IRS Form 709 is a U.S. tax form used for reporting gifts for federal gift tax and certain generation-skipping transfer taxes. Individuals must file this form if they give gifts exceeding the annual exclusion limit to any person during the year. The form allows the IRS to track substantial gifts as part of the unified gift and estate tax system, ensuring that taxes are paid on certain transfers of wealth that exceed allowable exclusions and deductions.

The main purpose of Form 709 is to report lifetime transfers subject to gift tax. It helps to record an individual’s lifetime gift tax exclusion usage, which is essential for determining the amount of exemption used up at the time of the individual’s death for estate tax purposes. By accurately filing this form, individuals ensure compliance with tax laws, prevent future tax liabilities for their heirs, and manage their potential estate tax responsibilities more effectively.

Other IRS Forms for Individuals

Individual taxpayers have to report different financial information to the Internal Revenue Service. Look through the other IRS forms to make sure you filed everything you are required of.

Instructions For Filling Out The IRS 709 Form

Before filling out the application, be sure to read the step-by-step instructions. Any information can help you fill it out and protect you from risks and penalties.

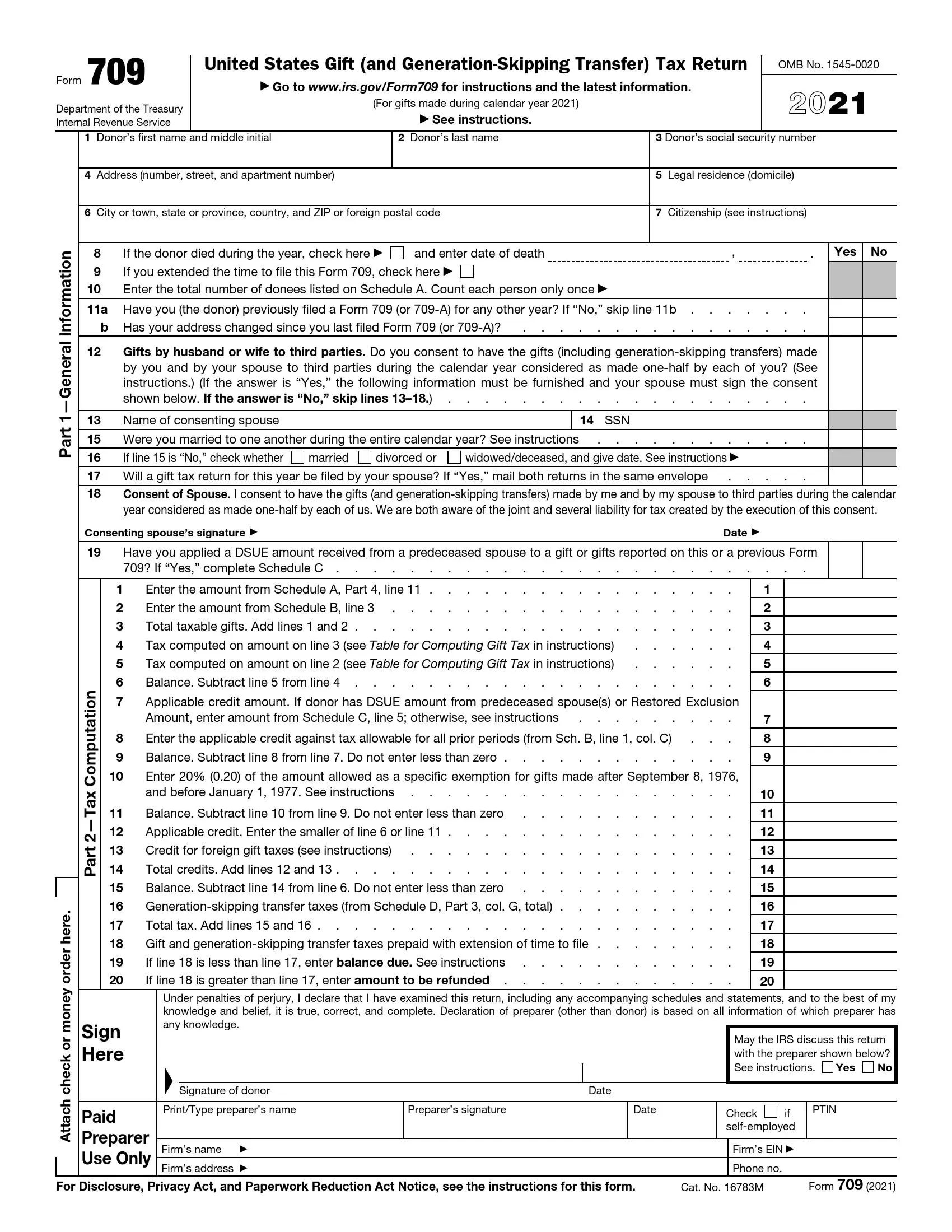

1. Basic Information

As with any other official document, the form includes general information about you. You need to enter your first and last name and your social security number. If you do not have such a number, enter your taxpayer identification number, but only if you have previously used it when filing tax documents in the United States. If you don’t have any code at all, leave the line blank. Next, enter your current address, specifying the city and street. If you have a foreign address, enter it without abbreviations. Specify your citizenship.

