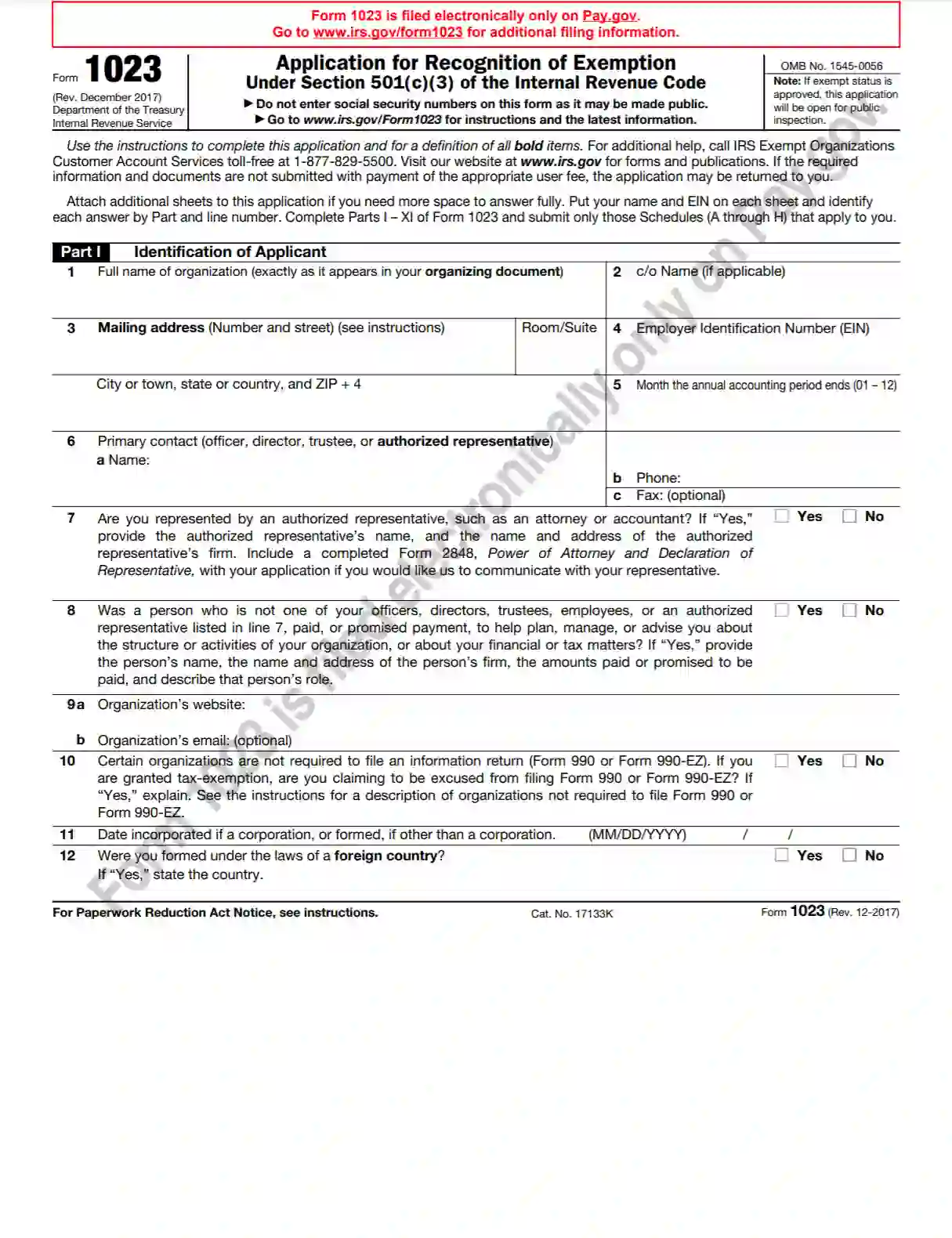

Form 1023 is a detailed application used by organizations in the United States to obtain tax-exempt nonprofit status under Section 501(c)(3) of the Internal Revenue Code. Formally known as the Application for Recognition of Exemption, this form is essential for organizations that wish to operate without federal income tax liability and allow their donors to claim tax deductions for contributions. The comprehensive application requires information about the organization’s purpose, activities, governance structure, and financial records to assess its eligibility for tax-exempt status.

The purpose of Form 1023 is to demonstrate to the Internal Revenue Service (IRS) that an organization meets the strict criteria for 501(c)(3) exemption. These criteria include being organized and operated exclusively for religious, charitable, scientific, educational, or other qualified purposes. Successfully filing Form 1023 can help an organization attract more support through tax-deductible donations, a critical factor for many nonprofits sustaining their operations and programs.

