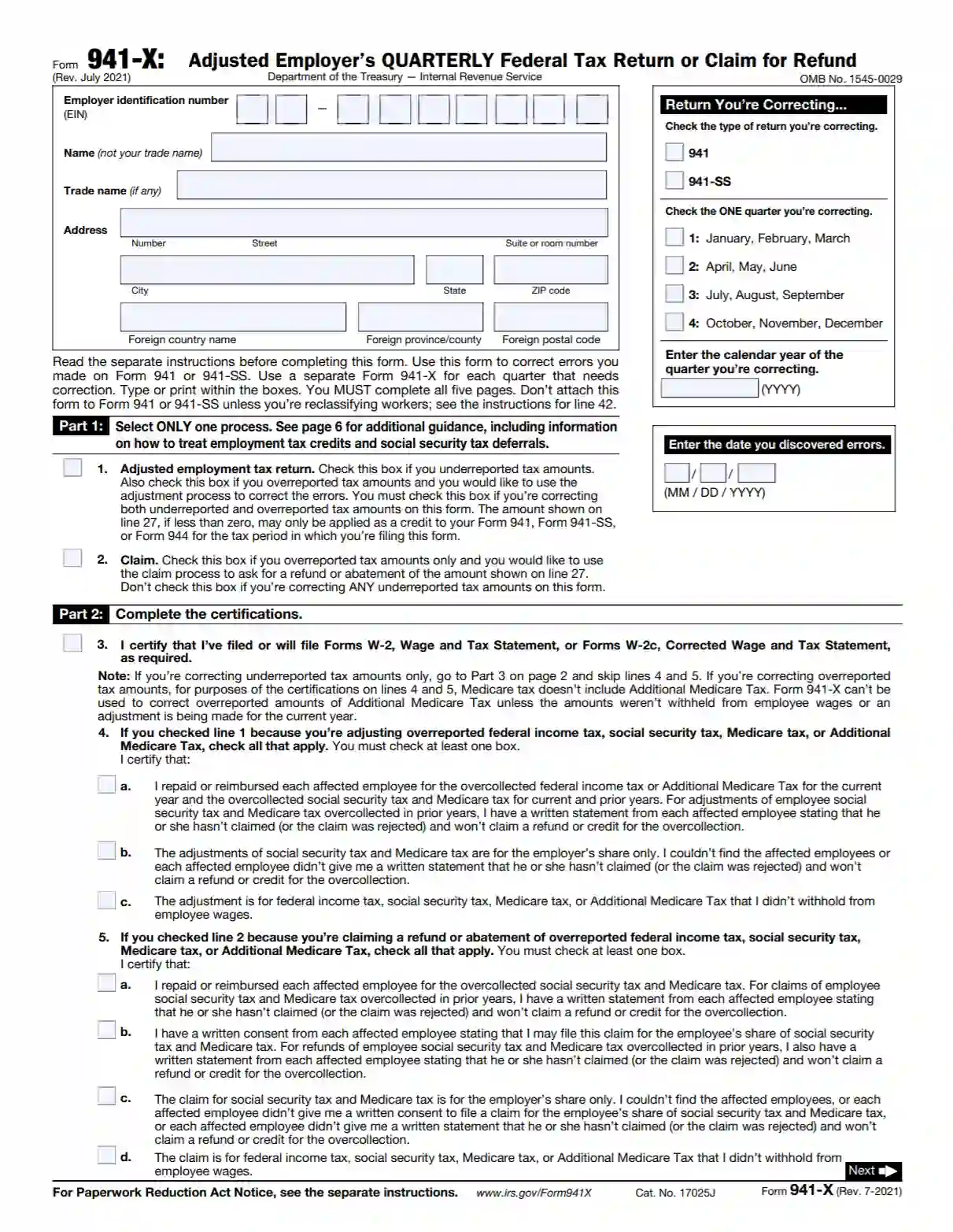

Form 941-X is a specific IRS document titled “Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund.” Employers use this form to correct errors found on a previously filed Form 941, the standard quarterly payroll tax return. Errors that can be corrected using Form 941-X include overpayments or underpayments of income, Social Security, or Medicare taxes.

The purpose of Form 941-X is to adjust amounts that were either reported too high or too low on the original Form 941. Employers may use this form to make corrections and claim refunds for overpayments or to calculate and pay additional taxes due for underpayments. It’s an essential tool for ensuring payroll tax compliance and accuracy in reporting, helping employers maintain proper financial records and meet federal tax obligations.

Other IRS Forms for Business

Form 941-X is a mandatory form for those who make amends to an already submitted form 941. learn what other IRS forms are mandatory for businesses in certain situations.

Instructions For Forms

So, filling out any official document is not an easy task. Sometimes employers have to study additional materials and rules to avoid misunderstandings and repeated corrections. What issues does this form help to decide on?

- Correction of salary, tips, and other payments;

- Change in income tax, taxable wages, and tips for social security;

- Change in the deferred amount of the employer’s or employee’s share of social support tax;

- Correction of the tax credit for small business salaries to increase research activities.

These are the main points to use this form to correct tax documents. By the way, you may now request a refund or a reduction in fines by filling out this application. In general, if you have not previously submitted Form 941 for one or more quarters, you do not need to use the above-mentioned additional application. You may fill out Form 941 for each quarter of a particular year.

Exclude the possibility of submitting the form in the last days of the deadline, as it will negatively affect your requests. Fill out the application on time. If you manage to make mistakes from January to March of the current year, submit the form until April 30 (included). If the errors occur in the forms you submitted from April to June, the deadline for filling out the application will be shifted to July 31 (from July to September is October 31, and from October to December is January 31).