Now you need to select the items and specify the valid data. For instance, if the donor died in the current year, write the date of death. If you once extended the time of submission of the document, specify in the ninth paragraph. In any case, do not ignore these questions.

2. Gifts And Taxes

These items relate to questions about gifts and the consent of the spouses to their division. We remind you that a married couple does not have the right to file a joint tax return since everyone is individually responsible for the form. On the other hand, there is another rule regarding married couples. If both spouses agree to share the gifts and taxes accordingly, file both individual tax returns together. If you give your consent regarding presents to third parties, fill out items 13 to 18. If your answer is no, leave them blank.

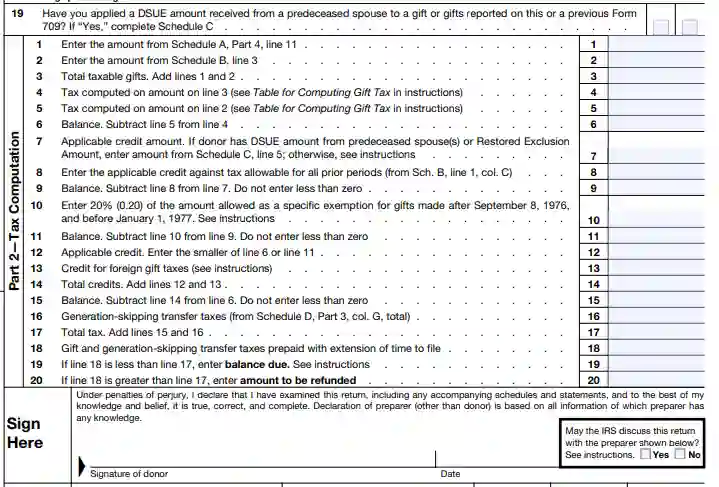

3. Tax Calculation

In the United States, there is a rule that a person whose spouse died after 2010 has the right to use the unused amount of the deceased’s exclusion (DSUE). If you applied this rule and used the amount, fill in this section. If your answer is no, sign the document and go to the next section.

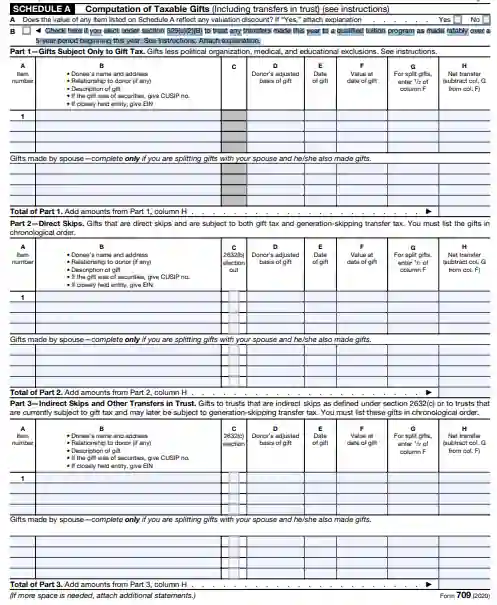

4. Taxable Gifts

It is one of the significant sections of this application, so read the information and questions carefully and answer very clearly. In this section, you may include all gifts and transfers, except those related to political organizations, medical and educational exclusions. Select the appropriate option in the first line about discounts. If the price contains a discount for any reason, answer ” yes ” and fill in all the details.

The item “B” applies to qualified education and asks for specific information. If your translations made this year are related to training programs, attach an explanation. Plus, you must report all such contributions for 2020 for any person exceeding $75,000. Next, you create a list of such gifts by filling in the columns (A-H). You specify the donee’s name and address, the date, and the description itself.

After creating the gift list, fill out all three parts of the form. The first part applies exclusively to gift taxes. The second part is related to those things that are taxed on gifts and the GST. Finally, the third part refers to those things that are currently taxable but may later be subject to GST tax. These are three different parts, don’t mix up the data.

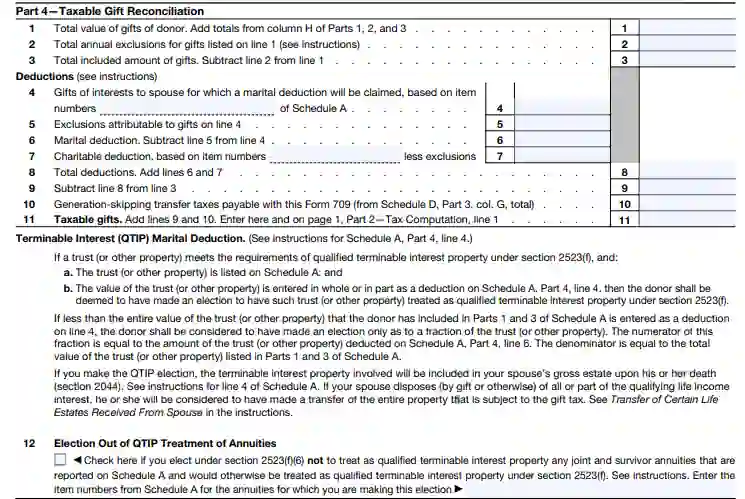

5. Settlement Of Issues

In this section (Part 4), you check the taxable gifts and data. In the first line, specify only the presents of the giver. The second row refers to the total number of annual exceptions you request for gifts from the top table. Then fill in the list of information, including deductions within the framework of marital shares and charity.