Other IRS Forms for Partnerships

If you have already filed the Form 1040, you might need to file more forms, depending on the complexity of your finances. Check what IRS forms are often filled out by our users along with the standard tax return form for individual taxpayers.

How to Fill Out Form 1023

You need to get the accurate form template before you proceed with the filing process. The form is available online on the official IRS website, so you can either find and download it from there, or you can use our latest software tools and developments to create an already customized form and edit the PDF file online on our website.

Hereunder, we have compiled a comprehensive guide on filling out the form, so you can refer to it and follow the instructions step by step to avoid unnecessary mistakes. The form contains some updates compared to the previous years, so you may also want to check out the refreshments and novelties on the IRS website.

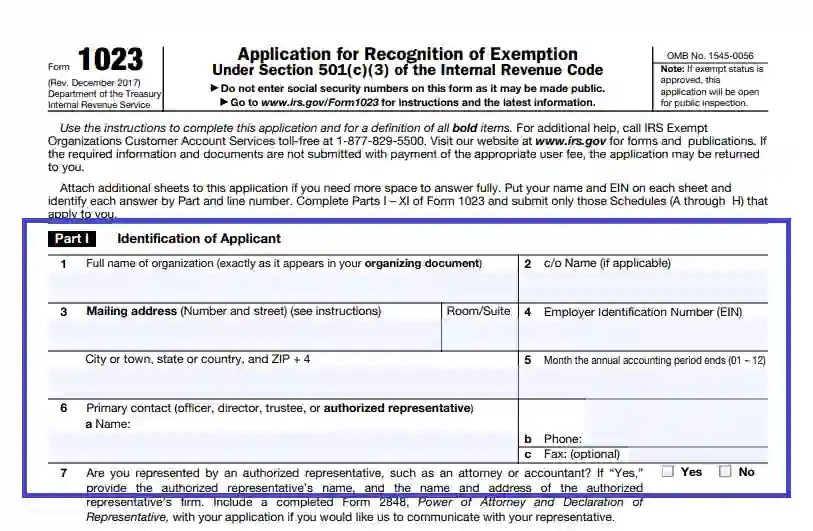

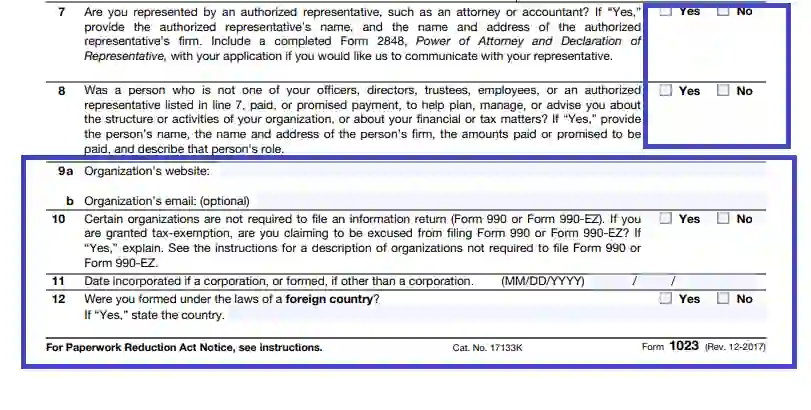

Identify the Applicant

In the first part of the application form, you must identify the applicant. Enter the legal name of the organization applying for the special tax status, its mailing address, including state, city, ZIP, street, and building number, EIN, the month of the accounting period beginning, and the respective contact info (fax, daytime telephone number, and the name of the responsible contact person).

Below you can add some additional info about your company, like the website address, contact E-mail, date of establishment, authorization, and foreign residence (if applicable). Check the necessary boxes and fill in the blank spaces and shown below.

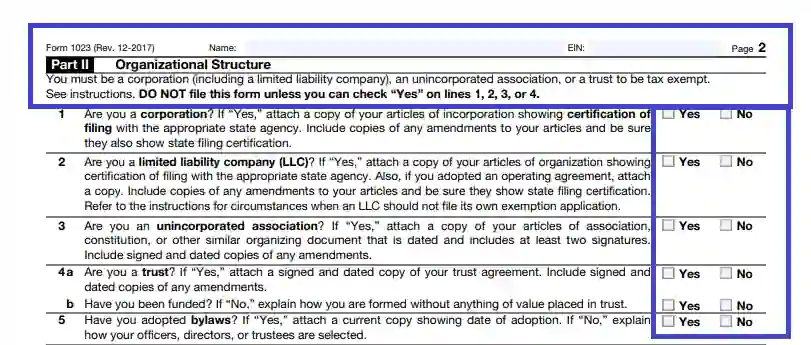

Define the Organizational Structure

In the second part, you must define the organization’s legal entity type and structure. Choose among the four given options and tick the corresponding box to do so.