Please read the instructions for completing this form. Note that you need to use a separate form 941-X for each quarter that needs correction. Since an easy paperwork process is a priority for each employer, fill out the application correctly and honestly. False information will lead to rejection or refusal of acceptance from local authorities.

Enter Basic Information

First of all, enter all information about your organization (the current address, the name of the legal entity, and your name). If the legal address of your company has changed, make sure to correct it. It makes it easier for the Tax Service to update the addresses for further work with them.

Do not forget to register the organization’s identification number. In general, you need to fill out all four pages of the form. In the right corner, specify which application you want to correct and for which quarterly year. Be sure to enter the date when you found the errors in the filling.

Provide the Reason For Filling Out The Form

The entire form consists of several parts. In the first part, specify the reason for filling out the application. Select the check box in the appropriate field. The first point refers to the correction of undervalued and inflated amounts. You choose the second option if you file a claim for a refund of a certain amount.

Fill Out Certifications

Next, fill out the second part of the form carefully, as there are some nuances. If you change the undervalued amounts, select only the third item by going to the third section. If the corrections relate to inflated payments, fill in the fourth and fifth items by selecting the appropriate one. It is a mandatory requirement, as you must protect your employees from collecting overpaid taxes on social security and medicine.

Another important point about the third point is to fill out additional forms W-2 or W-2C. It confirms your intentions to correct errors and provide correct data.

Insert Quarterly Year Data And Corrections

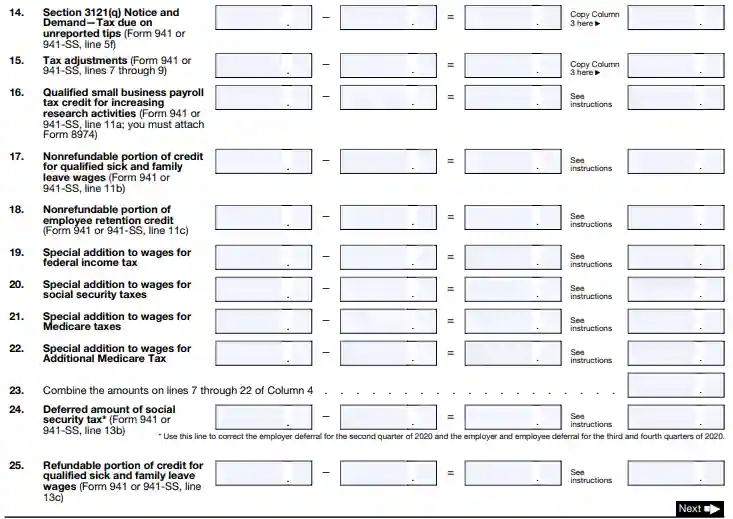

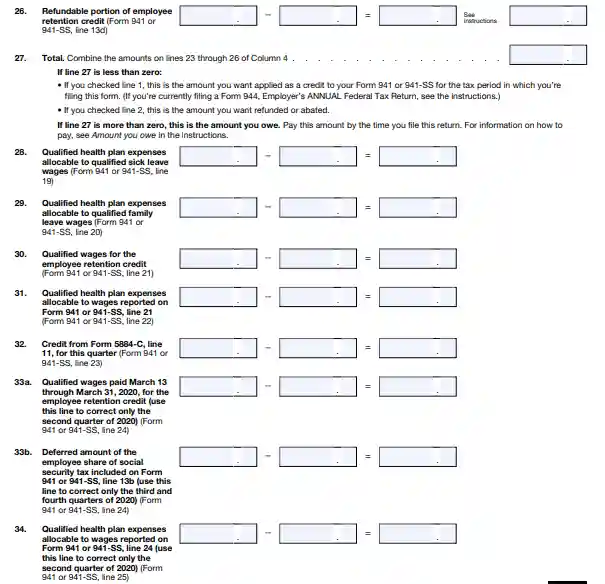

The third section is the most significant because it contains mathematical calculations and tax amounts. Before filling in the data, check its validity several times. It will allow you to avoid all sorts of mistakes and miscalculations. From the sixth to the thirteenth point, specify the amounts for all your employees regardless of corrections. Remember that if a line is not relevant to your case, leave it blank.

From 14 to 22, from 24 to 26, and from 28 to 34 points, fill in only what applies to your corrections. Not all items here apply to all situations by quarter years, so check the information several times. Pay attention to the special conditions for filling in the form. As for the 27th point, you need to specify the total final amount, combining the data from the fourth column from 23 to 26 points. For more information, see our guide to filling out the form.

Explain the Corrections

As noted earlier, you must specify the reasons and explain in detail your intentions for corrections. Select the 35th item if your errors relate to both undervalued and overstated amounts. Field 36 belongs to a different kind of fixes that are associated with the reclassified workers. In any case, in the 37th column, you must explain in detail each reason for the correction. It is a mandatory requirement of the form. Enter the following data:

- line numbers of this form, error-related

- date of detection

- the difference in the amount

- the reason for the error

Put a Signature

Any official document must be signed. Unfortunately, without your signature, the authorities will not accept it and will not consider it. Who has the right to sign the document?

- individual entrepreneur and private companies such as LLC

- partnerships or unincorporated organizations

- single-member LLC

- trust organization

There are also alternative options for signing this form. For example, corporate officials or agents may sign this application with a rubber stamp or computer software (electronic signature). This section also contains information about the paid originator of this form. Such persons must sign the document with a manual signature indicating their data. The initiator shall provide you a copy of the declaration in addition to the copy for the Internal Revenue Service. When filling out this application, use our software to fill out this form.