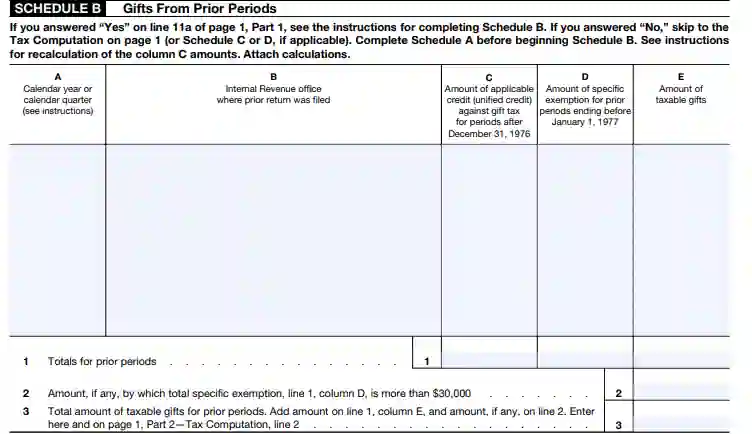

Then you go to the next section, but before that, be sure to check item 11a on the first page. If you haven’t previously filed a gift tax return, choose “no.” Otherwise, select “yes,” and fill in the items in this table in chronological order. Specify specific amounts for periods. Be sure to write down all changes to your data, including your first and last name. Also, include all tax offices and their addresses to which you have filed your tax returns.

6. DSUE Amount

This section deals with the amount of unused exclusion of the deceased spouse, as mentioned earlier. If you have had several marriages during which the spouses died, you have the right to use the DSUE amount. But you can’t use all the amounts at once. Fill in all information about the deceased spouse, including the date of death (A-F and total data).

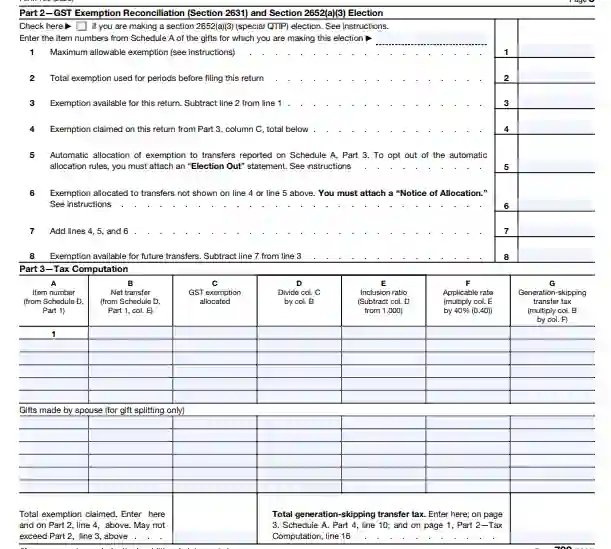

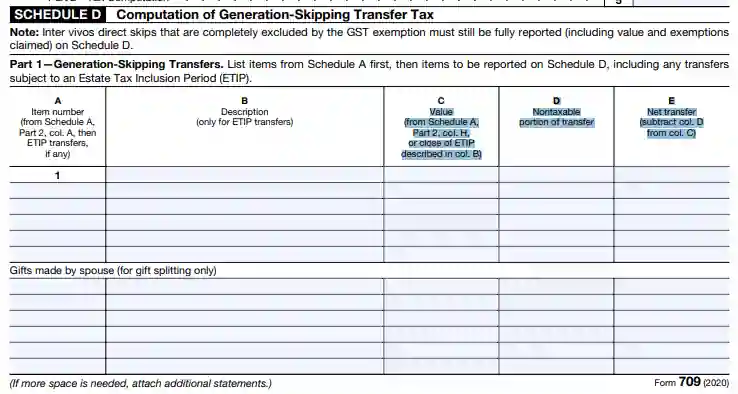

7. GST Tax

The final section consists of three parts, the first of which is about transfers. Enter all the gifts listed above in section ” A ” in chronological order. In the second column, give a detailed description, but only the ETIP translations. If there is no such information, leave the column empty. In the following columns, enter the mathematical calculations in the acceptable values.

The second and third parts are exclusively about checking the exceptions of such transfers. Plus, each donor is entitled to a lifetime GST exemption under US law. Before entering the amounts, make sure that they are correct. After filling out this application, be sure to check the data several times and sign it.