State the Required Provisions in the Founding Document

Above in the article, we have briefly mentioned the necessary provisions that compulsory to include in the company’s founding statutes to be eligible to apply for the special status and respective benefits. Mark if you have those provisions in the sections of Part 3 of the application form.

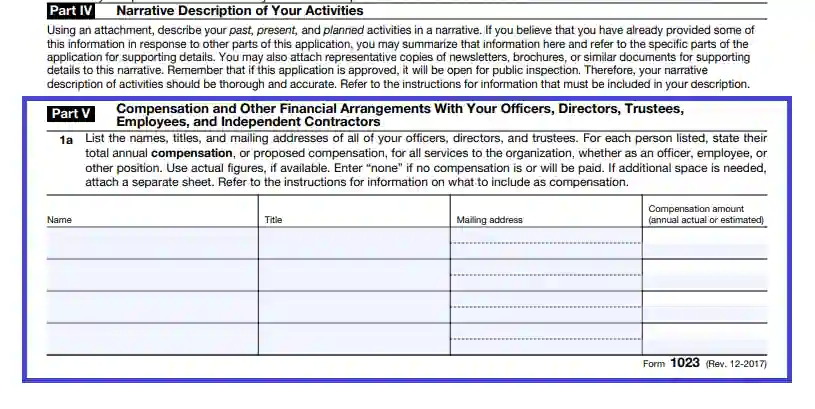

Describe Your Goals and Activities

Part 4 is represented by a narrative that you, as the owner, provide on your company’s primary activities. The form is long enough so, not to overload it with additional supplementary information, you are suggested to use attachments to describe your primary goals and activities. Remember that they have to comply with the legal requirements for the applicants.

Designate Your Financial Arrangements

Part 5 comprises a significant share of the application form and requires detailed information on the company’s management, including members, officers, and other significant employees that play their part in managing the company’s business. You should indicate the full legal name of each candidate, their title, physical address, and the respective compensation amount in US dollars. Fill in the table in the given manner.

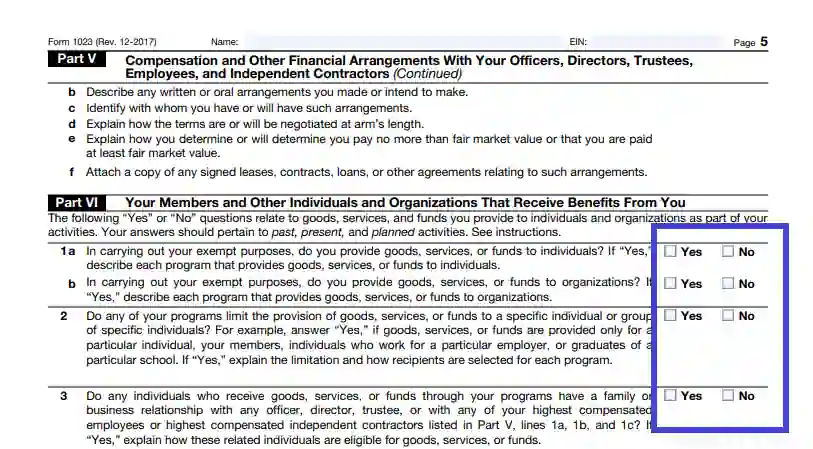

Indicate Other Beneficiaries (if any)

In Part 6, you should answer the questions about any other beneficiaries of the subject company that receives gains in some form. Put the ticks in the “Yes” or “No” boxes to affix your answers. Provide only accurate and factual information.

Describe Your History

Part 7 is quite short: here, you must answer two questions on your company’s history. Mark if your company is a successor of some other entity.

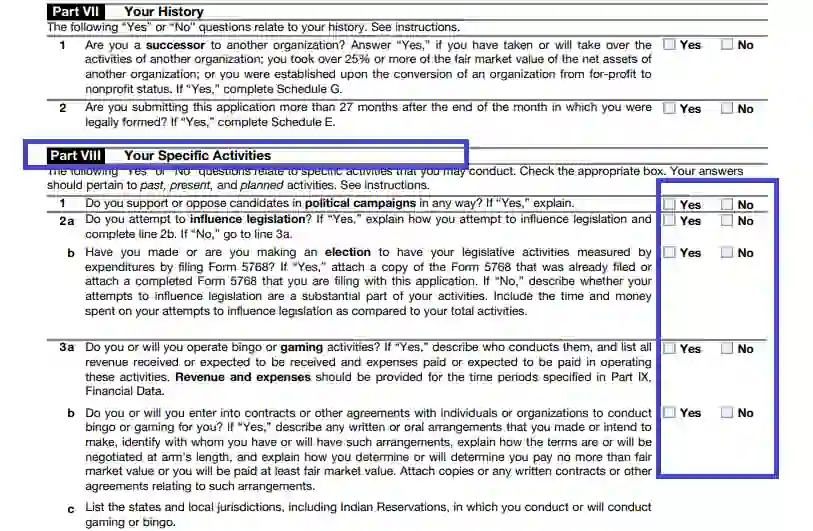

Define Any Specific Activities

Further on, you must provide the info on any specific activities that your company is attempting to perform. These questions are meant to find out if you are trying to pass an application for tax exemption while doing something off of the prohibition list. You must commit to not performing any political activity of trying to influence the legislative process (check other required provisions as well).

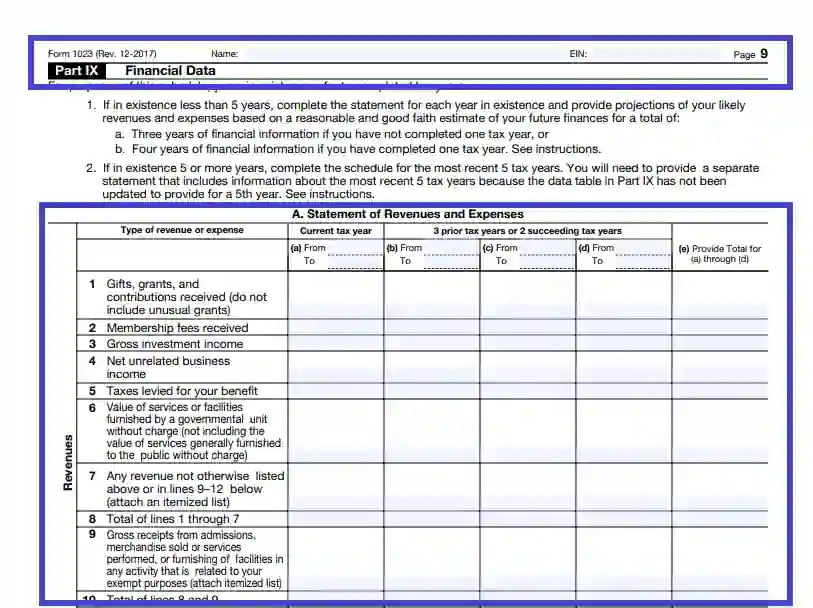

Insert Financial Data

Part 9 requires you to insert all the related financial data and obligations that your non-profit legal entity has. These financial obligations and expenses may include grants and gifts, membership fees, investments, or any other extraordinary fundraising investments and accumulations that your company is related to.

Confirm Your Charity Status

Under the Internal Revenue Code, the legal entity claiming the exceptional tax benefits and preferential status must have one of the public charity statuses. Pick out the relevant charity status that suits your particular company the most and tick the corresponding box.

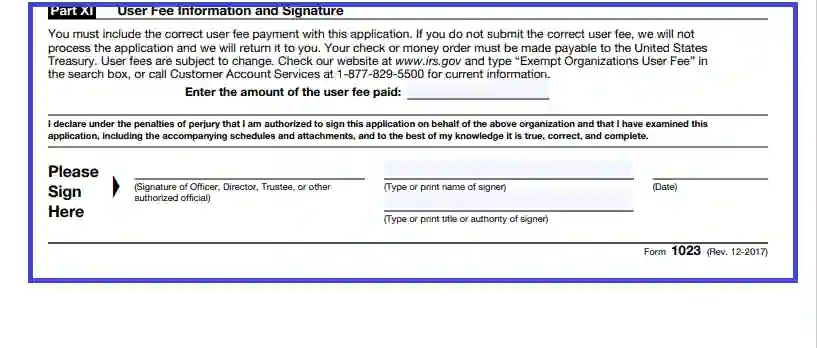

Provide User Info and Signature

In the concluding part, you must enter the amount of the user fee paid and submit the receipt (according to the annual gross income). The responsible officer filling out the form shall put a signature, their title, current calendar date, and printed name.

Fill Out the Supplements and Schedules

Along with the applicable provisions, you have to fill out and submit a number of supplements and schedules (from A through H). All of them are designated for different types of organizations that are eligible for the tax exemption option. You must choose the proper Schedule according to the entity type and only fill out that particular Schedule. Leave the other Schedules empty and untouched.

We also advise you to use the user’s Checklist at the end of the form template to make sure that you have all the necessary documents filled out and prepared.